|

市场调查报告书

商品编码

1630250

CSaaS(网路安全即服务):市场占有率分析、产业趋势/统计、成长预测(2025-2030)Cyber Security as a Service - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

价格

※ 本网页内容可能与最新版本有所差异。详细情况请与我们联繫。

简介目录

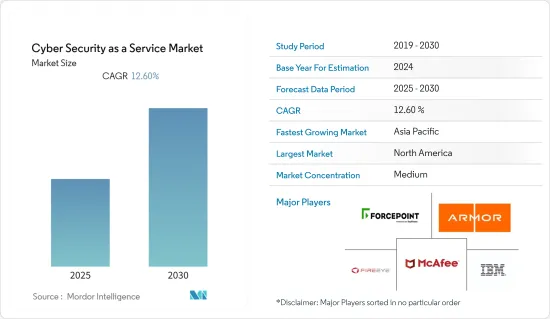

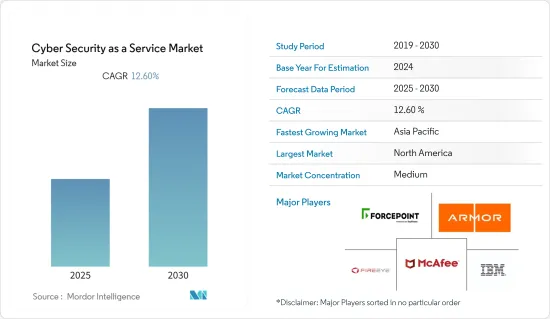

CSaaS(网路安全即服务)市场预计在预测期内复合年增长率为 12.6%。

主要亮点

- 在预测期内,对 CSaaS 的需求将会增加,因为 CSaaS 提供跨人员、流程和技术的专业知识和经验,并且还包括具有从合规角度管理违规行为所需专业知识的法律团队。此外,CSaaS 可以根据每个组织的需求进行客製化,从策略角度到完成部署。

- 除此之外,全球网路威胁不断增加,与每次资料外洩相关的成本也在增加。根据 RiskBased Security 的数据,2019 年上半年约有 41 亿笔记录外洩。根据 Verizon 2020 年资料外洩调查报告,大约 71% 的资料外洩是出于经济动机,25% 是由于间谍活动。

- 随着威胁和资料外洩的增加,世界各地的企业都严重担心失去客户信任以及为企业带来严重的财务后果。 IBM 的数据显示,2019 年组织平均损失的业务成本为 142 万美元,平均总成本为 392 万美元。 2019年,发现资料外洩的平均时间为206天,遏制资料外洩的平均时间为73天。这进一步导致公司的财务损失。

- 在所有资料外洩和攻击中,恶意攻击造成了 2019 年的大部分资料外洩。此外,过去五年来恶意攻击的数量迅速增加。企业经常成为恶意攻击的目标,尤其是小型组织。据赛门铁克称,员工人数少于 250 人的小型组织最容易成为恶意攻击的目标,每 323 封电子邮件中就有 1 封是恶意的。

- 此外,由于COVID-19的爆发,业界对CSaaS(网路安全即服务)的需求激增,导致公司提供此类解决方案并进一步扩大我开始投资的市场的服务范围。

- 资料外洩是最重要的网路安全问题,在预测期内可能会持续存在。另外,该产业也发现网路安全技能有缺口,全球近三分之二的公司报告IT安全人员短缺。这是推动CSaaS(网路安全即服务)需求的因素之一。

CSaaS(网路安全即服务)市场趋势

能源和公共产业产业推动市场成长

- 在全球范围内,能源和公共产业部门占一个国家拥有和运营的关键基础设施的很大一部分。高度现代化和自动化的关键基础设施,如发电部门、石油和天然气设施以及水处理和处理厂,非常容易受到网路和实体威胁,包括骇客、恶意组织和国家行为者。

- 根据波奈蒙研究所的报告,四分之三的能源公司和公共产业最近经历了至少一次资料外洩。电力的物理脆弱性与发电设施、变电站和输电有关。大型精製也是主要目标。由于过去十年中管道石油运输的增加,存在大量且基本上未受保护的目标。石油和天然气的脆弱性包括河流交叉线、互连线、泵浦、阀门、压缩机和天然气城门。

- 许多营运和保护关键基础设施的电力公司需要强有力的合作。此外,电网和能源安全需要产业、国土安全部、国防部 (DOD) 和能源部 (DOE) 之间的公私合作和监管协调。电网和其他工业基础设施越来越容易受到实体和网路安全攻击。

