|

市场调查报告书

商品编码

1630271

机器人作业系统:市场占有率分析、产业趋势/统计、成长预测(2025-2030)Robot Operating System - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

※ 本网页内容可能与最新版本有所差异。详细情况请与我们联繫。

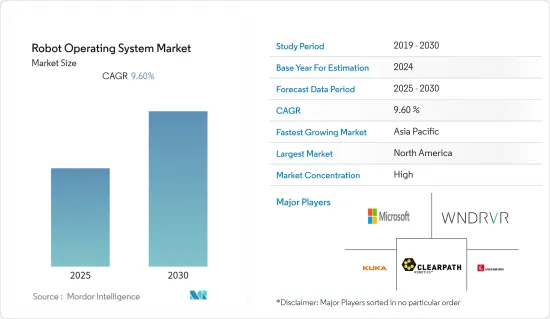

机器人作业系统市场预计在预测期内复合年增长率为 9.6%。

主要亮点

- 此外,ROS 可用于建立和模拟机器人应用程式和无人地面车辆任务。大流行期间越来越多地引入机器人。世界经济论坛对 300 家全球公司进行的调查显示,五分之四的企业领导者正在加快工作数位化计画并引入人工智慧和机器人等新技术。

- 各机器人製造商也看到机器人销售的快速成长。例如,据 EES Corporation 称,医疗保健机器人的销售将在 2021 年增加,以帮助医疗保健工作者。全球大幅成长 69%。

- 机器人作业系统 (ROS) 由开放原始码机器人基金会开发,是用于建立机器人应用程式的软体和工具的集合。机器人作业系统市场(市场研究)的特点是全球机器人采用率不断增加,对具有成本效益和可配置机器人的需求以及供应商为其硬体客户开发 ROS 服务的投资不断增加。

- 根据国际机器人联合会预测,到2025年,协作机器人市场规模预计将达到123亿美元。智慧机器人可以透过程式设计与工人一起工作,承担大多数工厂工人所做的日常和繁琐的任务,并进行准确的交货。此外,机器人製造商正致力于改进培训、程式设计方法和模拟,以保持其独特性,同时用升级的系统取代旧系统。因此,开放原始码ROS的采用正在增加。

- 市场上一些领先的供应商联合发布了基于 ROS 的技术,该技术能够实现多个 AMR 之间的协作,从而将性能和即时通讯提升到新的水平。例如,2022 年 2 月,诺斯罗普·格鲁曼公司的 Remotec 宣布与 Kinova 建立战略伙伴关係,以培育强大的创新和技术(I&T) 生态系统,以快速开发和部署基于人工智慧的应用程式.

机器人作业系统 (ROS) 市场趋势

最终用户产业越来越多地采用 ROS 预计将推动市场成长

- 对自主机器人不断增长的需求正在刺激开放原始码ROS 的采用,因为此类机器人的软体开发面临多学科的挑战。根据三菱重工2022年工业年度报告,机器人和自动化的技术采用率将在2021年占65.1%,预计2025年将达到73%。

- 由于此类机器人的操作行为和模式多种多样,对此类机器人的需求正在增加。此外,机器人变得更小,并具有完美的方位和方向,使它们能够执行任务而不会出现错误或运动延迟。此外,对能够在对人类不太友善的条件下使用的机器人的需求不断增加,例如高温、高压和难以到达危险地点的挑战。

- 履约、仓储和物流领域的参与者大量涌入,使得该市场成为基于 ROS 的解决方案的主要且永续的市场。此外,仓库劳动力短缺也是物流公司在仓库采用机器人的主要动力。

- 为了支持机器人在商业和工业应用中的发展,市场上的研究供应商已经快速开发了 ROS 软体。 2021 年 4 月,Canonical 和 Open Robotics 宣布建立合作伙伴关係,以增强机器人作业系统 (ROS) 的安全维护 (ESM) 和企业支持,作为 Canonical 的 Ubuntu Advantage 服务包的一部分。

