|

市场调查报告书

商品编码

1630338

中东和非洲的纸和纸板:市场占有率分析、行业趋势和成长预测(2025-2030)Middle East And Africa Paper And Paperboard - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

※ 本网页内容可能与最新版本有所差异。详细情况请与我们联繫。

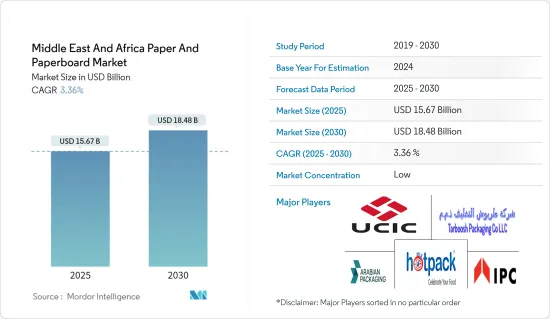

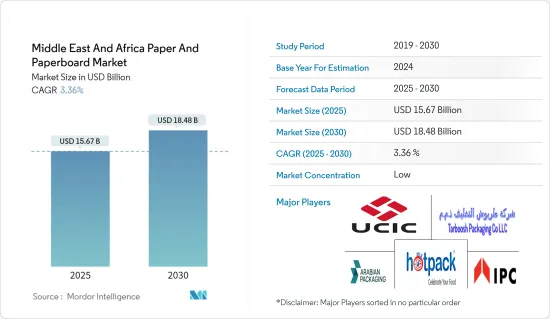

中东和非洲纸和纸板市场规模预计到2025年为156.7亿美元,预计到2030年将达到184.8亿美元,预测期内(2025-2030年)复合年增长率为3.36%。

在食品和饮料、个人护理、医疗保健和电子商务等行业成长的推动下,中东和非洲的纸和纸板包装市场预计将稳步扩张。此外,该地区的永续性努力正在推动可回收纸和纸板产品的采用。

主要亮点

- 纸浆由木材和非木材原料製成,是纸和纸板包装的生产基地。木浆的重要来源是废纸。由于其永续性和经济性,木浆已被用于纸张和纸板包装的各种最终用途行业。

- 中东永续包装产品市场正在崛起,这主要是由于减少传统包装材料碳排放的意识不断增强。根据 2030 年国家愿景,卡达政府启动了多项绿色经济计划,以遏制对不可再生资源的依赖并最大限度地减少废弃物排放。

- 与食品和饮料行业的趋势类似,随着注重健康的消费者选择杂货宅配和餐套件,食品供应商的外带偏好显着增加。此外,麦当劳等全球速食巨头正抓住环保食品包装的势头,推动市场成长。据估计,零售包装可以显着节省成本,有可能将货架补货和处理成本降低 50%。这项好处正在影响食品宅配服务,使他们更加关注环保纸质包装。

- 此外,快速的都市化和旅游业的繁荣导致游客更喜欢更安全的加工食品,刺激了对包装食品和饮料的需求。据沙乌地阿拉伯统计总局称,食品和饮料行业销售额预计将从 2020 年的 144.6 亿美元增至 2025 年的 160.3 亿美元。这种上升趋势预计将推动食品和饮料领域对永续包装解决方案的需求,例如折迭纸盒和盒子。

- 此外,电子商务的繁荣和技术进步预计将刺激运输和工业包装的成长。鑑于市场前景广阔,纸业领域的国内外投资者都热衷于加强其影响力并提高区域产品能力。网路购物需求的增加进一步凸显了人们对纸浆和纸製品日益增长的兴趣。

- 然而,对纸包装不断增长的需求面临不负责任的砍伐森林的严峻挑战。这不仅威胁纸板包装产业的原料供应,也对关键生态系统构成风险。永续的纸张生产可能导致生态劣化和社会衝突,特别是在这种做法仍然猖獗的地区。

中东和非洲纸及纸板市场趋势

电子商务成长推动了对瓦楞纸箱的需求

- 随着永续性成为整个供应链的关键议题,瓦楞包装正逐渐普及。纸浆和造纸工业正在使现代瓦楞纸板的原料更加可回收。此外,人们越来越喜欢纸板形式的保护,而不是聚苯乙烯泡沫塑胶等基于发泡聚苯乙烯的替代品。

- 电子商务的兴起彻底改变了零售业的面貌。这一趋势改变了消费行为和零售经营模式,目前正在中东地区扩张,为产业相关人员创造了重大机会。推动中东电子商务成长的关键因素包括高人均收入、强大的运输和物流网路、不断上升的网路普及率以及技术进步。

- 由于瓦楞纸箱等永续包装解决方案的环境和经济效益,国家监管机构和政府机构越来越重视它们。这项重点进一步支持市场扩张。例如,2023年7月,Apex Business Trading在阿曼萨梅尔工业城设施大楼开设了纸板工厂新分店,并同时推出了四款创新产品。

