|

市场调查报告书

商品编码

1630266

供应商管理软体:市场占有率分析、产业趋势与统计、成长预测(2025-2030)Vendor Management Software - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

※ 本网页内容可能与最新版本有所差异。详细情况请与我们联繫。

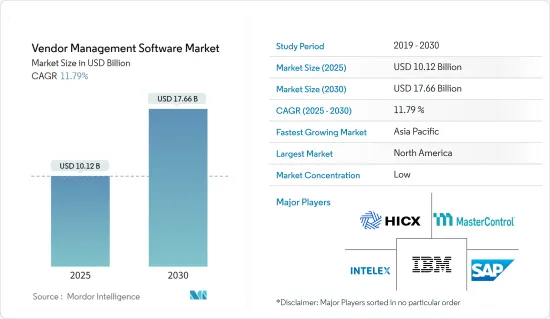

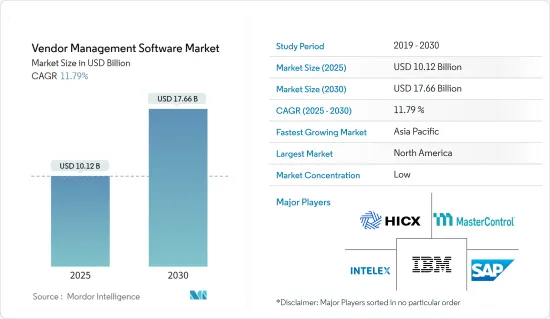

供应商管理软体市场规模预计到 2025 年为 101.2 亿美元,预计到 2030 年将达到 176.6 亿美元,预测期内(2025-2030 年)复合年增长率为 11.79%。

供应商管理软体在简化与供应商关係相关的流程方面发挥关键作用,使企业能够维持高效且具成本效益的供应商网路。该软体可优化供应商选择、追踪绩效、管理合约并确保合规性。随着供应链变得更加复杂以及对第三方供应商的依赖增加,这些解决方案变得至关重要。零售和 BFSI(银行、金融服务和保险)等各行业的公司正在投资供应商管理工具,以实现高效的供应商生命週期管理、供应商关係管理和第三方风险缓解。

云端基础的解决方案的进步

主要亮点

- 云端运算降低了采用障碍 由于基于云端基础的解决方案的进步,供应商管理软体市场正在经历快速成长。云端的采用提供了灵活性、扩充性和较低的初始成本,这使其对中小型企业特别有吸引力。这些公司正在利用云端解决方案来优化采购和供应链管理。

- 提高可存取性和扩充性:云端基础的系统可让企业即时监控供应商合规性和风险管理,无论其位置为何。这种可访问性对于在多个地区运营的公司至关重要,因为云端基础的工具可以帮助您跨时区高效管理供应商。

- 成本效益:云端模型具有成本效益,减少了大量初始投资的需要。企业可以扩展其供应商管理解决方案以满足需求,这种功能对于处理不断变化的供应商需求的组织尤其有益。

- 资料保护和合规性:云端基础的供应商管理软体的供应商优先考虑资料安全,并制定严格的通讯协定来确保敏感供应商资讯的保护。定期软体更新有助于企业遵守行业法规并降低因违规受到处罚的风险。

注重降低管理成本

主要亮点

- 透过自动化降低成本:降低管理成本是实施供应商管理软体的关键驱动力。透过自动化供应商入职、合约管理和合规追踪等流程,企业可以减少管理时间和成本。自动化减少了人为错误,提高了效率,即时分析改善了决策。

- 简化管理业务:供应商管理软体可自动执行供应商绩效评估、风险评估和合规管理等关键功能,进而大幅减少文书工作。这种数位化使公司能够透过消除重复性任务来降低人事费用。

- 资料主导的决策:透过将供应商资料集中在单一平台上,公司可以统一其采购工作。这使采购团队能够专注于策略决策而不是日常供应商管理,从而改善了供应商生命週期管理。

- 改善供应商谈判:有关供应商绩效的准确资料洞察使公司能够谈判更好的条款和合同,进一步有助于降低业务成本和整体效率。

云端基础的供应商管理解决方案的采用现状

主要亮点

- 在企业中越来越受欢迎:云端基础的供应商管理软体越来越受欢迎,企业正在转向这种解决方案来获取经济高效且扩充性的供应商管理工具。即时资料存取和供应商风险管理是推动云端采用的关键功能,尤其是在零售和 BFSI 等供应链复杂的行业中。

- 增强的安全性:随着企业采用云端基础的工具,供应商管理软体供应商正在专注于改进安全功能,以确保敏感的供应商资料受到保护。定期合规更新对于医疗保健和金融服务等受到高度监管的行业也很重要。

