|

市场调查报告书

商品编码

1630281

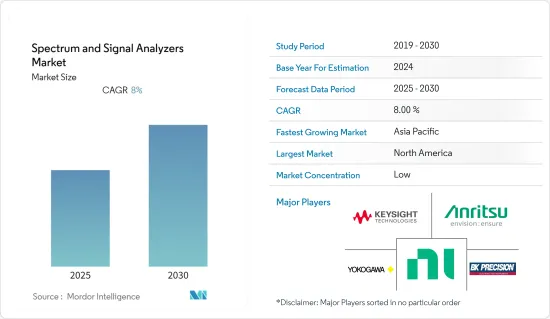

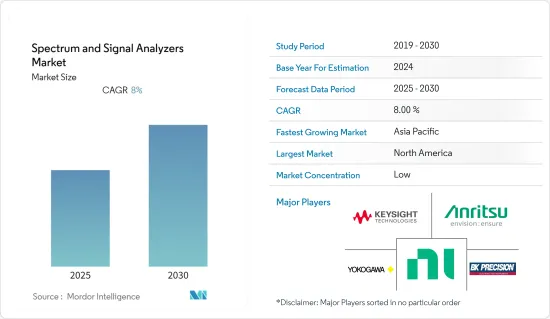

频谱讯号分析仪:市场占有率分析、产业趋势、成长预测(2025-2030)Spectrum and Signal Analyzers - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

价格

※ 本网页内容可能与最新版本有所差异。详细情况请与我们联繫。

简介目录

频谱讯号分析仪市场预计在预测期间内复合年增长率为 8%

主要亮点

- 消费者对无线技术的需求不断增长正在推动市场成长。频率和频宽的提高、多任务处理能力以及可携式和手持式频谱分析仪的接受度不断提高是推动市场成长的一些因素。

- 此外,频谱分析仪在医疗保健等终端用户行业中的日益增长的应用预计将成为市场的关键驱动因素。心电、脑电、血压计在使用前需要进行测试和校准,这就需要频谱分析仪、讯号产生器等测试设备。此外,根据世界卫生组织的数据,心血管疾病仍然是世界上第一大死因,使用这种设备来校准心血管监测设备预计对市场来说是个好兆头。

- 最近推出的讯号分析仪将扫频调谐频谱分析仪的卓越动态范围与向量讯号分析仪的功能相结合,促进了通道内测量,例如:讯号分析仪的多功能性来自于实现全数位中频,而不是传统频谱分析仪中使用的类比中频。

- 相反,阻碍市场发展的一个因素是专用频谱分析仪的高成本。正因为如此,企业正在尝试实施控制设备成本的策略。此外,由于使用先进且复杂的技术来检查和测量讯号,分析设备的成本正在增加。

- COVID-19 大流行导致所研究的市场出现显着波动。疫情对不同终端用户的影响不同。在 COVID-19 大流行期间,各国政府增加投资以支持多个行业的科学进步和基础设施,以及对研发和自动化的关注,对所研究的市场产生了重大影响。

频谱讯号分析仪市场趋势

汽车领域预计将显着成长

- 汽车产业的频谱讯号分析仪市场预计将显着成长。此领域频谱分析仪发展的重要因素包括对无线技术不断增长的需求,以及汽车行业对多任务处理能力的快速增长的需求。频谱分析仪性能不断提高,以满足汽车雷达测试要求。频谱分析仪是安装在实验室和製造场所用于此类高频应用的设备。

- 此外,也严格对汽车雷达系统进行精确检验,以提高道路安全。是德科技等多家供应商也提供类似的解决方案。 Keysight E8740A 汽车雷达讯号分析和产生解决方案有助于分析和产生 24 GHz、77 GHz 和 79 GHz 雷达频率的汽车雷达讯号,并支援超过 5 GHz 的更高频宽。

- 汽车产业的成长也将取决于5G等网路和通讯技术的成长。 2022 年 5 月 是德科技 (Keysight Technologies, Inc.),一家提供先进设计和检验解决方案并帮助加速创新以连接和保障世界安全的科技公司,毫米波和兆赫探头技术开发商DMPI Inc.,设计和製造毫米波和兆赫装置、组件和系统,以及 Virginia Diodes,设计和製造毫米波和太赫兹设备、组件和系统。 Inc. 联手推出全新 170GHz/220GHz 宽频向量网路分析 (VNA) 解决方案,可缩短 5G 和新兴 6G 应用的设计和检验週期。