- 此次伙伴关係将使 ROS 机器人和服务更易于建置和打包、更易于管理且部署更可靠,从而为机器人社群提供支援。

- 然而,仍然值得注意的挑战是分析。大多数从 AMR 收集并发送到高级云端空间进行处理的资料会导致云端建设延迟,从而导致作业系统高成本。

亚太地区预计将出现显着成长

- 亚太地区的机器人数量和机器人数量均取得了令人瞩目的成长。由于製造业越来越多地采用自动化以及整个全部区域工业机器人的采用不断增加,预计亚太地区将在预测期内呈现最高的成长率。

- 中国、日本、泰国和韩国等国家製造了大量的商务用和工业机器人。由于电子和汽车製造领域的大规模应用,中国和印度的机器人采用率非常高。

- 例如,印度政府计划投资军事机器人,并最近与日本合作。到2023年,该国计画部署约544个具有人工智慧功能的先进机器人士兵,这些机器人士兵重量轻,配备监视录影机和传输装置,射程为200公尺。

- 预计在预测期内,中国的自动化程度将激增。根据 IFR 的数据,2020 年新部署的机器人中有 71% 安装在亚洲,高于 2019 年的 67%。中国是该地区装机数量最多的国家,大幅增加20%至16.84万台。这也是单一国家最高的,运作单位达到 943,223 个(成长 21%)。

- 「中国製造2025」计画最初是一个十年愿景,旨在将中国从低端产品生产国转变为高端产品生产国,使中国成为高科技製造业的世界领导者。这种转变有可能对人工智慧、巨量资料、物联网和机器人等技术产生正面影响,从而增强自动化和工业 4.0。快速的工业化、巨额的外国投资以及持续的製造强国地位,为中国的机器人应用提供了广阔的市场。

- 此外,2021年5月启动的投资支援计画预计将进一步鼓励机械设备投资。根据IFR预测,电子产业和汽车供应商对机器人的需求预计将在2021年大幅成长11%,并在接下来的几年中年均成长8%。

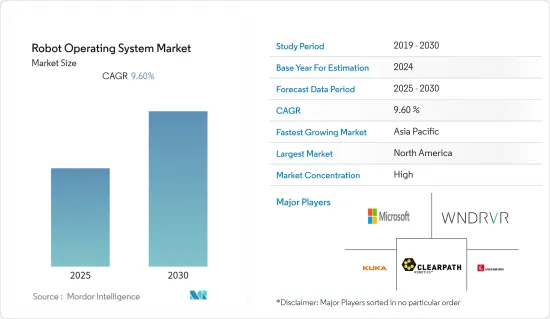

机器人作业系统(ROS)产业概述

ROS 市场竞争激烈,目前由少数精通机器人技术的参与者主导。全球市场预计将具有一体化性质,在市场上占有重要份额的主要参与者正在基本客群>。微软公司、KUKA AG 和 Clearpath Robotics 是当前市场的重要参与者。

- 2022 年 2 月—三菱电机公司开发了一种免教学机器人系统技术,使机器人能够以与人类相同的速度执行排序和整理等任务,而无需专家指导。预计可应用于食品加工厂等。

- 2021 年 3 月 - Ambi Robotics 宣布推出一款基于人工智慧的先进机器人作业系统,将模拟变为现实。此次推出是为了因应 COVID-19 大流行期间线上运输需求的大幅成长。

其他好处:

- Excel 格式的市场预测 (ME) 表

- 3 个月的分析师支持

目录

第一章简介

- 研究假设和市场定义

- 调查范围

第二章调查方法

第三章执行摘要

第四章市场洞察

- 市场概况

- 产业吸引力-波特五力分析

- 供应商的议价能力

- 消费者议价能力

- 新进入者的威胁

- 替代品的威胁

- 竞争公司之间的敌对关係

- 产业价值链分析

- 市场驱动因素

- 中小企业和大型企业对工业自动化的需求不断增加

- 研发经费增加

- 最终用户产业更采用 ROS

- 市场限制因素

- 维护成本高

- 实施成本高

第五章 COVID-19 对市场的影响

第六章 市场细分

- 按地区

- 北美洲

- 欧洲

- 亚太地区

- 世界其他地区

第七章 竞争格局

- 公司简介

- Microsoft Corporation

- KUKA AG

- Wind River Systems Inc.

