|

市场调查报告书

商品编码

1630299

群体智能:市场占有率分析、产业趋势/统计、成长预测(2025-2030)Swarm Intelligence - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

※ 本网页内容可能与最新版本有所差异。详细情况请与我们联繫。

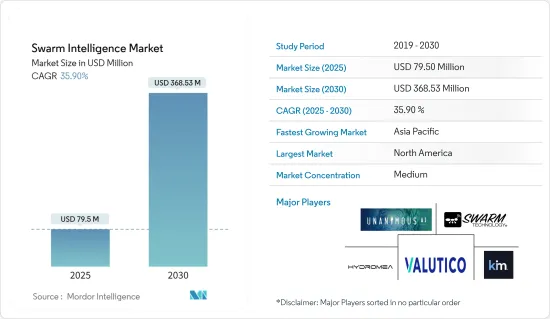

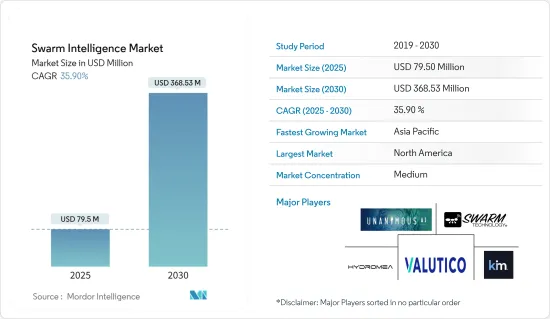

群体智慧市场规模预计到 2025 年为 7,950 万美元,预计到 2030 年将达到 3.6853 亿美元,预测期内(2025-2030 年)复合年增长率为 35.9%。

主要亮点

- 透过整合生物行为的人工智慧应用正在推动市场发展。人工智慧的进步、自动化程度的提高以及对高效资料分析的需求不断增加预计将推动市场成长。

- 对有效和创新解决方案的需求不断增长以及技术发展等因素主要推动了群体智慧市场的成长。此外,军事和通讯应用中使用量的增加预计将在预测期内见证市场的成长。

- 群体智能与先进技术密不可分,进而产生协同效应,增加影响力。例如,群体机器人可以与物联网 (IoT) 设备集成,为智慧城市、工业自动化和环境监测应用提供自主监测和控制系统。

- 人工智慧和机器学习也提高了群体演算法的性能和弹性,使它们更具适应性和智慧。尤其是强化学习技术,使群体机器人系统更容易学习和适应,进而提高其在动态环境中的表现和弹性。

- 然而,市场成长受到基于丛集的系统的实施、设计复杂性和实施成本的挑战。开发群体智慧解决方案需要模仿复杂生物系统行为的复杂演算法,并且需要人工智慧、机器人和控制系统等领域的专业知识。因此,取得和留住专业人员来设计、实施和管理这些系统的成本可能很高。

群体智慧市场趋势

随着最佳化演算法的出现,运输和物流领域受到关注

- 物流和集体运输正变得越来越流行,自动驾驶汽车的早期实验也显示出有希望的结果。集团物流在世界各地的生产基地和仓库设施中发展势头强劲。这是因为集团物流允许运输助理在仓库和其他设施区域自由移动,而不受某些预先定义线性移动的限制。

- 集群智慧在仓库和生产现场的运输解决方案中的使用正在迅速增加,基于地面的运输系统正在被取代(例如沿着输送机、铁轨、导轨)。自动驾驶汽车的优点在于它们可以普遍使用并单独到达目的地。

- 在交通运输领域,不断增加的运营成本和更长的出行时间导致需要使用基于群体智能的蚁群优化算法来解决的分析模型,以优化路线,预计将进一步推动整个交通运输领域的调查市场。预测期内。

- 基于群体智慧的智慧交通解决方案的优点在于灵活性。自动驾驶汽车的开发和使用已达到较高水准。无人驾驶物流概念的使用,以及向集团物流的扩展,预计将在未来几年内彻底改变整个产业,并意味着生产基地和仓库的未来。

预计北美将成为预测期内最大的成长市场

- 该地区交通系统中自动搬运车的使用正在迅速扩大。因此,这家自动化物料输送解决方案供应商正在其由专有 X-Swarm 智慧控制的智慧运输系统产品组合中添加自动小车搬运车,瞄准小型运输工具运输等新应用领域。

- 例如,2023 年 1 月,AGILOX 透过新型全向小车移动器 AGILOX ODM 扩大了自主移动机器人 (AMR) 的范围。这种智慧AMR是基于AGILOX提供的产业细分。

- 美国拥有最大的军事预算,并正在发射集群无人机来改变战争的方式。由于军事和国防服务中越来越多地采用基于群体的无人机,它也被认为是整个北美群体智慧成长的主要贡献者之一。

