|

市场调查报告书

商品编码

1630256

多租户资料中心:市场占有率分析、产业趋势/统计、成长预测(2025-2030)Multi-Tenant Data Center - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

※ 本网页内容可能与最新版本有所差异。详细情况请与我们联繫。

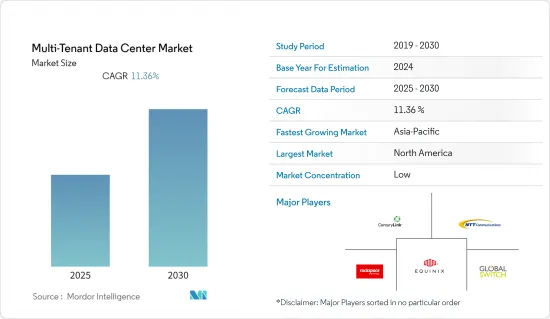

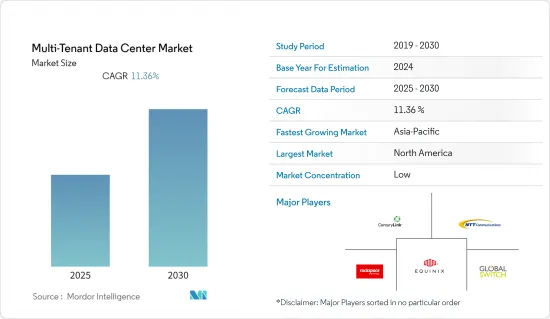

预计多租户资料中心市场在预测期内的复合年增长率为 11.36%。

主要亮点

- 多租用户资料中心透过软体应用程式的单一实例为多个用户端提供服务。它还允许企业更好地服务其客户和最终用户。因此,云端供应商和企业对多租户资料中心的需求正在迅速增加,显着推动了市场成长。

- 推动多租户资料中心成长的一个主要因素是绿色资料中心的日益普及。全球资料中心不断增加的电力消耗和碳排放正在提高企业对绿色资料中心设施需求的认识。未来几年,多租户资料中心市场将受到软体定义资料中心 (SDDC) 的使用和不断增加的网路流量的推动。

- 推动多租户资料中心市场成长的其他因素包括持续的资料中心升级导致现有资料中心的陈旧、IT 服务需求的增加以及 IT 支出的增加。多租户资料中心市场的成长也受到低营运成本、快速回应和部署以及 IT 技术进步的推动。

- 此外,各重要市场主体深度参与各类多租户资料中心的建置。例如,2022 年 8 月,总部位于堪萨斯州的品质技术服务公司 (QTS) 将购买Fayetteville以西的615 英亩农田,扩大其在亚特兰大大都会区的业务范围,这是世界上最大的农田,我们计划开发一个多用途农田。费耶特县发展局仅以 1.54 亿美元(约每英亩 25 万美元)的价格将土地出售给 QTS。

- 多租户资料中心市场面临的两个问题是资料安全性和某些多租户资料中心缺乏弹性。这些问题可能会减缓未来几年的市场成长。

- 资料中心产业长期以来一直在发生变化,但过去几年尤其具有挑战性,这主要是由于 COVID-19 大流行造成的。远距教育和工作的迅速增加、使用 Zoom 代替电话进行商务通话以及使用应用程式处理所有事情等趋势正在变得持续。特别是近年来,线上活动的快速成长增加了对资料中心閒置频段的需求,因为 COVID-19 大流行使得存取网路应用程式变得至关重要。随着越来越多的人依赖网路进行工作、社交网路、电子商务、银行业务、娱乐等,对近乎无限的执行时间和储存容量的需求持续成长。

多租户资料中心市场趋势

零售託管预计将保持强劲成长

- 零售託管是指客户使用资料中心内租用的空间(例如隔离区域中的机架空间)。小型企业通常更喜欢零售託管,因为它具有多种优点,包括易于维护。由于土地租金的原因,拥有一个资料中心并不是一个可行的选择。此外,由于财务限制,託管中心的维护通常很困难。

- 零售託管市场可能受到新兴国家对託管服务的高需求的推动。与批发託管服务相比,零售託管服务对于在一个或多个地点需要较少运算能力来服务本地和全球客户的企业来说非常有用。零售託管市场预计在预测期内将显着成长。

- 零售资料中心通常需要大约 100kW 的能源来供电,但批发客户由于其大规模运营,通常需要超过 100kW 的能源。许多设施由託管供应商提供,包括安全设备、客户支援和冷却设备。此外,对互连性的需求不断增加,从而增加了零售主机代管的整体需求。

