|

市场调查报告书

商品编码

1630261

汽车生物辨识技术 -市场占有率分析、产业趋势/统计、成长预测(2025-2030)Biometric in the Automotive - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

价格

※ 本网页内容可能与最新版本有所差异。详细情况请与我们联繫。

简介目录

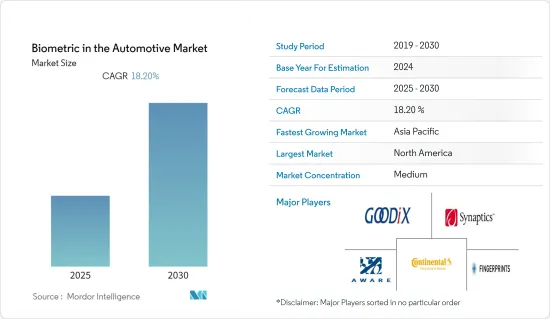

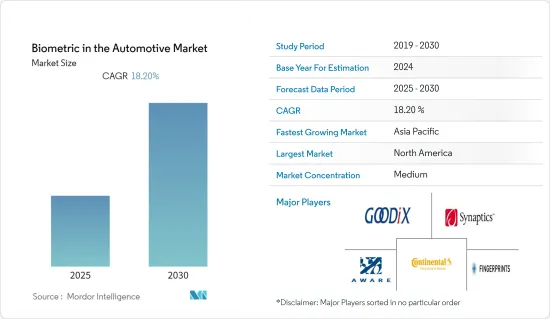

汽车生物辨识市场预计在预测期内复合年增长率为 18.2%

主要亮点

- 在汽车产业,生物辨识应用涵盖各个领域。例如使用各种生物辨识扫描器对车辆启动进行存取控制,以及为使用者启用个人化车辆,以便驾驶人和乘客可以存取播放清单、联络人和喜爱的应用程式。这些生物辨识技术在汽车中的应用预计在预测期内将会增加。

- 虹膜辨识被认为是一种用于汽车驾驶员身份验证的可靠且准确的生物识别技术,参与企业正在利用更多功能来实现它,例如保护透过网关提供的多种服务。 2022 年 4 月,现代汽车申请了一项系统专利,该系统使用虹膜扫描技术在进入车辆时验证驾驶员身份。该系统还可以阻止某人启动车辆,除非生物识别匹配。

- 最近,iLock 宣布合作,将其虹膜生物识别技术应用于 SiriusXM 电子钱包,并开发高度安全的非接触式闸道原型。驾驶人和乘客将能够在路上寻找、支付和预付咖啡、汽油、电影票、停车位等。 EyeLock自订设计的安装在遮阳板上的原型可捕获驾驶员和乘客的虹膜生物识别,从而消除驾驶员在交易过程中分心的情况。这些新技术解决了虹膜辨识领域生物识别应用的未来新趋势。

- 脸部认证在汽车领域变得越来越重要。汽车製造商斯巴鲁在其最新的森林人车型中引入了脸部认证。该系统结合了红外线 LED 和摄像头,可以监控驾驶员注意力不集中或困倦的征兆,并在必要时发出警告。该系统最多可识别五名驾驶员,从而可以自动针对每个人量身定制设定和偏好。

- 此外,各汽车製造商正在引入指纹技术来解锁他们的汽车。指纹认证被认为是生物认证的主要方法,因为找到两个相同指纹(即使是双胞胎)的机率为 640 亿分之一,因此更加可靠。

- 现代汽车等汽车製造商已经采用了指纹识别系统,允许多个驾驶员註册指纹。根据您的指纹,您的爱车将自动调整您的座椅位置和后视镜角度。现代汽车表示,新增的指纹认证技术利用人体电容,让读取器辨识指纹,以防止骇客攻击和伪造。据说读取器错误率为五万分之一。

