|

市场调查报告书

商品编码

1630330

卷对卷软性电子产品:市场占有率分析、行业趋势和统计、成长预测(2025-2030)Roll To Roll Flexible Electronics - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

※ 本网页内容可能与最新版本有所差异。详细情况请与我们联繫。

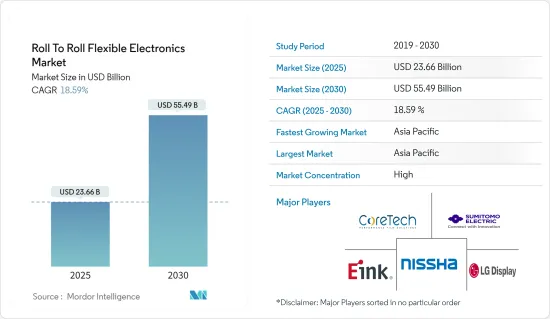

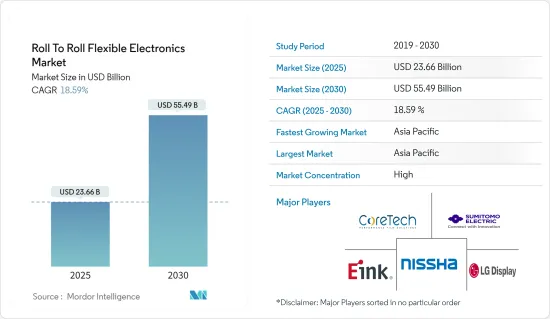

卷对卷软性电子产品市场规模预计到 2025 年为 236.6 亿美元,到 2030 年将达到 554.9 亿美元,预测期内(2025-2030 年)复合年增长率为 18.59%。

卷对卷 (R2R) 印刷柔性电路解决了传统刚性电路的安装和空间限制。基于适应性基板建构的 R2R 柔性电路在电子设计中变得越来越重要,特别是考虑到当今的空间限制。因此,製造商正在生产更紧凑的设备,以满足家用电子电器中对这些电路快速增长的需求。这些电路可以弯曲和扭曲,而不会影响其功能,使其成为现代电子设备的理想选择。

卷对卷 (R2R)软性电子产品市场的主要驱动力包括节能、薄型和柔性消费性电子产品的发展,以及 R2R 列印在电子元件生产中的显着成本效益。软性电子产品在医疗保健应用中的采用正在增加。这些应用范围从穿戴式健康监测器到灵活的医疗感测器,凸显了 R2R 技术在各个领域的多功能性和日益增长的重要性。

在经济实惠的型号和广泛的互联网接入的推动下,全球智慧型手机的普及率迅速增加,这是卷对卷软性电子产品市场的主要驱动力。中国和印度等国家人口迅速成长,可支配收入不断增加,正成为智慧型手机领域的主导者。随着这些地区智慧型手机普及率的提高以及製造商寻求将先进功能融入其设备中,对软性电子产品的需求预计将大幅增长。

然而,由于研发 (R&D) 和基础设施要求较高,因此存在一些挑战,限制了基于卷对卷 (R2R) 的软性电子产品需求的增长。由于研发和基础设施的初始成本较高,包括企业和消费者在内的潜在采用者对投资软性电子产品技术犹豫不决。这种不情愿源自于对投资收益(ROI) 和初始部署负担能力的担忧。

COVID-19大流行后通讯设备、数位化趋势、智慧建筑、基于ADAS的车辆、工业4.0等的出现增加了对智慧电子、工业物联网和通讯设备的需求,推动了市场成长。

因此,大流行后由于互联网普及率的提高和自动化趋势而对电子设备的需求正在支撑所研究市场的成长。

卷对卷软性电子产品市场趋势

消费性电子实现显着成长

- 消费者越来越喜欢纤薄、轻巧、可携带的设备。因此,智慧型手机、平板电脑、穿戴式装置和其他装置对轻巧灵活的电子产品的需求不断增长。因此,为了满足这些规范,製造商正在转向 R2R 列印,这使得电子元件能够经济高效、灵活且大规模地製造。

- 在经济实惠的型号和广泛的网路存取的推动下,智慧型手机在全球的普及率迅速增加,成为卷对捲软性电子产品市场的主要催化剂。中国和印度等国家人口迅速成长,可支配收入不断增加,正成为智慧型手机领域的主导者。随着这些地区智慧型手机普及率的提高以及製造商寻求将先进功能融入其设备中,对软性电子产品的需求预计将大幅增长。

