|

市场调查报告书

商品编码

1630284

CaaS(容器即服务)-市场占有率分析、产业趋势与统计、成长预测(2025-2030)Container as a Service - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

※ 本网页内容可能与最新版本有所差异。详细情况请与我们联繫。

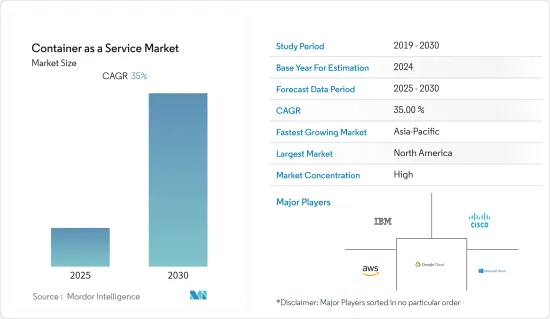

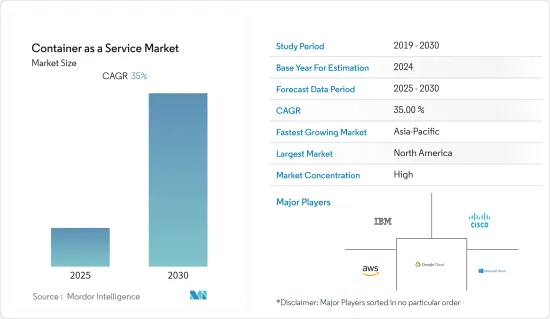

CaaS(容器即服务)市场预计在预测期内复合年增长率为 35%

主要亮点

- 该市场提供了广泛的成长潜力,主要归功于 CaaS(容器即服务)的快速采用,它可以帮助 IT 部门和开发人员创建、管理和运行隐藏的容器化应用程式。此外,由于託管应用程序,公司对减少运输时间的服务的需求不断增长,以及对成本效益和提高生产力的好处的认识不断增强,正在推动整个市场的指数级增长。

- 此外,CaaS 模型为中小型企业 (SME) 提供了新的商机,因为它们使业务组织能够承受更大的敏捷性(尽快创建新的生产工作负载的能力)。此外,该技术重量轻且非常易于管理,可快速交付和部署新的应用程式和容器。预计这将进一步加速市场成长。

- 此外,市场正在见证各种重大发展。例如,2022 年 10 月,专用安全测试解决方案供应商 Veracode 宣布增强其持续软体安全平台,包括容器安全。 Veracode Container Security 的早期存取计画主要面向现有客户。新的 Veracode Container Security 主要是为了满足云端原生软体工程团队的整体需求,解决各种容器映像的漏洞扫描、安全配置和秘密管理需求。

- 然而,由于资料安全相关问题日益增多,CaaS 市场预计将面临障碍。这是因为资料通常储存在云端伺服器上,这使其面临各种骇客攻击。云端伺服器还需要持续的电力供应和网路连接才能有效运作。因此,在新兴市场,CaaS(容器即服务)市场很可能进一步萎缩。

COVID-19 的爆发暴露了供应链的脆弱性。大多数 IT 公司都是提供关键 IT 服务的脆弱生态系统的一部分。鼓励远距工作的规定将确保服务供应商能够获得其关键任务业务客户所需的工具和技术,以实现其提供的服务的速度、安全性、品质和整体有效性,从而带来市场成长机会。着增加。

CaaS(容器即服务)市场趋势

BFSI 产业预计将得到最大程度的采用

- 随着越来越多的 BFSI 公司采用云端并使其云端供应商多元化,金融科技正在大幅改变银行体系。此外,行动银行和数位付款等技术正在彻底改变银行业,特别是在印度和中国等新兴经济体。因此,CaaS 模型的使用和部署也在增加。容器应用程式平台旨在自动化任何云端提供者的应用程式堆迭的託管、配置、部署和管理。

- 这些解决方案帮助银行实现数位基础现代化,提高竞争力,加速未来分店的服务交付,优化付款处理模型,并在不影响网路安全的情况下加深客户参与。为应用程式开发人员提供自助服务访问,可以轻鬆按需部署应用程序,帮助银行在竞争日益激烈的金融服务环境中加快步伐并缩短上市时间。这些解决方案可协助金融机构开发和支援广泛的应用程序,同时保持严格的安全性和合规性要求。您还可以提供新用途来吸引客户和员工。

