|

市场调查报告书

商品编码

1630285

自动采矿设备:市场占有率分析、产业趋势与统计、成长预测(2025-2030)Automated Mining Equipment - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

价格

※ 本网页内容可能与最新版本有所差异。详细情况请与我们联繫。

简介目录

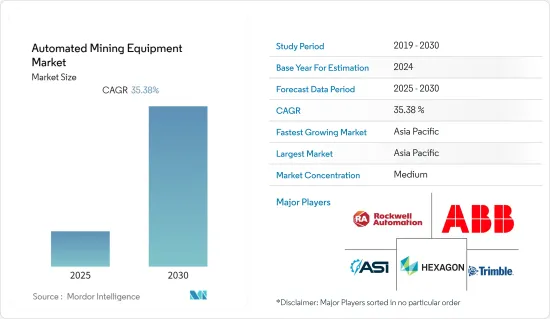

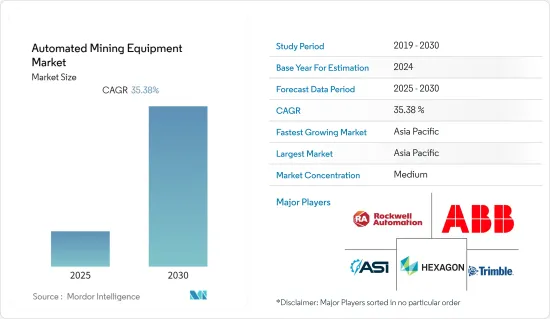

预计自动采矿设备市场在预测期间的复合年增长率为35.38%。

主要亮点

- 采矿业是一个复杂的行业,从地壳中提取各种形状、大小和化学成分的原料。将其转化为标准化、高品质的最终产品非常困难,导致产业选择提高效率和生产力的解决方案。矿山通常位于偏远地区,采用自动化可以帮助更好地利用资源。

- 自主技术提供了一些不容忽视的好处。这些影响整个采矿价值链和依赖采矿来满足原料需求的产业。如果实施得当,采用自动化技术的公司可以快速实现显着的生产力提高和费用降低。

- 此外,世界各地的矿业公司正在迅速利用技术发展,更好地利用设备和人力资源来提高安全性。例如,2020 年 9 月,物流公司 Bis 和以色列航太工业公司 (IAI) 宣布成立新的合资企业 Automate,为采矿作业提供自主系统。 IAI 表示,合资企业将使采矿业相关人员能够利用采矿作业自动化的优势来提高安全性和生产力。

- 预计该行业将受益于安全措施的显着改善。识别流程和工作程序将帮助您制定 SOP 来解决危险点并降低这些风险。此外,透过使用可以在不安全或具有挑战性的地点进行操作的自动化设备,采矿公司可以提高产量,同时降低地下开采时员工的风险,从而减少矿工的数量。例如,在非洲的多个矿场实施自动化技术后,Randgold Resources 将季度受伤率降低了 29%。

- 此外,该行业对自动化设备的需求主要是由于对提高生产力和改善工人安全的需求不断增长而推动的。 COVID-19 疫情引发了自动化需求,预计长期来看将会增加,主要是为了解决劳动力短缺和成本上升的问题。即使在采矿业内,情况似乎也因产品而异。黄金、铁矿石和铀等大宗商品的开采仍然蓬勃发展。相较之下,火力发电和冶金大宗商品由于充分暴露于消费者需求,因此面临更大的压力。

自动化矿山设备市场趋势

挖掘者预计将在硬体领域占据主要市场占有率

- 在采矿领域,我们看到各种各样的挖土机,从滑橇大小到巨型建筑大小的推土机。这些挖掘机用于任何采矿作业的基础。挖土机在利用液压系统挖掘和拉回材料方面发挥重要作用。许多公司提供的挖土机分为轮式挖土机和大型挖土机两种,製造流程也有差异。

