|

市场调查报告书

商品编码

1630319

库存标籤:市场占有率分析、产业趋势、成长预测(2025-2030)Inventory Tags - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

※ 本网页内容可能与最新版本有所差异。详细情况请与我们联繫。

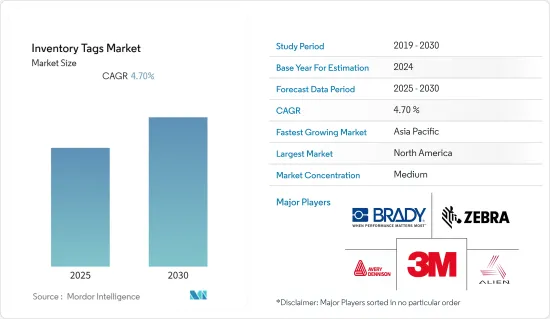

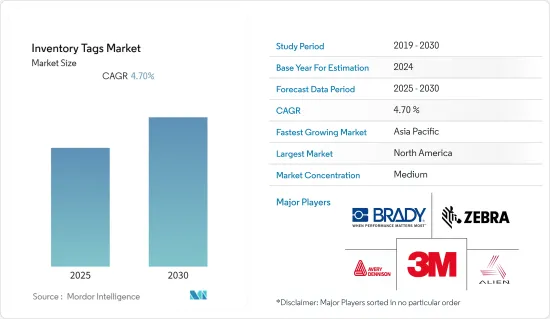

库存标籤市场预计在预测期内复合年增长率为 4.7%

主要亮点

- 努力实现标准化、扩大应用领域、提高使用库存标籤的意识、加强先进技术的整合以改进现有技术以及传播消费者知识是推动全球库存标籤市场成长的主要因素。此外,新兴经济体可支配收入的增加预计将增加对某些零售产品的需求。这是预计推动全球库存标籤市场成长的另一个主要因素。

- 与产品连接的库存标籤有助于安全识别和跟踪,减少人为错误,从而有助于有效的供应链管理。库存标籤提供了稍后可以使用的产品的详细信息,还可以实现库存跟踪,允许仓储和物流选择即时库存。

- 当存量基准长期不准确时,管理补货计划几乎是不可能的,从而导致缺货。它还会导致糟糕的客户体验,因为客户必须等待更长时间才能收到订单,或者一旦意识到自己犯了错误,订单就会被取消。美国零售商的平均库存准确率仅为 63%。美国公司尚未妥善管理库存,以防止错误、错失机会和增加成本。库存以及应付帐款占用了 1.1 兆美元的现金,相当于美国GDP 的 7%(资料来源:REL)。这对应于该地区库存标籤的市场渗透率。

- 此外,医院还使用库存标籤来创建智慧柜,用于存放带入医院的所有药品和其他产品。这些智慧柜与医院的库存管理系统同步,使授权人员在需要时更容易找到产品。这些智慧橱柜会对您的预算产生重大影响。透过实施 RFID 追踪系统,洛杉矶的 Adventist Health White Memorial 将人工库存盘点时间减少了 67%,并透过使用过期日期前的产品,每年节省了 12 万美元。

- 此外,COVID-19 的影响扰乱了关键产业的供应链分配,直接影响库存标籤销售。为了遏制病毒的传播,自 2020 年 1 月底以来,各国政府在全国实施了宵禁和隔离。因此,许多生产基地已关闭,以减少人与人接触的可能性,从而影响经济。

库存标籤市场趋势

RFID 在库存标籤市场技术领域占据主要份额

- RFID 技术预计将在汽车、製药和医疗产业中显着成长。 RFID可以显着降低公司仓库的人事费用。需要更多员工的流程可以用更少的员工来完成。

- RFID 技术和智慧标籤最常见的用途是追踪供应链中的货物、监控零件在製造生产线中的移动、资产追踪、安全以及客户无需使用现金支付货物的付款系统等。作为改进计划的一部分,许多物流中心和仓库正在简化流程。

