|

市场调查报告书

商品编码

1630290

物联网 (IoT) 平台:市场占有率分析、产业趋势/统计、成长预测(2025-2030 年)Internet Of Things (IoT) Platform - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

※ 本网页内容可能与最新版本有所差异。详细情况请与我们联繫。

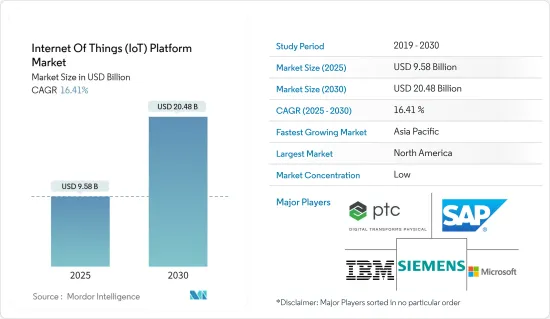

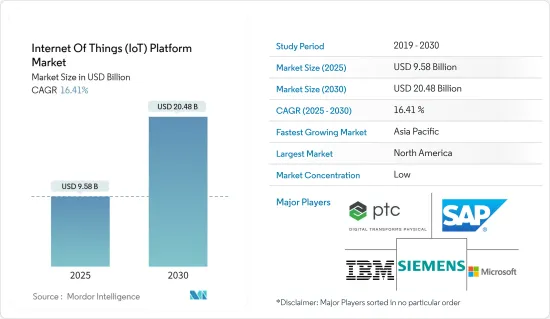

物联网(IoT)平台市场规模预计到2025年将达到95.8亿美元,到2030年将达到204.8亿美元,预测期间(2025-2030年)复合年增长率为16.41%。

物联网平台由专为物联网应用设计的开发板组成。这些平台在帮助物联网设备的各种设计人员将计划连接到互联网方面发挥着重要作用。物联网平台提供与各种支援物联网的硬体设备的连接,包括笔记型电脑、手机、穿戴式健身设备、工业控制系统和车用通讯系统单元。

主要亮点

- IoT 平台也称为应用程式支援平台 (AEP),被定义为一种位于 IoT 装置、闸道和应用程式层之间的中间件形式。典型的物联网平台由基本元件组成,包括处理单元、记忆体单元和连接模组。轻鬆整合现有的商用感测器和致动器。

- 物联网平台是物联网架构的关键元件,它连接虚拟世界和现实世界,并在管理资料流的同时实现物件之间的通讯。它还支援应用开发并提供连接的物联网设备的基本分析。

- 此物联网平台专为物联网应用而设计,可供支援物联网的硬体设备(例如行动电话、笔记型电脑、工业控制系统(ICS)、穿戴式健身设备和汽车远端资讯处理单元)的多个设计人员计划。随着平台整合成为一种趋势,一致的协作正在扩大其市场地位,重点是增加功能,同时最大限度地减少存取所需的应用程式数量。例如,去年,物联网营运商 1NCE 和 Amazon Web Services (AWS) 合作协助扩展 1NCE 的物联网平台,将其云原生物联网服务分发到更靠近世界各地的客户。 1NCE 独特的软体基于 AWS 构建,使物联网开发人员能够透过即插即用功能快速将蜂巢式物联网连接整合到他们开发的解决方案中。

- 市场上物联网生态系统中的连网设备数量不断增加。这使得传输、下载和上传大量资料的需求变得至关重要,尤其是在企业资料中心。这些中心正在部署物联网平台,以增强其管理物联网资料资源的专业知识、速度和敏捷性的能力。巨量资料也是一个有望补充调查市场的领域,因为连接的物联网设备的增加导致资料量的增加。

- 云端资料储存需求的增加和资料分析需求的成长等因素预计将在预测期内推动企业物联网平台市场的发展。资料流量的增加是支撑云端资料储存需求的主要因素。随着物联网在全球的普及,设备之间的连接也不断增加。因此,累积了大量的资料。

- 随着疫情期间减少接触的努力不断加强,医疗保健组织正在部署物联网解决方案来帮助保护个人防护装备。美国五家医院已加入测试Medtronic全球首款可远端监控和调节的人工呼吸器。美敦人工呼吸器允许医生透过笔记型电脑从任何地方远端监控和调整人工呼吸器,从而帮助减少医院中个人防护装备 (PPE) 的使用。根据微软去年稍早发布的物联网讯号报告,COVID-19 为组织及其物联网策略带来了意想不到的好处,近44% 的受访产业专业人士表示,COVID-19 大流行将加速物联网投资。