- Clearpath Robotics

- Husarion Inc.

- Brain Corporation

- Neobotix GmbH

第八章投资分析

第九章 市场机会及未来趋势

The Robot Operating System Market is expected to register a CAGR of 9.6% during the forecast period.

Key Highlights

- Furthermore, ROS can be used in building and simulating robotics applications and unmanned ground vehicle missions. There has been a strong adoption of robots during the pandemic. According to a World Economic Forum survey of 300 global companies, four of five business executives are accelerating plans to digitize work and deploy new technologies, such as AI and Robotics.

- Various robot manufacturers have also seen a spike in the sales of robots. For instance, according to EES corporation, in 2021, the sales of healthcare robots have risen purposed for helping medical professionals. Significant growth of 69% has been noticed worldwide.

- The robot operating system (ROS) developed by Open Source Robotics Foundation is a collection of software and tools that enable building robot applications. The robot operating system market (hereafter referred to as the 'market studied') is characterized by increased global robotics adoption, the requirement for cost-effective and configurable robots, and increased investment being realized from vendors to develop ROS services for their hardware clients.

- According to the International Federation of Robotics, the market for collaborative robots is expected to reach USD 12.3 billion by 2025. Intelligent robots work alongside workers and can be programmed by most factory workers to take on routine, tedious tasks and deliver with accuracy. Additionally, robot manufacturers focus on improving training and programming methods and simulations, replacing older systems with upgraded ones while retaining their proprietaries. Hence, the open source ROS finds its increased adoption.

- Some of the major vendors in the market are collaborating to launch ROS-based technology that enables a new level of performance and collaboration between multiple AMRs with real-time communication. For instance, in February 2022, Northrop Grumman's Remotec announced a strategic partnership today with Kinova, aiming to foster a robust Innovation and Technology (I&T) ecosystem to develop and deploy AI-based applications faster.

Robot Operating System (ROS) Market Trends

Increased Adoption of ROS by End-user Industries is Expected to Drive the Market Growth

- The increasing demand for autonomous robots is fueling the adoption of open-source ROS, as software development for such robots faces multi-disciplinary challenges. According to MHI Industrial Annual Report, 2022, the technology adoption rate of robotics and automation accounted for 65.1% in 2021 and is expected to reach 73% by 2025.

- The demand for such robots is increasing numerously due to their different operational behavior and patterns. Furthermore, they are smaller and made with the perfect orientation and instructions to perform tasks without errors and delays in actions. It is increasingly demanded with applicability for conditions, such as not-so-human friendly conditions, elevated temperature, pressure, and challenging to reach hazardous places.

- With the massive influx of players in order fulfillment, warehouse, and logistics space, such markets serve a ready yet sustainable market for ROS-based solutions. Plus, warehouse labor shortages have primarily motivated the logistics company to employ bots within their warehouse.

- There has been rapid development in the ROS software by vendors studied in the market for supporting the growth of robotics in commercial and industrial adoption. In April 2021, Canonical and Open Robotics announced a partnership for Robot Operating System (ROS) Extended Security Maintenance (ESM) and enterprise support as part of Ubuntu Advantage, Canonical's service package for Ubuntu.

- The partnership helps in supporting the robotics community by making ROS robots and services easier to build and package, more straightforward to manage, and more reliable to deploy.

- However, a challenge that remains to be focused upon is analytics. Most of the data collected from AMRs and sent to advanced cloud spaces for processing makes the cloud build latency and, in turn, high cost of an operating system.

Asia-Pacific is Expected to Grow at a Significant Growth Rate

- Asia-Pacific has recorded impressive growth in robots, both in volume and robots. It is expected to have the highest growth rate during the forecast period owing to the increasing adoption of automation by manufacturing industries and the adoption of industrial robots throughout the region.