- 是德科技全新 220 GHz 宽频网路分析仪可让您满足 5G 和未来 6G 技术的需求,这些技术将极大地影响物联网和无所不在的无线连接的通讯。

- 此外,安立等汽车测试解决方案检验联网汽车通讯系统的运作情况,并确保优质产品按时上市。该公司为各种汽车应用提供高性能测试解决方案。

亚太地区预计将经历显着成长

- 预计亚太地区在研究期间将以显着的速度成长。中国、韩国、新加坡、日本和印度等主要国家正在推动该地区的大幅扩张。基础设施的激增和人口的成长也支撑着市场。例如,2022年9月,中国透过三大国家计画银行追加转移3,000亿元人民币用于基础建设计划。

- 汽车製造商和家用电子电器製造商对频谱分析仪的需求不断增加,进一步推动了全部区域的市场扩张。因此,公司正在投资开发高频频谱分析仪。

- 日本安立公司 (Anritsu Corporation) 推出一款无线讯号分析仪产品,其频率范围可从 DC 扩展到 44.5GHz 至 325GHz。安立的频谱分析仪可以捕捉宽频讯号,而 FFT 技术支援时域和频域的多功能讯号分析。

- 此外,领先公司产品推出预计也将有助于市场成长。例如,2022 年 8 月,安立公司确认发布单一初始扫描 NVA频谱分析仪产品,支援 70kHz 至 220GHz 的频率。

- 由于中国和印度的半导体和电子公司的突出地位,亚太市场预计将成长。由于 IT 和通讯行业以及航空和军事工业的高支出,频谱分析仪的广泛部署推动了该地区的市场,从而促进了市场的扩张。例如,2022 年 9 月,航太技术新兴企业Skyroot Aerospace 在 GIC 印度直接投资集团领投的资金筹措中获得了 5,100 万美元。该公司表示,这是印度航太技术领域最重要的资金筹措交易。

频谱讯号分析仪产业概述

频谱讯号分析仪市场较为分散。在大多数情况下,不断增加的研发力度、新技术以及频谱分析仪的日益普及正在为频谱分析仪市场提供利润丰厚的机会。整体而言,现有企业之间的竞争非常激烈。此外,大公司的产品创新策略正在渗透市场成长。

- 2022 年 9 月 - 罗德与施瓦茨推出 R&S FSV 和 R&S FSVA 讯号与频谱分析仪。 R&S FSVA3050 和 R&S FSV3050 版本的频宽高达 50GHz。

- 2022 年 9 月 - Siglent 宣布其性能係列中的两款新产品。频谱分析仪SSA5,000A和RF/MW信号产生器SSG5,000A。凭藉这两款新产品,Sigrent 的射频产品现已覆盖 20 GHz 以上的频率。

其他好处

- Excel 格式的市场预测 (ME) 表

- 3 个月分析师支持

目录

第一章简介

- 研究假设和市场定义

- 调查范围

第二章调查方法

第三章执行摘要

第四章市场动态

- 市场概况

- 市场驱动因素

- 对具有多任务功能的频谱分析仪的需求不断增长

- 技术进步带来频谱分析仪产品的创新

- 市场限制因素

- 对具有最大功能且经济高效的频谱分析仪的需求

- 产业价值链分析

- 产业吸引力-波特五力分析

- 新进入者的威胁

- 买方议价能力

- 供应商的议价能力

- 替代品的威胁

- 竞争公司之间的敌对关係

第五章技术概况

第六章 市场细分

- 按频段

- 6GHz以下

- 6~18GHz以下

- 18GHz或更高

- 按最终用户产业

- 资讯科技/通讯

- 车

- 航太/国防

- 医疗保健

- 其他的

- 地区

- 北美洲

- 欧洲

- 亚太地区

- 拉丁美洲

- 中东/非洲

第七章 竞争格局

- 公司简介

- Keysight Technologies Inc.

- Anritsu Corporation

- Yokogawa Electric Corporation

- National Instruments Corporation

- B&K Precision Corporation

- Rohde & Schwarz GmbH & Co.

- Advantest Corporation

- Teledyne Lecroy, Inc.