- 根据国际贸易局预测,到2025年,非洲电商用户数量预计将超过5亿人。杂货业出现了 54% 的快速成长,主要是由于大流行和随后的关闭。类似的成长趋势在各种食品配送平台中都很明显,包括杂货和快餐业。消费者对价格敏感,并经常利用线上促销和优惠券。

- 沙乌地阿拉伯雄心勃勃地将自己定位为全球电子商务的关键参与企业,旨在建立重要的国家、区域和国际影响力。国际领先的数位商务新闻媒体《Cross Border》杂誌预测,到 2027 年,沙乌地阿拉伯的线上销售成长率将维持每年 13.5% 的强劲成长率。预计到2027年,该国电子商务销售额将飙升至300亿美元,到2030年将飙升至440亿美元。电子商务的激增预计将推动对轻量、无空气瓦楞纸箱以及二级和三级包装解决方案的需求。

阿联酋预计将确认最快的市场成长

- 在阿联酋,由于食品和非食品领域终端用户行业的大幅扩张,预测期内对瓦楞纸板、折迭纸盒和瓦楞纸箱的需求将增加。由于成年人口的增长,整个研究全部区域的饮食习惯发生了明显的变化。这项变化正在增加食品领域对包装食品、新鲜蔬菜和水果的需求。

- 阿联酋的纸和纸板包装市场正在加速成长。这种快速增长归因于公众环保意识的不断增强、对永续包装解决方案的需求不断增长以及对适当包装的需求不断增长。因素包括电子商务市场的快速成长以及经济成长和人均收入增加刺激的对电子产品、家居用品和个人保健产品的需求增加。

- 为了回应一次性塑胶禁令,各行业正在转向可回收和可重复使用的包装解决方案。对生物分解性包装纸和纸板的需求不断增长,进一步推动了这个市场的扩张。一个着名的例子是 KEZAD 集团的阿布达比哈利法经济区。该公司最近宣布建立一家新工厂,专门生产再生牛皮纸大捲轴。此举使该公司的产品范围多样化,符合阿联酋对生物分解性包装材料快速成长的需求。

- 已调理食品经常使用纸盒进行二次包装。截至 2024 年 4 月,阿联酋拥有 568 家製造商和加工商(主要是中小企业)以及该领域的 2,000 多家製造公司。值得注意的是,阿联酋的食品加工产业能够满足国内需求以及区域和全球市场的需求。

- 线上食品配送服务和外带的成长预计也将支持该国对纸包装产品的需求。食品零售是阿联酋第四大电子商务领域。食品电子商务是指零售商和餐厅在网路上销售的产品,例如杂货、包装食品和已调理食品。根据美国农业部对外农业服务局预测,2023年阿联酋食品电商零售额将从6.41亿美元增加到10.72亿美元。由于对折迭纸盒和食品包装盒等产品的需求不断增加,预计未来一段时间也会出现这种增长。

中东和非洲纸和纸板行业概况

中东和非洲的纸和纸板市场是细分的。它由多家领先公司组成,包括 International Packaging Company LLC、Arabian Packaging Co、United Carton Industries Company 和 Hotpack Packaging Industries。永续性意识的供应商正在利用策略合作计划和收购作为竞争优势,并加强其产品线,以进一步扩大基本客群并获得市场占有率。

其他好处

- Excel 格式的市场预测 (ME) 表

- 3 个月分析师支持

目录

第一章简介

- 研究假设和市场定义

- 调查范围

第二章调查方法

第三章执行摘要

第四章市场洞察

- 市场概况

- 产业价值链分析

- 产业吸引力-波特五力分析

- 新进入者的威胁

- 买方议价能力

- 供应商的议价能力

- 替代品的威胁

- 竞争公司之间的敌对关係

第五章市场动态

- 市场驱动因素

- 对轻量、可持续材料的需求不断增长

- 电子商务的成长创造了对各种纸和纸板包装的需求

- 市场限制因素

- 原料成本上涨

第六章 市场细分

- 依产品类型

- 折迭式纸盒

- 瓦楞纸箱

- 其他的

- 按最终用户产业

- 食物

- 饮料

- 医疗保健

- 个人护理

- 电

- 其他的

- 按国家/地区

- 阿拉伯聯合大公国

- 沙乌地阿拉伯

- 埃及

- 摩洛哥

- 南非

- 奈及利亚

第七章 竞争格局

- 公司简介

- International Packaging Company LLC

- Arabian Packaging Co. LLC

- United Carton Industries Company(UCIC)

- Tarboosh Packaging Co. LLC

- Hotpack Packaging Industries LLC

- International Paper

- Al Rumanah Packaging

- Green Packaging Boxes Ind LLC

- Matco Packaging LLC

- Global Carton Boxes Manufacturing LLC

第八章 市场机会及未来趋势

The Middle East And Africa Paper And Paperboard Market size is estimated at USD 15.67 billion in 2025, and is expected to reach USD 18.48 billion by 2030, at a CAGR of 3.36% during the forecast period (2025-2030).

