|

市场调查报告书

商品编码

1630320

排放监测系统:市场占有率分析、产业趋势/统计、成长预测(2025-2030)Emission Monitoring Systems - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

※ 本网页内容可能与最新版本有所差异。详细情况请与我们联繫。

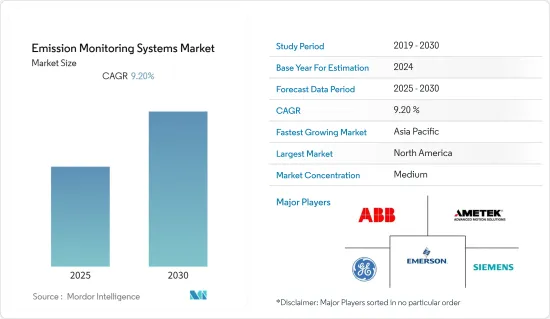

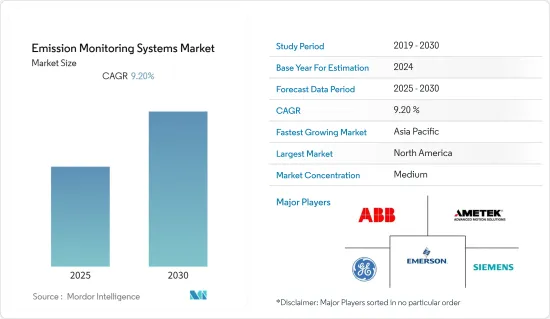

排放监测系统市场预计在预测期内复合年增长率为 9.2%。

主要亮点

- 排放监测系统可测量大气中的各种气体,包括二氧化碳、氮气、汞、二氧化硫、一氧化碳和六价铬。在连续系统中,分析仪主要用于测量排放的气体,软体组件可让使用者评估相应的排放结果。预测型系统使用建模软体根据控制设备运行参数计算排放率,从而允许使用者预测排放水平。

- 使用这些排放监测系统来遵守政府制定的排放标准是市场成长的主要考虑因素之一。例如,美国环保署部署了多个联邦计画来监测该地区的排放气体。此外,国家当局不断收集排放资料正在推动市场发展。

- 各国政府已采取法规来控制工业活动的排放,提振了市场。例如,马来西亚环境部颁布了《1974年环境品质法》和《2014年空气污染预防条例》,透过建立第7条空气污染预防系统和第9条空气污染预防系统绩效监测来控制空气污染。这些因素迫使政府使用排放监测系统。

- 因为 COVID-19 是一种传染性呼吸道疾病,空气品质影响呼吸道健康。 2020 年 4 月 22 日,资料分析公司 EMSOL 宣布将与 Network Rail 合作监测火车站内的空气质量,并实施减少车站周围污染的策略。该计划将主要惠及从新冠肺炎 (COVID-19) 中康復的患者以及在市中心地区空气品质较差的情况下患有呼吸系统疾病的患者。

- 预计对清洁能源的日益关注将阻碍预测期内全球排放气体监测系统市场的成长。进入本世纪以来,可再生能源日益普及。许多国家正在做出巨大努力来生产永续、可靠和高效的再生能源来源,例如太阳能、风能和生质能源。这些能源来源预计将取代现有的传统能源来源。因此,为了减少二氧化碳排放,世界必须迅速转型为低碳能源来源。因此,不再需要排放监测系统。

排放监测系统市场趋势

油气板块可望大幅成长

- EPA(美国环保署)《空气污染和清洁空气法案》对发电厂、石油和天然气以及建筑材料等各个行业的烟囱排放污染物浓度进行了限制。根据 EPA 法规,需要实施 CEMS 来确定持续符合或超过既定标准。

- 此外,全球石油和天然气基础设施的快速成长以及多个发电设施的存在预计也将在预测期内推动对这些系统的需求发挥重要作用。

- 例如,根据EIA的数据,从2015年开始,美国电力产业特定燃料的二氧化碳排放将以燃料进行预测,直到2050年。预计到2050年,美国电力部门将利用天然气产生6.85亿吨二氧化碳。

- 排放监测系统用于测量并最大程度地减少甲烷、二氧化碳和二氧化硫等危险化学品的排放,以及欧洲议会和理事会的工业排放气体指令 (IED) 以及美国EPA 的清洁空气法案它主要部署在石油和天然气行业,以收集向政府监管机构(例如该法案)报告排放气体所需的资料。

