|

市场调查报告书

商品编码

1630322

柔版印刷机:市场占有率分析、产业趋势/统计、成长预测(2025-2030)Flexographic Printing Machine - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

※ 本网页内容可能与最新版本有所差异。详细情况请与我们联繫。

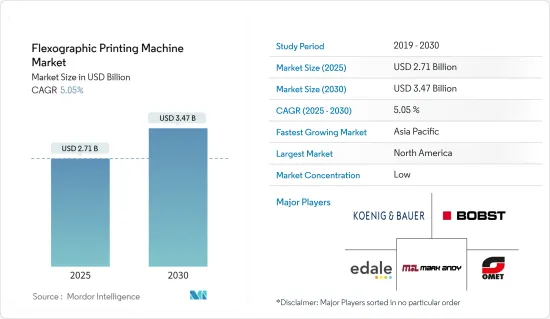

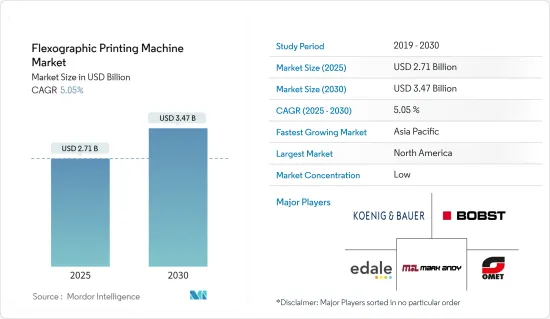

柔印机市场规模预计到2025年将达到27.1亿美元,到2030年将达到34.7亿美元,预测期间(2025-2030年)复合年增长率为5.05%。

主要亮点

- 柔版印刷机使用柔性橡胶或感光聚合物凸版和四个辊:墨水辊、计量辊、印版滚筒和压印滚筒。将油墨引入网纹辊,网纹辊将油墨转移到缠绕在滚筒上的柔性浮雕图像板上。此滚筒将图形列印到高速通过印刷机的标籤纸上。

- 柔版印刷机能够高速运转,不仅可以使用水性油墨,还可以使用油性油墨,适用于多种承印物和其他产品,用途广泛且易于操作印刷机,特别是对可拉伸某些塑胶薄膜进行长尺寸印刷的需求正在增加,预计将更频繁地采用柔印机。

- 电脑直接製版流程越来越多地应用于柔印印前,使机器能够缩短印前时间。此工艺已广泛应用于胶印平版印刷。多家供应商将平顶网点引入印版中,大大提高了印刷一致性和整体品质。

- 随着包装产业的快速成长,特别是食品饮料和个人护理等领域,对柔印机的需求迅速增加。这些印刷机擅长在各种基材上进行高速印刷。柔版印刷的创新,例如高清 (HD) 柔版印刷的兴起和数位流程的融合,正在显着提高印刷品质和效率。这些进步导致更多製造商采用柔印系统。

- 此外,人工智慧、机器学习、物联网、资料分析等方面的进步正在显着个人化产品。柔版印刷的组合即使对于大订单也能实现卓越的印刷个人化。然而,成本因素仍然是一个主要障碍。

- 虽然柔印预计将推动市场成长,但数位印刷和扫描等可行替代品的竞争加剧等因素预计将在预测期内挑战变化。

柔版印刷市场趋势

食品和饮料预计将占据最大的市场占有率

- 柔版印刷正在各行业掀起波动,在商业营运和消费者市场预期中找到了巨大的应用。消费市场的需求往往变化很快。消费者总是寻找可以在杂货店购买的包装精美的产品。因此,食品业一直努力透过缩短前置作业时间、提高印刷品质、缩短生产週期来满足市场需求。

- 由于生产成本降低和对不断增长的市场需求的更快响应等多种因素,食品业对柔印机的需求不断增加。柔印的用途非常广泛,可以使用任何油墨在各种材料上印刷。包装用品和柔版油墨比其他印刷程序所需的材料便宜。