- 由于 COVID-19 大流行,全球汽车产量直线下降。据欧洲汽车工业协会称,迄今为止,整个欧盟因工厂关闭而造成的生产损失至少达到 2,446,344 辆汽车。生物识别系统尤其被视为早期检测、患者筛检和公共监控的关键技术,以阻止 COVID-19 的传播,但汽车领域正面临着由于供应链导致的汽车产量下降的问题。

汽车生物辨识市场趋势

脸部认证预计将大幅成长

- 预计在预测期内,汽车产业中脸部认证的采用将会增加。此技术的应用有助于车辆出入控制及其安全。市场驱动因素是考虑实施监控驾驶人和乘客情绪并追踪行为的解决方案。

- 此外,脸部辨识解决方案还用于各种汽车行业应用,例如汽车点火和减少汽车盗窃。一旦车主通过身份验证,他们还可以自动调整车辆设定以适应个人喜好,例如调整暖气或选择您最喜欢的音乐。

- 随着自动驾驶汽车在技术上变得越来越重要,使用脸部辨识来实现安全和存取预计将变得更加重要。例如,如果驾驶员出现困倦或昏昏沉沉的情况,车辆可以进行控制以确保安全。这些因素进一步增加了此类解决方案的市场潜力。

- 捷豹路虎正在测试一种监测乘员情绪的系统。安装在方向盘上的摄影机和生物辨识感应器可以监控驾驶者的脸部表情。系统不断对其进行分析并自动改变驾驶室的功能。例如,如果系统侦测到驾驶员压力,它可以将环境照明变更为平静的颜色。此外,如果您发现疲劳征兆,请选择更刺激的播放清单或降低车内温度。这个基于人工智慧的系统可以学习并适应个人行为。

- 这英国汽车製造商也正在为车辆后方的乘客研究类似的技术。车辆头枕中整合的两个摄影机可监控后座乘客的脸部表情。如果他们感到困了,系统可以调暗灯光、调暗窗户或增加座椅的加热。

- 2021 年 5 月,特斯拉 Model 3 和 Model Y 中安装的 ADAS(高级驾驶员辅助系统)使用脸部辨识来确保驾驶员就座并集中註意力。在车内,摄影机资料在本地储存和分析。根据特斯拉的人工智慧汽车系统专利申请,该公司正在致力于利用脸部生物辨识技术来追踪乘客位置和个人化设定。

- 此外,现代汽车于 2021 年 9 月宣布,即将推出的 Genisys 品牌首款全电动运动型公共事业车 GV60 将配备名为 Face Connect 的脸部辨识系统。 GV60上安装的脸部辨识系统用于开门和启动引擎。

- 随着汽车需求的增加,脸部认证的需求预计也会增加。根据国际汽车工业协会的数据,2021年全球汽车销量成长了5%,这标誌着在因COVID-19导致需求连续两年下降后出现销售復苏的迹象。

北美占据主要市场占有率

- 北美是全球最大的汽车生产基地之一。近年来,汽车产业呈现温和成长。该地区的汽车产业面临二手车市场的激烈竞争。 Cox Automotive预计,2021年二手车销售量将比2020年成长10%,达到4,090万辆。

- 因此,该地区的汽车製造商正在依靠生物辨识技术等新技术来增加价值并在市场上脱颖而出。该地区的汽车产业是一个由生物辨识技术应用驱动的新兴市场。公司正在针对该市场对其生物识别产品进行策略性定位和细分。

- 例如,2022 年 2 月,总部位于密西根州的福特全球技术公司获得了一项内置于汽车中的脸部辨识系统的专利,该系统可以识别驾驶员并仅通过查看驾驶员即可解锁车门。

- 此外,2022 年 1 月,向美国专利商标局提交了一份患者申请,暗示传闻中的 Apple Car 将与车载 AI 整合。该专利提供了车载系统的技术规格细节,该系统包含一个摄像头,可以检测坐在车内的个人的生物识别信息,如果收到离开车辆的命令,则可以覆盖对该人的控制。

