|

市场调查报告书

商品编码

1630238

软性电子产品:市场占有率分析、产业趋势/统计、成长预测(2025-2030)Flexible Electronics - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

价格

※ 本网页内容可能与最新版本有所差异。详细情况请与我们联繫。

简介目录

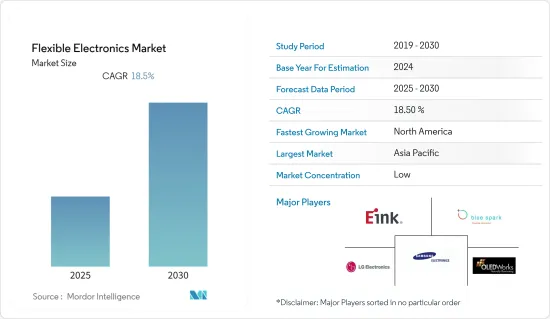

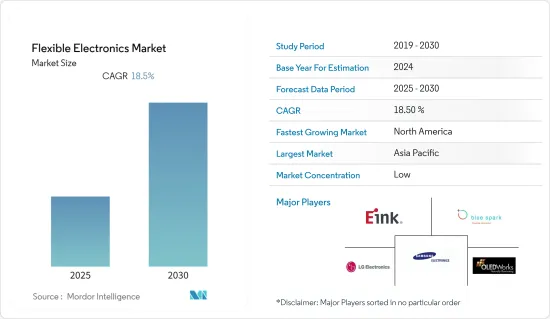

预计软性电子产品市场在预测期内的复合年增长率为 18.5%。

主要亮点

- 此外,2021年3月,凸版印刷开发出一种柔性薄膜电晶体(TFT),可承受曲率半径为1毫米的100万次弯曲,开/关电流比为107以上,载子迁移率为10 cm2 /Vs等,着眼于实用化表现出优越性。预计这将推动折迭式智慧型手机、穿戴式感测器、智慧包装、医疗设备等的需求。

- 折迭式智慧型手机在市场上也越来越受欢迎。例如,2022 年 7 月,三星电子发布了最新的折迭式智慧型手机系列。最新的下一代折迭式智慧型手机 Galaxy Z Flip 4 和 Galaxy Z Fold 4 是在名为「Unfold Your World」的 Galaxy Unpacked 线上活动上发布的。

- 此外,据BNP Media称,到2030年,电子元件将占汽车总生产成本的50%。在这十年之前,这一比例仅为 30%。轻薄且灵活的电子产品的进步推动了从曲面电视到带有血糖监测仪的隐形眼镜等各种创新。这可能会导致可印刷太阳能电池和使用有机发光二极体(OLED)的柔性萤幕的成长。

- 此外,套模电子产品 (IME) 和柔性感测器的进步进一步扩大了柔性印刷电子产品在智慧穿戴技术中的应用范围。穿戴式设备,尤其是智慧穿戴设备的成长可能会在预测期内进一步扩大市场范围。思科预计,到 2021 年,全球连网穿戴装置数量将超过 9 亿。

- COVID-19 的疫情给电子製造商造成了严重的延误,中国的供应商很难让他们的工厂运作。许多位于美国和欧洲的电子製造商依赖中国供应商生产的某些零件。电子产业协会 IPC 于 2020 年 2 月进行的一项调查显示,参与调查的 150 家电子製造商和供应商中,有 65% 的人表示,由于 COVID-19 的传播,供应商出现了延误。

软性电子产品市场趋势

医疗保健领域的 3D 整合预计将推动市场发展

- 3D列印正在不断发展并具有广泛的应用,包括医疗保健领域的3D列印软性电子产品设备。 3D列印机可用于将生物医学设备直接列印到人体皮肤上,并可帮助建立灵活的电子感测器来测量身体压力。这些印表机有望改善义手和手术机械臂的感觉。

