|

市场调查报告书

商品编码

1630329

转换后的软包装:市场占有率分析、产业趋势与统计、成长预测(2025-2030)Converted Flexible Packaging - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

※ 本网页内容可能与最新版本有所差异。详细情况请与我们联繫。

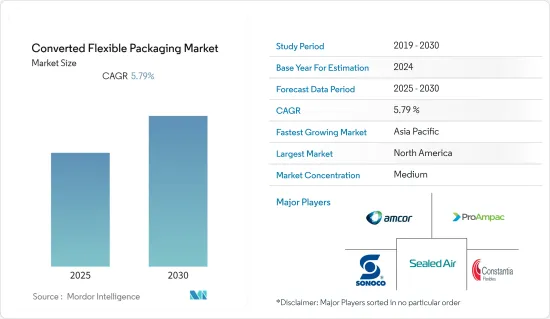

预计转换软包装市场在预测期间内复合年增长率为 5.79%

主要亮点

- 对食品等便利加工产品的需求不断增长,推动了软包装转型的需求。环保包装形式的趋势也不断增长。创新产品,例如允许冷冻食品和其他食品在包装内蒸气的自排气薄膜,可能代表技术改进和开发的突破。

- 各国电子商务市场的扩张正在创造对纸板和纸板产品的特殊需求,特别是来自运输和物流公司的需求。另外,包装材料的环保性提高了包装材料的受欢迎程度,带动了市场。

- 此外,铝箔是用于转换软包装的热门包装材料之一。从食品、饮料到化妆品,许多产品都采用铝包装,以在整个保质期内保持产品的完整性。根据欧洲铝箔协会统计,2021年1月至3月期间向欧洲铝箔轧延公司的交付达到24.5万吨,比2020年(23.95万吨)增加2.3%。

- 不断变化的软包装产业面临着材料成本上涨和对低脂休閒食品等产品需求增加的挑战。这些产品需要创新的技术和材料组合来满足包装商的新鲜度需求。技术进步包括受控调气包装(CAP/MAP),可显着延长农产品、肉类和其他产品的保存期限。

- 最近爆发的新冠肺炎 (COVID-19) 疫情给转型的软包装製造商带来了大量担忧,但预计这种担忧不会持续太久。疫情封锁的影响包括供应链中断、製造所用原材料的缺乏、劳动力短缺、导致最终产品产量膨胀并超出预算的价格波动以及运输问题。

改装软包装市场的趋势

食品和饮料将推动改装软包装市场的成长

- 由于肉类消费量增加等因素,预计转换后的软包装市场将在预测期内呈指数级增长。全球人口成长、收入成长和都市化等因素与肉品消费呈现强烈正相关。世界卫生组织 (WHO) 估计,到 2030 年,肉品消费量可能增加至 3.76 亿吨。

- 水产品仍然是推动改装软包装领域成长的主要食品市场之一。预计未来几年,水产品将继续主导肉类和家禽市场。消费者对独立包装部分和盒装预调味蛋白质的持续需求将支持这一点。

- 公司专注于食品和饮料行业的可持续产品创新。例如,2022 年 3 月,基于纤维的消费包装解决方案製造商 Graphic Packaging International 扩大了其面向饮料行业的可持续多件包装的范围。为了履行持续产品创新以支持循环经济的承诺,该公司推出了 EnviroClip。它是一种柔性纸板,可替代标准塑胶环和饮料罐收缩膜。此类创新正在推动软包装市场的转型。

- 同样,2022 年 4 月,亚马逊宣布推出由再生纸製成的新包装。当顾客从亚马逊生鲜或全食超市订购冷藏或冷冻杂货时,它们会采用方便的包装交付,方便顾客在家中回收。过渡到完全可回收的隔热包装每年可减少约 735,000 磅塑胶薄膜、315 万磅天然棉纤维和 1500 万磅不可回收混合塑胶。

- 此外,烘焙点心消费量的增加继续推动软塑胶包装解决方案的采用,以延长保质期。大约 80% 的烘焙产品现在以软包装形式出售,随着麵包店现在生产的麵包种类和产品种类越来越多,市场参与企业正在寻求满足市场需求。