- 消费性电子产品的小型化趋势是采用 R2R 列印电子产品的主要动力。随着设备变得更小、更便携,製造商正在寻求能够生产更小零件和功能的製造方法,而 R2R 列印可以生产更薄、更灵活、更轻的电子元件。降低製造成本和减少材料废弃物正在推动消费电子製造商采用 R2R 列印。

- 家用电子电器的技术趋势正在加速对 R2R 柔性电子产品的需求。穿戴式装置和折迭式智慧型手机的日益普及需要灵活的显示器和其他可以无缝整合到这些装置中的组件。此外,超薄和轻量化电子产品的趋势正在鼓励製造商探索新材料和製造工艺,以支援消费性电子产品的 R2R软性电子产品。

亚太地区成长强劲

- 在亚太卷对卷软性电子产品市场,供应商正在强调研究和开发,在行业内建立伙伴关係关係,并瞄准潜在的製造机会。这种合作使工业合作伙伴能够试验新产品的小批量生产,从而最大限度地降低风险。

- 中国软性电子产品产业在全球舞台上已从跟随者转变为主导者。为把握新机会,各厂商纷纷战略布局产业布局,打造「中国碳谷」产业基地。每个供应商的努力范围包括研究核心技术、创新和开发软性电子产品以及投资人才发展以充分挖掘创新潜力。

- 在印度,表面涂层领域的 RK PrintCoat Instruments UK 与印度坎普尔理工学院 (IITK) 的国家软性电子产品中心 (FlexE 中心) 合作。此次合作将专注于设计、製造和供应专门的捲对卷 (R2R) 试验线,用于软性电子产品的研究、开发和原型製作。

- 澳洲先进光电中心专注于太阳能的发展。虽然传统电池板和电池仍然很重要,但未来 20 年预计太阳能技术将取得重大进展。薄型柔性薄膜和太阳能窗等创新技术将会出现。为了实现澳洲到 2050 年的净零目标,太阳能发电产业需要到 2030 年将电力需求翻一番,从 20% 增加到 40%,并目标是到 2050 年实现 100%可再生能源。

卷对卷软性电子产品产业概述

由于捲对捲软性电子产品市场仍处于起步阶段,竞争公司之间不存在直接竞争。大多数技术投资公司针对不同的领域和行业。因此,现在解读目标市场中竞争公司之间的竞争还为时过早。

由于建造製造设施和开始生产需要大量投资,因此估计新进入者的威胁较低。世界各地的政府政策都支持该产业,因为这些产品有助于减少各种电子元件的尺寸和成本。

因此,新进入者利用这个机会进入市场并展现自己的存在。然而,转换成本可能很高,而且新进入者可能无法找到消除这些成本的方法。建立工厂生产卷对卷软性电子产品成本高昂,因为它需要先进的製造机械和研发资源。因此,新业务进入市场的难度很高。

技术意识和专业知识较低也限制了投资该市场的新参与企业的数量。然而,由于卷对卷软性电子产品技术的潜在市场巨大,随着商业化的进展,新进入者的威胁预计将增加。

其他好处:

- Excel 格式的市场预测 (ME) 表

- 3 个月的分析师支持

目录

第一章简介

- 研究假设和市场定义

- 调查范围

第二章调查方法

第三章执行摘要

第四章市场洞察

- 市场概况

- 产业吸引力-波特五力分析

- 新进入者的威胁

- 买家/消费者的议价能力

- 供应商的议价能力

- 替代品的威胁

- 竞争公司之间的敌对关係

- COVID-19 和宏观经济趋势的市场影响分析

- 技术简介(印刷技术)

第五章市场动态

- 市场驱动因素

- 物联网应用中柔性电子元件的部署

- 对轻质、机械灵活且具成本效益的产品的需求不断增长

- 市场挑战/限制

- 研发 (R&D) 和基础设施的资本需求较高

第六章 市场细分

- 按用途

- 感应器

- 展示

- 电池

- 太阳能电池

- 按最终用户产业

- 消费性电子产品

- 汽车/运输设备

- 卫生保健

- 航太/国防

- 其他最终用户产业

- 按地区

- 北美洲

- 欧洲

- 亚洲

- 澳洲/纽西兰

- 拉丁美洲

- 中东/非洲

第七章 竞争格局

- 公司简介

- E Ink Holdings Inc.