物联网 (IoT) 平台市场趋势

医疗最终用户产业可望显着成长

- 据 BICS SA/NV 称,连网医疗设备预计将占所有物联网技术的 40%,并将透过易于部署的监控和报告功能改善患者体验,从而改变整个行业。

- 全球医疗保健劳动力短缺是该行业的重大担忧。光是在美国,未来三年就将短缺12.4万名医生。儘管亚洲和非洲的缺口数量低于预期,但缺口仍然很大。这一因素表明医疗设施升级的需求和医疗保健行业的快速成长,这可能会进一步推动市场。先进的互联医疗设备可能会有很高的需求。

- 包括物联网在内的文明病管理应用仍处于起步阶段且成本高。消费者一般需要体验这些服务。这为服务该消费群体的供应商提供了机会。

- 很少有行业比医院更需要谨慎的时间安排。生死攸关的情况通常需要快速反应、获得正确的用品和药品,并了解哪些医生在哪里以及如何联繫他们。透过使用物联网,医院工作人员现在可以即时了解医疗设备的位置、设备的数量以及同事的行踪。避免了医院内的感染疾病,并且始终保持高水准的卫生。

- 例如,在去年的 CES 上,Olea Sensor Networks 推出了 OSN 数位健康平台,该平台基于 OleaSense 的下一代非接触式远距生命征象监测系统。用于物联网产品开发和高级研究的数位健康开发平台使用 Olea 的 AI 讯号处理和峰值检测演算法来处理即时资料并提取生命统计数据,例如心臟、呼吸和心率变异性。

- 根据爱立信的报告,到 2028年终,预计近 60% 的蜂巢式物联网连接将是宽频连接,其中 4G 连接占大多数。随着 5G 新无线电 (NR) 在现有无线电波和新无线电波中实施,吞吐量资料速率将显着增加。支援技术是医疗保健产业促进物联网应用创新的基本需求。基于物联网的医疗保健系统的实施是基于从医院、復健中心、社区和家庭收集的巨量资料。收集的资料即时更新,资料交易可以在连接的事物之间同时发生。资讯可以储存在我们的伺服器上。

预计北美将占据较大市场占有率

- 据 GSMA Intelligence 称,未来三年北美地区预计将建立 54 亿个物联网 (IoT) 连线。北美有 28 亿个物联网连线。在该地区,物联网的采用是出于降低成本的愿望,儘管物联网的采用是由组织推动业务效率和提高竞争力所驱动的。根据 Ovum 的研究,美国公司经常使用物联网来降低成本。

- 物联网在美国是一个快速成长的产业。美国的现代製造设施依靠新技术和创新以更低的成本生产更高品质的产品。根据消费者科技协会的数据,上年度美国连网设备的出货量为 7.91 亿台。

- 物联网技术正在克服製造业的劳动力短缺问题,尤其是在美国等已开发国家。因此,美国联邦政府和私营部门正在投资工业4.0物联网技术,以扩大已被中国和其他低劳动成本国家取代的美国工业基础。因此,物联网技术可能主要推动全部区域智慧工厂解决方案的采用。

- 为了满足客户的动态需求并增强产品系列,公司正在将新功能融入现有产品并开发新产品。例如,物联网 (IoT) 平台参与者 Airura Networks 加速了消费品牌和网路服务供应商 (ISP) 的数位转型,一年前,加拿大轮胎公司 (Canadian Tire) 在加拿大各地开设了 500 多家商店。该公司宣布将采用其承包联网韧体来提供一系列新的全球可用智慧家庭产品。

- 同样在去年,罗杰斯通讯 (Rogers Communications) 的企业部门罗杰斯商业 (Rogers Business) 宣布了适用于智慧城市和建筑的新物联网 (IoT) 解决方案。这些来自罗杰斯多元化合作伙伴的新解决方案透过提高水、停车、交通、运输和车队管理方面的回应能力和效率,扩展了罗杰斯目前的物联网产品组合。空气品质、安全和数位指示牌系统方面的先进技术也包含在新的智慧建筑解决方案中。

物联网 (IoT) 平台产业概览

物联网 (IoT) 平台市场分散且竞争激烈,国内外市场都有许多参与者。由于市场上有许多科技巨头,因此市场显得分散。市场主要企业正在采取各种策略,包括产品创新和併购。该市场的主要参与者包括 IBM 公司、微软公司和 SAP。