亚太地区占市场主导地位

- 亚太地区是重要且成长最快的区域市场之一。考虑到中国、印度等新兴市场的巨大潜力,转型后的软包装产业近期发生了许多策略联盟、资产置换、产能扩张、併购等事件。

- 例如,ePac 软包装公司于 2022 年 8 月宣布,将在未来 18 个月内加速发展并成为全球性公司。 E-Pac 将在亚太地区、欧洲以及中东和非洲其他地区建立 11 个新的销售和製造地,从而将 E-Pac 的全球足迹扩大到 36 个地点。

- 水产品是推动软包装市场成长的因素之一。据联合国粮食及农业组织称,到2030年,将额外需要4,000万吨水产品来满足日益增长的需求,增幅接近30%。随着中国加工、分销和低温运输系统的完善,冷冻和加工水产品的消费预计将稳定成长。此外,高端超级市场的日益普及以及消费者对包括水产品在内的更多样化和营养丰富的膳食的渴望可能会导致冷冻和加工水产品的销售增加。

- 近年来,由于包装食品消费的增加、意识的提高以及对优质产品的需求不断增长,印度的包装持续成长。消费者对包装食品,特别是包装食品宅配的意识正在增强。 2021 年,印度食品安全与标准局 (FSSAI) 宣布了新的包装法规,以取代 2011 年的法规。新法规包括60mg/kg或10mg/dm2的迁移限值以及塑胶包装材料中某些污染物的迁移限值。

- 此外,印刷包装和日益专业化的肉类薄膜包装的机会预计将支持该地区的成长。由于其成本效益、多功能性、降级能力和优异的阻隔性能,聚乙烯预计仍将是亚太地区使用最广泛的薄膜。

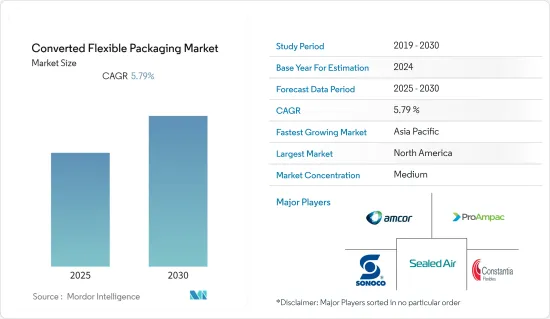

软包装产业概况

改装后的软包装市场竞争适度且集中,参与企业众多。就市场占有率而言,其中一些主要参与企业目前占据市场主导地位。由于市场内外的建设性力量,市场正在经历加速成长。由于策略的改进,某些细分市场预计将获得绝对的市场主导地位。市场吸收成本可以轻鬆处理,为市场扩张创造空间。

- 2022 年 5 月 - ProAmpac 宣布收购专门食品 Packaging,这是一家为快餐和酒店行业生产纸张、薄膜和铝箔特种包装产品的家族製造商。随着 Specialty Packaging 的互补产品系列和製造能力的增加,Proanpack 将扩大其对食品服务客户的影响力,并扩大其在美国西南部的足迹。

- 2021 年 8 月 - Amcor 宣布建设计画两个最先进的研发中心。在比利时和中国建设新设施。我们将从 2022 年中期开始迎接客户,并在未来两年内全面扩张。预计总投资约3500万美元。

其他好处

- Excel 格式的市场预测 (ME) 表

- 3 个月分析师支持

目录

第一章简介

- 研究成果

- 研究场所

- 调查范围

第二章调查方法

第三章执行摘要

第四章市场动态

- 市场概况

- 利用市场促进因素和市场限制因素

- 市场驱动因素

- 对便捷包装的需求不断增长

- 长期储存需求和生活方式的改变

- 市场限制因素

- 对环境和回收的担忧

- 价值链/供应链分析

- 产业吸引力-波特五力分析

- 新进入者的威胁

- 买家/消费者的议价能力

- 供应商的议价能力

- 替代品的威胁

- 竞争公司之间敌对关係的强度

- COVID-19 对市场的影响

第五章市场区隔

- 按材质

- 塑胶薄膜

- 纸

- 铝箔

- 其他的

- 按用途

- 零售

- 饮食

- 药品

- 非食品

- 其他的

- 地区

- 北美洲

- 欧洲

- 亚太地区

- 其他的

第六章 竞争状况

- 公司简介

- ProAmpac

- Amcor Plc

- Sealed Air Corporation

- Sonoco Products Company

- Constantia Flexibles Group GmbH

- Graphics Packaging Holding Company

- Bischof+Klein SE & Co. KG

- Honeywell International Incorporated

- Oracle Packaging Inc.(Tekni-Plex Inc.)

