|

市场调查报告书

商品编码

1630278

5G服务:市场占有率分析、产业趋势/统计、成长预测(2025-2030)5G Services - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

※ 本网页内容可能与最新版本有所差异。详细情况请与我们联繫。

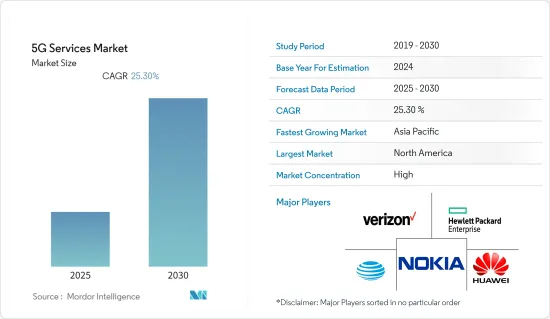

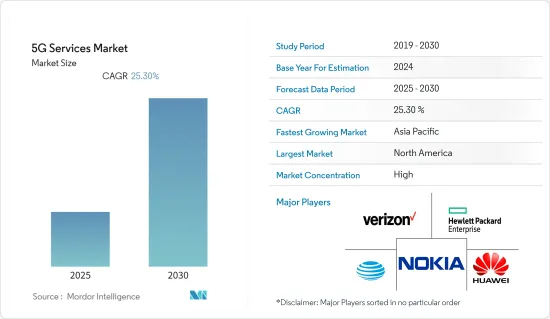

预计5G服务市场在预测期内的复合年增长率为25.3%。

主要亮点

- 5G 服务市场预计将改变各种宽频服务领域,并增强各个最终用户垂直领域的连线。推动市场占有率扩大的主要因素是行动订阅数量的增加、视讯内容的线上串流媒体、5G基础设施的加强以及使用5G的各种物联网应用。

- 工业自动化中的物联网预计将从 5G 服务中受益最多。在工业 4.0 计划和 5G-ACIA 等行业协会的影响下,3GPP 目前正在定义支援该细分市场的功能。它可能是特定于 5G 的部分,可用于本地区域使用案例和专用网路部署。

- 更有效地使用依赖低延迟的云端解决方案将透过更快的宽频服务下载速度来提高企业效率和创新,这反过来又将有助于行动电话设备製造商和内建分散式天线系统(5G新无线电(5G NR)规则)使通讯业者和目标商标产品製造商 (OEM)(例如 DAS)提供者能够遵守 5G 新无线电 (5G NR) 规则。

- 考虑到提供不间断的5G服务所需的高密度BTS单元,安装必要的5G基础设施和软体升级的资本成本相当高。

- 此外,随着 COVID-19 大流行增加了对虚拟空间的依赖,部署先进 5G 基础设施的需求也达到了最大。业务转移到云端和其他虚拟空间的频率不断增加,正在推动对强大连接平台的投资。

5G服务市场趋势

资料流量的增加和对高速资料连接的需求推动市场成长

- 5G 标准可能支援超高清音频和视频,以创建依赖语音通讯的新应用,例如远距临场系统。 5G的设备密度、低延迟、安全和视讯能力有潜力支援丰富的通讯服务等加值通讯服务,特别是对企业而言。

- 北美拥有全球最高的行动宽频和智慧型手机普及率。北美通讯业者开始关闭 2G 和 3G 网路以重新调整频宽。随着区域通讯业者转向使用低、中型、高频段混合的 5G 网络,这一趋势预计将持续下去。

- 瑞典、阿联酋等国家正在努力透过不断的网路演进来增强用户体验并提供卓越的效能。随着更先进的服务和设备的出现,通讯业者可能需要瞄准更高的服务品质水准。

- 此外,随着对串流媒体服务的依赖程度越来越高,4G网路主要支援串流媒体AR/VR、4k/8k影片和360度影片,而5G影片内容将变得身临其境型、资料密集。总流量将会增加。

- 5G 订阅流量的成长将由智慧型手机订阅数量的增加以及影片内容观看对每次订阅平均资料需求的增加所推动。

预计北美将占据最大份额

- 美国对 5G 物联网连接的需求预计将进一步增加。根据物联网协会的数据,美国在智慧家庭采用方面处于领先地位,每个家庭拥有智慧家庭设备的比例最高,消费者拥有两到三个使用案例(安全、能源、电器)的设备的趋势最为强烈。

- 此外,该国预计将有数十亿台设备连接到物联网、设备和感测器。随着5G网路的推出,Google和Facebook等公司将利用更宽的频宽和更快的网路速度,并且很快就会开发出更先进的服务。

- 美国除了推出5G服务外,还需要注重软体开发。重新利用目前用于军事和气象雷达的国家中频频谱可以提高网路效率。

- 中国也正在推广自动驾驶和连网驾驶等技术,以改善道路安全、缓解道路拥塞并减少空气污染。这些旨在获得现实驾驶场景经验的措施也得到了联邦运输和数位基础设施部的支持。