- 轮式挖土机也常用于多工处理,旨在提供此类任务所需的速度和动力。负载管理方面的不断创新使得製造具有最大挖掘能力的挖土机成为可能。自动化挖土机的知名度不断提高,以解决安全问题并提高生产力。操作员站在视线范围内,使用遥控器操作车辆。这样,现场挖土机的自动化可以提高生产率和准确性,减少操作员的疲劳和燃油消耗。

- 2020 年 3 月,海克斯康旗下 Leica Geosystems 在 3D 挖土机控制解决方案 iXE3 中发布了新的半自动挖土机功能,包括倾斜和倾斜旋转铲斗自动化。此解决方案可自动控制铲斗、动臂、倾斜和倾斜旋转铲斗功能,以更快、更准确地钻探目标设计平面和横坡。这种新的半自动功能甚至可以让没有经验的操作员执行复杂的任务,提高生产力,减少人工干预,并提高工作速度和准确性。

- 重型机械和施工机械製造商正在与高科技公司合作开发自动挖土机。例如,基于倾转器技术的设备製造商 Engcon 与Kobelco Construction Machinery Europe BV (KCME) 和 Leica Geosystems 合作,为神钢 SK210LC-10 挖土机开发了相容倾转器的挖土机引导系统。该系统基于 Leica Geosystems 的最新 3D 机器控制 (3DMC) 技术和 Engcon 的最新倾斜旋转器技术。

- 此外,现代施工机械于 2021 年 1 月推出了升级版挖土机系列,系列名为 SMART PLUS 和新的全球色彩,以加强其品牌定位,特别是在印度和出口市场。

预计北美将占据较大市场占有率

- 北美是主要的采矿设备市场之一,由于美国和加拿大的存在,两国总合在采矿业中占有很大的份额。根据美国地质调查局编制的资料,全球超过22%的活跃矿产探勘地点仅位于加拿大。美国和加拿大合计持有国际活跃矿产探勘地点的34%以上。美国和加拿大在一些重要矿物的生产中所占的份额使其他国家相形见绌。

- 此外,美国政府制定了各种法规来指导采矿作业,以确保采矿作业不会破坏环境并为相关工人提供安全。因此,自动驾驶车辆在危险环境中不受时间限制工作的能力正在推动该地区的市场。美国政府制定了《国家环境政策法》(NEPA)、《资源保护和回收法》(RCRA)、《清洁空气法》(CAA)、《清洁水法》(CWA) 和《有毒物质控制法》等环境法规(国家安全局)。这些法规正在推动该国对自动采矿车辆的需求。

- 该地区为采矿设备製造商提供了重要的业务。例如,日本小松公司是世界领先的采矿设备供应商之一,透过销售建筑、采矿和公共事业设施设备,在该地区创造 4,478 亿日圆。日本小松公司美国子公司日本小松公司美国公司最近宣布,其领先的自主运输系统 (AHS) 已获得在商业长期演进 (LTE)行动宽频技术上运作的资格。这是AHS首次在民用LTE上商用。

- 此外,区域参与者正在为市场成长做出贡献。例如,思科的物联网工业网路技术和山特维克的自动化系统和软体帮助瑞典矿业公司 Boliden 实现了采矿作业的自动化和最佳化。山特维克采矿和岩石技术是山特维克集团的一个业务领域。为采矿和建设产业提供设备、工具、服务和技术解决方案的全球供应商。其应用领域包括岩石开挖、岩石切割、破碎和筛检、装载和输送、隧道挖掘、采石、破碎和拆除。

- 此外,ABB 在加拿大推出了 ABB 能力营运管理系统。该系统最大限度地协调每週生产计画和采矿业的动态情况,从而提高效率、提高生产力并实现盈利最大化。该系统是与 Boliden AB 和 ArcelorMittal Mining Canada 合作开发的。此外,ABB 采矿营运管理系统 (OMS) 即时连接和协调矿山操作员、劳动力、设备和采矿活动,从工作面准备到破碎机。

自动化矿山设备产业概况

自动化采矿设备仍然是一个整合的市场,少数大型企业拥有重要的市场占有率。然而,随着整体市场规模的增加,市场的扩张吸引了新的参与者,而这些参与者近年来积极进入市场。以下是一些最新进展。