- 亚洲地区是RFID技术最重要的用户,由于印度、中国、日本、韩国和台湾等国家的RFID应用机会增加,RFID收益预计将大幅成长。

- 由于市场竞争日益激烈以及随之而来的全球范围内经济实惠的 RFID 解决方案的出现,RFID市场占有率预计将在预测期内显着增加。製造业和医疗领域越来越多地采用 RFID 解决方案也将推动预测期内的市场扩张。政府对各行业日益严格的监管和倡议预计也将促进 RFID 市场的研究。

- 然而,安装、购买和维护 RFID 的高昂成本,以及对资料安全和隐私的担忧,预计将限制产业扩张。此外,工业4.0、物联网和智慧製造解决方案预计将增加RFID标籤的利用率,为RFID市场预测创造有利的发展可能性。

亚太地区是库存标籤市场成长最快的地区

- 亚太地区是库存标籤成长最快的市场之一,包括中国和印度等地区。标籤的需求增加部分源自于传统工业产品。根据中国轻工业委员会 (CNLIC) 统计,约 80% 的轻工业产品需要包装和标籤。运输和物流标籤也是中国工业供应链中快速成长的环节。

- 作为重要的标籤出口国,中国已经拥有全球85%的RFID产能。中国的第二代国民身份证计划是金额最大的RFID订单,中国打算几乎完全使用中国资源来完成这个计画。由于政府的大力支持,中国将 RFID 广泛应用于从火车票到图书馆资产等各种应用。随着中国成为包括汽车和飞机在内的大多数领域的製造业领导者,製造业和许多其他行业对 RFID 的需求可能会增加。

- RFID 及其与 QR 等消费者可扫描程式码的整合所提供的可追溯性对于供应链在中国广大地区运输产品时防止伪造和丢失至关重要。宝神是一家年产10亿张RFID标籤的中国领先包装公司,最近宣布推出新的Eprint RFID产品线,专注于快速消费品、线上销售和药品的防伪解决方案。

- 此外,印度是世界上最大的製药製造商之一。生产的大部分药品供国内消费,但也有大量出口到美国等国家。许多印度药品出口商正在使用智慧标籤技术来满足进口国的安全法规。

- 此外,艾利丹尼森等跨国公司正在印度开设工厂,以满足其库存标籤需求。该公司在印度普纳开设了第一个智慧标籤创新实验室。该实验室将作为一个互动设施,提供实践经验、现场演示和技术支持,帮助客户和相关人员探索智慧标籤解决方案和 RFID 部署的机会。

库存标籤行业概览

库存标籤市场竞争适中,由许多全球和区域参与企业组成。这些参与企业占据了很大的市场份额,并致力于在全球范围内扩大基本客群。这些供应商正专注于研发投资,以引入新的解决方案、策略联盟以及其他有机和无机成长策略,以便在预测期内获得竞争优势。 2022年5月,全球数位ID技术和解决方案领导者SML集团(「SML」)宣布启动其射频ID(「RFID」)嵌体研发(R&D)中心和生产基地。新中心是 SML 长期策略目标的一部分,旨在支持其日益全球化的业务,同时吸引更广泛的客户群,以实现跨市场的一切都以数位方式识别的未来。

其他好处

- Excel 格式的市场预测 (ME) 表

- 3 个月分析师支持

目录

第一章简介

- 研究成果和先决条件

- 调查范围

第二章调查方法

第三章执行摘要

第四章市场动态

- 市场概况

- 市场驱动因素

- 即时追踪

- 防止遗失、窃盗和伪造

- 产品远端识别

- 市场限制因素

- 软体和设备整合相关的高成本

- 工业的魅力-波特五力

- 新进入者的威胁

- 买家/消费者的议价能力

- 供应商的议价能力

- 替代品的威胁

- 竞争公司之间敌对关係的强度

- 评估工业中的 COVID-19

第五章市场区隔

- 技术部分

- RFID

- 条码

- 其他的

- 类型

- 塑胶

- 纸

- 金属

- 其他的

- 最终用户产业

- 工业的

- 零售

- 运输/物流

- 其他的

- 地区

- 北美洲

- 欧洲

- 亚太地区

- 其他的

第六章 竞争状况

- 公司简介

- Avery Dennison Corporation

- 3M Company

- Zebra Technologies Corporation

- Alien Technology, LLC

- Brady Worldwide, Inc.

- Tyco International Plc

- Smartrac NV

- Johnson Controls International Plc

- Cenveo Corporation

- Checkpoint Systems, Inc.