- 石油和天然气气候倡议(OGCI) 的成员设定了 2025 年将甲烷排放减少 0.25% 的目标。这是2017年水准的五分之一。预计每年可减少甲烷排放35 万吨(约 880 万吨二氧化碳当量)。正如 BP、EOG(和其他公司)在其策略中指出的那样,数位技术将在追踪排放和记录现场进展方面发挥关键作用。 OGCI 在其 12 项投资中,有 5 项投资于透过感测器、卫星和报告进行排放监测。这些趋势和倡议预计将进一步推动市场成长。

北美占据主要市场占有率

- 美国环保署致力于透过改善空气品质和减少空气污染来保护公众健康。美国《清洁空气法案》的实施以及此后几位创新者所取得的技术进步极大地改善了美国的空气品质。

- EPA 主要与州、地方政府和部落政府合作,减少 180 多种有害空气污染物的排放。此外,烟雾中的粒状物还会导致许多健康问题,包括潮热、流鼻水和支气管炎等疾病。这些细颗粒也会导致慢性心臟和肺部疾病,这是推动排放监测系统需求的主要因素之一。

- 许多州和地区正在透过实施促进能源效率和碳管理的政策来引领向清洁能源的过渡。例如,不列颠哥伦比亚省的 CleanBC 计画设定了省级目标,到 2030 年,排放量较 2005 年大幅减少 40%,到 2040 年,减少 60%,到 2050 年,减少 80%。

- 政府减少各种老化和公共建筑能源排放的努力也推动了市场需求。例如,美国总务管理局已与 IBM 公司签订合同,在 50 栋能源最消费量的州和联邦建筑中安装高效、智慧的建筑技术。

- 此外,在美国,超过 25 兆瓦的发电厂(包括大学发电机)都配备了连续排放监测系统,因为资料品质很重要。供应商正在开发更好的资料驱动工具,以提高 CEMS(连续排放监测系统)资料的品质。

排放监测系统产业概况

由于许多向国内和国际市场供应产品的参与者,排放监测系统市场竞争非常激烈。市场似乎适度集中。主要企业正在采取产品创新、併购、收购和策略伙伴关係关係等策略,以保持市场竞争力并扩大其地理覆盖范围。该市场的一些主要企业包括 ABB Ltd.、艾默生电气公司、西门子股份公司和罗克韦尔自动化公司。

- 2021 年 10 月 - ENVEA 推出汞连续排放监测系统 SM-5。此分析仪旨在准确、可靠地测量烟气中极低浓度的汞。

- 2021 年 9 月 - 艾默生推出全新罗斯蒙特 XE10 连续排放监测系统 (CEMS),旨在协助工业工厂满足日益严格的环境法规和不断变化的永续性要求。凭藉内建的性能分析和自动检验功能,新系统可确保准确的排放气体监测和报告,帮助工厂营运商降低因违规停工和处罚的风险。

其他好处

- Excel 格式的市场预测 (ME) 表

- 3 个月的分析师支持

目录

第一章简介

- 研究假设和市场定义

- 调查范围

第二章调查方法

第三章执行摘要

第四章市场洞察

- 市场概况

- 产业吸引力-波特五力分析

- 供应商的议价能力

- 买方议价能力

- 新进入者的威胁

- 替代品的威胁

- 竞争公司之间的敌对关係

- 产业价值链分析

- COVID-19 市场影响评估

第五章市场动态

- 市场驱动因素

- 严格的法律和环境法规

- 健康和安全问题增加

- 市场限制因素

- 定期维护成本高

第六章 市场细分

- 按成分

- 硬体

- 软体

- 服务

- 按最终用户

- 石油和天然气

- 金属/矿业

- 製药

- 发电

- 化学

- 其他最终用户

- 地区

- 北美洲

- 欧洲

- 亚太地区

- 拉丁美洲

- 中东/非洲

第七章 竞争格局

- 公司简介

- ABB Ltd

- AMETEK, Inc.

- Emerson Electric Co.

- General Electric Company

- Siemens AG

- Horiba Ltd.

- Rockwell Automation, Inc.