- Transcontinental Inc.

第七章 投资分析

第八章 市场机会及未来趋势

The Converted Flexible Packaging Market is expected to register a CAGR of 5.79% during the forecast period.

Key Highlights

- The increasing demand for convenience-oriented processed products such as food is driving the need to transform flexible packaging, as they typically use high-barrier, high-grade packaging materials for longer shelf life. The industry is also noticing an increasing trend towards environmentally friendly formats. Innovative products such as auto-venting films that allow frozen and other foods to be steamed inside the package could represent a breakthrough in technology improvement and development.

- The growing e-commerce market in various countries creates special demand for cardboard and corrugated products, especially from transportation and logistics companies. In addition, the environmental friendliness of packaging materials has made them more popular and is driving the market.

- Further, aluminum foil is one of the popular packaging materials for converted flexible packaging. Many products, from food and beverages to cosmetics, are packaged in aluminum to maintain product integrity throughout their shelf life. According to European Aluminum Foil Association, the first three months of 2021 saw deliveries from European foil rollers reach 245,000 tonnes, up by 2.3% compared to 2020 (239,500 tonnes), led by striving performance in overseas markets, where the growth of over 10% was achieved.

- The transformed flexible packaging industry is being challenged by rising material costs and increased demand for products such as low-fat snack foods. These products require innovative technology and material combinations to meet packers' freshness needs. Technological advances include controlled and modified atmosphere (CAP/MAP) packages, resulting in much longer shelf life for produce, meat, and other products.

- The recent outbreak of COVID-19 has left converted flexible packaging manufacturers in a deluge of concerns expected to be short-lived. The pandemic lockdown impacts include supply chain disruptions, unavailability of raw materials used in manufacturing, labor shortages, price volatility that can bloat end product production and exceed budgets, and shipping issues. etc. is included.

Converted Flexible Packaging Market Trends

Food & Beverage to Drive Growth in the Converted Flexible Packaging Market

- The converted flexible packaging market is anticipated to rise exponentially during the forecast period owing to factors such as increased consumption of meat products. Factors such as global population growth, income growth, and urbanization are strongly and positively associated with meat product consumption. The World Health Organization (WHO) evaluates that meat consumption could rise to 376 million tonnes by 2030.

- Seafood will continue to be one of the leading food markets driving growth in the converted flexible packaging sector. Seafood will continue to lead the market against meat and poultry over the coming years. It will be supported by ongoing consumer demand for individually wrapped portions and case-ready and pre-seasoned proteins.

- Companies are focused on innovating, sustainable products for the food and beverage industry. For instance, in March 2022, Graphic Packaging International, a textile-based consumer packaging solutions manufacturer, expanded its range of sustainable multi-pack packaging for the beverage industry. In line with its commitment to continuous product innovation to support a more circular economy, the company has launched its EnviroClip. It is a soft material paperboard alternative to the standard plastic ring and shrinks film for beverage cans. Such innovations drive the market for converted flexible packaging.

- Similarly, in April 2022, Amazon unveiled new packaging that uses recycled paper. Whether customers order refrigerated or frozen groceries from Amazon Fresh and Whole Foods Market, they are delivered segregated in packages that are easy and convenient for customers to recycle at home. Transitioning to fully recyclable insulation packaging reduces material waste, replacing approximately 735,000 pounds of plastic film, 3.15 million pounds of natural cotton fiber, and 15 million pounds of non-recyclable mixed plastics yearly.

- Moreover, the rising consumption of baked goods continues to drive the adoption of flexible plastic packaging solutions to extend shelf life. With around 80% of bakery products sold in converted flexible packaging and bakeries now producing a wider variety of bread and more items, market participants are developing advanced solutions to meet market demand.

Asia-Pacific Holds a Dominant Position in the Market

- The Asia Pacific is one of the important and fastest growing regional markets. Given the great potential in developing markets such as China and India, the transformed converted flexible packaging industry has recently seen several strategic partnerships, asset exchanges, capacity expansions, mergers, and acquisitions.

- For instance, in August 2022, ePac Flexible Packaging announced that it would accelerate its growth over the next 18 months and transition into a global company. Eleven new sales and manufacturing locations will be established in Asia Pacific, Europe, and other regions, expanding ePac's global footprint to 36 locations.