- 2021 年 9 月 - ABB 推出“ABBbility eMine”,这是一个加速向零碳采矿转型的解决方案组合。 eMine 由一系列电气化技术组成,可实现从矿山到港口的全电动矿山,并与数位应用程式和服务集成,以监控和优化能源使用。

- 2020 年 11 月 - ABB 推出矿用起吊装置安全套件,ABBbility Safety Plus for Hoists。产品包括 Safety Plus 煞车系统,其中包括 Safety Plus起吊装置监视器、Safety 起吊装置保护器和安全煞车液压系统。这些产品依照国际机械安全标准IEC62061设计,并通过瑞典研究机构RISE独立认证。用于起吊装置的 ABBbility Safety Plus 包括新型 ABB SIL 3 Safety Plus 煞车系统,这是采矿业首个完全独立认证的安全完整性 3 级矿井起吊装置系统。

其他好处

- Excel 格式的市场预测 (ME) 表

- 3 个月分析师支持

目录

第一章简介

- 研究假设和市场定义

- 调查范围

第二章调查方法

第三章执行摘要

第四章市场动态

- 市场概况

- 产业价值链分析

- 产业吸引力-波特五力分析

- 供应商的议价能力

- 消费者议价能力

- 新进入者的威胁

- 竞争公司之间的敌对关係

- 替代品的威胁

- COVID-19 对市场的影响

- 市场驱动因素

- 对提高生产力和工人安全的需求不断增加

- 对降低营运成本的兴趣日益浓厚

- 市场挑战

- 安全和漏洞问题

第五章市场区隔

- 按成分

- 硬体

- 挖土机

- 公路运输垃圾场

- 机器人卡车

- 钻头和破碎机

- 其他设备

- 软体

- 服务

- 硬体

- 按地区

- 北美洲

- 欧洲

- 亚太地区

- 拉丁美洲

- 中东/非洲

第六章 竞争状况

- 公司简介

- Rockwell Automation Inc.

- Trimble Inc.

- Autonomous Solutions Inc.

- ABB Ltd

- Hexagon AB

- Caterpillar Inc.

- Hitachi Ltd.

- Komatsu Ltd.

- Atlas Copco

- AB Volvo

第七章 投资分析

第八章 市场未来展望

简介目录

Product Code: 66944

The Automated Mining Equipment Market is expected to register a CAGR of 35.38% during the forecast period.

Key Highlights

- Mining is a composite industry that extracts raw materials of different shapes, sizes, and chemical compositions from the earth's crust. Transforming it into a standardized and high-quality final product is challenging and has pushed the industry to opt for solutions that improve its efficiency and productivity. Typically mines are located in remote areas, and adopting automation helps in resource utilization better.

- Autonomous technologies bring certain benefits which cannot be overlooked. These impact the whole value chain of the mining industry and the industries depending upon mining for their raw material requirements. The companies that implement automation technologies are anticipated to quickly realize a significant increase in productivity and a decrease in expenditures with the correct implementation.

- Moreover, Mining companies worldwide are swiftly utilizing technological developments to better use their equipment and human resources to improve safety. For instance, in September 2020, Bis, a logistics company, and Israel Aerospace Industries (IAI) announced its collaboration for 'Auto-mate,' a new joint venture, to provide autonomous systems for mining operations. According to IAI, the JV is likely to give the mining industry players access to the benefits of automation in their operations, which improves safety and productivity.

- The industry is anticipated to benefit from a considerable increase in safety practices. Identifying processes and operating procedures helps address danger points and develop the SOP to mitigate those risks. Moreover, using automated equipment, which can be maneuvered into unsafe areas and challenging locations, the mining companies can send fewer miners underground while extracting a higher output, with lower risk to their employees. For example, after implementing autonomous technologies in several African mines, Randgold Resources reduced the quarter-on-quarter injury rate by 29%.