- 创建和提供按需金融服务需要使用尖端的数位工具。其中之一是 Kubernetes (K8s),它主要是一种开放原始码容器编配和部署技术。该技术的虚拟作业系统允许应用程式跨平台、地理和云端无缝运行。透过在 Kubernetes 上运行容器化,银行组织可以为客户提供无缝体验、自动化储蓄、参与创新并保护客户资料。

- 容器化程式的敏捷性、可扩展性和极大改善的使用者体验对于满足当今银行的需求至关重要。无论是在私有云端、公共云端云或混合云端中,基于 Kubernetes 容器的编配都是金融服务公司的理想选择。银行可以使用 Kubernetes 在微服务、API 优先、云端原生和无头架构中部署容器化应用程式。

- 印度储备银行的声明称,2022财年印度各地记录的数字付款总数约为710亿笔。与前三年相比,这是一个显着的成长。因此,随着数位付款数量的增加,使用CaaS(容器即服务)的需求也将大幅增加,显着推动市场成长。

预计北美将占据最大的市场占有率

- 预计北美地区将在整个预测期内占据CaaS(容器即服务)市场的最大市场占有率。成长的大部分归功于美国和美国的经济成长,这两个国家的经济由于工业产品产量的增加而强劲。

- 此外,对微服务的需求不断增长、技术进步以及对微服务采用的需求不断增长等因素正在推动该地区的市场。此外,该地区最大的CaaS解决方案提供商正在提出新的想法并扩大业务,以占领该地区最大的市场占有率并利用巨大的机会。

- 例如,2022 年 12 月,AWS 发布了 Finch,开放原始码与云端无关的开源命令列用户端,专为运行、建置和发布 Linux 容器而设计。 Finch 主要捆绑开放原始码元件,例如 nerdctl、lima、containerd 和 buildkit。在发布期间,Finch 主要是原生 macOS 用户端,可在所有 Mac CPU 架构上运作。

- 同样在 2022 年 3 月,Docker, Inc. 宣布获得约 1.05 亿美元的额外融资。这笔额外融资将用于将主要由开发人员使用的 Docker 容器应用开发工具的范围扩展到无伺服器运算框架以及新兴的 WebAssembly (Wasm) 和 Web3 平台领域。此外,据该公司称,与传统应用程式建置方法相比,主要使用Docker 容器的应用程式开发团队发布程式码的频率提高了13 倍,采用新技术的工作效率提高了65%,并且遇到安全漏洞的可能性较小。

- 此外,到 2022 年 3 月,Oracle 云端基础架构 (OCI) 将扩展 11 项新的运算、网路和储存服务和功能,以帮助客户以更低的成本更快、更安全地运行工作负载。这项新服务为客户提供了真正灵活的核心基础设施服务,可自动优化专门针对应用程式需求量身定制的资源,从而显着降低成本。该公司的新服务还包括直接管理託管虚拟机器、允许您使用容器而无需 Kubernetes编配的容器实例,以及连接 NVMe 驱动器以实现低延迟储存的工作负载,其中包括 AMD E4-Dense Compute 实例、Oracle Cloud。 VMware 解决方案等等。

CaaS(容器即服务)产业概述

CaaS(容器即服务)市场相对集中,大型企业占较大市场份额。然而,由于CaaS是一种新兴的市场开发技术,因此存在巨大的商机,大量新参与企业将进入该市场,并寻求与主要参与企业合作,以获取重要的市场占有率。

2022 年 9 月,戴尔宣布扩大与红帽公司的合作关係,提供新的解决方案,协助在多重云端环境中管理和部署本地容器化基础架构。戴尔和红帽公司解决方案的结合可协助企业加速云端原生应用程式的整体开发和营运 (DevOps),同时消除 IT 管理瓶颈和障碍。

2022 年 5 月,微软宣布推出 Azure 容器应用程式的云端原生产品,让开发人员在预览版中建立容器驱动的微服务架构。 Azure 容器应用程式是建立在主要由来自 CNCF计划的开放原始码技术(例如分散式应用程式执行阶段(Dapr)、Kubernetes 事件驱动的自动缩放(KEDA) 和在Azure Kubernetes 服务(AKS) 上执行的Envoy)的基础上建构的。 Azure 容器应用程式可以在从公用 API 端点到微服务的各种环境中成功利用。该服务允许执行包装在任何容器中的使用程式码,无论编程或运行时模型如何。