- 全球供应链优势:云端基础的解决方案对于拥有国际供应链的组织尤其有利,因为它们允许从任何地方监控供应商合规性、合约管理和风险缓解。

- 提高灵活性并降低资本成本:与传统的本地系统不同,云端基础的供应商管理工具无需大量前期投资即可提供灵活性和扩充性。此功能对于想要优化采购和供应商管理流程同时有效管理预算的中小型企业特别有用。

供应商管理软体市场趋势

市场领先的零售业

- 复杂的供应商网络:零售业由于依赖复杂的供应商网络,预计将占据最大的市场占有率。供应商管理软体有助于简化供应商生命週期管理、监控供应商绩效并追踪监管标准的合规性,从而提高您的供应链效率并降低风险。

- 合规自动化零售公司越来越多地采用合规管理自动化工具来减少错误、简化流程并改善监督。当该行业面临日益严格的监管要求并确保持续的业务永续营运时,这一点尤其重要。

- 电子商务成长推动需求:随着电子商务的快速扩张,零售商正专注于将供应商入职和合约管理工具整合到其采购软体中。供应商管理解决方案越来越多地实施,因为这业务更顺利地运作并最大限度地降低法律风险。

- 透过绩效评估提高效率:供应商绩效评估是使用供应商管理软体的零售商的关键功能。透过评估供应商的交货时间、品管和价格等指标,零售商可以优化其供应商策略并提高供应链效率。

预计北美将主导市场

- 成熟的IT基础设施推动渗透 由于其先进的IT基础设施和广泛的数位化采用,北美预计将占据重要的市场占有率。製造业、医疗保健和金融服务等行业越来越多地转向供应商管理解决方案来有效管理供应商关係。

- 法律规范推动采用美国引领北美市场,严格的监管标准推动供应商合规管理系统的采用。这些工具可协助公司降低风险、减少违规处罚并简化供应商管理。

- 自动化供应商入职流程:北美越来越多地采用自动化供应商入职流程,使公司能够改善整合并减少管理业务。随着公司寻求简化业务和改进供应商生命週期管理,这一趋势预计将持续下去。

- 加强合约管理:北美公司也在实施合约管理软体,以优化采购业务并确保法规。该全部区域供应商管理软体的采用正在增加,因为这些工具可以更好地管理供应商合约。

供应商管理软体产业概述

- 市场分散,参与者多元化 供应商管理软体市场高度分散,大型科技公司和利基供应商都在争夺市场占有率。 SAP SE 和 IBM Corporation 等大型供应商正在扩展其人工智慧和自动化工具产品,而 LogicManager, Inc. 和 Ncontracts LLC 等小型供应商正在满足特定的行业需求,例如合规性管理和风险缓解。

- 扩大全球影响力:Intelex Technologies Inc.、MasterControl, Inc. 和 MetricStream Inc. 等主要企业致力于扩大其产品组合併在全球扩张。这些公司提供全面的供应商生命週期管理解决方案,整合了绩效追踪、风险管理和合规性。

- 人工智慧整合推动未来成长:供应商管理软体中越来越多地采用人工智慧和机器学习是塑造市场未来的关键趋势。人工智慧驱动的工具增强了供应商选择、风险分析、绩效评估,并为企业提供更快、资料驱动的决策能力。

- 需求更多合规工具:随着产业面临越来越大的监管压力,提供适应性强、扩充性的合规管理解决方案的公司将脱颖而出。尤其是在医疗保健、金融服务和零售等行业,对合规性的关注正在成为成功的关键因素。

其他好处

- Excel 格式的市场预测 (ME) 表

- 3 个月的分析师支持

目录

第一章简介

- 研究假设和市场定义

- 调查范围

第二章调查方法

第三章执行摘要

第四章市场洞察

- 市场概况

- 市场促进因素与市场约束因素介绍

- 市场驱动因素

- 日益需要最大限度地降低管理成本

- 越来越多地采用云端基础的运算

- 云端基础的解决方案的进步

- 市场限制因素

- 安装和维护成本高

- 产业吸引力-波特五力分析

- 供应商的议价能力

- 买家/消费者的议价能力

- 新进入者的威胁

- 替代品的威胁

- 竞争公司之间敌对关係的强度

- 评估 COVID-19 对产业的影响

第五章市场区隔

- 按发展

- 本地

- 云

- 按最终用户产业

- 零售

- BFSI

- 製造业

- 资讯科技/通讯

- 其他最终用户产业

- 按地区

- 北美洲

- 欧洲

- 亚洲

- 澳洲/纽西兰

- 拉丁美洲

- 中东/非洲

第六章 竞争状况

- 公司简介

- MasterControl, Inc.