- Further, the demand for automation equipment in the industry is primarily driven by the rising need to enhance productivity and improve workers' safety. The outbreak of COVID-19 has caused the demand for automation and is expected to increase over the long run, primarily to cope with the shortage of labor and rising costs. Within the mining industry, the situation is likely to vary from commodity to commodity. The mining of commodities, such as gold, iron ore, and uranium, has remained buoyant. In contrast, thermal and metallurgical commodities have come under more pressure as the commodity is fully exposed to consumer demand.

Automated Mining Equipment Market Trends

Excavators is Expected to Hold Significant Market Share in the Hardware Segment

- A wide range of excavators can be seen in the mining fields, ranging from a skid's size to a massive building-sized earth mover. These excavators are used in the foundation of any mining operation. The excavators play a vital role in digging and pulling back the materials using hydraulics. Many companies offer excavators classified into two categories: wheeled excavators and large excavators, with differences in their manufacturing processes.

- Moreover, wheeled excavators are popularly used for multi-tasking and are designed to deliver the speed and power required for such tasks. Continuous innovations in load management have enabled the creation of excavators with maximum digging capacities. To cater to the concerns about safety and improved productivity, automated excavators provide improved visibility. The operator stands in line with the sight and uses a remote to run the vehicle operations. Thus, automating the excavator on a job site can increase productivity and accuracy and decrease operator fatigue and fuel consumption.

- In March 2020, Leica Geosystems, a Hexagon company, released its new semi-automated excavator functionality for the iXE3 3D excavator machine control solution, including tilt and tilt rotator bucket automation. The solution automatically controls bucket, boom, tilt, and tilt rotator bucket functions to dig faster and more accurately to the target design surface and cross slope. The new semi-automatic functionality makes the operator execute complex tasks, increase productivity, reduce manual controls, speed, and accuracy of the work, even for less experienced operators.

- The manufacturers of heavy earthmoving and construction machinery are collaborating with tech companies to develop automated excavators. For instance, Engcon, the tilt rotators technology-based equipment manufacturer, teamed with Kobelco Construction Machinery Europe BV (KCME) and Leica Geosystems, developed the tilt rotator compatible excavator guidance system on a Kobelco SK210LC-10 excavator. The system is based on the latest 3D machine control (3DMC) technology by Leica Geosystems, along with the newest tilt rotator technology from Engcon.

- Further, in January 2021, Hyundai Construction Equipment launched the upgraded series of excavators under the series name SMART PLUS and new global color to strengthen the brand positioning, especially in India and the export market.

North America is Expected to Account For Significant Market Share

- North America is one of the major mining equipment markets, owing to the United States and Canada's presence, which combinedly hold a significant share in the mining industry. According to the data produced by the US Geological Survey, more than 22% of the global active mineral exploration sites are located solely in Canada. Together, the United States and Canada host more than 34% of the international active mineral exploration sites. The production shares of the two countries, for a few essential mineral commodities, put them in leading positions compared to other countries.

- Further, the US government has various regulations that guide the mining industry to work without damaging the environment and providing safety to the workers involved. This is driving the market in the region due to the capabilities of automated vehicles working in hazardous environments without time boundaries. The US government has environmental regulations such as National Environmental Policy Act (NEPA), Resource Conservation and Recovery Act (RCRA), Clean Air Act (CAA), Clean Water Act (CWA), Toxic Substances Control Act (TSCA), etc. Owing to such regulations, the country is driving the demand for autonomous mining vehicles.

- The region provides substantial business for mining equipment producers. For instance, Komatsu, one of the significant vendors of mining equipment worldwide, generated JPY 447.8 billion from the region with sales of its construction, mining, and utility equipment. Komatsu's American subsidiary, Komatsu America Corp., recently announced that its front-runner Autonomous Haulage System (AHS) has qualified to operate on private long-term evolution (LTE) mobile broadband technology. It is the first AHS enabled to run on private LTE in commercial operations.