其他好处

- Excel 格式的市场预测 (ME) 表

- 3 个月分析师支持

目录

第一章简介

- 研究成果

- 研究场所

- 调查范围

第二章调查方法

第三章执行摘要

第四章市场动态

- 市场概况

- 利用市场促进因素和市场限制因素

- 市场驱动因素

- 成本效益和生产力优势

- 比本地容器更具弹性

- 微服务的普及

- 市场限制因素

- 安全性和合规性很难实现

- 产业吸引力-波特五力分析

- 供应商的议价能力

- 买家/消费者的议价能力

- 新进入者的威胁

- 替代品的威胁

- 竞争公司之间的敌对关係

- 技术简介

- 透过提供的解决方案

- 储存和网路

- 监测分析

- 管理和编配

- 安全

- 持续整合和持续部署

- 支援与维护

- 透过提供的解决方案

第五章市场区隔

- 按发展

- 本地

- 云

- 按服务类型

- 专业服务

- 託管服务

- 按公司规模

- 小型企业

- 大公司

- 按最终用户使用情况

- BFSI

- 零售

- 资讯科技/通讯

- 製造业

- 其他的

- 地区

- 北美洲

- 美国

- 加拿大

- 欧洲

- 英国

- 德国

- 法国

- 欧洲其他地区

- 亚太地区

- 中国

- 澳洲

- 日本

- 其他亚太地区

- 拉丁美洲

- 墨西哥

- 巴西

- 其他拉丁美洲

- 中东/非洲

- 北美洲

第六章 竞争状况

- 公司简介

- Amazon Web Services, Inc.

- Google LLC(Google Cloud)

- Cisco Systems, Inc.

- IBM Corporation(Red Hat, Inc.)

- Microsoft Corporation(Microsoft Azure)

- Rancher Labs

- VMware, Inc.(Pivotal Software, Inc.)

- SUSE

- Rackspace Inc.

- TATA Communications

- Oracle Corporation

- Hewlett Packard Enterprise Development LP

第七章 投资分析

第八章市场机会及未来趋势

The Container as a Service Market is expected to register a CAGR of 35% during the forecast period.

Key Highlights

- The market has a promising growth potential, mainly due to the surge in the adoption of containers as a service to assist IT departments and developers in creating, managing, and running containerized applications. Moreover, with the growing awareness of the benefits of cost-effectiveness and increased productivity, the rise in the need for services from businesses to reduce shipping times as a result of hosted applications facilitates the overall market's exponential growth.

- Furthermore, the CaaS model is expected to provide new business opportunities for small and medium-sized enterprises (SMEs) since it enables business organizations to endure a greater degree of agility, which is the ability to create a new production workload as quickly as possible. Additionally, the technique is quite easy to manage, as these are lightweight, enabling rapid delivery and deployment of new application containers. This is further expected to augment market growth.

- Moreover, the market is witnessing various significant developments. For instance, in October 2022, Veracode, a provider of application security testing solutions, announced the enhancement of its Continuous Software Security Platform to include container security. This early access program for Veracode Container Security is mostly underway for existing customers. The new Veracode Container Security offering, mainly built to meet the overall needs of cloud-native software engineering teams, addresses vulnerability scanning, secure configuration, and secret management requirements for various container images.

- However, the CaaS market is expected to face hindrances due to the rise in data security-related issues since usually the data is stored on cloud servers, exposing it to various hacking concerns. Also, cloud servers need a constant supply of electricity and internet connectivity to operate efficiently. This is likely to make the market for containers as a service even smaller in developing areas.

The COVID-19 outbreak made supply chains' vulnerabilities clear. Most IT firms were part of fragile ecosystems that provided critical IT services. Mandates encouraging remote work prompted service providers to guarantee that mission-critical enterprise clients had access to the tools and technologies required to enable the speed, security, quality, and general effectiveness of services offered, enhancing the market's growth opportunities vastly.