- 此外,市场正在见证主要企业的各种主要产品发布和投资。例如,2022 年 3 月,营运商中立的託管供应商 Telehouse Europe 在伦敦开设了第五个託管资料中心。 Telehouse 的最新计划还涉及整修汤森路透以前占用的企业资料中心空间,并将其改造成由 100%可再生能源供电的主要零售託管中心。 Telehouse预计整个18MW计划的总建造成本为2.23亿英镑(2.94亿美元),到2025年Docklands资料中心的总投资将达到10亿英镑(13.2亿美元)。

- 零售资料中心託管市场预计将受到新兴国家公司对託管服务日益增长的需求的推动。此外,需要地理分散的容量且预算有限的公司可能会选择零售託管。据Vertiv称,到2028年,产业总收入预计将增加至1,360亿美元以上。这可能为市场在整个预测期内的成长和扩张创造巨大的成长机会。

亚太地区预计将大幅成长

- 由于託管服务的大规模外包,预计亚太地区的多租户资料中心市场将显着成长。在中国等国家,超大规模平台正在兴起,需要为中国的超大规模平台提供资料中心服务。由于这些资料的产生,日本的主机代管密度很高。例如,Digital Realty 在日本推出了第一个资料中心,称为“Digital Osaka 1”,这表明区域投资有所增加。

- 此外,新加坡因其四通八达的交通而被认为是世界上最大的航运港口之一。新加坡政府致力于透过经济成长和新想法来丰富国家。因此,科技业持续在新加坡投入大量资金。

- 印度是世界上成长最快的经济体之一,可能会推动基于公有云端为基础的资料中心的成长。 IT 产业作为印度最大的私人雇主在印度市场占据主导地位,而资料中心的广泛使用是市场成长的主要推动力。

- 此外,印度市场正在进行各种重要的投资和推出。例如,微软于 2022 年 3 月宣布将在特伦甘纳邦海得拉巴建造最新的资料中心区域。这项策略投资符合微软帮助客户在人工智慧和云端数位经济中蓬勃发展的承诺。

- 在印度,微软的资料中心目前分布在三个地区:清奈、孟买和普纳。海德拉巴资料中心将是该网路的最新成员。海德拉巴资料中心将为企业、教育机构、开发人员、新兴企业和政府机构带来微软在资料解决方案、生产力工具、云端、人工智慧 (AI)、客户关係管理 (CRM) 和资料安全方面的完整产品组合。

多租户资料中心产业概述

多租户资料中心市场较为分散,由数量有限的大型资料中心託管服务供应商和大量小型供应商组成。在预测期内,随着託管中心数量的增加,参与者之间的竞争可能会加剧。

新加坡最高的多租户资料中心 Equinix 的 SG5 将于 2022 年 8 月开业,该资料中心的初始投资约为 1.44 亿美元。 SG5 的高度并不是唯一值得注意的特征。这是 Equinix 在新加坡的第五个资料中心,也是其第二个待开发区设施。

2022 年 5 月,全球资料中心互连和託管服务领导者 Cyxtera 宣布,将透过与印度领先的数位 ICT 解决方案供应商 Sify Technologies Limited 建立策略合作伙伴关係,开始在印度提供託管解决方案。 Sixterra 将能够为印度另外五个市场的客户提供託管服务,印度是全球最重要、成长最快的经济体之一。作为伙伴关係关係的一部分,Sify 将向北美、欧洲和亚太地区的 10,000 多家客户销售 Sixterra 的全套解决方案。

其他好处:

- Excel 格式的市场预测 (ME) 表

- 3 个月分析师支持

目录

第一章简介

- 研究假设和市场定义

- 调查范围

第二章调查方法

第三章执行摘要

第四章市场洞察

- 市场概况

- 产业吸引力-波特五力分析

- 供应商的议价能力

- 买家/消费者的议价能力

- 替代品的威胁

- 新进入者的威胁

- 竞争公司之间的敌对关係

- 产业价值链/供应链分析

- 评估 COVID-19 对产业的影响

第五章市场动态

- 市场驱动因素

- 对绿色资料中心的需求不断增长

- 网路资料流量增加

- 市场限制因素

- 资料中心整合

- 资料安全问题

第六章 市场细分

- 按解决方案类型

- 零售託管

- 批发託管

- 按用途

- 公共云端

- 私有云端

- 按最终用户产业

- 资讯科技/通讯

- 卫生保健

- 防御

- 製造业

- 零售

- 其他最终用户产业

- 按地区

- 北美洲

- 欧洲

- 亚太地区

- 拉丁美洲

- 中东/非洲

第七章 竞争格局

- 公司简介

- CenturyLink Inc.