- 能源基础设施产业很容易受到 COVID-19 等感染。这些组织负责处理国家的关键基础设施,使敏感的业务资料和人员资讯面临风险。

- 一场以新冠病毒 (COVID-19) 作为武器的新宣传活动瞄准了世界各地的能源部门。在产业标的中,能源产业尤其是电力业是热门标的。

- 例如,北美电力可靠性委员会发出警告称,骇客,特别是对沙乌地阿拉伯石化厂安全发动攻击的 Xenotime 组织,已开始针对美国电力部门。为了应对这些威胁,美国联邦能源监管委员会于 6 月核准了新的网路安全报告要求。

北美市场占据主导地位

- 由于先进的数位化和互联设备数量的增加,北美在全球网路安全即服务市场的市场占有率方面处于世界领先地位。该地区在采用创新技术方面也处于世界领先地位,拥有强大的网路安全供应商,为市场成长做出了贡献。组织内部对减少网路滥用、提高员工生产力和解决IT基础设施攻击的需求日益增长,预计将推动北美 CsaaS 市场的成长。

- 此外,该地区还有许多公司正在为该地区市场的持续成长做出贡献并扩大在该地区的服务。例如,2020年1月,Accenture同意从博通收购赛门铁克的保全服务业务。该业务包括透过安全营运中心网路进行全球威胁监控和分析、即时对抗威胁情报和特定产业威胁情报以及事件回应服务等服务。

- 此外,以国家来看,美国的资料外洩事件仍然比其他国家的资料外洩事件代价更高。该国资料外洩的平均成本为 819 万美元,几乎是全球平均水平的两倍,并且在过去 14 年中增长了 130% 以上。

- 在美国,NEC CIP 法规已就位,重点在于变电站级安全。美国总统政策指令 21 将能源部门确定为一个独特且重要的部门,因为它提供了涵盖所有关键基础设施部门的「赋能功能」。 2019年3月,宣布成立美国网路安全、能源安全与紧急应变办公室,拨款9,600万美元。

CSaaS(网路安全即服务)产业概述

全球CSaaS(网路安全即服务)市场竞争格局异常激烈。随着网路安全即服务(CSaaS)在全球的快速采用,许多主要企业正在致力于创新和开发网路安全解决方案和服务。由于需求不断增长,网路安全市场涌现许多新兴企业,并在市场上占有重要地位。以下是市场的一些主要发展:

- 2020 年 2 月,McAfee Inc. 宣布其云端原生 Mvision 平台的创新,并推出了 Unified Cloud Edge (UCE)。

其他好处:

- Excel 格式的市场预测 (ME) 表

- 3 个月的分析师支持

目录

第一章简介

- 研究假设和市场定义

- 调查范围

第二章调查方法

第三章执行摘要

第四章市场洞察

- 市场概况

- 产业吸引力-波特五力分析

- 供应商的议价能力

- 买家/消费者的议价能力

- 新进入者的威胁

- 替代品的威胁

- 竞争公司之间的敌对关係

第五章市场动态

- 市场驱动因素

- 资料外洩增加

- 与本地解决方案相关的高成本

- 中小型企业的采用率增加

- 市场限制因素

- 云端基础的应用程式容易遭受网路犯罪

- 市场机会

- 企业 BYOD 趋势不断成长

- 生态系分析

- COVID-19 对 CSaaS 产业的影响

- 新案例研究和部署情境(IT、通讯和零售公司中 CSaaS 实施的有效性;CSaaS 在中小型企业中实现有效威胁预防和缓解的作用)

- 资料外洩成本分析

第六章 市场细分

- 按组织规模

- 小型企业

- 大公司

- 按安全类型

- 漏洞和安全评估

- 威胁情报和业务分析

- 审核和日誌记录

- 持续监控和加密

- 身分和存取管理

- 其他安全类型

- 按最终用户产业

- 卫生保健

- BFSI

- 资讯科技/通讯

- 政府机构

- 能源/公共产业

- 其他最终用户产业

- 按地区

- 北美洲

- 欧洲

- 亚太地区

- 拉丁美洲

- 中东/非洲

第七章 竞争格局

- 公司简介

- Foresite MSP LLC

- FireEye Inc.

- Forcepoint LLC

- Convergent Network Solutions Ltd

- IBM Corporation

- McAfee Inc.

- Armor Defense Inc.

- Transputec Ltd

- Zeguro Inc.