5G服务业概况

5G服务业拥有AT&T、Verizon、诺基亚等主要企业,因此公司之间的竞争非常激烈。如果这些公司能够持续创新其产品,他们就能超越竞争对手。这些公司透过併购、策略联盟和研发在市场上占有重要地位。

2022年5月,诺基亚公司宣布推出5G-Advanced,扩大了5G上行讯号的可达范围。 5G-Advanced 透过利用更好的随机存取通道覆盖范围,首先在初始连接设定期间改善上行链路覆盖范围,同时支援需要较低资料速率的新型设备,并支援将新的5G 功能引入垂直行业和市场。然后,5G-Advanced 动态变更上行链路波形,以在分配的连线预算内优化上行链路资料速率。当使用者靠近小区边缘时,网路会动态地优先考虑可改善覆盖范围的波形,并在使用者移向小区中心时降低其优先权。

其他好处:

- Excel 格式的市场预测 (ME) 表

- 3 个月的分析师支持

目录

第一章简介

- 研究假设和市场定义

- 调查范围

第二章调查方法

第三章执行摘要

第四章市场洞察

- 市场概况

- 产业吸引力-波特五力分析

- 新进入者的威胁

- 买方议价能力

- 供应商的议价能力

- 替代品的威胁

- 竞争公司之间的敌对关係

- 技术简介

- 按类型

- 增强型行动宽频(EMBB)

- 超可靠低延迟通讯(URLLC)

- 大规模机器通讯(MMTC)

- 按类型

第五章市场动态

- 市场驱动因素

- 对超低延迟连线的需求不断增长

- 资料流量增加以及对高速资料连接的需求增加

- 市场限制因素

- 实施成本高

- 评估 COVID-19 对产业的影响

第六章 市场细分

- 按最终用户产业

- 资讯科技与电信

- 媒体与娱乐

- 车

- 能源与公共事业

- 航太/国防

- 其他最终用户产业

- 按地区

- 北美洲

- 美国

- 加拿大

- 欧洲

- 德国

- 英国

- 法国

- 义大利

- 其他欧洲国家

- 亚太地区

- 中国

- 日本

- 印度

- 韩国

- 其他亚太地区

- 世界其他地区

- 北美洲

第七章 竞争格局

- 公司简介

- Nokia Corporation

- Huawei Technologies Co Ltd.

- AT&T Inc

- Verizon Communications Inc

- HP Enterprise Development LP

- T-Mobile USA, Inc.

- Deutsche Telekom AG

- Telefonaktiebolaget LM Ericsson

- Swisscom AG

- Vodafone Group

- BT Group

- Telstra Corporation Limited

第八章投资分析

第九章 市场机会及未来趋势

The 5G Services Market is expected to register a CAGR of 25.3% during the forecast period.

Key Highlights

- The market for 5G services is expected to revolutionize the domain of various broadband services and empower connectivity across different end-user verticals. The main drivers responsible for increasing the market share are an increase in mobile subscriptions, online streaming of video content, strengthening 5G infrastructure, and various IoT applications utilizing 5G.

- IoT in industrial automation is expected to derive maximum benefit from 5G services. The functionality to support this segment is currently being defined in 3GPP, influenced by Industry 4.0 initiatives and industry bodies, such as 5G-ACIA. It will likely be a 5G-specific segment, valid for local area use cases and private network deployments.

- The use of more effective cloud solutions that rely on low latency improves firm efficiency and innovation through increased download speeds of broadband services, which also, in turn, leads the carriers and original equipment manufacturers (OEMs), such as cellular device manufacturers and in-building distributed antenna systems (DAS) providers to follow the 5G New Radio (5G NR) rules to enable such offerings.

- The capital costs of installing the required 5G infrastructure and software upgrades are considerably high, considering the high density of BTS units needed to provide uninterrupted 5G services.

- Moreover, with extensive reliance on virtual space increasing during the COVID-19 pandemic, the need to deploy advanced 5G infrastructure has become paramount. Increased migration frequency of business operations to the cloud and other virtual spaces has prompted investments in robust connectivity platforms.

5G Services Market Trends

Increasing Data Traffic and Demand for High Speed Data Connectivity will Drive the Market Growth

- 5G standards are likely to support ultra-HD voice and video to produce new applications that rely on voice communication, for instance, telepresence. The 5G's device density, low latency, security, and video capabilities may support added value communications offerings, like Rich Communication Services, especially for enterprises.

- North America has the highest levels of mobile broadband and smartphone adoption globally. The operators in North America have begun to shut down 2G and 3G networks to reframe the spectrum. This trend is expected to continue as regional operators switch to 5G networks using a mix of low, medium, and high-band spectrums.

- Countries such as Sweden and the United Arab Emirates strive to offer superior performance by strengthening user experience through continuous network evolution. As more advanced services and devices emerge, the operators may need to raise their targeted service quality levels even higher.