- Seafood is one of the main drivers of growth in the converted flexible packaging market. According to the Food and Agriculture Organization (FAO), an additional 40 million tonnes of seafood will be needed by 2030 to meet rising demand or a nearly 30% increase. As China's processing, distribution, and cold chain systems improve, frozen and processed seafood consumption is expected to grow steadily. Additionally, the growing popularity of high-end supermarkets and consumer desire for a more varied and nutritious diet, including seafood, is seen as an increase in frozen and processed fish sales.

- In recent years, India has seen sustained growth in packaging owing to rising consumption of packaged food, awareness, and demand for quality products. Consumer awareness of packaged food, especially packaged food delivery, is increasing. In 2021, the Food Safety and Standards Authority of India (FSSAI) announced new packaging regulations to replace the 2011 regulations. The new rules include migration limits of 60 mg/kg or 10 mg/dm2 and migration limits for certain contaminants in plastic packaging materials.

- In addition, growth in the region is expected to be supported by opportunities for printed packaging and increasingly specialized film packaging for meat products. Polyethylene is expected to continue to be the most widely used film in Asia-Pacific due to its cost-effectiveness, versatility, downgrade capability, and excellent barrier properties.

Converted Flexible Packaging Industry Overview

The Converted Flexible Packaging Market is moderately competitive and concentrated and consists of some influential players. Regarding market share, some of these major players currently dominate the market. The market is showing an increase in growth rate due to constructive forces from internal and external market forces. Certain areas of the market are expected to gain absolute dominance in the market due to improved strategies. Market-absorbed costs are easily handled, creating room for market expansion.

- May 2022 - ProAmpac announced the acquisition of Specialty Packaging, Inc., a family-owned manufacturer of specialty packaging products in paper, film, and foil for the fast food and hospitality industries. The addition of Specialty Packaging's complementary product portfolio and manufacturing capabilities will extend ProAmpac's reach to food service customers and expand its footprint in the Southwest United States.

- August 2021 - Amcor has announced plans to construct two new state-of-the-art innovation centers. The new facilities in Belgium, and China. The company will welcome customers from mid-2022 and fully extend over the next two years. The total investment is expected to be approximately USD 35 million.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Deliverables

- 1.2 Study Assumptions

- 1.3 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET DYNAMICS

- 4.1 Market Overview

- 4.2 Introduction to Market Drivers and Restraints

- 4.3 Market Drivers

- 4.3.1 Augmented Demand for Convenient Packaging

- 4.3.2 Need for Longer Shelf Life and Changing Lifestyles

- 4.4 Market Restraints

- 4.4.1 Concerns about the Environment and Recycling

- 4.5 Value Chain / Supply Chain Analysis

- 4.6 Industry Attractiveness - Porter's Five Force Analysis

- 4.6.1 Threat of New Entrants

- 4.6.2 Bargaining Power of Buyers/Consumers

- 4.6.3 Bargaining Power of Suppliers

- 4.6.4 Threat of Substitute Products

- 4.6.5 Intensity of Competitive Rivalry

- 4.7 Impact of Covid-19 on the market

5 MARKET SEGMENTATION

- 5.1 By Material

- 5.1.1 Plastic Film

- 5.1.2 Paper

- 5.1.3 Aluminum Foil

- 5.1.4 Other Materials

- 5.2 By Application

- 5.2.1 Retail

- 5.2.2 Food & Beverage

- 5.2.3 Pharmaceutical

- 5.2.4 Non-Food

- 5.2.5 Other Applications

- 5.3 Geography

- 5.3.1 North America

- 5.3.2 Europe

- 5.3.3 Asia Pacific

- 5.3.4 Rest of the World

6 COMPETITIVE LANDSCAPE

- 6.1 Company Profiles

- 6.1.1 ProAmpac

- 6.1.2 Amcor Plc

- 6.1.3 Sealed Air Corporation

- 6.1.4 Sonoco Products Company

- 6.1.5 Constantia Flexibles Group GmbH

- 6.1.6 Graphics Packaging Holding Company

- 6.1.7 Bischof + Klein SE & Co. KG

- 6.1.8 Honeywell International Incorporated

- 6.1.9 Oracle Packaging Inc. (Tekni-Plex Inc.)

- 6.1.10 Transcontinental Inc.