|

市场调查报告书

商品编码

1630295

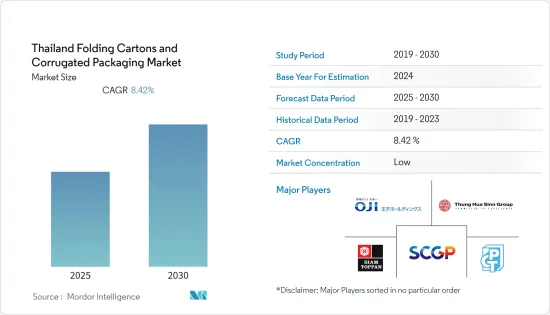

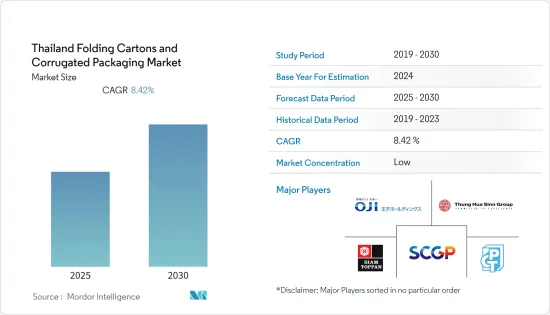

泰国折迭式纸盒和纸板包装:市场占有率分析、行业趋势、成长预测(2025-2030)Thailand Folding Cartons and Corrugated Packaging - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

※ 本网页内容可能与最新版本有所差异。详细情况请与我们联繫。

预计泰国折迭式纸盒和瓦楞包装市场在预测期内的复合年增长率为8.42%。

主要亮点

- 市场成长主要得益于包装食品和饮料的持续需求。同样,ThaiBev 的目标是增加再生纸的比例,并在瓦楞纸箱的生产中使用损坏的纸箱。

- 主要使用折迭式纸盒的行业包括食品和饮料行业、个人护理行业、医疗保健行业和家居用品行业。日本正在经历从塑胶到纸质包装的重大转变,预计这将为纸箱包装市场的製造商创造新的商机。随着消费者越来越意识到塑胶对环境的负面影响,製造商正在利用这个机会创新环保解决方案。

- 随着电子商务需求的增加,包装挑战也随之增加。永续包装从未像现在这样成为品牌和消费者的首要任务。将生态包装引入品牌营运不再是一种选择,而是一种必然。

- 泰国的经济发展导致纸箱及纸板製品的生产和消费增加。泰国的纸箱包装产业正在蓬勃发展,并为国家经济做出了宝贵贡献。这是由于对合适的包装材料的需求不断增加,这些材料可用于包装多个最终用户垂直领域的任何物品。

- 网路购物在泰国逐渐成为主流,越来越多的消费者因为网购的便利性而选择网路购物。随着 COVID-19 大流行期间实施严格的限制和社交距离规则,这种转变变得更加普遍。随着该国电子商务的兴起,即使在大流行之后,市场仍在扩大。

泰国折迭式纸盒和纸板包装市场的趋势

由于电子商务的增加而增加的包装能力推动了市场的成长

- 由于COVID-19大流行,在线销售的包装纸板、薄纸和特殊纸的需求增加,推动了该国纸板包装行业的成长。

- 自疫情爆发以来,电子商务销售额已连续两年多成长。同时,瓦楞纸业务需要支援才能继续成长。造纸厂正在满载运转,一些生产商正在限制订单并将委託给较小的公司。消费者越来越多地选择电子商务而不是实体店。因此,预计未来需求将持续增加。

- 近年来,电子商务行业已成为重要参与者,亚马逊使用瓦楞纸箱进行初级包装,并依靠塑胶包装来进行单一商品的包装。泰国人对包装废弃物的日益担忧促使政府颁布法规,鼓励公众采用折迭式纸盒和瓦楞纸箱等环保材料作为可行的包装选择,您很可能面临压力。

- 智慧型手机的普及与电子商务的价值直接相关。根据Tech Asia预测,未来两年泰国电商市场规模预计将达到240亿美元。

- 泰国国家统计局去年进行的一项调查显示,约99.9%的15至24岁受访者表示他们使用智慧型手机。这些数字正在推动电商购物的需求,并间接影响国内纸箱包装的成长。

食品和饮料领域预计将占据主要市场占有率

- 由于该国中阶人口不断增长以及食品支出增加,收入增加正在推动食品和饮料行业的成长。随着越来越多的人口居住在曼谷广阔的郊区,对方便包装食品的需求不断增加。

- 此外,快速的都市化增加了该国对加工食品和已调理食品的需求。已调理食品是采用纸箱作为二次包装的顶级公司之一,推动了市场成长。根据《全球有机贸易指南》,本财年泰国有机包装食品和饮料的消费额预计约为 3,020 万美元。

- 此外,乳製品包装产业对纸盒包装的需求不断增加。液体包装是乳製品最常见的纸板包装类型。随着消费者积极从软性饮料转向健康的乳製品替代品,国内牛奶消费量预计将增加。

