|

市场调查报告书

商品编码

1630236

持续测试:市场占有率分析、产业趋势与统计、成长预测(2025-2030)Continuous Testing - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

※ 本网页内容可能与最新版本有所差异。详细情况请与我们联繫。

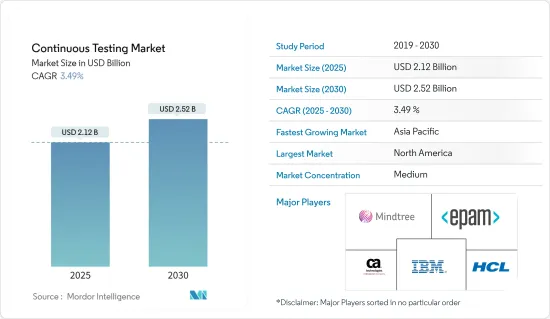

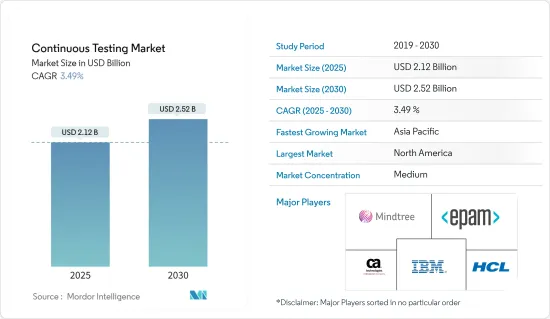

持续测试市场规模预计到 2025 年为 21.2 亿美元,预计到 2030 年将达到 25.2 亿美元,在市场估计和预测期间(2025-2030 年)复合年增长率为 3.49%。

复杂IT基础设施的开发结合了实体系统和虚拟环境,需要持续测试以获得正确的回馈和持续交付。持续整合(CI)在业界已经很普遍。相较之下,配置部分缺少一些环节,为持续测试和持续部署创造了机会。

主要亮点

- 全球业务的日益数位化正在增加对软体开发的需求。开发公司也希望透过自动化测试流程来提高效率。因此,对持续及时交付的需求不断增长正在推动市场成长。

- 采用敏捷和 DevOps 方法进行计划管理也正在推动市场成长。例如,塔塔咨询服务公司在业务中采用了敏捷和商业 4.0 概念。这些方法涉及持续测试,而不是在最后一刻发现问题并重复该过程。

- 对传统方法的依赖以及缺乏熟练且经验丰富的测试自动化人才正在阻碍持续测试市场的成长。

- 然而,在公司内不同团队(例如业务分析师团队、开发团队和 QA 团队)之间的正确整合方面,公司在持续测试的测试设计方面面临一些挑战。儘管企业都意识到持续测试的重要性,但采用持续测试显然是一个开放的局面,有些企业尚未采用持续测试。儘管在软体开发生命週期的各个领域中持续测试的采用有了显着的改进,但企业仍然发现采用DevOps和持续交付很困难。

- 由于 COVID-19 的爆发,一些公司已经让员工在家工作,这大大增加了开发人员实施 CT 工具的需求。企业越来越多地将其应用程式迁移到云端和云端基础的平台。在这种情况下,有必要使用CT工具。

持续测试市场趋势

云端基础的部署预计将显着成长

- 云端在持续测试部署中发挥重要作用。云端基础的测试由于易于部署、支援敏捷团队与不同团队协作、轻鬆的行动存取以及随时随地推动结果的能力而缩短了上市时间。所有这一切都是使用云端处理完成的。

- 云端基础的配置可以为第三方工具和 API 提供 24x7 支持,无需停机。世界各地的组织正在转向云端基础的服务,这使其成为现代商业趋势。据 Flexera Software 称,75% 的企业已采用 Microsoft Azure 来获得公共云端体验。支援各种专业业务应用程式的云端服务的广泛可用性正在将企业转变为数位企业。

- 云端基础的持续测试可以消除前期投资的需要并减少持续的维护成本,从而降低成本。

- 例如,Testsigma Technologies 提供人工智慧驱动的持续交付持续测试,作为其云端基础的敏捷和 DevOps 持续测试平台的一部分。这种整合的自动化测试工具可以自动执行 Web 和行动应用程式以及 API 的全面测试。云端基础的测试还允许测试人员透过客製化的资料库库支援实现资料检验和现场检查,并执行安全的资料库检查。

- 测试过程的部署比本地部署更快,从而节省时间和资源。此外,云端可让您随时随地存取您的测试环境。持续测试使用 Selenium 等平台执行定期自动化测试,以建立测试案例并快速提供结果。