Driven by the growth of industries like food and beverages, personal care, healthcare, and e-commerce, the MEA paper and paperboard packaging market is poised for steady expansion. Additionally, the region's commitment to sustainability is boosting the adoption of recyclable paper and paperboard products.

Key Highlights

- Pulp, derived from wood and non-wood materials, is the foundation for producing paper and paperboard packaging. A significant source of wood pulp comes from recycled paper. Given its sustainability and affordability, wood pulp has become the go-to choice for various end-use industries in paper and paperboard packaging.

- In the Middle East, the market for sustainable packaging products is on the rise, primarily due to heightened awareness about reducing the carbon footprint of conventional packaging materials. In alignment with its National Vision 2030, the Qatari government has initiated multiple green economy programs to curtail reliance on non-renewable resources and minimize waste output.

- Similar to trends in the food and beverage sector, a surge in health-conscious consumers opting for grocery delivery and meal kits has led to a notable uptick in take-out preferences among food suppliers. Furthermore, global fast-food giants like McDonald's are seizing the momentum of eco-friendly food packaging, propelling market growth. Retail-ready packaging offers significant cost savings, with estimates suggesting a potential 50% reduction in shelf restocking and handling costs. This advantage has influenced food delivery services and heightened their focus on environmentally friendly, paper-based packaging.

- Moreover, rapid urbanization and a boom in tourism, with visitors prioritizing safer processed foods, have spurred the demand for packaged food and beverages. According to the General Authority for Statistics in Saudi Arabia, the food and beverage sector's revenue is projected to rise from USD 14.46 billion in 2020 to an estimated USD 16.03 billion by 2025. This upward trajectory is set to boost the demand for sustainable packaging solutions, like folding cartons and boxes, in the food and beverage domain.

- Furthermore, the e-commerce boom and technological advancements will likely spur growth in transport and industrial packaging. Given the market's promising outlook, domestic and international investors in the paper-based sector are keen on bolstering their presence and enhancing regional product capacity. The uptick in online shopping demand further underscores the rising interest in pulp and paper products.

- However, the burgeoning demand for paper packaging faces a daunting challenge: irresponsible deforestation. This not only threatens the paperboard packaging industry's raw material supply but also poses risks to vital ecosystems. Unsustainable practices in paper production can lead to ecosystem degradation and even social conflicts, especially in regions where such practices are still rampant.

Middle East And Africa Paper And Paperboard Market Trends

Demand For Corrugated Boxes Backed By E-commerce Growth

- As sustainability becomes a pivotal concern across the supply chain, corrugated packaging is gaining traction. The pulp and paper industry's advancements in producing modern containerboards from raw materials enhance its recyclability. Moreover, there's a growing preference for corrugated protective formats over polymer-based alternatives like foams.

- The rise of e-commerce has reshaped the retail landscape. This trend, which has altered consumer behavior and retail business models, is now expanding in the Middle East, presenting substantial opportunities for industry stakeholders. Key drivers fueling e-commerce growth in the Middle East include high per capita income, robust transportation and logistics networks, rising internet penetration, and technological advancements.

- Regulatory and governmental bodies nationwide are increasingly prioritizing sustainable packaging solutions, such as corrugated boxes, for their environmental benefits and financial advantages. This emphasis is further propelling market expansion. For example, in July 2023, Apex Business Trading inaugurated a new branch of its Corrugated Boxes Factory at the Facility Building in Samail Industrial City, Oman, and simultaneously launched four innovative products.

- According to the International Trade Administration, Africa is projected to have over 500 million e-commerce users by 2025. The grocery sector witnessed a 54% surge, primarily driven by the pandemic and subsequent lockdowns. Similar growth trends were evident across various food delivery platforms, encompassing both the grocery and fast food sectors. Consumers displayed price sensitivity, often capitalizing on online promotions and coupons.

- Saudi Arabia is ambitiously positioning itself as a key player in the global e-commerce landscape, aiming to establish a significant national, regional, and international presence. Cross Border Magazine, a prominent international digital commerce news outlet, projects Saudi Arabia's online revenue growth to maintain a robust annual rate of 13.5% through 2027. E-commerce sales in the kingdom are anticipated to soar to USD 30 billion by 2027, further escalating to USD 44 billion by 2030. This surge in e-commerce engagement is expected to drive demand for lightweight, air-free corrugated boxes and secondary and tertiary packaging solutions.