- Cyber Security Services

- Sara Technologies Inc.

- Cloud24x7 Inc.

第八章投资分析

第9章市场的未来

简介目录

Product Code: 66413

The Cyber Security as a Service Market is expected to register a CAGR of 12.6% during the forecast period.

Key Highlights

- Over the forecast period, the demand for CSaaS is expected to gain traction as it provides expertise and experience across people, processes, and technology, even encompassing a legal team with the expertise required to manage a breach from a compliance perspective. Also, CSaaS can be tailored to each organization's requirements from a strategic perspective to complete deployment.

- In addition to this, the global cyber threats are on the rise, and the costs associated with each data breach are also on the rise. According to RiskBased Security, during the first half of 2019, nearly 4.1 billion records were exposed. According to Verizon Data Breach Investigation Report 2020, about 71% of the breaches were financially motivated, and 25% were motivated by espionage.

- With the growing number of threats and data breaches, a serious concern for businesses worldwide is the loss of customer trust, which led to serious financial consequences for the companies. According to IBM, the average cost of lost business for organizations in 2019 stood at USD 1.42 million, and the total average cost stood at USD 3.92 million. The average time to identify a breach in 2019 was 206 days, and the average time to contain a breach was 73 days. This further leads to financial losses for a business.

- Among all of the data breaches and attacks, malicious attacks caused the majority of the data breaches during 2019. Also, the number of malicious attacks have increased exponentially in the last five years. Enterprises are the target of malicious attacks, and especially smaller organizations were attacked frequently. According to Symantec, smaller organizations with less than 250 employees had the highest target of malicious attacks with a malicious email rate of 1 in 323.

- Moreover, with the outbreak of COVID-19, the demand for cybersecurity as a service in the industry is surging, attracting enterprises to invest in either offering such solutions or expanding their service offering in the market further.

- Data breaches continue to be the most significant cybersecurity concern and likely to continue during the forecast period; thus, cybersecurity is a primary concern for enterprises and businesses. Apart from this, the industry sees a shortage in the cybersecurity skill gap, with nearly two in three organizations reporting a shortage in IT security staff across the world. This is one of the factors augmenting the demand for cybersecurity as a service.

Cyber Security as a Service Market Trends

Energy and Utility Sector Drive the Market Growth

- The energy and utility sector, globally, hosts a large share of critical infrastructure owned and operated by a country. Highly modernized and automated critical infrastructure, such as the electricity generation sector, oil and gas establishments, and water processing and treatment plants, are highly vulnerable to cyber and physical threats and have been easily targeted by hackers and evil organizations, and state actors.

- According to the Ponemon Institute Report, three-quarters of energy companies and utilities have experienced at least one recent data breach. The physical vulnerabilities for electric power are related to generation facilities, substations, and transmission lines. Large oil refineries are also primary targets. An increase in the transportation of oil through pipelines over the past decade offers a vast and largely unprotected target array. Oil and gas vulnerabilities include lines at river crossings, interconnects, pumps, valves, and compressors, and natural gas city gates.

- Many electric companies operating and protecting critical infrastructure require a strong working partnership. Further, power grid and energy security require private-public cooperation and regulatory coordination among industries, DHS, the Department of Defense (DOD), and the Department of Energy (DOE). The power grid and other industrial infrastructures have been increasingly subjected to both physical and cybersecurity attacks.

- Energy infrastructure industries are more susceptible to outbreaks, such as COVID-19, as such organizations handle a country's critical infrastructure, putting confidential business data and personnel information at risk.

- Energy sectors across the world are being targeted in a new campaign that weaponizes the COVID-19 outbreak. Among industrial targets, the energy sector, and particularly the electric power sector, have become prime targets.

- For instance, the North American Electric Reliability Corporation issued an alert warning that hackers, particularly the Xenotime group, which was responsible for an attack that jeopardized the safety of a Saudi petrochemical plant, began targeting the US power sector. In June, those types of threats prompted the Federal Energy Regulatory Commission to approve a new, mandatory cybersecurity reporting rule.

North-America to Dominate the Market

- North America is the market leader in global cybersecurity as a service market globally in terms of market share due to the high level of digitalization and the rising number of connected devices. Also, the region leads globally as innovative technology adopters and has a significant presence of cybersecurity vendors contributing to the growth of the market. The increasing need among organizations to reduce the misuse of the internet, enhance employees' productivity, and address attacks on their IT infrastructures is expected to drive the growth of the CsaaS market in North America.