北美占最大市场占有率

- 预计北美将成为持续测试市场的最大贡献国家。该地区强大的金融基础使其能够对先进的解决方案和技术进行大量投资。

- 美国和加拿大的公司越来越需要减少开发软体所花费的时间,这推动了持续测试的使用。

- 此外,互联网基础设施以及网路和行动应用程式的进步增加了对快速测试和配置的需求。敏捷和 DevOps 方法的日益普及对测试活动的组织产生了重大影响。

- 美国政府越来越多地采用持续测试来进行应用开发,而且众多私人公司的需求也在不断增长。例如,Google、Netflix、Amazon 和 Meta 等公司每天使用 DevOps 部署软体升级数千次。

持续测试产业概述

持续测试市场由 Mindtree Limited、EPAM Systems Inc.、Broadcom Inc. (CA Technology Inc.)、IBM Corporation 和 HCL Technologies Ltd. 等参与者分割。

- 2024 年 4 月:HCL 宣布在拉斯维加斯举行的 Google Cloud Next'24 大会上荣获三项年度合作伙伴奖。 HCLTech 因其提供有效且高效的应用程式到云端迁移的能力而荣获年度云端迁移专业化合作伙伴奖。 HCLTech CloudSMART 工业化服务是 Google Cloud 和多重云端环境的可扩展选择。

- 2023 年 11 月 有效性测试平台 Cable 推出交易保证,这是业界首个解决方案,旨在增强金融犯罪合规性和交易测试。为银行、金融科技和付款管道提供唯一针对金融交易的全自动持续有效性测试解决方案,确保严格遵守与交易监控和製裁可疑活动报告(SAR)相关的监管要求。

其他好处:

- Excel 格式的市场预测 (ME) 表

- 3 个月的分析师支持

目录

第一章简介

- 研究假设和市场定义

- 调查范围

第二章调查方法

第三章执行摘要

第四章市场洞察

- 市场概况

- 产业价值链分析

- 产业吸引力-波特五力分析

- 供应商的议价能力

- 消费者议价能力

- 新进入者的威胁

- 竞争公司之间的敌对关係

- 替代品的威胁

- COVID-19 对市场的影响

第五章市场动态

- 市场驱动因素

- 采用敏捷和 DevOps

- 对持续、及时交付的需求不断增加

- 市场限制因素

- 对传统方法的依赖

- 缺乏熟练的测试自动化人才

第六章 市场细分

- 按服务

- 託管服务

- 专业服务

- 透过介面

- 网路

- 桌面

- 移动的

- 依部署类型

- 本地

- 云端基础

- 按地区

- 北美洲

- 欧洲

- 亚洲

- 澳洲/纽西兰

- 拉丁美洲

- 中东/非洲

第七章 竞争格局

- 公司简介

- Mindtree Limited

- EPAM Systems Inc.

- Broadcom Inc.(CA Technologies Inc.)

- IBM Corporation

- HCL Technologies Ltd

- Atos SE

- Sauce Labs Inc.

- Cigniti Technologies Limited

- Cognizant Technology Solutions Corp.

- Tech Mahindra Limited

- Hexaware Technologies Ltd

- Larsen & Toubro Infotech Ltd

第八章投资分析

第9章市场的未来

The Continuous Testing Market size is estimated at USD 2.12 billion in 2025, and is expected to reach USD 2.52 billion by 2030, at a CAGR of 3.49% during the forecast period (2025-2030).

The development of the complex IT infrastructure combines physical systems and a virtualized environment, which needs continuous testing for proper feedback and continuous delivery. Continuous integration (CI) is already widespread in the industry. In contrast, there was some missing link in the deployment part, creating an opportunity for continuous testing and continuous deployment.

Key Highlights

- The growing digitalization in businesses globally is creating the demand for software development. Also, developing companies are leaning toward increasing efficiency by automating their testing processes. Hence, the growing demand for continuous and timely delivery drives the market's growth.

- Adopting Agile and DevOps approaches for project management also boosts the market's growth. For instance, Tata Consultancy Services is adopting Agile and Business 4.0 concepts for their whole operations. These approaches include continuous testing rather than detecting a problem at the last stage and repeating the process.

- The dependency on traditional approaches and lack of skilled and experienced test automation workforce are hampering the growth of the continuous testing market.

- However, organizations face several challenges related to testing design for continuous testing in terms of proper integration between the different teams across the company, like business analyst teams, development, and QA teams. Although enterprises realize the importance of continuous testing, the deployment of CT has a vividly open landscape, and several companies have yet to adopt it. While there have been significant improvements in adopting continuous testing in each area of the software development lifecycle, enterprises still find it challenging to implement DevOps and continuous delivery.

- Due to the COVID-19 pandemic, several businesses had employees working from home, and the need to adopt CT tools for developers increased substantially. Companies have been increasingly moving their apps to the cloud or cloud-based platforms. Such instances necessitate the adoption of CT tools.

Continuous Testing Market Trends

Cloud-based Deployment is Expected to Grow Significantly

- The cloud plays a critical role in the deployment of continuous testing. Cloud-based testing helps reduce time-to-market, owing to the ease of deployment and collaboration assistance with the different teams in an Agile Team, easy mobile accessibility, and the ability to derive results on the go. All of these are executed with the use of cloud computing.