- Hewlett Packard Enterprise Development LP

第七章 投资分析

第八章 市场机会及未来趋势

The Inventory Tags Market is expected to register a CAGR of 4.7% during the forecast period.

Key Highlights

- Works towards normalization, growing application segments, increasing awareness of using inventory tags, augmented integration of advanced technologies to improve existing technology, and mounting knowledge among the general population are major factors that drive the growth of the global inventory tags market. Moreover, rising disposable incomes in developing economies are expected to augment demand for several retail products. This is another primary factor anticipated to propel the global inventory tags market growth.

- Inventory tags connected to products help secure identification and tracking, reduce human error, and hence assist in effective supply chain management. Inventory tags provide detailed information about products that can later be used and even let the stock be tracked, making warehousing and logistics opt just in time for their inventories.

- When inventory levels are chronically inaccurate, it is next to impossible to manage replenishment schedules, leading to stockouts. It also leads to poor customer experience as customers must either wait longer to receive their orders or face canceled orders once the error is realized. The average U.S. retail operation has an inventory accuracy of only 63 %. American businesses have yet to get on the proper inventory management for preventing leading to errors, lost opportunity, and increased costs. Inventory and accounts receivable and accounts payable have tied up USD 1.1 trillion in cash, equivalent to 7% of the U.S. GDP (source REL). This caters to the market penetration for the inventory tags in the region.

- Furthermore, inventory tags are used by the hospitals to create smart cabinets where all medications or other products that are being brought into a hospital are being put. These smart cabinets sync with the hospitals' inventory management systems, making it easier for authorized personnel to locate products when required. These smart cabinets can have huge budget ramifications. After implementing an RFID tracking system, Adventist Health White Memorial in Los Angeles reduced its manual inventory counting time by 67% and costs by USD 120,000 per year by using products before expiration.

- Furthermore, the impact of Covid-19 disrupted the supply chain distribution in significant industries., which has directly impacted the sales of inventory tags. To contain the spread of the virus, Governments in various countries imposed curfews and quarantines across the country from the end of January 2020 onwards. This has affected the economy, as many production sites closed to reduce possible contact between individuals.

Inventory Tags Market Trends

RFID Holds a Substantial Share in Technology Segment of the Inventory Tags Market

- Sectors showing extraordinary growth potential for RFID technology are the automotive, pharmaceutical, and healthcare industries. RFID can significantly reduce the labour cost borne by companies for warehouses, as labour costs amount to about 50-80% of the total charges in a distribution center. Processes that require a higher number of employees can be completed with a smaller number of employees.

- The most common use of RFID technology and smart labels are tracking goods in the supply chain, monitoring parts moving to a manufacturing production line, tracing assets, security, and payment systems that let clients pay for items without using cash. Many distribution centers and warehouses are increasing the efficiency of their processes as a part of improvement programs.

- The Asia region is forecasted to be the most significant user of RFID technology and will witness substantial RFID revenues due to increasing opportunities for RFID applications in countries such as India, China, Japan, South Korea, and Taiwan.

- Due to increased market competition and the consequent availability of reasonably priced RFID solutions on a global scale, the RFID market share is anticipated to experience a noticeable increase throughout the projected period. An increase in the installation of RFID solutions across the manufacturing and healthcare sectors also drives the expansion of this market during the forecast period. The government's increased rules and initiatives for various industries are also anticipated to drive the RFID market study.

- However, the high cost of installing, purchasing, and maintaining RFID and worries about data security and privacy are anticipated to limit industry expansion. In addition, industry 4.0, the Internet of Things, and smart manufacturing solutions are predicted to increase the usage of RFID tags, creating a lucrative potential for the RFID market forecast to develop.

APAC is Growing wit the Fastest Pace in Inventory Tags Market

- Asia-Pacific is one of the fastest-growing markets for inventory tags, including regions such as China, India, and others. The increase in demand for tags partly originates from traditional industrial products. According to the China National Light Industry Council (CNLIC), approx 80% of light industrial products need packaging and tags. Transportation & Logistics tags are also fast-growing segments in China's industrial supply chain.