- Equinix Inc.

- Global Switch Ltd.

- NTT Communications Corporation

- Rackspace Inc.

- Internap Corporation

- Ascenty SA

- CentriLogic Inc.

- AT&T Inc.

- IBM Corporation

第八章投资分析

第九章 市场机会及未来趋势

The Multi-Tenant Data Center Market is expected to register a CAGR of 11.36% during the forecast period.

Key Highlights

- Multi-tenant data centers cater to multiple clients with a single instance of a software application, with clients having a shared affinity at some level. Also, it allows enterprises to serve clients and end users better. Hence, there is a surge in the overall demand for multi-tenant data centers from cloud providers and enterprises, which is fueling the market's growth significantly.

- The primary factor driving the growth of multi-tenant data centers is the growing popularity of green data centers. The consumption of electricity and the increase in carbon emissions by data centers globally are creating awareness among enterprises about the need for green data center facilities. In the next few years, the multi-tenant data center market will be driven by the use of software-defined data centers (SDDCs) and the growth of internet traffic.

- Some other factors, such as continuous upgradation in data centers resulting in obsolescence in existing data centers, an increase in demand for IT services, and increased IT spending, are driving the growth in the multi-tenant data center market. Also, the growth of the multi-tenant data center market is due in part to low operational costs, quick response and deployment, and technical advances in IT.

- Moreover, various significant market players are well involved in building various multi-tenant data centers. For instance, in August 2022, Kansas-based Quality Technology Services (QTS) plans to develop the world's largest multi-tenant data center campus across 615 acres of current farmland just west of downtown Fayetteville to expand its metro Atlanta footprint. The Fayette County Development Authority sold the property to QTS for just USD 154 million, or roughly USD 250,000 per acre.

- Concerns about data security and the inflexibility of some multi-tenant data centers are two problems that the multi-tenant data center market has to deal with. These problems could slow the market's growth over the next few years.

- The data center sector had been changing for a long time, but the last several years have been particularly challenging, mainly owing to the COVID-19 pandemic. The surge in remote school and work, making business calls on Zoom instead of the phone, and utilizing an app for everything is a permanent trend. The fast growth of online activity has raised the demand for data center white space, particularly in recent years, as the COVID-19 pandemic made access to internet applications a requirement. With more people relying on the internet for work, social networking, e-commerce, banking, and entertainment, the demand for almost limitless uptime and storage capacity kept growing.

Multi-Tenant Data Center Market Trends

Retail colocation is Expected to Hold Significant Growth Rate

- Retail colocation is where the customer takes the space for lease within the data center, such as rack space within the caged-off area. Owing to various advantages, like ease of maintenance, smaller enterprises generally prefer retail colocation. Owning a data center is not a viable option due to the cost of land leasing. Also, maintenance of a colocation center is often not within budget constraints.

- The retail colocation market is likely driven by the high demand for colocation services from developing countries. Compared to wholesale colocation services, retail colocation services are highly suitable for enterprises requiring lesser computing power at one site or across multiple locations to service local and global customers. The retail colocation market is anticipated to witness significant growth during the forecast period.

- About 100 kW of energy is typically needed to power retail data centers, while wholesale customers usually need more than 100 kW, owing to their business scale. Many facilities, such as security provision, customer support, cooling facilities, etc., are provided by colocation suppliers. Moreover, there lies a growing need for interconnectivity, increasing the overall demand for retail colocation.

- Furthermore, the market is witnessing various key launches and investments by key players as part of its strategy to improve business and their presence to reach customers and meet their requirements for various applications. For instance, in March 2022, Carrier-neutral colocation provider Telehouse Europe opened its fifth colocation data center in London. Also, Telehouses's latest project is looking forward to refurbishing the enterprise data center space once utilized by Thompson Reuters and turning it into a major retail colocation hub powered by 100% renewable energy. Telehouse anticipates the entire 18MW project to cost GBP 223 million (USD 294 million), and its total investment in Docklands data centers is expected to reach GBP 1 billion (USD 1.32 billion) by 2025.

- The retail data center colocation market is likely driven by the increased demand for colocation services from organizations in developing countries. Also, enterprises with the need for geographically distributed capacity and limited budgets are likely to opt for retail colocation. As per Vertiv, the total industry revenues are expected to increase to over 136 billion dollars by 2028. This would possibly create immense growth opportunities for the market to grow and expand all throughout the forecast period.