- 食品和饮料行业是软包装产品的重要消费者,例如使用柔印机印刷的薄膜和袋子。预计在预测期内,此类包装的消费量不断增加将增强此类机械的市场需求。

- 食品和饮料行业受到有关包装和标籤中油墨使用的严格规定。柔版印刷使用快干且无毒的油墨,适用于印刷食品和饮料包装,预计在预测期内将推动柔版印刷机的采用。

- 根据重工业部统计,2020年印度印製机械产值为1,267.8亿印度卢比(15.3亿美元),2024年将达到2,347.9亿印度卢比(28.4亿美元)。产值的增加可能对柔版印刷机市场产生正面影响。柔性版印刷广泛应用于包装产业,也包括食品和饮料包装。随着消费者在食品和非酒精饮料上的支出增加,对需要柔版印刷机等印刷设备的包装材料和标籤的需求不断增长。

亚太地区预计将创下最高成长率

- 亚太地区的主要驱动因素包括城市人口成长、包装食品需求增加、聚合物薄膜的便利取得以及相对廉价的劳动力资源。用复杂设计装饰容器的经济选择预计将在对价格敏感的东南亚扩大。

- 快速消费品产品的消费预计将随着食品、饮料和个人护理用品的需求而增加,从而增加食品企业对快速、高品质标籤解决方案和包装的需求。

- 该地区的电子商务产业正在迅速成长,是预测期内推动柔印机采用的关键因素之一。柔印在标籤和纸板印刷中发挥重要作用,并在整个行业中广泛采用。例如,据印度投资局称,印度电子商务市场的商品总价值预计也将成长,到 2026 年将达到 2,000 亿美元。

- 日本包装市场的主要产业是食品、酒精饮料、非酒精饮料、化妆品和洗护用品。日本包装工业的一个特征是广泛应用于食品工业。在日本,瓦楞纸箱等纸包装的需求主要用于食品包装、电器产品、药品和化妆品等包装产品,以及邮件和小包裹递送和运输的盒子。塑胶包装也常用作食品和饮料容器。日本快速扩张的电子商务领域也促进了柔版印刷机的扩张。柔版印刷机易于使用,可显着节省时间和成本,使其迅速受到处理多种产品的企业的欢迎。

- 另一方面,柔印机最近在印度显着成长。各国包装模式的快速转变是产业扩张的主要驱动力之一。大量创新的包装方法正在被引入。由于市场成长和復苏不断加快,印度柔版印刷机市场潜力巨大。该国柔版印刷机市场扩张的主要因素是对高品质、高速印刷机以及各种产品的包装解决方案的需求不断增长。政府也透过教育消费者如何正确贴标籤来支持印刷机市场。

柔印业概况

由于以下主要企业的存在,柔印机市场竞争公司之间的竞争非常激烈: Koenig & Bauer AG 和 Mark Andy Inc. 等公司透过不断研发创新产品获得了竞争优势。

其他好处

- Excel 格式的市场预测 (ME) 表

- 3 个月分析师支持

目录

第一章简介

- 研究假设和市场定义

- 调查范围

第二章调查方法

第三章执行摘要

第四章市场动态

- 市场概况

- 市场驱动因素

- 高速生产的需求不断增加

- 市场限制因素

- 初始设定成本增加

- 产业价值链分析

- 产业吸引力-波特五力分析

- 新进入者的威胁

- 买方议价能力

- 供应商的议价能力

- 替代品的威胁

- 竞争公司之间敌对关係的强度

第五章市场区隔

- 按材质

- 纸

- 塑胶薄膜

- 金属膜

- 纸板

- 按最终用户产业

- 药品

- 饮食

- 化妆品

- 家电

- 后勤

- 印刷媒体

- 地区

- 北美洲

- 美国

- 加拿大

- 欧洲

- 英国

- 德国

- 法国

- 义大利

- 西班牙

- 亚洲

- 中国

- 日本

- 印度

- 澳洲/纽西兰

- 拉丁美洲

- 巴西

- 阿根廷

- 墨西哥

- 中东/非洲

- 沙乌地阿拉伯

- 南非

- 埃及

- 北美洲

第六章 竞争状况

- 公司简介

- Wolverine Flexographic LLC(Crosson Holdings, LLC)

- Bobst Group SA

- Edale UK Limited

- Heidelberger Druckmaschinen AG

- OMET

- MPS Systems BV

- Koenig & Bauer AG

- Mark Andy Inc.

- Rotatek

- Star Flex International

- Comexi

- Windmoeller & Hoelscher Corporation

- Orient Sogyo Co., Ltd.

