|

市场调查报告书

商品编码

1630333

MaaS(微电网即服务)-市场占有率分析、产业趋势与统计、成长预测(2025-2030)Microgrid as a Service - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

※ 本网页内容可能与最新版本有所差异。详细情况请与我们联繫。

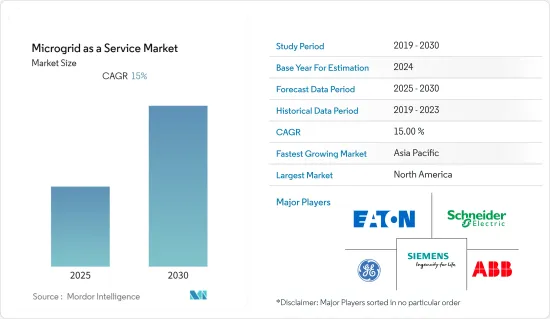

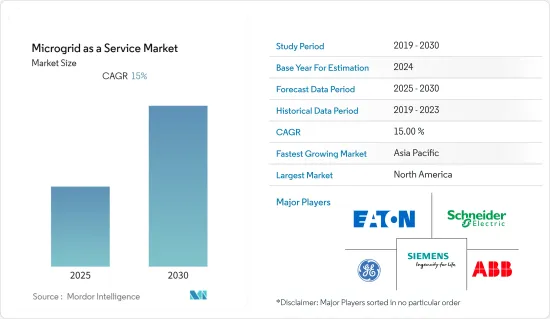

MaaS(微电网即服务)市场预计在预测期内复合年增长率为 15%

主要亮点

- 微电网主要为客户提供更多对其能源需求的控制、提高弹性和可靠性、平衡能源使用、实现清洁能源目标以及其他创新产品和服务。当微电网由公用事业公司部署或与公用事业公司联合部署时,它们不仅可以帮助公用事业公司提高整个能源电网的弹性,而且不仅有利于微电网用户,也有利于电网和所有用户,还可以为其用户带来许多公共利益。

- 随着多种无线和物联网技术的出现,现在可以透过即时资料流、处理、储存和监控基础设施来优化微电网效能,进一步消除人为干预。现今的输电主要利用微电网的功能来减少对远距配电线路的依赖并减少输电损耗。

- 基于公共产业的电网基础设施的持续扩张,以及水力、太阳能和风力发电等可再生能源技术的广泛部署,正在加强电网系统的发展。降低能源储存成本和显着降低排放也是推动市场占有率的关键因素。

- 然而,缺乏适当的培训计划以及对微电网即服务(MaaS)解决方案的好处认识不足预计将限制市场成长。这些系统非常复杂,其设计和规划也非常复杂。因此,需要适当的训练来了解微电网系统的技术细节。

MaaS(微电网即服务)市场趋势

住宅和商业领域将经历显着成长

- 住宅和商业建筑的屋顶宽阔、平坦、开放,适合安装太阳能板,可以帮助企业大幅减少电费。由屋顶太阳能板供电的微电网不仅可以产生绿能,还可以提供绝缘屏障,降低夏季的冷却成本。

- 随着政府在这一领域采取的各种倡议,预计市场将进一步成长。例如,2020 年 1 月,Pecan Street 与 Concurrent Design 合作开发了一个名为「能源开关」的住宅微电网,作为能源部资助计画的一部分。该计划为期一年,其中包括为期两个月的演示,最后由 NREL 进行第三方性能检验。

- 此外,市场也正在寻找策略伙伴关係关係,以扩大市场覆盖范围和创新产品。例如,2019 年 4 月,凯雷集团和施耐德电机宣布加强伙伴关係,主要开发新的创新基础设施计划。透过此次合作,施耐德电机将把其先进连接能力和即时洞察能力应用到凯雷当前和未来的基础设施和微电网投资。

- 此外,此次伙伴关係的目标主要是支持甘乃迪机场现代化项目等大型计划,该项目使用微电网将机场 100%可再生能源,以及为商业和工业客户提供的模组化微电网项目。支援EaaS(能源即服务)解决方案的系统。

- 微电网服务即使在停电期间也能提供可靠的解决方案,预计将推动该领域的需求,因为世界各地的企业都因停电而遭受收入损失。

预计北美将占据较大市场占有率

- 预计北美地区在预测期内将占据市场的主要份额。产量的增加、高品质的电力需求和安全的工业运作是预计推动市场成长的一些因素。此外,美国能源局正在支持该国微电网的开发和部署。

- 基于太阳能和储存技术的微电网预计将在该地区更快地扩张,因为它们被部署为地方、州和联邦各级气候相关战略计划的一部分。美国军方已经在全美各地的军事基地部署了多个微电网,国防部正在多个军事基地积极部署基于可再生能源的微电网。