- LP Technologies Inc.

- Stanford Research Systems, Inc.

- Avcom of Virginia Inc.

第八章投资分析

第九章 市场机会及未来趋势

简介目录

Product Code: 66907

The Spectrum and Signal Analyzers Market is expected to register a CAGR of 8% during the forecast period.

Key Highlights

- Consumers' surging demand for wireless technology is responsible for the market's growth. The advancement in frequency and bandwidth, multitasking features, and growing acceptance of portable and handheld spectrum analyzers are some of the factors propelling the market growth.

- Additionally, the increasing application of spectrum analyzers in end-user industries, such as healthcare, is expected to act as a significant driver for the market. The use of ECG, EEG, and blood pressure monitors that need to be tested and calibrated before use requires testing devices like spectrum analyzers and signal generators for the same. Moreover, according to WHO, cardiovascular diseases remain the number one cause of death globally, and the use of this equipment in calibrating cardio monitoring devices is expected to augur well for the market.

- Signal Analyzer, launched nowadays, combines the superior dynamic range of a swept-tuned spectrum analyzer with vector signal analyzer capabilities facilitating in-channel measurements, like error vector magnitude (EVM), that require both magnitude and phase information. The versatility of signal analyzers is derived from implementing a fully digital IF that replaced the analog IF used in traditional spectrum analyzers.

- On the contrary, the factors responsible for hindering the market include the high cost of specialized spectrum analyzers. This has been a reason companies across the board have been trying to implement strategies to manage the costs of such equipment. Additionally, the costs of these analyzers have been rising due to the use of advanced and complex technologies for testing and measuring signals.

- The COVID-19 outbreak resulted in significant fluctuations in the market studied. The pandemic impacted each end-user differently. During the COVID-19 pandemic, the growing investments by governments to support scientific progress and infrastructure in several industries, coupled with the focus on R&D and automation, have significantly influenced the studied market.

Spectrum and Signal Analyzers Market Trends

Automotive Segment is Expected to Witness Significant Growth

- The automotive industry is projected to witness considerable growth in the spectrum and signal analyzers market. The critical factor attributed to the development of spectrum analyzers in this sector is the rising demand for wireless technology, surging demand from the automotive industry with multi-tasking capabilities, and others. The spectrum analyzer's performance rises to meet automotive radar test requirements. The spectrum analyzer is equipment in the lab or production floor in these high-frequency applications.

- Additionally, precise verification of automotive radar systems is being undertaken strictly for heightened safety on the road. Several vendors, like Keysight, offer solutions for the same. The Keysight E8740A automotive radar signal analysis and generation solution facilitates the analysis and generation of automotive radar signals across the 24 GHz, 77 GHz, and 79 GHz radar frequencies and is capable of addressing growing bandwidths of 5 GHz and beyond.

- The growth of the automotive industry is also dependent on the growth of network and communication technologies such as 5G. In May 2022, Keysight Technologies, Inc., a technology company that delivers advanced design and validation solutions to help accelerate innovation to connect and secure the world; FormFactor, Inc., a provider of basic test and measurement technologies along the complete IC life cycle; DMPI Inc., a developer of millimeter-wave and terahertz probe technology; and Virginia Diodes, Inc., who designs and produces millimeter wave and terahertz devices, components, and systems, have joined forces to deliver a new 170 GHz / 220 GHz Broadband Vector Network Analysis (VNA) Solution that shortens design and verification cycles for 5G and emerging 6G applications.

- The joint solution, Keysight's new 220 GHz Broadband Network Analyzer, would enable customers to address the needs of 5G and future 6G technologies that will significantly impact communications through the internet of things and ubiquitous wireless connections.

- Further, the automotive test solutions of players like Anritsu validate the operation of connected car communications systems, ensuring that quality products reach the market on time. The company provides high-performance test solutions for a variety of automotive applications.

Asia-Pacific Expected to Witness Significant Growth

- The Asia-Pacific region is expected to grow at a considerable pace throughout the study period. The tremendous expansion of this area is being driven by important nations, including China, South Korea, Singapore, Japan, and India. Burgeoning infrastructures and an expanding population are also supporting the market. For instance, in September 2022, China transferred 300 billion yuan more earmarked for infrastructural projects via three state planning banks.