- 2023 年 12 月 - Elevate 与 Microsoft 合作,协助改善重型行动装置产业物联网 (IoT) 解决方案的开发。该公司将把监控机器健康状态的物联网平台 Elevat Machine Connect 与支援网路边缘云端运算的软体 Microsoft Azure Edge 整合(请参阅下方的侧边栏)。这加快了从 Elevat 等解决方案收集的资料的处理速度,从而能够更及时地制定决策并最大限度地减少计划外机器停机时间。

- 2023 年 5 月 - IBM 和 SAP SE 将 IBM Watson 技术嵌入到 SAP 解决方案中,以提供人工智慧主导的洞察和自动化,从而加速创新并在整个SAP 解决方案组合中打造高效且有效的使用者体验,并宣布将创建一个

其他好处:

- Excel 格式的市场预测 (ME) 表

- 3 个月分析师支持

目录

第一章简介

- 研究假设和市场定义

- 调查范围

第二章调查方法

第三章执行摘要

第四章市场洞察

- 市场概况

- 产业吸引力-波特五力分析

- 新进入者的威胁

- 买方议价能力

- 供应商的议价能力

- 替代品的威胁

- 竞争公司之间的敌对关係

第五章市场动态

- 市场驱动因素(自动化程度提高、巨量资料分析成为关键资产、物联网投资增加等)

- 市场挑战(市场分散化、缺乏平台扩展和管理的基础设施等)

- 关键使用案例和案例研究(供应链视觉性、智慧灌溉、服务管理、製造绩效等)

- 市场开发策略(生态系统开发、客户成功、定价等)

- 物联网市场格局(当前状况、各类别的支出金额、影响产业成长的关键因素、按支出金额分類的主要最终用户产业、主要发展等)

第六章 市场细分

- 按发展

- 本地

- 云/SaaS

- 依平台类型

- 应用程式支援

- 设备管理

- 进阶分析

- 云端储存/IaaS

- 连接性

- 按最终用户产业

- 产业

- 连接建筑

- 智慧家庭

- 流动性

- 医疗保健

- 其他最终用户应用程式

- 按地区

- 北美洲

- 欧洲

- 亚洲

- 澳洲/纽西兰

- 拉丁美洲

- 中东/非洲

第七章 竞争格局

- 公司简介

- IBM Corporation

- Microsoft Corporation

- PTC Inc.

- SAP SE

- Siemens AG

- C3.ai

- Oracle Corporation

- GE Digital(General Electric Company)

- Hitachi Ltd

- Software AG

- ABB Ltd

- Amazon Web Services Inc.

- AVEVA Group PLC

- Alitzon Inc.

- Robert Bosch GmbH

第八章投资分析

第9章市场的未来

The Internet Of Things Platform Market size is estimated at USD 9.58 billion in 2025, and is expected to reach USD 20.48 billion by 2030, at a CAGR of 16.41% during the forecast period (2025-2030).

IoT platforms consist of development boards that are designed particularly for IoT applications. These platforms play an important role in helping various designers of IoT devices to connect their projects to the internet. IoT platform provides connectivity to various IoT-compatible hardware devices such as laptops, mobiles, wearable fitness devices, industrial control systems, automotive telematics units, etc.

Key Highlights

- IoT platforms, also called application enablement platforms or AEPs, are defined as a form of middleware that lies between the layers of IoT devices and gateways and applications, which it enables to build. A typical IoT platform consists of essential components that include a processing unit, a memory unit, and a connectivity module. They allow easy integration of existing commercial sensors and actuators.

- IoT platforms are the main component of IoT architecture that connects the virtual world and the real world and enables communication between objects while managing data flows. They also support application development and provide basic analytics for connected IoT devices.

- IoT platforms are designed specifically for IoT applications and consist of various development boards that play a crucial role in helping multiple designers of IoT-compatible hardware devices such as mobiles, laptops, industrial control systems (ICS), wearable fitness devices, and automotive telematics units to connect their project to the internet. Consistent collaborations are broadening market positions as consolidations of platforms have become the trend, with an emphasis on increasing functionality while minimizing the number of applications required to access them. For instance, the previous year, the IoT Carrier 1NCE and Amazon Web Services (AWS) collaborated to boost the expansion of the 1NCEs IoT platform, dispersing its cloud-native IoT offering closer to customers worldwide. Its unique software offering is built on AWS to enable quick integration of cellular IoT connectivity into solutions developed by IoT developers with plug-and-play functionalities.

- The market has been witnessing an increasing number of connected devices in an IoT ecosystem. Because of this, the need for transferring, downloading, and uploading large volumes of data, mostly in enterprise data centers, has become essential. These centers are deploying IoT platforms to enhance their capabilities in terms of expertise, speed, and agility to manage IoT data resources. As the amount of data grows owing to an increasing number of connected IoT devices, big data is another field that is expected to complement the studied market.