- 最近,食品加工和包装解决方案公司利乐和mmilk在泰国推出了首款利乐顶纸瓶。 A2+和绿色牛奶等mmilk产品现在将在泰国以四顶纸盒和瓶子形式出售。

- 食品加工和包装服务公司利乐泰国公司与森林管理委员会 (FSC) 和世界自然基金会泰国分会合作,鼓励泰国消费者在饮料纸盒上寻找利乐标誌。该公司表示,消费者将获得由环保材料(来自负责任管理的森林的纸张)製成的纸箱产品,并且还将支持当地农业。

泰国折迭式纸盒及纸板包装产业概况

泰国的折迭式纸盒和瓦楞包装市场高度分散,主要参与者包括 Siam Toppan Packaging、Thai Containers Group (SCG Packaging)、Thung Hua Sinn Group、Continental Packaging (Thailand) 和 Oji Holdings Corporation。市场参与者正在采取联盟和收购等策略来增强其产品供应并获得永续的竞争优势。

- 2022年5月,泰国货柜集团宣布将把其在泰国的纤维包装产能每年扩大7.5万吨,并于2023年中期开始商业生产,以满足随着经济復苏而增加的需求。

其他好处:

- Excel 格式的市场预测 (ME) 表

- 3 个月的分析师支持

目录

第一章简介

- 研究假设和市场定义

- 调查范围

第二章调查方法

第三章执行摘要

第四章市场洞察

- 市场概况

- 产业吸引力-波特五力分析

- 供应商的议价能力

- 消费者议价能力

- 新进入者的威胁

- 竞争公司之间的敌对关係

- 替代品的威胁

- 产业价值链分析

第五章市场动态

- 市场驱动因素

- 由于电子商务的增加而增加包装能力

- 由于美国贸易战,主要生产转移至泰国

- 政府促进永续包装环境的倡议

- 扩大轻质材料的采用以及最终用户领域印刷技术的创新空间

- 市场挑战

- 对各种应用中瓦楞纸产品的材料可得性和耐用性的担忧

- 市场机会

- 最终用户群参与永续性

- 政府倡议

- COVID-19 对产业的影响

第六章 市场细分

- 按最终用户

- 饮食

- 医疗保健和製药

- 家庭和个人护理

- 其他最终用户产业(製造、汽车等)

第七章 竞争格局

- 公司简介

- Siam Toppan Packaging Co. Ltd

- Thai Containers Group(SCG Packaging)

- Thung Hua Sinn Group

- Continental Packaging(Thailand)Co. Ltd

- Oji Holdings Corporation

- ASA Group Company Limited

- Sarnti Packaging Co. Ltd

- Balance Packing Co. Ltd

- BG Packaging Company Limited

- Tri-Wall Ltd

- C&H Paperbox(Thailand)Co. Ltd

- Hong Thai Packaging Company Limited

第八章市场的未来

The Thailand Folding Cartons and Corrugated Packaging Market is expected to register a CAGR of 8.42% during the forecast period.

Key Highlights

- Growth in the market studied is mainly due to the continued demand for packaged food and beverages. Likewise, ThaiBev aimed to increase the recycled paper proportion and use damaged cartons to produce corrugated cartons.

- The industries where folding cartons are mainly used include the food and beverage industry, personal care industry, healthcare industry, household care industry, and others. The country is experiencing a significant shift from plastic to paper-based packaging adoption, expected to generate incremental opportunities for manufacturers in the folding carton packaging market. Since consumers are becoming increasingly aware of plastic adverse effects on the environment, manufacturers are capitalizing on this opportunity to innovate in eco-friendly solutions.

- As the e-commerce demand grows, so does the packaging challenge. Sustainable packaging is an unprecedented priority for both brands and consumers. Implementing eco-packages in brand operations is no longer an option but a necessity.

- The economic development in Thailand resulted in the increased production and consumption of folding cartons and corrugated packaging products. The Thai folding carton packaging industry is witnessing growth and contributing noteworthily to the country'scountry's economy. It is because of the increasing demand for suitable packaging materials that can be used to pack anything across several end-user verticals.

- Online shopping is gradually becoming a significant mainstream in Thailand, with more consumers preferring it due to its convenience. This shift became even more prevalent during the COVID-19 pandemic, with the strict lockdown and social distancing rules being in place. With the Rising E-commerce in the country, the market is increasing after the pandemic.

Thailand Folding Cartons & Corrugated Packaging Market Trends

Increasing Packaging Capacity Due to Rising E-commerce Drives the Market Growth

- Increased demand for packing boards for online sales, tissue papers, and specialty papers, as a result of the COVID-19 pandemic, promoted the paperboard packaging industry growth in the country.

- Since the pandemic began, e-commerce sales have grown by more than two years. Meanwhile, the corrugated business needs help to keep up. Paper mills operate at total capacity; some producers limit orders and outsource to smaller firms. Consumers are increasingly choosing e-commerce over brick-and-mortar establishments. Thus, the demand is expected to continue to rise.

- The e-commerce industry emerged as a significant player in recent years, with Amazon using corrugated board boxes for the principal packaging and relying on plastic packaging for individual items. The increasing concerns of Thai people associated with packaging waste are likely to compel the government to ring regulations that prompt the citizens to adopt environment-friendly options, such as folding cartons or corrugated boxes, as a viable choice for packaging.