- Nissha GSI Technologies Inc.

- CoreTech Films(Saint-Gobain High Performance Solutions)

- LG Display Co. Ltd

- Sumitomo Electric Industries Inc.

- Zinergy

- Fujikura Ltd

- Multek Corporation

- Ynvisible Interactive Inc.

第八章投资分析

第九章市场机会

The Roll To Roll Flexible Electronics Market size is estimated at USD 23.66 billion in 2025, and is expected to reach USD 55.49 billion by 2030, at a CAGR of 18.59% during the forecast period (2025-2030).

Roll-to-roll (R2R) printed flexible circuits address the conformability and space constraints of traditional rigid circuits. These R2R flexible circuits, built on adaptable substrates, are increasingly pivotal in electronic device design, especially given today's space limitations. As a result, manufacturers are crafting more compact devices to meet the surging demand for these circuits in consumer electronics. The ability to bend and twist these circuits without compromising their functionality makes them ideal for modern electronic devices.

Key drivers of the roll-to-roll (R2R) flexible electronics market include the push for energy-efficient, thin, and flexible consumer electronics and the notable cost benefits of R2R printing in producing electronic components. The adoption of flexible electronics is rising in healthcare applications. These applications range from wearable health monitors to flexible medical sensors, highlighting the versatility and growing importance of R2R technology in various sectors.

The global surge in smartphone adoption, driven by affordable models and widespread internet access, is a primary catalyst for the roll-to-roll flexible electronics market. Countries like China and India, with their burgeoning populations and rising disposable incomes, are emerging as dominant players in the smartphone arena. The increasing penetration of smartphones in these regions is expected to drive significant growth in the demand for flexible electronics as manufacturers seek to incorporate advanced features into their devices.

However, the high requirement for research and development (R&D) and infrastructure poses several challenges restraining the demand growth for roll-to-roll (R2R) based flexible electronics. The significant upfront costs of R&D and infrastructure development deter potential adopters, including businesses and consumers, from investing in flexible electronics technologies. This reluctance stems from concerns over return on investment (ROI) and the affordability of initial deployment.

The demand for communication devices, digitalization trends, and the emergence of smart buildings, ADAS-based automobiles, Industry 4.0, and others after the COVID-19 pandemic have raised the growth of smart electronics, IIOTs, and communication devices, which have fueled the market growth.

Therefore, the demand for electronic devices, in line with the growth of Internet penetration and automation trends in the post-pandemic period, has supported the growth of the studied market.

Roll To Roll Flexible Electronics Market Trends

Consumer Electronics to Witness Major Growth

- Consumers increasingly prefer devices that are slim, lightweight, and portable. Thus, the need for lightweight, flexible electronics has increased for devices like smartphones, tablets, and wearables. As a result, to obtain these specifications, manufacturers are shifting to R2R printing, which enables them to manufacture electronic components cost-effectively, flexibly, and on a larger scale.

- The global surge in smartphone adoption, driven by affordable models and widespread internet access, is a primary catalyst for the roll-to-roll flexible electronics market. Countries like China and India, with their burgeoning populations and rising disposable incomes, are emerging as dominant players in the smartphone arena. The increasing penetration of smartphones in these regions is expected to drive significant growth in the demand for flexible electronics as manufacturers seek to incorporate advanced features into their devices.

- The trend toward miniaturization in consumer electronics has significantly driven the adoption of R2R printing electronics. As devices become smaller and more portable, manufacturers are seeking manufacturing methods that can produce components and features on reduced scales, where R2R printing allows the production of thin, flexible, and lightweight electronic components. The lower manufacturing cost and reduced material waste have driven R2R printing adoption among consumer electronics manufacturers.

- Technological trends in consumer electronics are accelerating the demand for R2R flexible electronics. The increasing popularity of wearable devices and foldable smartphones requires flexible displays and other components that can be integrated seamlessly into these devices. In addition, the trend toward ultra-thin and lightweight electronics is pushing manufacturers to explore new materials and manufacturing processes and cater to R2R flexible electronics for consumer electronics products.

Asia-Pacific to Register Major Growth

- In the Asia-Pacific roll-to-roll flexible electronics market, vendors are emphasizing R&D, forging partnerships within the industry, and eyeing potential manufacturing opportunities. Such collaborations enable industrial partners to trial low-volume manufacturing of new products, minimizing risks.