- Factors such as increasing demand for data storage over the cloud and growing demand for data analytics are expected to boost the market for enterprise IoT platforms over the forecast period. Increased data traffic has been the main underlying factor responsible for the demand for cloud data storage. With an increase in IoT adoption across the world, connectivity among devices is also growing. Hence, there is an accumulation of vast piles of data.

- The increased efforts to minimize contact amid the pandemic drive healthcare organizations to deploy IoT solutions that help preserve PPE. Five US hospitals have jumped to test Medtronic's first-of-its-kind ventilator that can be monitored and adjusted remotely. Medtronics' ventilator, which was created in response to COVID-19, is helping to reduce hospital use of PPE by allowing practitioners to remotely monitor and adjust the ventilator via a laptop computer from anywhere. According to Microsoft's IoT Signals report from prior to last year, COVID-19 resulted in unexpected benefits for organizations and their IoT strategies, with nearly 44% of all surveyed industry professionals expected to accelerate their IoT investments as a result of the COVID-19 pandemic.

Internet of Things (IoT) Platform Market Trends

Medical End-User Industry is Expected to Witness Significant Growth

- According to the BICS SA/NV, connected medical devices are expected to represent 40% of all IoT technology, transforming the industry by building an enhanced patient experience with easy-to-deploy monitoring and reporting proficiencies.

- A worldwide shortage of healthcare workers is a significant concern for the industry. In the United States alone, the shortage is projected at 124,000 physicians in the coming three years. Although it is lower than the anticipated shortages in Asia and Africa, it still signifies a crucial deficiency. This factor indicates a need for upgraded medical facilities and rapid growth in the healthcare sector, which may further drive the market. Advanced and connected medical equipment are more likely to experience demand.

- Lifestyle disease management applications involving IoT are still at a nascent stage and are costly. Ordinary consumers generally need to experience these services. This creates an opportunity for vendors serving such consumer segments.

- Only a few industries require such careful timing of responses as hospitals do. Life and death circumstances frequently need quick thinking, obtaining the appropriate supplies or medications, and knowing which doctor is accessible and where to reach him. Hospital staff can now track the whereabouts of medical equipment, the quantity of supplies, and the whereabouts of their coworkers in real-time, thanks to the use of IoT. Infections within the hospital can be avoided, and a consistently high degree of hygiene can be maintained.

- For instance, the previous year, Olea Sensor Networks announced the OSN Digital Health Platform at CES the same year, based on Olea's next-gen system for contactless and remote vital sign monitoring of OleaSense. The digital health development platform for IoT product development and advanced research processes real-time data using Olea's AI signal processing and peak detection algorithms, extracting vital statistics such as cardiac, respiration, and heart-rate variability.

- According to Ericsson report, Nearly 60% of cellular IoT connections are anticipated to be broadband connections by the end of 2028, with 4G connecting the vast majority. Throughput data rates will significantly rise as 5G New Radio (NR) is implemented in both existing and new airwaves. To promote innovations in IoT applications, enabling technologies is an essential need for the healthcare sector. The implementation of IoT-based healthcare systems is based on big data collected from hospitals, rehabilitation centers, communities, and homes. The gathered data updates in real-time, and the data transactions may happen simultaneously among the connected things. Information can be stored on the servers.

North America is Expected to Hold Significant Market Share

- According to GSMA Intelligence, it is anticipated that there will be 5.4 billion Internet of Things (IoT) connections overall in North America in the coming three years. In North America, there were 2.8 billion Internet of Things connections. In order to promote operational efficiency and boost competitiveness, IoT adoption is driven by organizations; however, in the area, IoT adoption is driven by the desire to save costs. An Ovum survey found that American businesses frequently used IoT to cut costs.

- IoT is a rapidly growing industry in the United States. Modern manufacturing facilities in the US rely on new technologies and innovations for producing higher quality products at an enhanced rate with lower costs. According to the Consumer Technology Association, based on prior to the previous year, the connected device shipments were 791 million units in the United States.

- IoT technologies are overcoming the labor shortage in the manufacturing sector, especially in developed countries like the United States. Due to this, the Federal Government and the private sector in the United States are investing in Industry 4.0 IoT technologies to increase the American industrial base, which China and other low-labor cost countries have taken over. Therefore, IoT technologies may mainly drive the adoption of smart factory solutions across the region.