- There is an increasing demand for spectrum analyzers among automotive manufacturers and consumer electronics companies, further helping the market expand across the region. This has resulted in companies investing in the development of high-frequency spectrum analyzers.

- Anritsu Corporation, a Japanese company, has introduced wireless signal analyzer products from DC to 44.5 GHz and extendable to 325 GHz. Anritsu spectrum analyzers can capture wideband signals, but FFT technology supports multifunction signal analyses in both the time and frequency domains.

- Furthermore, product launches by major companies are also expected to contribute to market growth. For instance, in August 2022, Anritsu Corporation confirmed the release of its single initial sweep NVA-spectrum analyzer product, which supports frequencies from 70 kHz to 220 GHz.

- Due to the prominence of China and India's top semiconductor and electronics firms, the market in the Asia Pacific is expected to grow. The region's market will be driven by and contribute to market expansion through the widespread deployment of spectrum analyzers as a result of large expenditures in both IT & telecom and aviation & military industries. For instance, in September 2022, Start-up in space technology, Skyroot Aerospace, secured USD 51 million in a fundraising round headed by GIC India Direct Investment Group. According to the company, this is the most significant funding transaction in the Indian space-tech sector.

Spectrum and Signal Analyzers Industry Overview

The spectrum and signal analyzer market is fragmented. Mostly, increased R&D efforts, new technologies, and increased adoption of spectrum analyzers provide lucrative opportunities in the spectrum analyzer market. Overall, the competitive rivalry among the existing competitors is high. Moreover, the product innovation strategy of large companies is penetrating the market growth.

- September 2022 - Rohde & Schwarz introduced the R&S FSV and R&S FSVA signals and spectrum analyzers. The R&S FSVA3050 and R&S FSV3050 versions have been released with a frequency bandwidth of up to 50 GHz.

- September 2022 - Siglent introduced two fresh products to its Performance Series. The SSA5000A spectrum analyzer and the SSG5000A RF/MW signal generator are the first and second, respectively. With these two new items, Siglents' RF offering now includes frequencies over 20 GHz.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET DYNAMICS

- 4.1 Market Overview

- 4.2 Market Drivers

- 4.2.1 Growing Demand for Spectrum Analyzers With Multi-Tasking Capabilities

- 4.2.2 Technological Advancement Leading to Innovation in Spectrum Analyzer Offering

- 4.3 Market Restraints

- 4.3.1 Requirement of Cost-Effective Spectrum Analyzers With Maximum Features

- 4.4 Industry Value Chain Analysis

- 4.5 Industry Attractiveness - Porter's Five Forces Analysis

- 4.5.1 Threat of New Entrants

- 4.5.2 Bargaining Power of Buyers

- 4.5.3 Bargaining Power of Suppliers

- 4.5.4 Threat of Substitute Products

- 4.5.5 Intensity of Competitive Rivalry

5 TECHNOLOGY SNAPSHOT

6 MARKET SEGMENTATION

- 6.1 By Frequency Range

- 6.1.1 Less than 6 GHz

- 6.1.2 6-18 GHz

- 6.1.3 More than 18 GHz

- 6.2 By End-user Industry

- 6.2.1 IT & Telecommunication

- 6.2.2 Automotive

- 6.2.3 Aerospace & Defense

- 6.2.4 Healthcare

- 6.2.5 Other End-user Industries

- 6.3 Geography

- 6.3.1 North America

- 6.3.2 Europe

- 6.3.3 Asia-Pacific

- 6.3.4 Latin America

- 6.3.5 Middle East & Africa

7 COMPETITIVE LANDSCAPE

- 7.1 Company Profiles

- 7.1.1 Keysight Technologies Inc.

- 7.1.2 Anritsu Corporation

- 7.1.3 Yokogawa Electric Corporation

- 7.1.4 National Instruments Corporation

- 7.1.5 B&K Precision Corporation

- 7.1.6 Rohde & Schwarz GmbH & Co.

- 7.1.7 Advantest Corporation

- 7.1.8 Teledyne Lecroy, Inc.

- 7.1.9 LP Technologies Inc.

- 7.1.10 Stanford Research Systems, Inc.

- 7.1.11 Avcom of Virginia Inc.

8 INVESTMENT ANALYSIS

9 MARKET OPPORTUNITIES AND FUTURE TRENDS

02-2729-4219

+886-2-2729-4219