- Sick AG

- Teledyne Technologies, Inc.

- Thermo Fisher Scientific Inc.

第八章投资分析

第9章市场的未来

The Emission Monitoring Systems Market is expected to register a CAGR of 9.2% during the forecast period.

Key Highlights

- The emission monitoring system measures various gases in the air, such as carbon dioxide, nitrogen, mercury, sulfur dioxide, carbon monoxide, and hexavalent chromium. In the continuous type system, the analyzer is primarily used to measure the gases emitted, whereas the software component enables the users to evaluate the results of the applicable emission. The predictive type system uses modeling software to calculate the emission rate, which is based on the control device operating parameters and enables the user to predict the emission levels.

- Using these emission monitoring systems to comply with the emission standards created by the government is one of the major considerations from the market growth perspective. For instance, the United States Environmental Protection Agency has rolled out multiple federal programs to monitor emissions in the region. Moreover, state authorities' continuous collection of emission data has thrust the market.

- Various governments adopt regulations to control industrial activity emissions, boosting the market. For instance, the Department of Environment, Malaysia, deployed the Environmental Quality Act 1974 and Clean Air Regulation 2014, which has Regulation 7 Air Pollution Control System and Regulation 9 - Performance Monitoring of Air Pollution Control System, to control air pollution. All these factors are forcing the government to use emissions monitoring systems.

- With the recent COVID-19 outbreak, the emissions monitoring systems are playing a crucial role in monitoring the air quality and providing necessary information during this pandemic, as COVID-19 is an infectious respiratory disease, and air quality affects respiratory health. On April 22, 2020, the data analytics company, EMSOL, announced working with Network Rail to monitor air quality in train stations and implement a strategy to lower the pollution around them. The project mostly benefits patients recovering from COVID-19 and people with respiratory issues exposed to poor air quality in busy areas.

- During the forecast period, the growing emphasis on clean energy is expected to hinder the growth of the global emission monitoring system market. Renewable energy has grown in popularity since the beginning of the century. Many countries are making significant efforts to produce renewable energy sources that are sustainable, reliable, and efficient, such as solar power, wind power, and bioenergy. These energy sources are assumed to replace existing conventional energy sources. As a result, to reduce CO2 emissions, the world must rapidly transition to a low-carbon energy source. As a result, an emission monitoring system is no longer required.

Emission Monitoring Systems Market Trends

Oil & Gas Segment is Expected to Witness Significant Growth

- The EPA's (Environmental Protection Agency) air pollution and clean air act have set a limit on the in-stack emission of pollutant concentrations at the point of release for various industries such as power plants, oil & gas, and building materials are thereby required to maintain their emission monitoring standards continue to have an operating license. Under the EPA regulations, implementing a CEMS is necessary for continuous compliance determination or exceeding set standards.

- The rapid growth of the crude oil and natural gas infrastructure across the globe and several power generation facilities is also expected to play a crucial role in driving the demand for these systems over the forecast period.

- For instance, according to EIA, the U.S. electric power sector's carbon dioxide emissions from selected fuels from 2015 with projections to 2050 by fuel. It is estimated that 685 million metric tons of carbon dioxide will be produced using natural gas in the U.S. electric power sector in 2050.

- Emission monitoring systems are primarily deployed in the oil and gas industry to measure and minimize the emission of hazardous chemicals such as methane, carbon dioxide, and sulfur dioxide, among others, and to gather the required data for reporting emissions released to government regulatory agencies such as the industrial emissions directive (IED) by the European Parliament and the Council on industrial emissions and clean air act by the EPA in the United States.

- The members of the Oil and Gas Climate Initiative (OGCI) aimed to reduce methane emissions by 0.25% by 2025. This would be one-fifth of the levels in 2017. This is expected to reduce methane emissions by 350,000 tonnes per year (approximately 8.8 million tonnes of CO2 equivalent). As BP and EOG (among others) have stated in their strategies, digital technologies are poised to be critical in tracking emissions by site and recording progress. The OGCI has invested in emissions monitoring via sensors, satellites, and reporting in five of its twelve investments. Such trends and initiatives are expected to boost market growth even further.

North America to Hold Significant Market Share

- The US Environmental Protection Agency is committed to the protection of public health by the improvement of air quality and the reduction of air pollution. The implementation of the Clean Air Act in the United States and the technological advancements, since then, from multiple innovators have dramatically improved the air quality in the country, as cleaner air provides significant public health benefits.