- 此外,3D列印的柔性电手套可用于为患者提供舒适的热疗。因为这些柔性电子设备产生的热量可以透过增加血流量和减轻疼痛来治疗受伤部位。

- 3D 列印柔性穿戴式生物电子触觉感测器正在研究用于连续监测,以便及早发现疾病引起的生理异常。因此,我们正在致力于开发一种新型、多材料、多层全3D列印奈米复合材料(M2A3DNC)微工程、混合、柔性的软穿戴压力感测器。

- 此外,这些3D列印的柔性电子装置在身障者人造器官领域具有多种应用。此外,2021年11月,专门从事整形外科手术骨移植设计和製造的公司Graftys SA宣布收购致力于开发新一代可注射合成骨移植材料的法国公司Biologics4Life。此次收购扩大了该公司在骨移植和骨折和骨质流失患者先进治疗方面的专业知识。

预计北美市场将显着成长

- 北美软性电子产品市场预计将出现显着成长。对智慧型穿戴装置和消费性电子产品不断增长的需求正在推动该地区对软性电子产品的需求。例如,爱立信表示,在前几年稳定成长的基础上,到 2027 年,北美智慧型手机用户量预计将达到 3.58 亿支。截至 2021 年,美国人拥有约 3.28 亿支智慧型手机。

- 此外,据Cisco称,到2022年,北美连网穿戴装置数量预计将增长至超过4.39亿台,这使得美国穿戴式市场前景广阔。预计到 2022 年,北美将成为使用穿戴式装置 5G 连接最多的地区。

- 此外,领导了许多成功高科技产业的美国国防机构对军事应用的软性电子产品技术感兴趣,并正在支持必要的研究基础设施的发展。美国创新前沿的几个州已经认证了软性电子产品和印刷电子产品的研究中心。

- 此外,美国处于支援美国软性电子产品开发的最前沿。美国组织,包括陆军研究实验室、空军研究实验室 (AFRL)、海军研究办公室 (ONR) 和美国特种作战司令部 (SOCOM) 目前正在研究这一领域,主要用于显示器等国防应用。研究。

软性电子产品产业概况

软性电子产品市场是分散的。主要关注效率开发的製造商提供技术创新产品,这些产品具有与电源效率和产品设计相关的各种优势。企业参与者正在投资研发以加强其市场地位。主要市场参与企业包括 E Ink Holdings Inc.、Blue Spark Technologies 和三星电子。

- 2022 年 1 月 - LG Display 在 CES 2022 之前以概念形式推出了柔性 OLED 解决方案,包括室内固定自行车「Virtual Ride」和综合娱乐中心「Media Chair」。

- 2021 年 6 月 - 三星宣布开发出紧密贴合肌肤表面的全柔性 OLED 显示器。为了实现软性显示器,三星开发了采用脊製程排列在柔性合成橡胶体表面上的单独 OLED 像素。 OLED 之间的连接以及将显示器连接到驱动器系统的走线均由柔性材料製成。

其他好处:

- Excel 格式的市场预测 (ME) 表

- 3 个月的分析师支持

目录

第一章简介

- 研究假设和市场定义

- 调查范围

第二章调查方法

第三章执行摘要

第四章市场洞察

- 市场概况

- 产业吸引力-波特五力分析

- 供应商的议价能力

- 买方议价能力

- 新进入者的威胁

- 替代品的威胁

- 竞争公司之间的敌对关係

- 产业价值链分析

- COVID-19 市场影响评估

第五章市场动态

- 市场驱动因素

- 对轻质、机械灵活且具成本效益的产品的需求不断增长

- 由于研究和开发的成长,应用范围扩大

- 市场挑战

- 投资成本高

- 装配组装复杂,维修返工难度高

第六章 市场细分

- 按用途

- 感测

- 照明

- 展示

- 其他用途

- 按最终用户产业

- 家电

- 车

- 卫生保健

- 军事/国防

- 其他最终用户产业

- 按地区

- 北美洲

- 欧洲

- 亚太地区

- 世界其他地区

第七章 竞争格局

- 公司简介

- E Ink Holdings Inc.

- Blue Spark Technologies

- Samsung Electronics Co. Ltd

- LG Electronics Inc.