- Intelex Technologies Inc.

- IBM Corporation

- SAP SE

- HICX Solutions.

- Coupa Software Inc.

- SalesWarp

- Ncontracts LLC

- LogicManager, Inc.

- Gatekeeper

- MetricStream Inc.

- Quantivate, LLC.

第七章 投资分析

第八章 市场机会及未来趋势

The Vendor Management Software Market size is estimated at USD 10.12 billion in 2025, and is expected to reach USD 17.66 billion by 2030, at a CAGR of 11.79% during the forecast period (2025-2030).

Vendor management software plays a critical role in streamlining processes associated with vendor relations, enabling companies to maintain efficient, cost-effective supplier networks. This software optimizes vendor selection, tracks performance, manages contracts, and ensures compliance. With the rising complexity of supply chains and increased reliance on third-party vendors, these solutions have become indispensable. Companies across sectors such as retail and BFSI (Banking, Financial Services, and Insurance) invest in vendor management tools for efficient vendor lifecycle management, supplier relationship management, and third-party risk mitigation.

Advancements in Cloud-Based Solutions

Key Highlights

- Cloud computing lowers adoption barriers: The market for vendor management software is experiencing rapid growth, driven by advancements in cloud-based solutions. Cloud deployments offer flexibility, scalability, and lower upfront costs, making them attractive, especially for small and medium-sized enterprises (SMEs). These businesses leverage cloud solutions to optimize procurement and supply chain management.

- Enhanced accessibility and scalability: Cloud-based systems allow businesses to monitor vendor compliance and risk management in real time, regardless of location. This accessibility is crucial for companies operating across multiple regions, as cloud-based tools help manage suppliers efficiently across time zones.

- Cost efficiency: Cloud models are cost-effective, reducing the need for high upfront capital investment. Businesses can scale their vendor management solutions according to demand, a feature particularly beneficial for organizations dealing with fluctuating vendor requirements.

- Data protection and compliance: Vendors of cloud-based vendor management software have prioritized data security, implementing strict protocols to ensure the protection of sensitive vendor information. Regular software updates help businesses stay compliant with industry regulations, reducing the risk of non-compliance penalties.

Focus on Administrative Cost Reduction

Key Highlights

- Cost reduction through automation: The need to reduce administrative costs is a key driver for adopting vendor management software. By automating processes like vendor onboarding, contract management, and compliance tracking, companies can cut down on administrative time and costs. Automation reduces human errors, enhances efficiency, and improves decision-making through real-time analytics.

- Streamlined administrative workload: Vendor management software automates essential functions such as supplier performance evaluation, risk assessments, and compliance management, significantly reducing paperwork. This digitization enables companies to cut labor costs by eliminating repetitive tasks.

- Data-driven decision-making: Centralizing supplier data on a single platform allows companies to consolidate procurement activities. This enables procurement teams to focus on strategic decisions rather than day-to-day vendor management, improving vendor lifecycle management.

- Improved vendor negotiations: With accurate data insights into supplier performance, companies can negotiate better terms and contracts, further contributing to operational cost savings and overall efficiency.

Adoption of Cloud-Based Vendor Management Solutions

Key Highlights

- Growing popularity among businesses: Cloud-based vendor management software is becoming increasingly popular, with businesses turning to these solutions for cost-effective, scalable vendor management tools. Real-time data access and vendor risk management are some of the key features driving cloud adoption, especially in industries with complex supply chains like retail and BFSI.

- Security enhancements: As businesses adopt cloud-based tools, vendor management software providers are focusing on improving security features to ensure that sensitive vendor data remains protected. These solutions also provide regular compliance updates, which is critical in heavily regulated industries such as healthcare and financial services.

- Benefits for global supply chains: Cloud-based solutions are especially advantageous for organizations with international supply chains, as they allow businesses to monitor vendor compliance, manage contracts, and ensure risk mitigation from any location.

- Increased flexibility and reduced capital costs: Unlike traditional on-premise systems, cloud-based vendor management tools offer flexibility and scalability without requiring high upfront investment. This feature is particularly beneficial for SMEs looking to optimize their procurement and vendor management processes while managing their budgets efficiently.

Vendor Management Software Market Trends

Retail Sector Leading the Market

- Complex vendor networks: The retail industry is expected to hold the largest market share due to its reliance on a complex network of suppliers. Vendor management software helps retailers streamline vendor lifecycle management, monitor supplier performance, and track compliance with regulatory standards, ensuring supply chain efficiency and risk mitigation.

- Automation driving compliance: Retailers are increasingly adopting automated compliance management tools to reduce errors, streamline processes, and enhance oversight. This is particularly relevant as the industry faces rising regulatory requirements and the need to ensure continuous operational continuity.