第七章 投资分析

第八章 市场未来展望

The Flexographic Printing Machine Market size is estimated at USD 2.71 billion in 2025, and is expected to reach USD 3.47 billion by 2030, at a CAGR of 5.05% during the forecast period (2025-2030).

Key Highlights

- Flexographic printing machinery uses relief plates of flexible rubber or photo-polymer plates, and four rollers such as an ink roller, meter roller, plate cylinder, and impression cylinder. Ink is introduced to an anilox roller that transfers the ink to a flexible, raised-relief image plate wrapped around a cylinder. This cylinder then lays the graphic onto the label paper as it passes through the press at high speed.

- The increasing demand for a printing machine that can be used for a variety of substrates and other products with high versatility and ease of operation, particularly for rather long printing runs on all extensible plastic film, is expected to fuel the adoption of the flexographic printing machines, as the flexographic printing machines can operate at high speeds and its applicability on a different surface and water-based inks as well as oil-based inks.

- Computer-to-plate processes are increasingly used in flexo prepress, enabling machines to reduce prepress times. The process has been extensively used in offset litho. The introduction of flat-top dots in Plates by several vendors has significantly improved print consistency and overall quality.

- As the packaging industry, especially in sectors like food, beverages, and personal care, witnesses rapid growth, the demand for flexographic printing machines has surged. These machines excel in high-speed printing across diverse substrates. Innovations in flexographic printing, including the rise of high-definition (HD) flexo printing and the melding of digital processes, have significantly boosted print quality and efficiency. Such advancements are drawing an increasing number of manufacturers towards adopting flexo systems.

- Moreover, advancements such as AI, machine learning, IoT, and data analytics have significantly personalized offerings. The convergence in flexographic printing enables superior print personalization for large-volume orders. However, the cost factor remains a big hurdle.

- While flexographic printing is anticipated to drive market growth, factors such as the increasing competition from viable alternatives such as digital printing and scanning are expected to challenge the change during the forecast period.

Flexographic Printing Market Trends

Food & Beverages is Expected to Hold the Largest Market Share

- Flexographic printing has been making waves across various industries, finding significant applications in business operations and consumer market expectations. The consumer market's demands are prone to rapid change. The consumer always wants well-packaged goods available at the grocery store. So, the food industry has constantly been working to meet market demand by improving lead times, increasing print quality, and shortening production periods.

- The demand for flexographic printing machines in the food industry is increasing due to several factors, including reducing production costs, meeting increased market demand quickly, and many more. Because of the versatile nature of flexography, any ink can be used to print on a broad range of different materials. Packaging supplies and flexographic inks are less pricey than those required in other printing procedures.

- The food and beverage industry is a significant consumer of flexible packaging products such as films, pouches, and many more printed using flexographic printing machines. The increasing consumption of such packaging is expected to bolster the market demand for such machines over the forecast period.

- The food and beverage industry is governed by stringent regulations regarding using inks on packaging and labeling. Flexographic printing, which involves quick-drying and non-toxic inks, is desirable for printing food and beverage packaging and is expected to boost the adoption of flexographic printing machines over the forecast period.

- According to the Ministry of Heavy Industries, the production value of printing machinery in India in 2020 was INR 126.78 billion (USD 1.53 billion), and it will reach USD 234.79 billion (USD 2.84 billion) in 2024. An increase in production value can positively influence the market for flexographic printers. Flexographic printing, which is used widely in the packaging industry, includes food and drink packaging; as consumer spending on foods and nonalcoholic beverages increases, there is a growing demand for packaging material and labels requiring print equipment such as flexographic printers.

Asia Pacific is Expected to Register the Highest Growth Rate

- The growing urban population primarily drives the Asia-Pacific region, increased packaged food demand, simple access to polymer films, and a relatively inexpensive labor pool. Economical options for adorning containers with complicated designs are projected to expand in South-East Asia, a price-sensitive market significantly.

- The consumption of FMCG products is anticipated to rise along with the demand for food and beverage products and personal care items-the necessity for high-speed & high-quality labeling solutions and the need for packaging in the food business.

- The e-commerce industry in the region is proliferating, which is one of the significant factors that would fuel the adoption of flexographic printing machines over the forecast period. Flexographic printing plays an essential role in printing labels and corrugated cardboard, which is widely adopted across the industry. For instance, according to Invest India, the e-commerce market in India is also set to grow for gross merchandise value to reach USD 200 billion by 2026.