Asia-Pacific Expected to Hold Significant Growth

- The multi-tenant data center market is expected to have significant growth in the Asia-Pacific region due to the large-scale outsourcing of managed hosting services in this region. A country like China has witnessed a rise in their hyper-scale platforms, owing to which providing data center services for Chinese hyper-scale platforms has become necessary. As a result of such data generation, Japan has a high density of colocation.For instance, Digital Realty launched its first data center in Japan, named "Digital Osaka 1," indicating increased regional investment.

- Moreover, Singapore is considered one of the largest shipping ports in the world as it ensures connectivity. Singapore's government is working to make the country rich through economic growth and new ideas. As a result, the technology industry continues to invest a lot of money in Singapore.

- India is one of the fastest-growing economies in the world, and it is likely to boost the growth of public cloud-based data centers. The IT industry dominates the Indian market as the largest private sector employer in the country, where data centers are widely used, propelling market growth significantly.

- Also, the Indian market is witnessing various crucial investments and launches. For instance, in March 2022, Microsoft announced that Hyderabad, Telangana, would be the site of its latest data center area. This strategic investment aligns with Microsoft's commitment to assisting clients in thriving in an AI- and cloud-enabled digital economy.

- In India, there are currently three regions distributed over Chennai, Mumbai, and Pune for Microsoft's data centers. The data center in Hyderabad would be a new addition to this network. It would thus provide the entire Microsoft portfolio across data solutions, productivity tools, cloud, artificial intelligence (AI), and customer relationship management (CRM) with data security for businesses, educational institutions, developers, start-ups, and governmental organizations.

Multi-Tenant Data Center Industry Overview

The multi-tenant data center market is fragmented and consists of a limited number of large-scale data center colocation service providers and numerous small-scale vendors. During the forecast period, there will be more competition between the players because the number of colocation centers is going up.

In August 2022, Equinix's SG5, Singapore's tallest multi-tenant data center, opened and was mainly constructed with an initial investment of around USD 144 million. The SG5 is noteworthy for more than its height. It's Equinix's fifth data center in Singapore, but only its second greenfield facility.

In May 2022, Cyxtera, a global leader in data center interconnection and colocation services, declared it would begin offering colocation solutions in India through a strategic partnership with Sify Technologies Limited, one of India's leading digital ICT solutions providers. Cyxtera can deliver colocation services to customers in five additional markets in one of the most essential and fastest-growing global economies. As part of the partnership, Sify would sell Cyxtera's full suite of solutions to more than 10,000 customers in North America, Europe, and the Asia-Pacific region.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumption And Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET INSIGHTS

- 4.1 Market Overview

- 4.2 Industry Attractiveness - Porter's Five Forces Analysis

- 4.2.1 Bargaining Power of Suppliers

- 4.2.2 Bargaining Power of Buyers/Consumers

- 4.2.3 Threat of Substitute Products

- 4.2.4 Threat of New Entrants

- 4.2.5 Intensity of Competitive Rivalry

- 4.3 Industry Value Chain / Supply Chain Analysis

- 4.4 Assessment Of The Covid-19 Impact On The Industry

5 MARKET DYNAMICS

- 5.1 Market Drivers

- 5.1.1 Increased Demand For Green Data Centers

- 5.1.2 Growing Internet Data Traffic

- 5.2 Market Restraints

- 5.2.1 Consolidation of Data Centers

- 5.2.2 Data Security Concerns

6 MARKET SEGMENTATION

- 6.1 By Solution Type

- 6.1.1 Retail Colocation

- 6.1.2 Wholesale Colocation

- 6.2 By Application

- 6.2.1 Public Cloud

- 6.2.2 Private Cloud

- 6.3 By End-user Industry

- 6.3.1 IT & Telecom

- 6.3.2 Healthcare

- 6.3.3 Defense

- 6.3.4 Manufacturing

- 6.3.5 Retail

- 6.3.6 Other End-user Industries

- 6.4 Geography

- 6.4.1 North America

- 6.4.2 Europe

- 6.4.3 Asia-Pacific

- 6.4.4 Latin America

- 6.4.5 Middle East & Africa

7 COMPETITIVE LANDSCAPE

- 7.1 Company Profiles

- 7.1.1 CenturyLink Inc.

- 7.1.2 Equinix Inc.

- 7.1.3 Global Switch Ltd.

- 7.1.4 NTT Communications Corporation

- 7.1.5 Rackspace Inc.

- 7.1.6 Internap Corporation

- 7.1.7 Ascenty S.A.

- 7.1.8 CentriLogic Inc.

- 7.1.9 AT&T Inc.

- 7.1.10 IBM Corporation