- The growing smartphone adoption in the country directly correlates with the e-commerce value since most citizens prefer online shopping through mobile phones rather than laptops or PCs. According to Tech Asia, the e-commerce market's estimated size in Thailand would amount to USD 24 billion in the next two years.

- According to a survey conducted by the National Statistical Office (Thailand) in the previous year, around 99.9% of respondents aged between 15 to 24 stated that they are using smartphones. Such figures drive the demand for e-commerce shopping, indirectly influencing the folding carton packaging growth in the country.

Food and Beverage Segment is Expected to Hold Major Market Share

- The increase in incomes and increased spending on food by the growing middle-class population in the country is driving the food and beverage industry growth. As a more significant share of the population lives in Bangkok's sprawling suburbs, the demand for convenient packaged food options is growing.

- Moreover, rapid urbanization increased the demand for processed foods and ready-to-eat meals in the country. Ready-to-eat meal products are among the top adopters of cartons as the secondary form of packaging, fueling the market's growth. According to Global Organic Trade Guide, the consumption value of organic packaged food and beverages in Thailand is estimated to be approximately USD 30.2 million in the current year.

- Additionally, there is an increasing demand for folding carton packaging from the dairy packaging sector. Liquid cartons are the most common type of paperboard packaging used for dairy products. Milk consumption in the country is likely to increase as consumers actively switch from soft drinks to healthy dairy alternatives.

- In recent years, Tetra Pak, a food processing and packaging solutions company, and mMilk, launched a tetra top carton bottle for the first time in Thailand. mMilk is well known in the country for its lactose-free milk. The mMilk products, such as A2+ and Green Milk, were to be sold in Thailand in tetra-top carton bottles.

- TETRA PAK Thailand, a food processing and packaging services company, in collaboration with the Forest Stewardship Council (FSC) and WWF Thailand, is encouraging Thai consumers to look for the Tetra Pak logo on beverage cartons. The company stated that the consumers would get carton products made from environmentally sound materials - paper sourced from responsibly managed forests that would also support local farming.

Thailand Folding Cartons & Corrugated Packaging Industry Overview

The Thailand Folding Cartons and Corrugated Packaging Market is highly fragmented, with significant players like Siam Toppan Packaging Co. Ltd, Thai Containers Group (SCG Packaging), Thung Hua Sinn Group, Continental Packaging (Thailand) Co. Ltd, and Oji Holdings Corporation among others. Players in the market are adopting strategies such as partnerships and acquisitions to enhance their product offerings and gain sustainable competitive advantage.

- In May 2022, the Thai Containers Group announced that it would be expanding its fiber packaging capacity by 75,000 metric tons per year in Thailand to fulfill the growing demand as the economy recovered with a commercial start-up in mid-2023.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET INSIGHTS

- 4.1 Market Overview

- 4.2 Industry Attractiveness - Porter's Five Forces Analysis

- 4.2.1 Bargaining Power of Suppliers

- 4.2.2 Bargaining Power of Consumers

- 4.2.3 Threat of New Entrants

- 4.2.4 Intensity of Competitive Rivalry

- 4.2.5 Threat of Substitutes

- 4.3 Industry Value Chain Analysis

5 MARKET DYNAMICS

- 5.1 Market Drivers

- 5.1.1 Increasing Packaging Capacity due to Rising E-commerce

- 5.1.2 Shift of Major Production to Thailand in lieu of US-China Trade War

- 5.1.3 Government Initiatives on Promoting Sustainable Packaging environment

- 5.1.4 Growing adoption of light weighing materials and scope for printing innovations across end user segments

- 5.2 Market Challenges

- 5.2.1 Concerns over Material Availability and Durability of Corrugated Board-based Products Across Applications

- 5.3 Market Opportunities

- 5.3.1 End User Segment Participation toward Sustainability

- 5.3.2 Governmental Initiatives

- 5.4 Impact of COVID-19 on the Industry

6 MARKET SEGMENTATION

- 6.1 By End User

- 6.1.1 Food and Beverage

- 6.1.2 Healthcare and Pharmaceutical

- 6.1.3 Household and Personal Care

- 6.1.4 Other End-user Industries (Manufacturing, Automotive, etc.)

7 COMPETITIVE LANDSCAPE

- 7.1 COMPANY PROFILES

- 7.1.1 Siam Toppan Packaging Co. Ltd

- 7.1.2 Thai Containers Group (SCG Packaging)

- 7.1.3 Thung Hua Sinn Group

- 7.1.4 Continental Packaging (Thailand) Co. Ltd

- 7.1.5 Oji Holdings Corporation

- 7.1.6 ASA Group Company Limited

- 7.1.7 Sarnti Packaging Co. Ltd

- 7.1.8 Balance Packing Co. Ltd

- 7.1.9 BG Packaging Company Limited

- 7.1.10 Tri-Wall Ltd

- 7.1.11 C&H Paperbox (Thailand) Co. Ltd

- 7.1.12 Hong Thai Packaging Company Limited