|

市场调查报告书

商品编码

1630265

Dark Analytics -市场占有率分析、产业趋势/统计、成长预测(2025-2030)Dark Analytics - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

※ 本网页内容可能与最新版本有所差异。详细情况请与我们联繫。

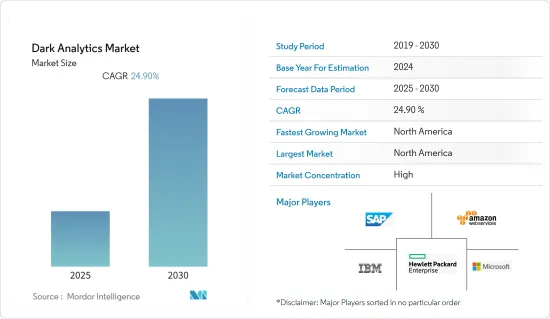

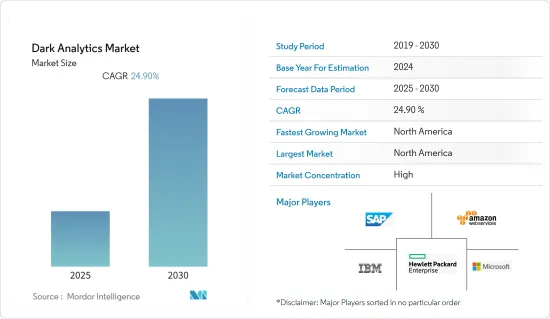

预计暗分析市场在预测期内复合年增长率为 24.9%

主要亮点

- 从网路、社群媒体和其他物联网系统等各种来源收集大量资料。这些资料呈指数级增长,但并未针对潜在影响进行组织或检查,而只是出于历史目的进行管理。据 IBM 称,收集到的资料中有 60% 很快就会失去效用。

- 推动暗分析市场成长的关键因素是透过分析销售、生产和分销趋势等关键业务流程的即时资料来获得决策见解。

- 如果使用得当,这些暗资料可以产生大量收益。例如,借助资料分析,行销部门可以了解哪些产品最受特定目标群体的追捧,从而寻找促销和优惠以提高业务绩效。

- 2022 年,Ocient 调查了 500 位 IT 经理,以了解他们对资料分析的看法。其中,64% 已经在使用超大规模资料集来获取见解并为决策提供资讯。该群体中 78% 的人认为更快的资料分析将产生更高的收益。为了保持竞争力并适应不断变化的市场需求,您需要快速分析资料。

- COVID-19有利于暗网智能的应用。这场大流行促使组织考虑各种商业性扩张方案。公司意识到他们可以从这些未充分利用的资料中提取有用的信息,并将其用于收益开发。例如,在分析流量模式后,使用非结构化客户地理位置和情绪资料来支援业务和行销策略。

- 如果不加以管理,此类暗资料可能会对资料保护程式带来重大风险,并导致意外成本。最近的一项研究显示,近 50% 的企业资料是非结构化或从未结构化的,每年的储存成本高达 2,600 万美元。

暗分析市场趋势

零售和电子商务保持强劲成长

- 在零售业,资料是透过多个客户接触点产生的。此外,随着电子商务销售透过数位化扩大,大量暗资料正在产生。对于零售公司来说,这些暗资料可能包含重要资讯。透过分析这些暗资料,零售公司可以提高和发展自己在竞争环境中的影响力。

- 几乎每家零售公司都意识到数位转型如何改变了消费者的购物和行为。零售公司开始考虑不同的策略来创造数位体验。探索先前未开发的客户数位生活资料,以深入了解如何在零售、行销、客户服务甚至产品开发策略中定位和个人化客户体验。

- Kroger 是美国最大的杂货零售商,在 35 个州拥有 2,700 多家商店,利用先进的分析来了解客户偏好和购买频率。克罗格是唯一一家比其他连锁超级市场更早采用电脑扫描器和结帐软体的零售商。凭藉其资料分析能力,克罗格能够确定通货膨胀率上升导致大多数消费者选择自有品牌而不是全国品牌。因此,我们在 2022 年第一季推出了 239 种新的自有品牌产品。

北美地区占比最大

- 据估计,未来几年北美将占据暗分析市场的最大份额。该地区的国家是暗分析技术的早期采用者。分析提供者在该地区占有重要地位,并为市场扩张做出了贡献。范例包括 IBM Corporation、Microsoft Corporation 和 SAS Institute, Inc.。

- 在北美,各种暗分析新兴企业为多个行业提供服务。主要的分析云端服务供应商也位于该地区。机器学习和人工智慧技术的出现、物联网的普及以及业务应用程式的快速成长是推动全球暗分析市场的其他关键因素。

- 2022 年 7 月,Dataiku 与德勤美国数据和人工智慧联盟生态系统联手,协助企业建构可大规模交付价值的可重复使用的人工智慧计划。两家公司将共同帮助企业向数千名用户部署人工智慧解决方案、简化机器学习管道、处理风险和管治以及提高资料品质。