- 2024 年 5 月,Tesseract Ventures 获得美国特种作战司令部 (USSOCOM) 颁发的其他交易协议 (OTA),用于开发创新无人机技术 SWARM(特种作战辅助机器人机器)。该先进系统透过先进的监视和战术性响应能力增强了特种作战部队 (SOF) 的作战能力。

- 该地区是致力于群体智慧应用的主要人工智慧(AI)和机器人公司的所在地,政府对人工智慧和机器人领域研发的支援预计将推动市场成长。此外,各行业对自动化的需求不断增长,加上创新文化,使该地区成为采用群体智慧的沃土。

群体智慧产业概况

群体智慧市场的竞争是温和的。有几家大公司。从市场占有率来看,目前少数参与者占据市场主导地位。然而,随着行为智能的进步,新参与者正在透过在新兴国家的投资、合併、收购和合作来增加其在市场上的影响力并扩大其足迹。

- Swarm 是 SpaceX 于 2023 年 7 月收购的物联网连接提供商,该公司停止销售新设备,并继续使用其 SwarmBEEs卫星星系支援地球与太空之间的持续 VHF通讯,随后发布了公告。

- 2023 年 5 月 Firestorm Labs 是第一个全模组化无人机系统 (MUAS) 的开发商,旨在为现代战场带来经济实惠的质量,与 AI 自主公司 EpiSci伙伴关係,开发了具有攻击能力的无人机蜂群解决方案。

其他好处:

- Excel 格式的市场预测 (ME) 表

- 3 个月分析师支持

目录

第一章简介

- 研究假设和市场定义

- 调查范围

第二章调查方法

第三章执行摘要

第四章市场洞察

- 市场概况

- 产业吸引力-波特五力分析

- 新进入者的威胁

- 买家/消费者的议价能力

- 供应商的议价能力

- 替代品的威胁

- 竞争公司之间的敌对关係

第五章市场动态

- 市场驱动因素

- 群体机器人需求的增加可望带动整个物流领域

- 即时人工智慧演算法在专利辨识的应用增多

- 市场限制因素

- 缺乏专业技能

第六章 市场细分

- 按类型

- 蚁群优化

- 粒子群最佳化

- 基于群体的网络

- 其他类型

- 按最终用户产业

- 运输/物流

- 机器人和自动化

- 卫生保健

- 零售(数位电子商务)

- 其他最终用户产业

- 按地区

- 北美洲

- 欧洲

- 亚洲

- 澳洲/纽西兰

第七章 竞争格局

- 公司简介

- Unanimous AI

- Swarm Technology

- ConvergentAI Inc.

- Valutico UK Ltd

- Sentien Robotics LLC

- Kim Technologies

- Brainalyzed Insight

- Power-Blox AG

- Swarm Systems Limited

- Hydromea

第八章投资分析

第九章 市场未来展望

The Swarm Intelligence Market size is estimated at USD 79.50 million in 2025, and is expected to reach USD 368.53 million by 2030, at a CAGR of 35.9% during the forecast period (2025-2030).

Key Highlights

- The market is driven by the application of artificial intelligence through the integration of biological behavior. Advancements in artificial intelligence, increasing automation, and the growing need for efficient data analysis are expected to drive market growth.

- Factors such as the increasing demand for effective and innovative solutions, as well as technological development, primarily drive the growth of the swarm intelligence market. Additionally, the increased use in military and communications applications is expected to provide growth prospects for the market over the forecast period.

- Swarm intelligence is inseparably linked to advanced technologies, resulting in synergies that increase their impact. For example, swarm robotics integrates with Internet of Things (IoT) devices, allowing for autonomous monitoring and control systems for smart cities, industrial automation, and environmental monitoring applications.

- Artificial intelligence and machine learning also enhance the performance and resilience of swarm algorithms, allowing them to be more adaptive and intelligent. In particular, reinforcement learning techniques make it easier for swarm robotics systems to learn and adapt, resulting in improved performance and resilience in dynamic environments.

- However, market growth is challenged by the implementation, complexity of the design, and deployment costs associated with swarm-based systems. The development of swarm intelligence solutions necessitates complex algorithms that imitate the behavior of complex biological systems, creating a need for expertise in areas such as artificial intelligence, robotics, and control systems. Thus, acquiring and retaining specialized talent for designing, implementing, and managing these systems incur considerable costs.

Swarm Intelligence Market Trends

Transportation and Logistics Sector is Gaining Traction Due to the Emergence of an Optimization Algorithm

- Intralogistics and collective transport are becoming increasingly popular, and early experiments with autonomous vehicles are showing promising results. At production sites and warehouse facilities worldwide, swarm logistics is gaining momentum as it enables the free movement of transport assistants in warehouses and other facility areas without restricting them to specific predefined linear movements.

- The use of swarm intelligence for transport solutions at warehouses and production sites is rapidly increasing, and floor-based transport systems are being replaced (e.g., on conveyor belts, rails, or along induction tracks). Autonomous vehicles' benefit is that they can be used universally and reach their destinations individually.