- As a significant tag exporter, China already has 85% of the world's RFID production capacity. The second-generation National Identification Card project in China is also the largest RFID order in terms of value, and China is completing it almost entirely with Chinese-only resources. China has used RFID extensively in a variety of applications, from train tickets to library assets, thanks to the government's strong support. As China becomes a manufacturing leader in most segments, including cars and planes, this will fuel rising demand for RFID in manufacturing and many other industries.

- The degree of traceability that integrates RFID with consumer-scannable codes like QR can provide is expected to be an all-important link to the supply chain to prevent counterfeiting and loss of goods transporting products across the vast geography of China. Baoshen, a leading Chinese packaging company with an annual capacity of producing 1 billion RFID tags, recently introduced a new Eprint line of RFID products focused on anti-counterfeit solutions for fast-moving consumer goods, online sales, and pharmaceutical drugs.

- Further, India is one of the top pharmaceutical manufacturers in the world. Although most of the production is distributed for domestic consumption, a considerable amount of drugs are exported to countries like the United States. Most of the pharmaceutical exporters in India use smart labeling techniques to meet the safety and security regulations of importing countries.

- Moreover, global players like Avery Dennison are opening their facilities in India to meet the needs of inventory tags. It opened its first intelligent label innovation lab in Pune, India. It will act as an interactive facility equipping customers and partners with hands-on experiences, live demonstrations, and technical support to help stakeholders explore opportunities for intelligent tag solutions and RFID adoption.

Inventory Tags Industry Overview

The inventory tags market is moderately competitive and consists of many global and regional players. These players account for a considerable share of the market and focus on expanding their customer base across the globe. These vendors focus on the research and development investment in introducing new solutions, strategic alliances, and other organic & inorganic growth strategies to earn a competitive edge over the forecast period. In may 2022, The Technology Innovation Development Facility (TIDC), a pioneering Radio Frequency Identification ("RFID") inlay Research & Development (R&D) center and production hub, was opened by SML Group ("SML"), a global leader in digital identification technology and solutions. The new center is a component of SML's long-term strategic ambitions as it works to build the technology ecosystem needed to support increasingly global operations that involve a larger client base as they move toward a future where everything will be identified digitally across markets.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Deliverables and Study Assumptions

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET DYNAMICS

- 4.1 Market Overview

- 4.2 Market Drivers

- 4.2.1 Real-Time Tracking

- 4.2.2 Provides Protection Against Loss, Theft, and Counterfeiting

- 4.2.3 Remote Identification of Products

- 4.3 Market Restraints

- 4.3.1 High Cost Associated with Software and Equipment Integration

- 4.4 Industry Attractiveness - Porter Five Forces

- 4.4.1 Threat of New Entrants

- 4.4.2 Bargaining Power of Buyers/Consumers

- 4.4.3 Bargaining Power of Suppliers

- 4.4.4 Threat of Substitute Products

- 4.4.5 Intensity of Competitive Rivalry

- 4.5 Assessment of COVID-19 on the Industry

5 MARKET SEGMENTATION

- 5.1 Technology

- 5.1.1 RFID

- 5.1.2 Barcodes

- 5.1.3 Other Technologies

- 5.2 Type

- 5.2.1 Plastic

- 5.2.2 Paper

- 5.2.3 Metal

- 5.2.4 Other Types

- 5.3 End-user Industry

- 5.3.1 Industrial

- 5.3.2 Retail

- 5.3.3 Transportation & Logistics

- 5.3.4 Other End-user Industries

- 5.4 Geography

- 5.4.1 North America

- 5.4.2 Europe

- 5.4.3 Asia Pacific

- 5.4.4 Rest of the World

6 COMPETITIVE LANDSCAPE

- 6.1 Company Profiles

- 6.1.1 Avery Dennison Corporation

- 6.1.2 3M Company

- 6.1.3 Zebra Technologies Corporation

- 6.1.4 Alien Technology, LLC

- 6.1.5 Brady Worldwide, Inc.

- 6.1.6 Tyco International Plc

- 6.1.7 Smartrac N.V.

- 6.1.8 Johnson Controls International Plc

- 6.1.9 Cenveo Corporation

- 6.1.10 Checkpoint Systems, Inc.

- 6.1.11 Hewlett Packard Enterprise Development LP