暗分析产业概述

近年来,暗分析市场受到关注。市场上的公司正在进行策略创新和合作,以提供对现有暗资料的洞察。市场上的供应商透过併购以及与价值链中的此类公司建立合作伙伴关係,增加了人工智慧和机器学习能力。这种策略方法预计将推动市场进行更密切的合作,以开发更好的解决方案,并可能影响市场结构。

2023 年 1 月,AWS 在印度启动了数据实验室计画。该计划透过培养内部资料分析技能、透过在职培训和各种培训课程来提高现有员工的技能以及与组织合作来使企业受益。 PayU Finance 利用 AWS 数据实验室摆脱传统基础设施,建构适合其业务需求的可扩展资料平台。

2022 年 11 月,资料分析公司 KNIME推出了KNIME Hub。这加速了技能开发,并使资料主导的决策更容易在任何公司中采用。使用者可以透过 KNIME 资料 Hub 应用程式检视、下载和共用解决方案。您也可以将工作流程部署为资料应用程式或服务,并将其提供给更多公司。

Amazon Web Services 宣布于 2022 年 11 月推出HealthLake。 HealthLake 是一项使用新技术的医学影像和分析服务。据该公司称,HealthLake Imaging 可以将医疗系统的医疗影像储存总成本降低高达 40%。例如,总部位于波士顿的 Radical Imaging 使用基于 HealthLake Imaging API 构建的 OHIF计划,为其客户提供零占用空间、支援云的医疗成像应用程式。

其他好处

- Excel 格式的市场预测 (ME) 表

- 3 个月分析师支持

目录

第一章简介

- 调查先决条件

- 调查范围

第二章调查方法

第三章执行摘要

第四章市场动态

- 市场概况

- 市场驱动因素

- 机器学习和人工智慧的采用率提高

- 由于物联网的引入,产生的资料量和类型迅速增加

- 市场限制因素

- 安全问题

- 产业吸引力-波特五力分析

- 买家/消费者的议价能力

- 供应商的议价能力

- 新进入者的威胁

- 替代品的威胁

- 竞争公司之间敌对关係的强度

第五章市场区隔

- 按分析类型

- 预测性

- 说明的

- 说明的

- 按行业分类

- BFSI

- 医疗保健

- 政府机构

- 通讯

- 零售/电子商务

- 其他行业

- 地区

- 北美洲

- 美国

- 加拿大

- 欧洲

- 英国

- 德国

- 欧洲其他地区

- 亚太地区

- 中国

- 日本

- 澳洲

- 其他亚太地区

- 其他的

- 拉丁美洲

- 中东/非洲

- 北美洲

第六章 竞争状况

- 公司简介

- IBM Corporation

- SAP SE

- Amazon Web Services Inc.

- Micro Focus International PLC

- Microsoft Corporation

- SAS Institute

- Teradata Corporation

- Hewlett-Packard Enterprise Company

- Oracle Corporation

第七章 投资分析

第八章市场机会及未来趋势

The Dark Analytics Market is expected to register a CAGR of 24.9% during the forecast period.

Key Highlights

- Vast amounts of data are collected from various sources, including the internet, social media, and other IoT systems. This data is expanding exponentially, but it is not organized or examined for potential consequences; instead, it is merely maintained for historical purposes. According to IBM, 60% of this gathered data loses its usefulness immediately.

- The main thing that is driving the growth of the dark analytics market is getting insights for making decisions by analyzing real-time data from key business processes like sales, production, and distribution trends.

- This dark data, if used appropriately, can generate a lot of revenue. For example, with the help of data analytics, the marketing division can understand which products are most demanded by particular target groups and thus look for promotions and offers to sell them to increase their performance.

- In 2022, Ocient polled 500 IT managers to find out what they thought about data analytics.62% agreed that data analysis is essential for business planning and company strategy. 64% of these already use hyperscale datasets to draw insights and use them in decision-making. 78% of this group realized faster data analytics generates higher revenue. The data should be analyzed quickly to stay ahead of the competition and adapt to changing market needs.

- The application of dark web intelligence benefited from COVID-19. The pandemic encouraged organizations to look into various commercial expansion options. Businesses believed they could extract useful information from this underutilized data to help with revenue development. For instance, unstructured customer geolocation and sentiment data were used to assist business and marketing strategy after it was analyzed for traffic patterns.

- This dark data can pose significant dangers to data protection procedures and accrue unanticipated expenditures if not managed. Recent studies show that almost 50% of a company's data is unstructured or never structured, which adds to an annual storage cost of $26 million.

Dark Analytics Market Trends

Retail and E-commerce to Hold Significant Growth

- During the time frame of the forecast, the retail and e-commerce vertical is expected to grow quickly.In retail industries, data is generated through multiple customer touchpoints. Also, as e-commerce sales have grown due to digitalization, a significant amount of dark data has been produced. For retailers, this dark data may hold crucial information. Retailers may develop and improve their presence in the competitive environment by analyzing this dark data, which also offers growth potential.