Container as a Service Market Trends

BFSI Sector Expected to Have Maximum Application

- Fintech has changed the banking system drastically, as more and more BFSI companies have embraced the cloud and diversified their cloud providers. Also, technologies like mobile banking, digital payments, etc., are revolutionizing the banking industry, especially in emerging countries like India and China. Hence, the use and deployment of CaaS models are also increasing. The container application platform is designed to automate the hosting, configuration, deployment, and administration of application stacks across any cloud provider.

- These solutions help the banks modernize their digital foundations for a competitive edge, speeding service delivery in branches of the future, optimizing payment processing models, and deepening customer engagement without compromising on cybersecurity. It gives application developers self-service access so they can easily deploy applications on demand that can help banks move more quickly and decrease time to market in the increasingly competitive environment of financial services. These solutions help financial institutions develop and support a broad range of applications while maintaining stringent security and compliance requirements. It also enables companies to deliver new applications to engage customers and associates.

- Creating and delivering on-demand financial services requires the use of cutting-edge digital tools. One of them is Kubernetes (K8s), which is mainly an open-source container orchestration and deployment technology. Applications can run seamlessly across platforms, regions, and clouds because of this technology's virtual operating systems. By operationalizing containerization with Kubernetes, banking organizations can thus offer a seamless experience to customers, automate savings, engage in innovation, and protect client data.

- In order to meet the needs of banks today, containerized programs' agility, scalability, and a quantum leap in user experience are essential. Whether in a private, public, or hybrid cloud, Kubernetes' container-based orchestration is the ideal option for financial services firms. So, banks can use Kubernetes to deploy containerized apps with an architecture that focuses on microservices, API-first, cloud-native, and headless, no matter what industry they work in-commercial, retail, or investing.

- As per the Reserve Bank of India, in the financial year 2022, the total count of digital payments that were recorded across India was around 71 billion. This was a drastic increase compared to the previous three years. Hence, with the rise in the number of digital payments, the need for using the container as a service will also increase considerably, facilitating the market's growth significantly.

North America is Expected to Account the Largest Market Share

- The North American region is expected to account for the largest market share in the Container as a Service market all throughout the forecast period. Most of the growth can be attributed to the growing economies of the U.S. and Canada, which are doing better because they are making more industrial goods.

- Also, factors such as increased demand for microservices, technological advancements, and the growing need for the adoption of microservices in this region are driving the market in the region. Also, the biggest CaaS solution providers in the region are coming up with new ideas and growing their businesses to get the most market share and take advantage of the huge opportunities in the region.

- For instance, in December 2022, AWS launched Finch, an open-source, cloud-agnostic command-line client designed especially for running, building, and publishing Linux containers. Finch primarily bundles together a number of open-source components such as nerdctl, lima, containerd, and buildkit. During the release, Finch was mostly a native macOS client that worked on all Mac CPU architectures.

- Also, in March 2022, Docker, Inc. revealed that it had picked up an additional sum of around USD 105 million in financing that, among other things, would be applied to extending the reach of the Docker container application development tools that developers mainly utilize into the realm of serverless computing frameworks and emerging WebAssembly (Wasm) and Web3 platforms. The company also says that application development teams that mainly use Docker containers release code 13 times more often, increase productivity with new technologies in 65% less time, and reduce the mean-time-to-remediate (MTTR) of security vulnerabilities by 62% compared to traditional ways of building applications.

- Moreover, in March 2022, Oracle Cloud Infrastructure (OCI) expanded with 11 new computing, networking, and storage services and capabilities that allow customers to run their workloads faster and more securely at a much lower cost. New offerings offer customers truly flexible core infrastructure services, automatically optimizing resources, especially to match application requirements, and significantly minimizing costs. Also, the company's new services include container instances that let customers use containers without directly managing the hosting VM or needing Kubernetes orchestration; AMD E4-Dense Compute instances that let customers use workloads that benefit from attached NVMe drives that offer low-latency storage; and an Oracle Cloud VMware Solution.

Container as a Service Industry Overview

The container market as a service is comparatively consolidated due to the existence of some leading players holding the majority share of the market. However, CaaS is a developing and demanding technology, and there are enormous business opportunities where a considerable number of new players are entering the market and are teaming up with significant players to capture a significant market share.