- Moreover, the regional players are contributing to the growth of the market. For instance, Cisco's IoT industrial networking technology and Sandvik's automation systems and software helped the Swedish mining company, Boliden, automate and optimize mining operations. Sandvik Mining and Rock Technology is a business area within the Sandvik Group. It is a global supplier of equipment and tools, services, and technical solutions for the mining and construction industries. The application areas include rock drilling, rock cutting, crushing and screening, loading and hauling, tunneling, quarrying, and breaking and demolition.

- Further, ABB has launched ABB Ability Operations Management System in Canada that maximizes coordination between weekly production plans and dynamic situations in mining to improve efficiency, increase productivity, and maximize profitability. It has developed in collaboration with Boliden AB and ArcelorMittal Mining Canada. Moreover, ABB Ability Operations Management System for mining (OMS) connects and coordinates mine operators, workforce, equipment, and mining activities in real-time, from face preparation to the crusher.

Automated Mining Equipment Industry Overview

Automated Mining Equipment remains a consolidated market with a few significant players owning a considerable market share. However, with the market's overall size, expanding the market attracts new players, who have actively entered the market only recently. Some of the recent developments in the market are.

- September 2021 - ABB has launched ABB Ability eMine, a portfolio of solutions that will help accelerate the move towards a zero-carbon mine. ABB also unveiled the piloting of the ABB Ability eMine FastCharge, the fastest and most powerful charging system, designed to interface with all makes of electric mining haul trucks. eMine comprises a portfolio of electrification technologies that make the all-electric mine possible from mine to port and are integrated with digital applications and services to monitor and optimize energy usage.

- November 2020 - ABB launched the ABB Ability Safety Plus for hoists, a suite of mine hoist safety. The products include Safety Plus Hoist Monitor, Safety Plus Hoist Protector, and Safety Plus Brake System, including Safety Brake Hydraulics. The products are designed following the international safety of machinery standard IEC62061, and the products have been independently certified by Sweden's research institute, RISE. ABB Ability Safety Plus for hoists includes the new ABB SIL 3 Safety Plus Brake System, the mining industry's first entirely independently certified Safety Integrity Level 3 mine hoist system.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumption and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET DYNAMICS

- 4.1 Market Overview

- 4.2 Industry Value Chain Analysis

- 4.3 Industry Attractiveness - Porter's Five Forces Analysis

- 4.3.1 Bargaining Power of Suppliers

- 4.3.2 Bargaining Power of Consumers

- 4.3.3 Threat of New Entrants

- 4.3.4 Intensity of Competitive Rivalry

- 4.3.5 Threat of Substitutes

- 4.4 Impact of COVID-19 on the Market

- 4.5 Market Drivers

- 4.5.1 Growing Demand for Increasing Productivity and Improving Workers Safety

- 4.5.2 Growing Concerns about Reduction of Operational Costs

- 4.6 Market Challenges

- 4.6.1 Security and Vulnerability Issues

5 MARKET SEGMENTATION

- 5.1 By Component

- 5.1.1 Hardware

- 5.1.1.1 Excavators

- 5.1.1.2 Load Haul Dump

- 5.1.1.3 Robotic truck

- 5.1.1.4 Drillers and Breakers

- 5.1.1.5 Other Equipments

- 5.1.2 Software

- 5.1.3 Services

- 5.1.1 Hardware

- 5.2 By Geography

- 5.2.1 North America

- 5.2.2 Europe

- 5.2.3 Asia Pacific

- 5.2.4 Latin America

- 5.2.5 Middle East and Africa

6 COMPETITIVE LANDSCAPE

- 6.1 Company Profiles

- 6.1.1 Rockwell Automation Inc.

- 6.1.2 Trimble Inc.

- 6.1.3 Autonomous Solutions Inc.

- 6.1.4 ABB Ltd

- 6.1.5 Hexagon AB

- 6.1.6 Caterpillar Inc.

- 6.1.7 Hitachi Ltd.

- 6.1.8 Komatsu Ltd.

- 6.1.9 Atlas Copco

- 6.1.10 AB Volvo

7 INVESTMENT ANALYSIS

8 FUTURE OUTLOOK OF THE MARKET

02-2729-4219

+886-2-2729-4219