- There are also many companies in the region, contributing to the constant growth of the market in the region and expanding their services in the market. For instance, in January 2020, Accenture agreed to acquire Symantec's Cyber Security Services business from Broadcom Inc., which includes services, such as global threat monitoring and analysis through a network of security operation centers, real-time adversary and industry-specific threat intelligence, and incident response services.

- Moreover, by countries, data breaches in the United States continued to be expensive than those in other nations. Data breaches in the country, on average, cost to USD 8.19 million, which is nearly double that of the global average, and this increased by over 130% over the last 14 years.

- The NEC CIP regulation is already in place in the United States, focusing on security at the substation level. The Presidential Policy Directive 21 of the United States identified the energy sector as uniquely critical, as it provides an "enabling function" across all critical infrastructure sectors. In March 2019, the announcement of an office of Cybersecurity, Energy Security, and Emergency Response for the United States was made, with an allocation of USD 96 million.

Cyber Security as a Service Industry Overview

The competitive landscape of the global cybersecurity as a service market is competitive. The rapid adoption of cybersecurity as a service across the world has led many companies to innovate and develop cybersecurity solutions and services. Owing to the increased demand, many start-ups have emerged in the cybersecurity market to establish a significant presence in the market. Some of the key developments in the market are:

- In Feb 2020 - McAfee Inc. announced innovations to its cloud-native Mvision platform with the availability of Unified Cloud Edge(UCE), which provides unified data and threat protection from the device level to the cloud.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET INSIGHT

- 4.1 Market Overview

- 4.2 Industry Attractiveness - Porter's Five Force Analysis

- 4.2.1 Bargaining Power of Suppliers

- 4.2.2 Bargaining Power of Buyers/Consumers

- 4.2.3 Threat of New Entrants

- 4.2.4 Threat of Substitute Products

- 4.2.5 Intensity of Competitive Rivalry

5 MARKET DYNAMICS

- 5.1 Market Drivers

- 5.1.1 Growing Incidence of Data Breaches

- 5.1.2 High Costs associated with On- premise Solutions

- 5.1.3 Increased Adoption from SME's

- 5.2 Market Restraints

- 5.2.1 Vulnerability of Cloud-based Applications to Cyber Crimes

- 5.3 Market Opportunities

- 5.3.1 Growing Trend of BYOD in Enterprises

- 5.4 Industry Ecosystem Analysis

- 5.5 Impact of COVID-19 on the CSaaS Industry

- 5.6 Emerging Case Studies and Implementation scenarios (Effect of CSaaS implementation among IT and Telecom and Retail Firms. Role of CSaaS in enabling Effective Threat Prevention and Mitigation among SMB's)

- 5.7 Cost Analysis of Data Breaches

6 MARKET SEGMENTATION

- 6.1 By Size of Organization

- 6.1.1 Small and Medium Enterprises

- 6.1.2 Large Enterprises

- 6.2 By Security Type

- 6.2.1 Vulnerability and Security Assessment

- 6.2.2 Threat Intelligence and Business Analytics

- 6.2.3 Auditing and Logging

- 6.2.4 Continuous Monitoring and Encryption

- 6.2.5 Identity and Access Management

- 6.2.6 Other Security Types

- 6.3 By End-user Industry

- 6.3.1 Healthcare

- 6.3.2 BFSI

- 6.3.3 IT and Telecom

- 6.3.4 Government

- 6.3.5 Energy and Utilities

- 6.3.6 Other End-user Industries

- 6.4 Geography

- 6.4.1 North America

- 6.4.2 Europe

- 6.4.3 Asia-Pacific

- 6.4.4 Latin America

- 6.4.5 Middle East & Africa

7 COMPETITIVE LANDSCAPE

- 7.1 Company Profiles

- 7.1.1 Foresite MSP LLC

- 7.1.2 FireEye Inc.

- 7.1.3 Forcepoint LLC

- 7.1.4 Convergent Network Solutions Ltd

- 7.1.5 IBM Corporation

- 7.1.6 McAfee Inc.

- 7.1.7 Armor Defense Inc.

- 7.1.8 Transputec Ltd

- 7.1.9 Zeguro Inc.

- 7.1.10 Cyber Security Services

- 7.1.11 Sara Technologies Inc.

- 7.1.12 Cloud24x7 Inc.

8 INVESTMENT ANALYSIS

9 FUTURE OF THE MARKET

02-2729-4219

+886-2-2729-4219