- 该地区的汽车公司,包括宝马、梅赛德斯-奔驰、大众和福特,已经提到为其高端豪华车配备生物识别技术和增强的安全功能。这些公司提到在各个领域探索生物辨识技术,包括车辆存取、点火器开关、车辆防盗装置、合理化和健康监测。

汽车生物辨识产业概况

汽车生物辨识市场竞争适中,由几家大型企业组成。然而,随着安全平台服务的进步,新参与企业正在增加其在市场上的影响力,从而扩大企业发展。我们将介绍一些最近的市场发展趋势。

- 2022 年 5 月 - Dermalog 和莱茵金属合作成立莱茵金属 Dermalog SensorTec GmbH。新公司将为汽车製造商提供创新的生物识别技术。

- 2021 年 11 月 - 该汽车製造商的戴姆勒移动部门宣布与 Visa 合作,使用指纹扫描来检验车辆的安全数位付款,让驾驶员无需语音命令或密码即可进行购物。该技术将于 2022 年在英国推广,然后在全球推广。

其他好处

- Excel 格式的市场预测 (ME) 表

- 3 个月分析师支持

目录

第一章简介

- 研究假设和市场定义

- 调查范围

第二章调查方法

第三章执行摘要

第四章市场动态

- 市场概况

- 产业吸引力-波特五力分析

- 买方议价能力

- 供应商的议价能力

- 新进入者的威胁

- 替代品的威胁

- 竞争公司之间的敌对关係

- 产业价值链分析

- 市场驱动因素

- 汽车领域新兴市场对安全和保全系统的需求不断增长

- 保险公司为配备生物识别技术的车辆提供的好处

- 市场限制因素

- 缺乏标准化

- COVID-19 市场影响评估

第五章市场区隔

- 类型

- 硬体

- 软体

- 扫描器类型

- 指纹认证

- 虹膜辨识

- 手掌识别

- 脸部辨识

- 语音辨识

- 其他扫描器类型

- 地区

- 北美洲

- 欧洲

- 亚太地区

- 拉丁美洲

- 中东/非洲

第六章 竞争状况

- 公司简介

- Synaptics Incorporated

- Fingerprint Cards AB

- Aware Inc.

- Cerence Inc.(Nuance Communications Inc.)

- Continental AG

- Sensory Inc.

- Shenzhen Goodix Technology Co. Ltd

- B-Secur Ltd

- EyeLock Inc.

- Precise Biometrics AB

第七章 投资分析

第8章 未来趋势

简介目录

Product Code: 66589

The Biometric in the Automotive Market is expected to register a CAGR of 18.2% during the forecast period.

Key Highlights

- In the automotive industry, the application of biometrics lies in various areas, including access control for starting a vehicle using various biometric scanners, enabling personalized vehicles for the users to allow drivers and passengers to call up playlists, contacts, and preferred apps. The application of these biometrics in automotive vehicles is expected to increase during the forecast period.

- Iris recognition is considered a reliable and accurate biometric technique for authentication of the driver in automobiles, and players are approaching with more features, such as securing the multiple services offered through the gateway. In April 2022, Hyundai filed a patent for a system that uses iris scanning technology to verify the driver's identity when they get into the vehicle. This system also prevents someone from starting the vehicle unless there is a biometric match.

- Recently, EyeLock announced a collaboration to apply its iris biometric authentication technology to the SiriusXM e-Wallet in a highly secure, touchless gateway prototype. Drivers and passengers will be able to find, pay, or pre-pay for coffee, gas, movie tickets, or parking while on the go. It helps to eliminate driver distractions during transaction processes, capturing driver or passenger iris biometrics with EyeLock's custom-designed, visor-mounted prototype. Such new technology caters to a new future trend in the biometric application in the iris recognition segment.

- Facial recognition has been gaining importance in the automotive sector. Automaker Subaru introduced facial recognition into its latest Forrester model. The system combines an infrared LED and a camera to monitor the driver for signs of inattention or sleepiness, warning them if needed. The system recognizes up to five individual drivers, so settings and preferences can be automatically adjusted for each person.