- China's flexible electronics sector has transitioned from being a follower to a dominant leader on the global stage. To capitalize on emerging opportunities, vendors are strategically focusing on industrial layouts, laying the groundwork for the envisioned "China Carbon Valley" industrial base. Their efforts encompass core technology research, innovation and development in flexible electronics, and investing in personnel training to harness the full innovative potential.

- In India, RK PrintCoat Instruments UK, a player in the surface coating domain, teamed up with the National Centre of Flexible Electronics (FlexE Centre) at the Indian Institute of Technology, Kanpur (IITK). Their collaboration focuses on designing, manufacturing, and supplying a specialized roll-to-roll (R2R) pilot line, catering to R&D and prototyping in flexible electronics.

- The Australian Center for Advanced Photovoltaics highlights the evolving landscape of solar energy. While traditional panels and batteries will maintain their significance, the next two decades promise breakthroughs in PV technology. Innovations like thin, flexible films and solar windows are on the horizon. To align with Australia's net-zero goal by 2050, the solar sector must double its contribution from 20% to 40% of electricity demand by 2030, aiming for a 100% renewable target by 2050.

Roll To Roll Flexible Electronics Industry Overview

There is no direct competitive rivalry, as the roll-to-roll flexible electronics market is still in the nascent stage. Most of the companies that have invested in technology are targeting different domains and industries. Therefore, it is early to decipher the competitive rivalry in the studied market.

Due to the high investments required to construct a manufacturing facility and initiate production, the threat of new entrants is estimated to be low. Government policies across the world support this industry, as these products help reduce the sizes and costs of various electronic components.

This encourages new entrants to use the opportunity to enter the market and mark their presence. However, there are significant switching costs, and subsequently, a new entrant may not be able to create a means to remove them. It costs a lot of money to set up a plant to produce roll-to-roll flexible electronics because it needs sophisticated manufacturing machinery and R&D resources. This makes it very difficult for new businesses to enter the market.

The current low state of technology awareness and expertise is also limiting the number of new players making investments in the market. However, the potential market is massive for roll-to-roll flexible electronics technology; hence, with rising commercialization, the threat of new entrants is expected to grow.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET INSIGHTS

- 4.1 Market Overview

- 4.2 Industry Attractiveness - Porter's Five Forces Analysis

- 4.2.1 Threat of New Entrants

- 4.2.2 Bargaining Power of Buyers/ Consumers

- 4.2.3 Bargaining Power of Suppliers

- 4.2.4 Threat of Substitute Products and Services

- 4.2.5 Intensity of Competitive Rivalry

- 4.3 Impact Analysis of COVID-19 and Macroeconomic Trends on the Market

- 4.4 Technology Snapshot (Printing Technologies)

5 MARKET DYNAMICS

- 5.1 Market Drivers

- 5.1.1 Deployment of Flexible Electronic Components in IoT Applications

- 5.1.2 Emerging Need for Lightweight, Mechanically Flexible, and Cost-effective Products

- 5.2 Market Challenges/restraints

- 5.2.1 High Capital Requirement for Research and Development (R&D) and Infrastructure

6 MARKET SEGMENTATION

- 6.1 By Application

- 6.1.1 Sensors

- 6.1.2 Displays

- 6.1.3 Batteries

- 6.1.4 Photovoltaics Cells

- 6.2 By End-user Industry

- 6.2.1 Consumer Electronics

- 6.2.2 Automotive and Transportation

- 6.2.3 Healthcare

- 6.2.4 Aerospace and Defense

- 6.2.5 Other End-user Industries

- 6.3 By Geography

- 6.3.1 North America

- 6.3.2 Europe

- 6.3.3 Asia

- 6.3.4 Australia and New Zealand

- 6.3.5 Latin America

- 6.3.6 Middle East and Africa

7 COMPETITIVE LANDSCAPE

- 7.1 Company Profiles

- 7.1.1 E Ink Holdings Inc.

- 7.1.2 Nissha GSI Technologies Inc.

- 7.1.3 CoreTech Films (Saint-Gobain High Performance Solutions)

- 7.1.4 LG Display Co. Ltd

- 7.1.5 Sumitomo Electric Industries Inc.

- 7.1.6 Zinergy

- 7.1.7 Fujikura Ltd

- 7.1.8 Multek Corporation

- 7.1.9 Ynvisible Interactive Inc.