- 预计美国也将推动对微电网的需求。例如,2019年12月,Northern Reliability, Inc.宣布已被电力研究实验室选中为美国设计和建造两个可携式微电网电池能源储存系统(BESS)。这些微电网将主要使用太阳能和电池储能係统(BESS)为海军的关键电力负载以及海军现场发电提供紧急备用电源。

- 美国东北部(例如纽约和马萨诸塞州)的极端天气条件要求微电网能够提供更强的抗停电能力。可再生能源政策也支持加州的微电网。此外,随着公用事业委员会响应新的微电网立法,预计加州将安装更多装置。

MaaS(微电网即服务)产业概述

MaaS(微电网即服务)市场竞争非常激烈,国内外许多大公司纷纷进入该市场。市场集中度中等,主要企业主要透过产品创新、併购等策略扩大服务范围,扩大全球影响力,同时维持竞争优势。市场上一些主要企业包括 ABB 有限公司、通用电气公司、西门子公司和伊顿公司。

- 2019 年 11 月 - 西门子与可再生能源开发商 JUWI 签署战略技术合作伙伴关係,重点关注采矿业微电网。两家公司的目标是部署并继续开发先进的微电网控制系统,以实现从可再生能源到矿场离网电源的无缝电力整合。

- 2019 年 4 月 - 劳斯莱斯电力系统公司宣布与科技公司 ABB 建立合作伙伴关係,共同推动微电网技术和先进自动化。两家公司的目标是为商业和工业公司建立节能微电网解决方案。

其他好处

- Excel 格式的市场预测 (ME) 表

- 3 个月分析师支持

目录

第一章简介

- 调查先决条件

- 调查范围

第二章调查方法

第三章执行摘要

第四章市场动态

- 市场概况

- 市场驱动因素

- 医院、国防和偏远地区的需求增加

- 政府高投入

- 市场限制因素

- 大规模微电网管理的复杂性

- 产业价值链分析

- 波特五力分析

- 新进入者的威胁

- 买家/消费者的议价能力

- 供应商的议价能力

- 替代品的威胁

- 竞争公司之间敌对关係的强度

第五章市场区隔

- 服务类型

- 工程和设计服务

- SaaS(Software-as-a-Service)

- 监控服务

- 营运/维护服务

- 按最终用户产业

- 政府机构

- 住宅/商业

- 产业

- 地区

- 北美洲

- 欧洲

- 亚太地区

- 其他的

第六章 竞争状况

- 公司简介

- ABB Ltd.

- General Electric Company

- Siemens AG

- Eaton Corporation Inc.

- Pareto Energy

- Spirae, Inc.

- Green Energy Corp.

- Schneider Electric SE

- Metco Engineering

- Aggreko PLC

第七章 投资分析

第八章 市场机会及未来趋势

The Microgrid as a Service Market is expected to register a CAGR of 15% during the forecast period.

Key Highlights

- Microgrids primarily offer the customers with more control over their energy needs enabling them to enhance the resiliency and reliability, balance their energy use, achieve cleaner energy goals, and to explore other innovative products and services. When they are deployed by or in combination with electric companies, they can help the electric companies in enhancing the resilience of the entire energy grid while providing numerous public benefits that extend beyond the microgrid users to the grid and to all customers.

- With the emergence of multiple wireless and IoT technologies, the performance of the microgrids can now be optimized with real-time data streaming, processing, storage, and monitoring infrastructure, which can further eliminate any human intervention. Manufacturers today are also leveraging the capabilities of microgrids, primarily to reduce the reliance on long-distance distribution lines, thereby reducing transmission losses.

- The on-going expansion of the utility-based grid infrastructure along with an extensive deployment of renewable energy technologies that includes hydro, solar, and wind energy has enhanced the development of grid systems. The decreasing cost of energy storage, and a significant reduction in emissions are some of the major factors that are expected to boost the market share.

- However, the lack of proper training programs and little awareness regarding the benefits of a microgrid-as-a-service solution is expected to act as a restraint towards market growth. These systems are very advanced, and their design and planning is also highly complex in nature. Thus, in order to understand the technicalities of a microgrid system, proper training is required.

Microgrid-as-a-Service Market Trends

Residential and Commercial Segment to Witness Significant Growth

- The residential and commercial facilities have large, flat, and open rooftops that are well-suited for installations of solar panels that can help companies drastically cut their electric bills. The rooftop solar panel-based microgrids can not only generate clean electricity but will also provide an insulation barrier that can help in reducing summer cooling costs.

- With various government initiatives in this segment, the market is expected to witness further growth. For instance, in Jan 2020, as part of a DOE-funded program in conjunction with concurrent design, Pecan Street developed a residential microgrid called The Energy Switch. The program was a fast-paced, one-year development plan that included a two-month demonstration and it ended with the NREL conducting a third-party validation of performance.