- Furthermore, various automobile players have also implemented fingerprint technology to unlock their cars. Fingerprint identification is majorly accepted in biometric identification as the probability of finding two same fingerprints is one in 64 billion, even with twins, increasing its credibility.

- Automobile players, such as Hyundai Motor, use fingerprints where multiple drivers can register theirs. Depending on the fingerprint, the car will automatically adjust seat positions and the angle of the rearview mirrors. Hyundai says its method to add fingerprint technology uses the human's capacitance where the reader differentiates and prevents hacking or any forged fingerprints. It has been said that the reader has an error rate of 1 in 50,000.

- Due to the COVID-19 pandemic, the production unit of automotive has fallen steeply at the global level. According to the European Automobile Manufacturers Association, EU-wide production losses due to factory shutdowns amount to at least 2,446,344 motor vehicles so far. In particular, biometric systems have been brought into the spotlight as a key technology for early detection, patient screening, and public safety monitoring in an effort to contain the spread of COVID-19; however, in the automobile sector, the demand reduced drastically due to low production of automotive and disruptions in the supply chain.

Biometric in the Automotive Market Trends

Facial Recognition is Expected to Grow at a Significant Rate

- The emphasis on the adoption of facial recognition in the automotive industry is expected to increase over the forecast period. The application of the technology helps access control of the vehicle and its safety. Enterprises in the market are looking to incorporate the solution to track driver and passenger behavior by monitoring their emotions.

- Furthermore, facial recognition solutions are also used for various automotive industry applications, such as car ignition and cutting down car thefts. These can also automatically adjust the vehicle settings and handle personal preferences, such as heat adjustment and selection of favorite music to play once the vehicle's owner is authorized.

- With autonomous cars becoming more and more relevant with the technology, using facial recognition to assimilate safety with access is expected to become more prominent. For instance, if the driver seems to be sleepy/dizzy, the vehicle can take control to ensure safety. These factors further enhance the potential of these solutions in the market.

- Jaguar Land Rover is testing a system for monitoring the mood of the occupant. A camera attached to the steering wheel and biometric sensors monitor the driver's facial expressions. The system continuously analyzes it and changes the cabin features automatically. For instance, if the system detects the driver is under stress, it can change the ambient lighting to calming colors. Then signs of weariness will lead to selecting a more stimulating playlist or reducing the temperature in the vehicle. The AI-based system is capable of learning and adapting accordingly to individual behavior.

- The British automaker is also researching similar technology for the passengers in the back of the vehicle. Two cameras incorporated in the headrests of the vehicle monitor the facial expressions of the rear passengers. If they get drowsy, the system can dim the lights, tint the windows, or turn up the seat heating.

- In May 2021, Tesla's advanced driver assistance systems in the Model 3 and Model Y vehicles used face recognition to ensure that the driver was seated and paying attention. Within the car, the camera data is stored and analyzed locally. According to a Tesla patent application for an AI automobile system, the business is working on leveraging face biometrics to track passenger whereabouts or personalize settings.

- Furthermore, Hyundai Motors announced in September 2021 that it would include a facial recognition system named Face Connect in its forthcoming GV60, the first all-electric sports utility vehicle from the Genisis brand. The facial recognition system in the GV60 is used to open doors and start the engine.

- With the growing demand for motor vehicles, it is expected that the demand for facial recognition will also increase. According to the International Organization of Motor Vehicle Manufacturers, global motor vehicle sales increased by 5% in 2021, representing the signs of rebounding in sales after two consecutive years of declining demand due to COVID-19.

North America Holds Significant Market Share

- North America is one of the largest automotive manufacturing hubs in the world. The automotive industry has shown marginal growth in recent years. The automotive sector in this region is facing stiff competition from the used car market. According to an estimate by Cox Automotive, there were 40.9 million used car sales in 2021, up by 10% from 2020.