- Countries such as China, Japan, Thailand, and South Korea manufacture both commercial and industrial robots in high volume. The adoption rate of robotics in China and India is very high, owing to the massive deployment in the electronic and automotive manufacturing sectors.

- The Indian government, for instance, plans to invest in military robotics and has recently tied up with Japan. By 2023, the country plans to implement AI and induct around 544 advanced robotic soldiers that are lightweight and consist of surveillance cameras and transmission systems with a range of 200 meters for the purpose.

- China is expected to witness an automation surge over the forecast period. According to IFR, 71% of all newly deployed robots in 2020 were installed in Asia, up from 67% in 2019. The region's largest adopter was China, where the installations grew strongly by 20% with 168,400 units. This was also the highest value recorded for a single country, with the operational stock reaching 943,223 units (+21%).

- The "Made in China 2025" plan began as a 10-year vision to transform China from a low-end to a high-end producer of goods, aiming to make China the global leader in high-tech manufacturing. This transformation may positively impact technologies like AI, Big Data, IoT, and robotics and enhance automation and industry 4.0. The fast industrialization, massive overseas investment, and continuing to be a manufacturing powerhouse accords China a vast market for the use of robotics.

- China's National Development and Reform Commission has announced an AI three-year implementation program expected to accelerate the adoption of advanced technologies to help the country become a superpower by 2030.n Moreover, an investment support program launched in May 2021 is expected to boost investment in machinery and equipment further. According to IFR, the demand for robots both from the electronics industry and automotive suppliers is expected to grow substantially by 11% in 2021 and by 8% annually on average in the following years.

Robot Operating System (ROS) Industry Overview

The ROS market is highly competitive and is currently dominated by a few players with technological expertise in robotic technology. The global market is expected to be consolidated in nature, and the major players with a prominent share in the market are focusing on expanding their customer base across foreign countries by leveraging on strategic collaborative initiatives to increase their market share and profitability. Microsoft Corporation, KUKA AG, and Clearpath Robotics are some significant players in the current market.

- February 2022 - Mitsubishi Electric Corporation developed a teaching-less robot system technology to enable robots to perform tasks, such as sorting and arrangement, as fast as humans without having to be taught by specialists. The technology is expected to be applied in facilities such as food-processing factories.

- March 2021 - Ambi Robotics launched its advanced robot operating system based on simulation to reality artificial intelligence. The launch is in line to meet the demand of the staggering growth of online deliveries during the COVID-19 pandemic.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET INSIGHTS

- 4.1 Market Overview

- 4.2 Industry Attractiveness - Porter's Five Force Analysis

- 4.2.1 Bargaining Power of Suppliers

- 4.2.2 Bargaining Power of Consumers

- 4.2.3 Threat of New Entrants

- 4.2.4 Threat of Substitutes

- 4.2.5 Intensity of Competitive Rivalry

- 4.3 Industry Value Chain Analysis

- 4.4 Market Drivers

- 4.4.1 Increasing Demand for Industrial Automation among SMEs and Large Enterprises

- 4.4.2 Increased Funding in Research and Development Activities

- 4.4.3 Increased Adoption of ROS by End-user Industries

- 4.5 Market Restraints

- 4.5.1 High Cost of Maintenance

- 4.5.2 High Cost of Installation

5 Impact of COVID-19 on the Market

6 MARKET SEGMENTATION

- 6.1 By Geography

- 6.1.1 North America

- 6.1.2 Europe

- 6.1.3 Asia-Pacific

- 6.1.4 Rest of the World

7 COMPETITIVE LANDSCAPE

- 7.1 Company Profiles

- 7.1.1 Microsoft Corporation

- 7.1.2 KUKA AG

- 7.1.3 Wind River Systems Inc.

- 7.1.4 Clearpath Robotics

- 7.1.5 Husarion Inc.

- 7.1.6 Brain Corporation

- 7.1.7 Neobotix GmbH