- The EPA primarily works with the state, local, and tribal governments to reduce more than 180 hazardous air pollutants emissions. Moreover, the fine particles in smoke can cause many health problems, such as burning eyes, runny nose, and illnesses like bronchitis. These microscopic particles can also cause chronic heart and lung diseases, one of the major factors driving the demand for emissions monitoring systems.

- Many provinces and states are taking the lead in transitioning to clean energy by introducing policies that promote energy efficiency and carbon management. For instance, British Columbia's CleanBC Plan has set provincial targets for significantly reducing emissions by 40% from FY 2005 levels by FY 2030, then 60% by FY 2040, and 80% by FY 2050.

- Government initiatives to reduce energy emissions from various old and public buildings are also increasing market demand. For example, the US General Services Administration signed a contract with IBM Corporation to install efficient and smart building technologies in 50 of the state and federal governments' most energy-consuming buildings.

- Furthermore, in the United States, any power plant larger than 25 megawatts, including generators at universities, is equipped with a continuous emissions monitoring system, as data quality is critical. Vendors are developing better data-driven tools to improve the quality of CEMS (Continuous Emission Monitoring System) data.

Emission Monitoring Systems Industry Overview

The emission monitoring systems market is highly competitive owing to the presence of many players in the market supplying their products in domestic and international markets. The market appears to be moderately concentrated. The major players are adopting strategies such as product innovation, mergers, acquisitions, and strategic partnerships to stay competitive in the market and expand their geographic reach. Some major players in the market are ABB Ltd., Emerson Electric Co., Siemens AG, and Rockwell Automation, Inc., among others.

- October 2021 - ENVEA introduced Mercury Continuous Emissions Monitoring System SM-5. This analyzer is designed to provide accurate and reliable measurement of very low concentrations of mercury in flue gas emissions.

- September 2021 - Emerson introduced the new Rosemount XE10 Continuous Emissions Monitoring System (CEMS), designed to help industrial plants meet increasingly stringent environmental regulations and evolving sustainability demands. With its built-in performance analytics and automated validation capabilities, the new system ensures accurate emissions monitoring and reporting to help plant operators reduce the risk of non-compliance shutdowns and penalties.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET INSIGHTS

- 4.1 Market Overview

- 4.2 Industry Attractiveness - Porter's Five Forces Analysis

- 4.2.1 Bargaining Power of Suppliers

- 4.2.2 Bargaining Power of Buyers

- 4.2.3 Threat of New Entrants

- 4.2.4 Threat of Substitutes

- 4.2.5 Intensity of Competitive Rivalry

- 4.3 Industry Value Chain Analysis

- 4.4 Assessment of COVID-19 Impact on the Market

5 MARKET DYNAMICS

- 5.1 Market Drivers

- 5.1.1 Stringent Legal and Environmental Regulations

- 5.1.2 Increasing Health and Safety Issues

- 5.2 Market Restraints

- 5.2.1 High Cost of These Systems for Regular Maintenance

6 MARKET SEGMENTATION

- 6.1 By Component

- 6.1.1 Hardware

- 6.1.2 Software

- 6.1.3 Service

- 6.2 By End User

- 6.2.1 Oil & Gas

- 6.2.2 Metal and Mining

- 6.2.3 Pharmaceutical

- 6.2.4 Power Generation

- 6.2.5 Chemicals

- 6.2.6 Other End Users

- 6.3 Geography

- 6.3.1 North America

- 6.3.2 Europe

- 6.3.3 Asia-Pacific

- 6.3.4 Latin America

- 6.3.5 Middle-East and Africa

7 COMPETITIVE LANDSCAPE

- 7.1 Company Profiles

- 7.1.1 ABB Ltd

- 7.1.2 AMETEK, Inc.

- 7.1.3 Emerson Electric Co.

- 7.1.4 General Electric Company

- 7.1.5 Siemens AG

- 7.1.6 Horiba Ltd.

- 7.1.7 Rockwell Automation, Inc.

- 7.1.8 Sick AG

- 7.1.9 Teledyne Technologies, Inc.

- 7.1.10 Thermo Fisher Scientific Inc.