- Moreover, the market is also witnessing strategic partnerships so as to increase their market reach and innovate their product. For instance, in April 2019, the Carlyle Group and Schneider Electric announced the enhancement of their partnership primarily to develop new and innovative infrastructure projects. The collaboration will result in Schneider Electric's applying its capabilities in advanced connectivity and real-time insights to current and future Carlyle infrastructure and microgrid investments.

- Furthermore, the goal of this partnership is to develop a system that is capable of taking on large-sized projects such as the JFK airport modernization project that will primarily use microgrids to transform the airport to a 100% renewable energy, as well as modular microgrid-enabled energy-as-a-service solutions for commercial and industrial customers.

- The Enterprises across the globe are witnessing loss of sales owing to the power outages, which is expected to drive the demand for microgrid services in the segment as they offer a reliable solution in case of power failures also.

North America is Expected to Hold a Significant Market Share

- The North America region is expected to hold a significant share of the market during the forecast period. The increased production rates, high-quality power requirements, and safe industrial operations are some of the factors, that are expected to drive the growth of the market. Moreover, the US Department of Energy is also empowering the development and deployment of microgrids in the country.

- The microgrids that are built on the solar and storage technology are expected to expand even more rapidly in the region as their deployment has become a part of the climate-related strategic plan at the local, state and federal levels. The US military has already deployed multiple microgrids on its military bases across the country and the Department of Defense is also actively implementing renewable-based microgrids on its multiple military bases.

- The US Navy is also expected to drive the demand for microgrids. For instance, in Dec 2019, Northern Reliability, Inc. announced that they have been selected by the Electric Power Research Institute to design and build two transportable microgrid Battery Energy Storage Systems (BESS) for the US Navy. These microgrid will primarily use solar energy and the BESS, along with the Navy's site generation, to provide emergency backup electricity to critical Navy electrical loads.

- The extreme weather conditions in the Northeastern states of US like New York and Massachusetts require an improved resistance to the power outages that microgrids can provide. The renewable energy policy has also driven microgrids in California. Moreover, California expects many more installations as the PUC is now responding to the new microgrid bill.

Microgrid-as-a-Service Industry Overview

The Microgrid as a Service Market is highly competitive owing to the presence of many large players in the market that are operating in domestic and international markets. The market appears to be moderately concentrated with the major players adopting strategies like product innovation and mergers and acquisitions primarily to expand their service offerings and expand their global reach while staying ahead of the competition. Some of the major players in the market are ABB Ltd., General Electric Company, Siemens AG, Eaton Corporation among others.

- Nov 2019 - Siemens and a renewable energy developer juwi entered into a strategic technology partnership to focus on the microgrids in the mining industry. Both the companies aim to roll-out and continuously develop the advanced microgrid control systems that will enable the seamless integration of power from renewable energy to a mine's off-grid power supply.

- Apr 2019 - Rolls-Royce Power Systems announced that they will partner with technology company ABB for the advancements in microgrid technology and advanced automation. Both the companies aims to create an energy-efficient microgrid solution for commercial and industrial companies.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET DYNAMICS

- 4.1 Market Overview

- 4.2 Market Drivers

- 4.2.1 Increasing Demand From Hospitals, Defense, and Remote Areas

- 4.2.2 High Investments from Governments

- 4.3 Market Restraints

- 4.3.1 Complexities in Managing Large-sized Microgrids

- 4.4 Industry Value Chain Analysis

- 4.5 Porters 5 Force Analysis

- 4.5.1 Threat of New Entrants

- 4.5.2 Bargaining Power of Buyers/Consumers

- 4.5.3 Bargaining Power of Suppliers

- 4.5.4 Threat of Substitute Products

- 4.5.5 Intensity of Competitive Rivalry

5 MARKET SEGMENTATION

- 5.1 Service Type

- 5.1.1 Engineering and Design Service

- 5.1.2 Software as a Service

- 5.1.3 Monitoring and Control Services

- 5.1.4 Operation and Maintenance Services

- 5.2 End-user Vertical

- 5.2.1 Government

- 5.2.2 Residential and Commercial

- 5.2.3 Industrial

- 5.3 Geography

- 5.3.1 North America

- 5.3.2 Europe

- 5.3.3 Asia Pacific

- 5.3.4 Rest of the World

6 COMPETITIVE LANDSCAPE

- 6.1 Company Profiles

- 6.1.1 ABB Ltd.

- 6.1.2 General Electric Company

- 6.1.3 Siemens AG

- 6.1.4 Eaton Corporation Inc.

- 6.1.5 Pareto Energy

- 6.1.6 Spirae, Inc.

- 6.1.7 Green Energy Corp.

- 6.1.8 Schneider Electric SE

- 6.1.9 Metco Engineering

- 6.1.10 Aggreko PLC