- Due to this, automotive manufacturers in the region rely on newer technologies, like biometrics, to create additional value and differentiation in the market. The automotive sector in the region is the newly emerging market for the application of biometrics. The companies are strategically positioning and segmenting their biometric offerings toward the market.

- For instance, in February 2022, Ford Global Technologies in Michigan was awarded a patent for facial recognition systems built into the vehicles that will recognize their drivers and unlock the doors on sight.

- Further, in January 2022, a patient was filed in the United States Patents and Trademarks office, suggesting that the rumored Apple Car would be integrated with onboard AI. This patent provides details on the onboard system's technical specifications that incorporate cameras that can detect the individual's biometrics sitting in the car and override control to that individual if a command is given to break away from exterior control.

- The automotive companies in the region, including BMW, Mercedes-Benz, Volkswagen, and Ford, have already mentioned integrating biometric technology in their high-end luxury segmented cars with high-security features. The companies have mentioned exploring biometric technology in various areas, including vehicular access, ignition switch, vehicle immobilizer, rationalization, and health monitoring.

Biometric in the Automotive Industry Overview

Biometrics in the automotive market is moderately competitive and consists of a few major players. However, with the advancement in security platform services, new players are increasing their market presence, thereby expanding their business footprint across emerging economies. Some of the recent developments in the market are:

- May 2022 - Dermalog and Rheinmetall partnered together to form Rheinmetall Dermalog SensorTec GmbH, aiming to bring enhanced safety to road traffic. The new company will supply innovative biometric technologies to vehicle manufacturers.

- Nov 2021 - The automaker's Daimler Mobility unit announced its partnership with Visa to use the fingerprint scan to verify secure digital payments from the vehicle, allowing the driver to make purchases without the need for voice commands or PINs. The technology will be rolled out in 2022 in the United Kingdom and globally later.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET DYNAMICS

- 4.1 Market Overview

- 4.2 Industry Attractiveness - Porter's Five Force Analysis

- 4.2.1 Bargaining Power of Buyers

- 4.2.2 Bargaining Power of Suppliers

- 4.2.3 Threat of New Entrants

- 4.2.4 Threat of Substitute Products

- 4.2.5 Intensity of Competitive Rivalry

- 4.3 Industry Value Chain Analysis

- 4.4 Market Drivers

- 4.4.1 Increase in Need for Safety and Security System Across the Emerging Markets of Automobile Sector

- 4.4.2 Benefits From Insurance Companies for Vehicles Installed with Biometric Technology

- 4.5 Market Restraints

- 4.5.1 Lack of Standardization

- 4.6 Assessment of Impact of COVID-19 on the Market

5 MARKET SEGMENTATION

- 5.1 Type

- 5.1.1 Hardware

- 5.1.2 Software

- 5.2 Scanner Type

- 5.2.1 Fingerprint Recognition

- 5.2.2 Iris Recognition

- 5.2.3 Palm Recognition

- 5.2.4 Facial Recognition

- 5.2.5 Voice Recognition

- 5.2.6 Others Scanner Types

- 5.3 Geography

- 5.3.1 North America

- 5.3.2 Europe

- 5.3.3 Asia-Pacific

- 5.3.4 Latin America

- 5.3.5 Middle East and Africa

6 COMPETITIVE LANDSCAPE

- 6.1 Company Profiles

- 6.1.1 Synaptics Incorporated

- 6.1.2 Fingerprint Cards AB

- 6.1.3 Aware Inc.

- 6.1.4 Cerence Inc. (Nuance Communications Inc.)

- 6.1.5 Continental AG

- 6.1.6 Sensory Inc.

- 6.1.7 Shenzhen Goodix Technology Co. Ltd

- 6.1.8 B-Secur Ltd

- 6.1.9 EyeLock Inc.

- 6.1.10 Precise Biometrics AB

7 INVESTMENT ANALYSIS

8 FUTURE TRENDS

02-2729-4219

+886-2-2729-4219