- In transportation, the increased operational costs for business, as well as high travel time, catered to the need for analytical models that can be solved using the swarm intelligence-based Ant Colony Optimization algorithm for optimizing the route, which is further projected to propel the studied market across the transportation sector over the forecast period.

- The increasing benefit of intelligent transport solutions based on swarm intelligence is the resulting flexibility. The development and use of autonomous vehicles have reached a high level. The use of driverless intralogistics concepts and, thus, a shift toward swarm logistics are anticipated to revolutionize the entire industry in the coming years and signify the future of production sites and warehouses.

North America is Expected to be the Largest-growing Market During the Forecast Period

- The use of automatic movers in transport systems is growing rapidly in the region. Thus, automated material handling solutions providers are adding an autonomous dolly mover to their range of intelligent transport systems controlled by its proprietary X-Swarm intelligence and targeting a new area of applications, such as the transport of small load carriers.

- For instance, in January 2023, AGILOX expanded its autonomous mobile robots (AMRs) range with the new Omnidirectional Dolly Mover AGILOX ODM. The intelligent AMR is based on the AGILOX X-SWARM technology and offers new applications and other industry segments where small load carriers, which the new AGILOX ODM is designed to transport, are widely used, especially in the electronics and pharmaceutical industries.

- The United States has the most significant military budget and is launching swarm drones to alter how wars are conducted. Also, it is considered one of the major contributors to the growth of swarm intelligence across North America, which is attributed to the increased adoption of swarm-based drones in the military and defense services.

- In May 2024, Tesseract Ventures was awarded an Other Transaction Agreement (OTA) by the US Special Operations Command (USSOCOM) for the development of an innovative drone technology, the Special Warfighter Assistive Robotic Machine (SWARM). This advanced system is set to enhance the operational capabilities of Special Operations Forces (SOF) through advanced surveillance and tactical response functionalities.

- The region has the presence of leading artificial intelligence (AI) and robotics companies that are working on swarm intelligence applications, and the government's support for research and development in the AI and robotics sectors is expected to drive market growth. Additionally, the growing demand for automation in various sectors, coupled with a culture of innovation, makes the region fertile ground for swarm intelligence adoption.

Swarm Intelligence Industry Overview

The swarm intelligence market is moderately competitive. It consists of a few major players. In terms of market share, some of the players currently dominate the market. However, with the advancement in behavioral intelligence, new players are increasing their market presence, thereby expanding their business footprint through investment, mergers, acquisitions, and collaboration across emerging economies.

- July 2023: Swarm, the Internet-of-Things connectivity provider acquired by SpaceX, announced that it would no longer be selling new devices and would continue to support ongoing VHF communications between Earth and space using its SwarmBEEs satellite constellation.

- May 2023: Firestorm Labs, the developer of the first completely modular unmanned aerial system (MUAS) to deliver affordable mass to the modern battlefield, formed a partnership with AI autonomy company EpiSci to develop attritable drone swarming solutions.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET INSIGHTS

- 4.1 Market Overview

- 4.2 Industry Attractiveness - Porter's Five Forces Analysis

- 4.2.1 Threat of New Entrants

- 4.2.2 Bargaining Power of Buyers/Consumers

- 4.2.3 Bargaining Power of Suppliers

- 4.2.4 Threat of Substitute Products

- 4.2.5 Intensity of Competitive Rivalry

5 MARKET DYNAMICS

- 5.1 Market Drivers

- 5.1.1 Growing Demand for the Swarm Robotics is Expected to Drive Across the Logistic Sector

- 5.1.2 Rising Application of Real-time Artificial Intelligence Algorithm in Patent Recognition

- 5.2 Market Restraints

- 5.2.1 Lack of Required Skills Among Professionals

6 MARKET SEGMENTATION

- 6.1 By Type

- 6.1.1 Ant Colony Optimisation

- 6.1.2 Particle Swarm Optimisation

- 6.1.3 Swarm-based Network

- 6.1.4 Other Types

- 6.2 By End-user Industry

- 6.2.1 Transportation and Logistics

- 6.2.2 Robotics and Automation

- 6.2.3 Healthcare

- 6.2.4 Retail (Digital Ecommerce)

- 6.2.5 Other End-user Industries

- 6.3 By Geography

- 6.3.1 North America

- 6.3.2 Europe

- 6.3.3 Asia

- 6.3.4 Australia and New Zealand

7 COMPETITIVE LANDSCAPE

- 7.1 Company Profiles

- 7.1.1 Unanimous AI

- 7.1.2 Swarm Technology

- 7.1.3 ConvergentAI Inc.

- 7.1.4 Valutico UK Ltd

- 7.1.5 Sentien Robotics LLC

- 7.1.6 Kim Technologies

- 7.1.7 Brainalyzed Insight

- 7.1.8 Power-Blox AG

- 7.1.9 Swarm Systems Limited

- 7.1.10 Hydromea