- OLEDWorks LLC

- Royole Corporation

- FlexEnable Ltd

- PragmatIC Inc.

- AU Optronics Corp.

- Imprint Energy Inc.

- BOE Technology Group Co. Ltd

- Flexpoint Sensor Systems Inc.

第八章投资分析

第9章市场的未来

简介目录

Product Code: 65320

The Flexible Electronics Market is expected to register a CAGR of 18.5% during the forecast period.

Key Highlights

- Moreover, in March 2021, Toppan Printing developed a flexible thin-film transistor (TFT) that can withstand million bending cycles to a 1 mm radius of curvature and demonstrates advantages for practical application, such as an on/off current ratio of at least 107 with carrier mobility of 10cm2/Vs. This is expected to gain demand for use in foldable smartphones, wearables sensors, smart packaging, medical devices, and more.

- In addition, foldable smartphones are gaining popularity in the market. For instance, in July 2022, Samsung Electronics announced its latest foldable smartphone series. The latest next-generation foldable smartphones, the Galaxy Z Flip 4 and the Galaxy Z Fold 4, were unveiled during the Galaxy Unpacked online event titled "Unfold Your World."

- Furthermore, according to BNP Media, by 2030, electronic components will account for 50% of an automobile's total production cost. Earlier this decade, it was only 30%. Progress in thin, light, and flexible electronics is behind a range of innovative technologies, from curved TVs to glucose-monitoring contact lenses. This can lead to the growth of printable solar cells and flexible screens using organic light-emitting diodes (OLEDs).

- In addition, the advancement of in-mold electronics (IME) and flexible sensors is further expanding the scope of flexible and printed electronics in smart wearable technologies. The growth of wearable devices, especially smart wearable devices, may further expand the market scope over the forecast period. Cisco estimated the number of connected wearables worldwide to surpass 900 million by 2021.

- The COVID-19 outbreak caused major delays for electronic manufacturers, as suppliers based in China struggled to keep factories running at full capacity. Many electronic manufacturers based in the United States or Europe depend on certain components built by suppliers in China. IPC, an electronic equipment trade organization, ran a survey in February 2020, in which 65% of the 150 electronic manufacturers and suppliers who participated reported delays from suppliers due to the spread of COVID-19.

Flexible Electronics Market Trends

3D Integration in Healthcare is Expected to Drive the Market

- 3D printing is advancing, and it has a wide range of applications, including 3D-printed flexible electronic devices in the healthcare sector. 3D printers can be used for the direct printing of biomedical devices onto the human skin and can help build flexible electronic sensors to measure body pressure. These printers are expected to improve sensation in prosthetic hands and surgical robotic arms.

- Additionally, a 3D-printed flexible electrical glove can be used to provide comfortable thermotherapy for patients, as the heat formed by these flexible electronic devices can treat injury points by enhancing blood flow and reducing pain.

- Research is being done to use 3D printed, flexible wearable Bioelectronic Tactile Sensors for continuous monitoring for early detection of disease-induced physiological irregularities. As such, efforts are made to develop novel, multi-material, and multilayer all-3D-printed nanocomposite-based (M2A3DNC) micro-engineered, hybrid, flexible, and soft wearable pressure sensors to record sensitive and multiple physiological signals for real-time human health monitoring.

- Moreover, these 3D-printed flexible electronic devices have various applications in the fields of prosthetic organs for the disabled. Furthermore, in November 2021, Graftys SA, a company specializing in designing and manufacturing bone graft substitutes for orthopedic surgery, announced the acquisition of Biologics4Life, a French company working on developing a new generation of injectable synthetic bone graft materials. The acquisition will increase the company's expertise in bone grafts and advanced treatment for patients suffering from fractures or bone loss.

North America to Experience Significant Market Growth

- North America is expected to register significant growth in the flexible electronics market. The increasing demand for smart wearables, combined with consumer electronics, is driving the demand for flexible electronics in the region. For example, according to Ericsson, the number of smartphone subscriptions in North America is estimated to reach 358 million by 2027, based on the steady growth seen in earlier years. Americans owned approximately 328 million smartphones as of 2021.