- To meet the dynamic demands of the customers and enhance their product portfolio, the companies are incorporating new features in existing products and developing new products. For instance, prior to the previous year, Ayla Networks, a player in the Internet of Things (IoT) platforms that speed up digital transformation for consumer brands and Internet service providers (ISPs), announced that Canadian Tire, a member of the Canadian Tire Corporation group of companies with over 500 stores across Canada, selected its turnkey IoT firmware to power a new, globally available line of smart home products.

- Furthermore, in last year, New internet of Things (IoT) solutions for smart cities and smart buildings were introduced by Rogers Business, the part of Rogers Communications that focuses on businesses. These new solutions from diverse Rogers partners increase response and efficiency in water, parking, traffic, transit, and fleet management, expanding Rogers' current IoT portfolio. Advanced technology in air quality, security, and digital signage systems have also been included in new smart building solutions.

Internet of Things (IoT) Platform Industry Overview

The Internet of Things (IoT) Platform Market is fragmented and highly competitive, owing to the presence of many players in the market operating in the domestic as well as the international market. The market appears to be fragmented due to the presence of many technological giants in the market. Various strategies are being adopted by the major players in the market, such as product innovation and mergers and acquisitions. Some of the major players in the market are IBM Corporation, Microsoft Corporation, and SAP, among others.

- December 2023 - Elevate has partnered with Microsoft Corp. to assist in improving the development of IoT (Internet of Things) solutions in the heavy-duty mobile equipment industry. The company would integrate its Elevat Machine Connect, an IoT platform that monitors machine health, with Microsoft Azure Edge, a software that enables cloud computing at the edge of a network (see sidebar below). This provides faster processing of data collected from solutions like Elevat's, allowing more timely decision-making to occur so unplanned machine downtime can be minimized.

- May 2023 - IBM and SAP SE announced that IBM Watson technology would be embedded into SAP solutions to provide AI-driven insights and automation to accelerate innovation and create efficient and effective user experiences across the SAP solution portfolio.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET INSIGHTS

- 4.1 Market Overview

- 4.2 Industry Attractiveness - Porter's Five Forces Analysis

- 4.2.1 Threat of New Entrants

- 4.2.2 Bargaining Power of Buyers

- 4.2.3 Bargaining Power of Suppliers

- 4.2.4 Threat of Substitute Products

- 4.2.5 Intensity of Competitive Rivalry

5 MARKET DYNAMICS

- 5.1 Market Drivers (Growing Automation, Big Data Analytics becoming a Key Asset, Greater IoT Spending, etc.)

- 5.2 Market Challenges (Market Fragmentation, Lack of Infrastructure to Scale Platforms and Manage them, etc.)

- 5.3 Key Use-cases and Case Studies (Supply Chain Visibility, Smart Irrigation, Service Management, Manufacturing Performance, etc.)

- 5.4 Go-To-Market Strategies (Ecosystem Development, Customer Success, Pricing, etc.)

- 5.5 IoT Market Landscape (Current Scenario, Spending Across Various Categories, Key Factors Influencing the Growth of the Industry, Major End-user Industries by Spending, and Key Developments)

6 MARKET SEGMENTATION

- 6.1 By Deployment

- 6.1.1 On-premise

- 6.1.2 Cloud/Saas

- 6.2 By Type of Platform

- 6.2.1 Application Enablement

- 6.2.2 Device Management

- 6.2.3 Advanced Analytics

- 6.2.4 Cloud Storage/IaaS

- 6.2.5 Connectivity

- 6.3 By End-user Industry

- 6.3.1 Industrial

- 6.3.2 Connected Building

- 6.3.3 Smart Home

- 6.3.4 Mobility

- 6.3.5 Medical

- 6.3.6 Other End-user Applications

- 6.4 By Geography

- 6.4.1 North America

- 6.4.2 Europe

- 6.4.3 Asia

- 6.4.4 Australia and New Zealand

- 6.4.5 Latin America

- 6.4.6 Middle East and Africa

7 COMPETITIVE LANDSCAPE

- 7.1 Company Profiles

- 7.1.1 IBM Corporation

- 7.1.2 Microsoft Corporation

- 7.1.3 PTC Inc.

- 7.1.4 SAP SE

- 7.1.5 Siemens AG

- 7.1.6 C3.ai

- 7.1.7 Oracle Corporation

- 7.1.8 GE Digital (General Electric Company)

- 7.1.9 Hitachi Ltd

- 7.1.10 Software AG

- 7.1.11 ABB Ltd

- 7.1.12 Amazon Web Services Inc.

- 7.1.13 AVEVA Group PLC

- 7.1.14 Alitzon Inc.

- 7.1.15 Robert Bosch GmbH