- Cloud-based deployment offers 24/7 support for third-party tools and APIs with zero downtime. Organizations across the world are moving to cloud-based services, which is a trend for modern businesses. According to Flexera Software, 75% of enterprises adopted Microsoft Azure for public cloud usage. The broad availability of cloud services to support various specialized business applications is helping companies transform into digital enterprises.

- Cloud-based continuous testing can save costs by eliminating the necessity for upfront hardware investments and decreasing ongoing maintenance costs.

- For instance, Testsigma Technologies offers AI-driven continuous testing for continuous delivery as part of its cloud-based continuous testing platform for Agile and DevOps. This unified automation testing tool can automate comprehensive testing for web and mobile apps and APIs. Cloud-based testing also enables testers to achieve data validation and field checks with the support of a customized database as an offering, thus leading to secure database checks.

- The deployment of the testing process is quick compared to on-premise deployment, thus saving time and resources. Additionally, the cloud allows access to the testing environment from anywhere, anytime. Continuous testing offers regular automated testing using platforms like Selenium to build test cases and deliver results faster.

North America Holds the Largest Market Share

- North America is projected to be the largest contributor to the continuous testing market. The region's strong financial position enables it to invest heavily in advanced solutions and technologies.

- The increasing need to reduce the time spent on software development in enterprises in the United States and Canada has boosted the use of continuous testing.

- Additionally, the advancements in internet infrastructure and web and mobile applications are increasing the demand for quick testing and deployment. The growing adoption of Agile and DevOps methodology has a significant impact on the organization of testing activities.

- The US government is increasingly adopting continuous testing for application development, leading to growing demand across various private companies. For instance, companies such as Google, Netflix, Amazon, and Meta are using DevOps to deploy software upgrades thousands of times each day, which is also expected to boost revenue growth in the region.

Continuous Testing Industry Overview

The continuous testing market is fragmented with the presence of players like Mindtree Limited, EPAM Systems Inc., Broadcom Inc. (CA Technology Inc.), IBM Corporation, and HCL Technologies Ltd.

- April 2024: HCL announced that it received three Partner of the Year awards at the Google Cloud Next '24, held in Las Vegas. HCLTech received the Cloud Migration Specialization Partner of the Year Award for its ability to provide effective and efficient migration of applications to the cloud. HCLTech CloudSMART Industrialized Services are scalable choices for Google Cloud and multi-cloud environments.

- November 2023: The effectiveness testing platform, Cable, launched its industry-first solution, Transaction Assurance, enhancing financial crime compliance and transaction testing. It offers banks, fintechs, and payment platforms the only fully automated and continuous effectiveness testing solution for financial transactions, ensuring strict adherence to regulatory requirements related to transaction monitoring as well as sanctions Suspicious Activity Reports (SARs).

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET INSIGHTS

- 4.1 Market Overview

- 4.2 Industry Value Chain Analysis

- 4.3 Industry Attractiveness - Porter's Five Forces Analysis

- 4.3.1 Bargaining Power of Suppliers

- 4.3.2 Bargaining Power of Consumers

- 4.3.3 Threat of New Entrants

- 4.3.4 Intensity of Competitive Rivalry

- 4.3.5 Threat of Substitutes

- 4.4 Impact of COVID-19 on the market

5 MARKET DYNAMICS

- 5.1 Market Drivers

- 5.1.1 Adoption of Agile and DevOps

- 5.1.2 Increasing Need for Continuous and Timely Delivery

- 5.2 Market Restraints

- 5.2.1 Dependency on Traditional Approaches

- 5.2.2 Lack of a Skilled and Experienced Test Automation Workforce

6 MARKET SEGMENTATION

- 6.1 By Service

- 6.1.1 Managed Service

- 6.1.2 Professional Service

- 6.2 By Interface

- 6.2.1 Web

- 6.2.2 Desktop

- 6.2.3 Mobile

- 6.3 By Deployment Type

- 6.3.1 On-premise

- 6.3.2 Cloud-based

- 6.4 By Geography

- 6.4.1 North America

- 6.4.2 Europe

- 6.4.3 Asia

- 6.4.4 Australia and New Zealand

- 6.4.5 Latin America

- 6.4.6 Middle East and Africa

7 COMPETITIVE LANDSCAPE

- 7.1 Company Profiles

- 7.1.1 Mindtree Limited

- 7.1.2 EPAM Systems Inc.

- 7.1.3 Broadcom Inc. (CA Technologies Inc.)

- 7.1.4 IBM Corporation

- 7.1.5 HCL Technologies Ltd

- 7.1.6 Atos SE

- 7.1.7 Sauce Labs Inc.

- 7.1.8 Cigniti Technologies Limited

- 7.1.9 Cognizant Technology Solutions Corp.

- 7.1.10 Tech Mahindra Limited

- 7.1.11 Hexaware Technologies Ltd

- 7.1.12 Larsen & Toubro Infotech Ltd