- Moreover, with increased dependence on streaming services, 4G networks supported majorly, streaming with AR/VR, 4k/8k video, and 360-degree videos, the 5G video content is expected to be immersive and consume a higher proportion of the overall data traffic.

- The 5G subscription traffic growth is driven by both the rising number of smartphone subscriptions and a need for increasing average data volume per subscription due to video content viewing.

North America is Expected to Hold the Largest Share

- 5G-enabled IoT connections are expected to witness a further increase in demand in the United States. As per the IoT Association, the United States leads, in terms of smart home adoption, with the highest smart home device ratio per household and the greatest consumer propensity to own devices across two or three use cases (security, energy, and appliances).

- Additionally, the country expects billions of devices to be connected to the internet, devices, and sensors of the Internet of Things. With the onset of 5G networks, the extensive bandwidth and faster internet speeds can be utilized by Google and Facebook; for instance, to develop more advanced services shortly.

- Apart from the launch of 5G services, the United States also needs to focus on software development. Repurposing the country's mid-band spectrums currently being used by the military or weather radars may make networks more efficient.

- Moreover, the country is promoting technologies, such as automated and connected driving, to enhance road safety, reduce road congestion, and decrease air pollution. Such initiatives to gain experience in actual driving scenarios are also supported by the Federal Ministry of Transport and Digital Infrastructure.

5G Services Industry Overview

The competitive rivalry among the 5G services industry players is high because of the presence of several significant players, including AT&T, Verizon, Nokia, and others. They could outperform rivals if they could consistently innovate their product offers. These businesses have established a substantial presence in the market through mergers and acquisitions, strategic alliances, and research and development.

In May 2022, Nokia Corporation announced its 5G-Advanced to widen the area that 5G uplink signals can reach. While 5G-Advanced will improve uplink coverage first with the initial connection setup by leveraging more excellent random access channel coverage, it will support new types of devices with low data-rate requirements and introduce 5G capabilities to new vertical sectors and markets. The uplink data rate will then be optimized within the allocated connection budget by 5G-Advanced dynamically altering the uplink waveform. When the user is close to the cell edge, the network will dynamically favor coverage-enhancing waveforms, and as the user travels into the cell center, it will deprioritize them.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions & Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET INSIGHTS

- 4.1 Market Overview

- 4.2 Industry Attractiveness - Porter's Five Forces Analysis

- 4.2.1 Threat of New Entrants

- 4.2.2 Bargaining Power of Buyers

- 4.2.3 Bargaining Power of Suppliers

- 4.2.4 Threat of Substitutes

- 4.2.5 Intensity of Competitive Rivalry

- 4.3 Technology Snapshot

- 4.3.1 By Type

- 4.3.1.1 Enhanced Mobile Broadband (EMBB)

- 4.3.1.2 Ultra-reliable Low Latency Communications (URLLC)

- 4.3.1.3 Massive Machine Communications (MMTC)

- 4.3.1 By Type

5 MARKET DYNAMICS

- 5.1 Market Drivers

- 5.1.1 Increasing Demand for Ultra-Low Latency Connectivity

- 5.1.2 Increasing Data Traffic and Demand for High Speed Data Connectivity

- 5.2 Market Restraints

- 5.2.1 High Deployment Cost

- 5.3 Assessment of Impact of COVID-19 on the Industry

6 MARKET SEGMENTATION

- 6.1 End-user Industry

- 6.1.1 IT & Telecom

- 6.1.2 Media & Entertainment

- 6.1.3 Automotive

- 6.1.4 Energy & Utility

- 6.1.5 Aerospace & Defense

- 6.1.6 Other End-user Industries

- 6.2 Geography

- 6.2.1 North America

- 6.2.1.1 United States

- 6.2.1.2 Canada

- 6.2.2 Europe

- 6.2.2.1 Germany

- 6.2.2.2 United Kingdom

- 6.2.2.3 France

- 6.2.2.4 Italy

- 6.2.2.5 Rest of Europe

- 6.2.3 Asia-Pacific

- 6.2.3.1 China

- 6.2.3.2 Japan

- 6.2.3.3 India

- 6.2.3.4 South Korea

- 6.2.3.5 Rest of Asia-Pacific

- 6.2.4 Rest of the World

- 6.2.1 North America

7 COMPETITIVE LANDSCAPE

- 7.1 Company Profiles

- 7.1.1 Nokia Corporation

- 7.1.2 Huawei Technologies Co Ltd.

- 7.1.3 AT&T Inc

- 7.1.4 Verizon Communications Inc

- 7.1.5 HP Enterprise Development LP

- 7.1.6 T-Mobile USA, Inc.

- 7.1.7 Deutsche Telekom AG

- 7.1.8 Telefonaktiebolaget LM Ericsson

- 7.1.9 Swisscom AG

- 7.1.10 Vodafone Group

- 7.1.11 BT Group

- 7.1.12 Telstra Corporation Limited