- Nearly all retailers acknowledge how the digital shift has changed consumer shopping and behavior. Retailers have started investigating various strategies for creating digital experiences. Some companies are even examining hitherto unexplored customer digital life data to gain insights into how to target better and personalize customer experiences in retailing, marketing, customer service, and even product development strategies.

- To keep track of their customers' preferences and purchases based on their regularity, Kroger Co., the largest grocery operator in the US with over 2700 shops throughout 35 states, uses advanced analytics. The only retailer to embrace computerized scanners and checkout software more quickly than any other supermarket chain was Kroger. Kroger was able to determine that rising inflation has caused most consumers to choose private labels over national brands thanks to its data analytics capabilities. It consequently introduced 239 new private-label goods in Q1 2022.

North America to Hold Largest Share

- North America is estimated to account for the largest share of the dark analytics market in the forthcoming years. Countries in the region are early adopters of dark analytics technology. Analytics providers have a significant presence in the area, which contributes to the market's expansion. IBM Corporation, Microsoft Corporation, and SAS Institute, Inc. are a few examples.

- In North America, various dark analytics startups provide services to multiple industries. In addition, leading analytics and cloud service providers are based in this region. The emergence of machine learning and AI technology, widespread adoption of IoT, and rapid growth in business applications are other vital factors fueling the global dark analytics market.

- In July 2022, Dataiku tied up with and joined the Deloitte US Data and AI Alliance Ecosystem to help enterprises build reusable AI projects that deliver value at scale. Together, the companies will help businesses deploy AI solutions to thousands of users, make ML pipelines more efficient, handle risk and governance, and improve the quality of data.

Dark Analytics Industry Overview

The dark analytics market has been gaining traction in recent years. The companies in the market have been strategically innovating and partnering to provide insights into the dark data present. The vendors in the market have added AI and machine learning capabilities through mergers and acquisitions or by partnering with such companies in the value chain. Such strategic approaches are expected to drive the market towards closer collaboration to develop a better solution and may impact the market structure.

In January 2023, AWS launched the Data Lab Program in India. The program will benefit enterprises by building internal data analytics skills, upskilling current staff through on-the-job training and different training courses, and partnering with organizations. PayU Finance uses AWS Data Lab to move away from legacy infrastructure and build a scalable data platform suited to its business requirements.

In November 2022, the data analytics company KNIME launched the KNIME hub. This will hasten skill development and make data-driven decisions simple to adopt throughout any firm. Users can view, download, and share their solutions via the KNIME data hub application. They can also deploy their workflows as data apps and services that can be made available to more significant businesses.

Amazon Web Services announced the launch of HealthLake in November 2022. HealthLake is a service for medical imaging and analytics that uses new technologies. The company says that HealthLake Imaging can help health systems save up to 40% on the total cost of storing medical images. For instance, Radical Imaging, a Boston-based company, is providing customers with zero-footprint, cloud-capable medical imaging applications using an OHIF project that is built on HealthLake Imaging APIs.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET DYNAMICS

- 4.1 Market Overview

- 4.2 Market Drivers

- 4.2.1 Increasing Adoption Rates of Machine Learning and Artificial Intelligence

- 4.2.2 Rapid Growth in Generated Data Volume and Variety Owing to Adoption of IoT

- 4.3 Market Restraints

- 4.3.1 Security Concerns

- 4.4 Industry Attractiveness - Porter's Five Forces Analysis

- 4.4.1 Bargaining Power of Buyers/Consumers

- 4.4.2 Bargaining Power of Suppliers

- 4.4.3 Threat of New Entrants

- 4.4.4 Threat of Substitute Products

- 4.4.5 Intensity of Competitive Rivalry

5 MARKET SEGMENTATION

- 5.1 By Type of Analytics

- 5.1.1 Predictive

- 5.1.2 Prescriptive

- 5.1.3 Descriptive

- 5.2 By End-user Vertical

- 5.2.1 BFSI

- 5.2.2 Healthcare

- 5.2.3 Government

- 5.2.4 Telecommunications

- 5.2.5 Retail & E-commerce

- 5.2.6 Other End-user Verticals

- 5.3 Geography

- 5.3.1 North America

- 5.3.1.1 United States

- 5.3.1.2 Canada

- 5.3.2 Europe

- 5.3.2.1 United Kingdom

- 5.3.2.2 Germany

- 5.3.2.3 Rest of Europe

- 5.3.3 Asia Pacific

- 5.3.3.1 China

- 5.3.3.2 Japan

- 5.3.3.3 Australia

- 5.3.3.4 Rest of Asia-Pacific

- 5.3.4 Rest of the World

- 5.3.4.1 Latin America

- 5.3.4.2 Middl-East & Africa

- 5.3.1 North America

6 COMPETITIVE LANDSCAPE

- 6.1 Company Profiles

- 6.1.1 IBM Corporation

- 6.1.2 SAP SE

- 6.1.3 Amazon Web Services Inc.

- 6.1.4 Micro Focus International PLC

- 6.1.5 Microsoft Corporation

- 6.1.6 SAS Institute

- 6.1.7 Teradata Corporation

- 6.1.8 Hewlett-Packard Enterprise Company

- 6.1.9 Oracle Corporation