United Arab Emirates is Expected Witness the Fastest Market Growth

- As end-user industries expand significantly in the food and non-food sectors in the United Arab Emirates, the demand for containerboard, folding cartons, and corrugated boxes will rise during the forecast period. Changing food habits, driven by a growing adult population, are evident across the studied regions. This shift has intensified the food sector's demand for packaged foods, fresh vegetables, and fruits.

- The paper and paperboard packaging market in the United Arab Emirates is witnessing accelerated growth. This surge can be attributed to heightened environmental awareness among the populace, a rising demand for sustainable packaging solutions, and the need for appropriate packaging. Contributing factors include the burgeoning e-commerce market and an uptick in demand for electronic goods, household items, and personal care products, all spurred by economic growth and increasing per capita incomes.

- In light of the ban on single-use plastics, industry players are pivoting towards recyclable and reusable packaging solutions. The growing appetite for biodegradable packaging papers and boards further fuels this market expansion. A notable example is Khalifa Economic Zones Abu Dhabi (KEZAD Group), which recently announced the establishment of a new plant dedicated to producing recycled Kraft Paper Jumbo reels. This move diversifies the company's product offerings and aligns with the surging demand for biodegradable packaging materials in the United Arab Emirates.

- Ready-to-eat meal products prominently utilize cartons as their secondary packaging. Data from the USDA's Foreign Agricultural Service highlights the robust food and beverage landscape in the United Arab Emirates; as of April 2024, the country boasted 568 manufacturers and processors in this sector, predominantly small to medium-sized enterprises, and over 2,000 manufacturing companies. Notably, the United Arab Emirates's food processing sector caters to domestic needs and regional and global markets.

- Also, the growth in online food delivery services and takeaways would bolster the country's demand for paper packaging products. Food retail is the fourth largest e-commerce segment in the United Arab Emirates. Food e-commerce refers to items sold online from retailers or restaurants, whether groceries, packaged food, or ready-to-eat meals. According to the USDA Foreign Agricultural Service, the retail value of food e-commerce in the United Arab Emirates increased from USD 641 million to USD 1072 million in 2023. This growth is expected to be witnessed in the upcoming period with the rise in demand for products like folding cartons and boxes for packaging food.

Middle East And Africa Paper And Paperboard Industry Overview

The Middle East and African paper and paperboard market is fragmented. It consists of several major players, including International Packaging Company LLC, Arabian Packaging Co, United Carton Industries Company, Hotpack Packaging Industries, and others. Vendors with a focus on sustainability are enhancing the product line, leveraging strategic collaborative initiatives and acquisitions as a competitive advantage to expand their customer base further and gain market share.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET INSIGHTS

- 4.1 Market Overview

- 4.2 Industry Value Chain Analysis

- 4.3 Industry Attractiveness - Porter's Five Forces Analysis

- 4.3.1 Threat of New Entrants

- 4.3.2 Bargaining Power of Buyers

- 4.3.3 Bargaining Power of Suppliers

- 4.3.4 Threat of Substitute Products

- 4.3.5 Intensity of Competitive Rivalry

5 MARKET DYNAMICS

- 5.1 Market Drivers

- 5.1.1 Growing Demand for Lightweight and Sustainable Materials

- 5.1.2 Increasing Growth of E-commerce Creates Demand for Various Paper and Paperboard Packaging Types

- 5.2 Market Restraint

- 5.2.1 Increasing Costs of Raw Materials

6 MARKET SEGMENTATION

- 6.1 By Product Type

- 6.1.1 Folding Cartons

- 6.1.2 Corrugated Boxes

- 6.1.3 Other Product Types

- 6.2 By End-user Industry

- 6.2.1 Food

- 6.2.2 Beverage

- 6.2.3 Healthcare

- 6.2.4 Personal Care

- 6.2.5 Electrical

- 6.2.6 Other End-user Industries

- 6.3 By Country

- 6.3.1 United Arab Emirates

- 6.3.2 Saudi Arabia

- 6.3.3 Egypt

- 6.3.4 Morocco

- 6.3.5 South Africa

- 6.3.6 Nigeria

7 COMPETITIVE LANDSCAPE

- 7.1 Company Profiles

- 7.1.1 International Packaging Company LLC

- 7.1.2 Arabian Packaging Co. LLC

- 7.1.3 United Carton Industries Company (UCIC)

- 7.1.4 Tarboosh Packaging Co. LLC

- 7.1.5 Hotpack Packaging Industries LLC

- 7.1.6 International Paper

- 7.1.7 Al Rumanah Packaging

- 7.1.8 Green Packaging Boxes Ind LLC

- 7.1.9 Matco Packaging LLC

- 7.1.10 Global Carton Boxes Manufacturing LLC