- The essential industries in the Japanese packaging market are food, alcoholic beverages, non-alcoholic beverages, cosmetics, and toiletries. The packaging industry in Japan is characterized by its intense usage in the food industry. In Japan, paper packaging, such as corrugated boxes, is mainly demanded for food packaging and packaged goods such as electrical appliances, medicine, and cosmetics, or as boxes for mail and parcel delivery or moving. Plastic packaging is commonly used for food and beverage containers as well. The rapidly expanding e-commerce sector in the country is also a factor in the expansion of flexographic machines. These machines are quickly becoming a popular option for businesses that deal in many products because they are easy to use and save a ton of time and money.

- On the other hand, flexographic printing machines have grown significantly in India recently. The quick shifts in packaging patterns across the nation are one of the main drivers of industry expansion. There has been a massive uptake of novel packaging methods. India's market for flexographic printing machines has a sizable potential because of increasing and recovering market growth. The main driver of the nation's expanding flexographic printing machine market is the increased need for packaging solutions for a variety of goods as well as for high-quality, fast printing equipment. Also, the government is assisting the printing machine market by educating consumers about proper labeling.

Flexographic Printing Industry Overview

The competitive rivalry in the flexographic printing machine market is high owing to the presence of some key players such as Koenig & Bauer AG and Mark Andy Inc., amongst others. These companies have gained a competitive advantage by continually innovating their offerings through research and development. These players, through strategic partnerships and mergers & acquisitions, have been able to gain a strong footprint in the market and develop the technology further.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET DYNAMICS

- 4.1 Market Overview

- 4.2 Market Driver

- 4.2.1 Rising Need for High Production Speeds

- 4.3 Market Restraint

- 4.3.1 Higher Initial Setup Cost

- 4.4 Industry Value Chain Chain Analysis

- 4.5 Industry Attractiveness - Porter's Five Force Analysis

- 4.5.1 Threat of New Entrants

- 4.5.2 Bargaining Power of Buyers

- 4.5.3 Bargaining Power of Suppliers

- 4.5.4 Threat of Substitute Products

- 4.5.5 Intensity of Competitive Rivalry

5 MARKET SEGMENTATION

- 5.1 Material

- 5.1.1 Paper

- 5.1.2 Plastic Films

- 5.1.3 Metallic Films

- 5.1.4 Corrugated Cardboard

- 5.2 End User Industry

- 5.2.1 Pharmaceutical

- 5.2.2 Food & Beverage

- 5.2.3 Cosmetics

- 5.2.4 Consumer Electronics

- 5.2.5 Logistics

- 5.2.6 Print Media

- 5.3 Geography

- 5.3.1 North America

- 5.3.1.1 United States

- 5.3.1.2 Canada

- 5.3.2 Europe

- 5.3.2.1 United Kingdom

- 5.3.2.2 Germany

- 5.3.2.3 France

- 5.3.2.4 Italy

- 5.3.2.5 Spain

- 5.3.3 Asia

- 5.3.3.1 China

- 5.3.3.2 Japan

- 5.3.3.3 India

- 5.3.4 Australia and New Zealand

- 5.3.5 Latin America

- 5.3.5.1 Brazil

- 5.3.5.2 Argentina

- 5.3.5.3 Mexico

- 5.3.6 Middle East & Africa

- 5.3.6.1 Saudi Arabia

- 5.3.6.2 South Africa

- 5.3.6.3 Egypt

- 5.3.1 North America

6 COMPETITIVE LANDSCAPE

- 6.1 Company Profiles

- 6.1.1 Wolverine Flexographic LLC (Crosson Holdings, LLC)

- 6.1.2 Bobst Group SA

- 6.1.3 Edale UK Limited

- 6.1.4 Heidelberger Druckmaschinen AG

- 6.1.5 OMET

- 6.1.6 MPS Systems B.V.

- 6.1.7 Koenig & Bauer AG

- 6.1.8 Mark Andy Inc.

- 6.1.9 Rotatek

- 6.1.10 Star Flex International

- 6.1.11 Comexi

- 6.1.12 Windmoeller & Hoelscher Corporation

- 6.1.13 Orient Sogyo Co., Ltd.