- Furthermore, according to Cisco Systems, the wearable market is promising in the United States, as the number of connected wearable devices in North America is expected to grow to over 439 million in 2022. North America is forecast to be the region with the most 5G connections made using wearable devices in 2022.

- Further, the U.S. defense establishment, which has promoted many successful high-technology industries, has been interested in flexible electronics technologies for military usage, and that will support the growth of the necessary research infrastructure. Several U.S. states that are at the front of U.S. innovation have recognized research centers for flexible and printed electronics.

- In addition, the U.S. Armed Services have been in front of support the development of flexible electronics in the United States. The Army Research Laboratory and other U.S. Army organizations, the Air Force Research Laboratory (AFRL), the Office of Naval Research (ONR), and the U.S. Special Operations Command (SOCOM) presently support many research efforts in the field with a weight on defense applications, chiefly displays.

Flexible Electronics Industry Overview

The flexible electronics market is fragmented. Manufacturers primarily focused on developing efficiency are offering technologically innovative products that provide various benefits related to power efficiency and product design. Enterprise players are investing in R&D to strengthen their market positions. Key market participants include E Ink Holdings Inc., Blue Spark Technologies, Samsung Electronics Co. Ltd, and others.

- January 2022 - LG Display has revealed its flexible OLED solutions in concept form, including the Virtual Ride indoor stationary bicycle and the Media Chair integrated entertainment center, ahead of CES 2022.

- June 2021 - Samsung announced the development of a fully flexible OLED display that can adhere to and conform to the skin's surface. To create a flexible display, Samsung developed individual OLED pixels that are ridged but sit on a flexible elastomer surface. The connections between the OLEDs and the traces that connect the display to the driver system are made with a flexible material.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET INSIGHTS

- 4.1 Market Overview

- 4.2 Industry Attractiveness - Porters Five Forces Analysis

- 4.2.1 Bargaining Power of Suppliers

- 4.2.2 Bargaining Power of Buyers

- 4.2.3 Threat of New Entrants

- 4.2.4 Threat of Substitutes

- 4.2.5 Intensity of Competitive Rivalry

- 4.3 Industry Value Chain Analysis

- 4.4 Assessment of Impact of COVID-19 on the Market

5 MARKET DYNAMICS

- 5.1 Market Drivers

- 5.1.1 Emerging Need For Lightweight, Mechanically Flexible, and Cost-effective Products

- 5.1.2 Growing R&D is Expanding the Application Scope

- 5.2 Market Challenges

- 5.2.1 High Investment Cost

- 5.2.2 Complex Assembly Process, Difficult Repair, and Rework

6 MARKET SEGMENTATION

- 6.1 By Application

- 6.1.1 Sensing

- 6.1.2 Lighting

- 6.1.3 Display

- 6.1.4 Others Applications

- 6.2 By End User Industry

- 6.2.1 Consumer Electronics

- 6.2.2 Automotive

- 6.2.3 Healthcare

- 6.2.4 Military and Defense

- 6.2.5 Other End User Industries

- 6.3 By Geography

- 6.3.1 North America

- 6.3.2 Europe

- 6.3.3 Asia Pacific

- 6.3.4 Rest of the World

7 COMPETITIVE LANDSCAPE

- 7.1 Company Profiles

- 7.1.1 E Ink Holdings Inc.

- 7.1.2 Blue Spark Technologies

- 7.1.3 Samsung Electronics Co. Ltd

- 7.1.4 LG Electronics Inc.

- 7.1.5 OLEDWorks LLC

- 7.1.6 Royole Corporation

- 7.1.7 FlexEnable Ltd

- 7.1.8 PragmatIC Inc.

- 7.1.9 AU Optronics Corp.

- 7.1.10 Imprint Energy Inc.

- 7.1.11 BOE Technology Group Co. Ltd

- 7.1.12 Flexpoint Sensor Systems Inc.

8 INVESTMENT ANALYSIS

9 FUTURE OF THE MARKET

02-2729-4219

+886-2-2729-4219