In September 2022, Dell declared that it is expanding its partnership with Red Hat to provide new solutions that will assist in managing and deploying on-premises, containerized infrastructure in multi-cloud environments. The combined Dell-Red Hat solutions would assist enterprises in speeding up the overall development and operations (DevOps) of cloud-native applications while removing IT management bottlenecks and barriers.

In May 2022, Microsoft declared a cloud-native product offering with Azure Container Apps, enabling developers to create microservice architectures utilizing containers in preview. Azure Container Apps is primarily built upon a foundation consisting of open-source technology with CNCF projects like Distributed Application Runtime (Dapr), Kubernetes Event-Driven Autoscaling (KEDA), and Envoy running on the Azure Kubernetes Service (AKS). Azure Container Apps can be well utilized in various contexts, from public API endpoints to microservices. The service enables the execution of application code wrapped in any container, regardless of programming or runtime model.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Deliverables

- 1.2 Study Assumptions

- 1.3 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET DYNAMICS

- 4.1 Market Overview

- 4.2 Introduction to Market Drivers and Restraints

- 4.3 Market Drivers

- 4.3.1 Benefits of Cost Effectiveness and Increased Productivity

- 4.3.2 Greater Flexibility Than On-Premises Containers

- 4.3.3 Increasing Popularity of Microservices

- 4.4 Market Restraints

- 4.4.1 Difficulty in Achieving Security and Compliance

- 4.5 Industry Attractiveness - Porter's Five Forces Analysis

- 4.5.1 Bargaining Power of Suppliers

- 4.5.2 Bargaining Power of Buyers/Consumers

- 4.5.3 Threat of New Entrants

- 4.5.4 Threat of Substitute Products

- 4.5.5 Intensity of Competitive Rivalry

- 4.6 Technology Snapshot

- 4.6.1 By Solutions Provided

- 4.6.1.1 Storage and Networking

- 4.6.1.2 Monitoring and Analytics

- 4.6.1.3 Management and Orchestration

- 4.6.1.4 Security

- 4.6.1.5 Continuous Integration and Continuous Deployment

- 4.6.1.6 Support and Maintenance

- 4.6.1 By Solutions Provided

5 MARKET SEGMENTATION

- 5.1 By Deployment

- 5.1.1 On-Premise

- 5.1.2 Cloud

- 5.2 By Service Type

- 5.2.1 Professional Services

- 5.2.2 Managed Services

- 5.3 By Size of the Enterprise

- 5.3.1 Small and Medium Enterprises

- 5.3.2 Large Enterprises

- 5.4 By End-user Application

- 5.4.1 BFSI

- 5.4.2 Retail

- 5.4.3 IT & Telecommunications

- 5.4.4 Manufacturing

- 5.4.5 Other End-user Applications

- 5.5 Geography

- 5.5.1 North America

- 5.5.1.1 United States

- 5.5.1.2 Canada

- 5.5.2 Europe

- 5.5.2.1 United Kingdom

- 5.5.2.2 Germany

- 5.5.2.3 France

- 5.5.2.4 Rest of Europe

- 5.5.3 Asia-Pacific

- 5.5.3.1 China

- 5.5.3.2 Australia

- 5.5.3.3 Japan

- 5.5.3.4 Rest of Asia-Pacific

- 5.5.4 Latin America

- 5.5.4.1 Mexico

- 5.5.4.2 Brazil

- 5.5.4.3 Rest of Latin America

- 5.5.5 Middle-East & Africa

- 5.5.1 North America

6 COMPETITIVE LANDSCAPE

- 6.1 Company Profiles

- 6.1.1 Amazon Web Services, Inc.

- 6.1.2 Google LLC (Google Cloud)

- 6.1.3 Cisco Systems, Inc.

- 6.1.4 IBM Corporation (Red Hat, Inc.)

- 6.1.5 Microsoft Corporation (Microsoft Azure)

- 6.1.6 Rancher Labs

- 6.1.7 VMware, Inc. (Pivotal Software, Inc.)

- 6.1.8 SUSE

- 6.1.9 Rackspace Inc.

- 6.1.10 TATA Communications

- 6.1.11 Oracle Corporation

- 6.1.12 Hewlett Packard Enterprise Development LP