- E-commerce growth boosting demand: With the rapid expansion of e-commerce, retailers are focusing on integrating vendor onboarding and contract management tools into their procurement software. This helps ensure smooth supplier operations and minimize legal risks, driving the adoption of vendor management solutions.

- Performance evaluation driving efficiency: Supplier performance evaluation is a key feature for retailers using vendor management software. By evaluating vendors on delivery, quality control, and pricing metrics, retailers can optimize supplier strategies and improve supply chain efficiency, enhancing vendor relationships and reducing third-party risks.

North America Expected to Dominate the Market

- Mature IT infrastructure fueling adoption: North America is anticipated to hold a significant market share, driven by its advanced IT infrastructure and widespread digital adoption. Industries such as manufacturing, healthcare, and financial services are increasingly utilizing vendor management solutions to manage supplier relationships efficiently.

- Regulatory frameworks promoting adoption: The U.S. leads the North American market, with stringent regulatory standards driving the implementation of vendor compliance management systems. These tools help businesses mitigate risks, reduce non-compliance penalties, and streamline supplier management.

- Vendor onboarding automation: In North America, the adoption of automated vendor onboarding processes is growing, allowing companies to improve integration and reduce administrative tasks. This trend is expected to continue, driven by businesses seeking operational efficiency and improved vendor lifecycle management.

- Contract management on the rise: North American companies are also turning to contract management software to optimize procurement operations and ensure legal compliance. These tools enable better control over vendor agreements, contributing to the growing adoption of vendor management software across the region.

Vendor Management Software Industry Overview

- Fragmented market with diverse players: The vendor management software market is highly fragmented, with both large technology giants and niche vendors competing for market share. Major players such as SAP SE and IBM Corporation are expanding their offerings to include AI and automation tools, while smaller vendors like LogicManager, Inc. and Ncontracts LLC cater to specific industry needs, such as compliance management and risk mitigation.

- Expanding global reach: Key players such as Intelex Technologies Inc., MasterControl, Inc., and MetricStream Inc. focus on broadening their portfolios and expanding globally. They offer comprehensive vendor lifecycle management solutions that integrate performance tracking, risk management, and compliance.

- AI integration driving future growth: The increasing incorporation of AI and machine learning in vendor management software is a key trend shaping the market's future. AI-powered tools enhance vendor selection, risk analysis, and performance evaluations, providing businesses with faster, data-driven decision-making capabilities.

- Enhanced compliance tools in demand: As industries face growing regulatory pressures, companies offering adaptable, scalable compliance management solutions will stand out. The focus on compliance is becoming a critical factor for success, especially in industries such as healthcare, financial services, and retail.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET INSIGHT

- 4.1 Market Overview

- 4.2 Introduction to Market Drivers and Restraints

- 4.3 Market Drivers

- 4.3.1 Increasing Need to Minimize the Administrative Costs

- 4.3.2 Increased Adoption of Cloud Based Computing

- 4.3.3 Advancements in Cloud-Based Solutions

- 4.4 Market Restraints

- 4.4.1 High Implementation and Maintenance Cost

- 4.5 Industry Attractiveness - Porter's Five Forces Analysis

- 4.5.1 Bargaining Power of Suppliers

- 4.5.2 Bargaining Power of Buyers/Consumers

- 4.5.3 Threat of New Entrants

- 4.5.4 Threat of Substitute Products

- 4.5.5 Intensity of Competitive Rivalry

- 4.6 Assessment of COVID-19 Impact on the Industry

5 MARKET SEGMENTATION

- 5.1 By Deployment

- 5.1.1 On-premise

- 5.1.2 Cloud

- 5.2 By End-user Industry

- 5.2.1 Retail

- 5.2.2 BFSI

- 5.2.3 Manufacturing

- 5.2.4 IT & Telecommunications

- 5.2.5 Other End-user Industries

- 5.3 By Geography

- 5.3.1 North America

- 5.3.2 Europe

- 5.3.3 Asia

- 5.3.4 Australia and New Zealand

- 5.3.5 Latin America

- 5.3.6 Middle East and Africa

6 COMPETITIVE LANDSCAPE

- 6.1 Company Profiles

- 6.1.1 MasterControl, Inc.

- 6.1.2 Intelex Technologies Inc.

- 6.1.3 IBM Corporation

- 6.1.4 SAP SE

- 6.1.5 HICX Solutions.

- 6.1.6 Coupa Software Inc.

- 6.1.7 SalesWarp

- 6.1.8 Ncontracts LLC

- 6.1.9 LogicManager, Inc.

- 6.1.10 Gatekeeper

- 6.1.11 MetricStream Inc.

- 6.1.12 Quantivate, LLC.