|

市场调查报告书

商品编码

1630341

工业测量仪器 -市场占有率分析、产业趋势/统计、成长预测(2025-2030)Industrial Metrology - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

价格

※ 本网页内容可能与最新版本有所差异。详细情况请与我们联繫。

简介目录

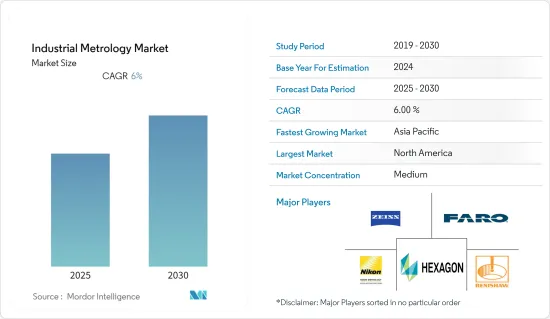

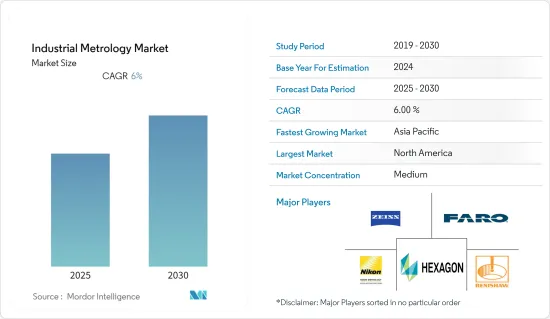

工业测量设备市场预计在预测期内复合年增长率为 6%

主要亮点

- 此外,BMW还开发了一种创新的全自动线上测量单元,用于品管。这种新型在线多测量单元透过将测量过程整合到生产流程中来简化此步骤,并且如果需要,可以 24/7运作。这个线上测量单元配备了四个机器人和包括雷射雷达在内的创新测量方法。

- 3D测量解决方案、可携式CMM、机器人安装的光学CMM扫描仪、云端基础的软体应用平台和尺寸测量服务等新兴市场的发展导致了市场的快速成长。例如,2021年10月,蔡司确认收购美国着名的GOM 3D非接触式测量解决方案供应商Capture 3D。 Capture 3D 提供 3D 计量解决方案,协助客户大幅改善其产品设计、製造、品管和生产流程。

- 整个製造价值链中越来越多地采用支援物联网的感测器也推动了测量过程的进步。 2021 年,乌尔姆大学医疗仪器雷射技术实验室 (ILM) 开发了一种特殊感测器,可缩短测量时间并减少环境影响。它使用多波长数位全像术和相关实现,允许在一张影像中收集漫反射和镜面表面的全区域地形资料。

- 此外,COVID-19大流行以及世界各地政府和企业采取的措施正在加速产业的数位转型。这些措施包括增加数位转型计划的预算。然而,计量作为其核心要素之一的基础设施的发展速度并不平衡。

- 由于新冠肺炎 (COVID-19) 疫情的爆发,工作环境经过重新设计,需要物理分散,从而减少了员工在一起的时间。这强烈要求行业变得更加敏捷。因此,未来几年全球对工业测量设备的需求预计将增加。这种病毒的全球影响正在推动虚拟和线上工具的发展,并可能进一步推动工业测量市场的成长。

工业测量设备市场趋势

汽车产业预计将占据最大份额

- 随着汽车製造迅速转向自动化设备,汽车产业预计将在预测期内发生重大演变。对可靠、高品质工艺的需求以及对电动车不断增长的需求预计将推动显着增长。

- 印度投资网格显示,价值 740 亿美元的汽车产业预计到 2026 年将达到 3,000 亿美元。印度还有四个大型汽车製造中心:北部的德里-古尔冈-法里达巴德,西部的孟买-浦那-纳西克-奥兰加巴德,南部的清奈-班加罗尔-霍苏尔,东部的詹谢普尔-加尔各答也有规划。

- 此外,汽车产业对各种零件的检验、测量和品质检查的需求不断增长,正在推动成长。汽车产业越来越多地使用光学测量系统和座标测量机 (CMM) 来取代传统的应变计、加速计、感测器和引伸计,以提高车辆的安全性和舒适性。此外,根据丰业银行的数据,2021年全球汽车销量为6,670万辆,预计到2022年将增至6,690万辆,这将推动未来研究市场的成长。

- 汽车技术的进步提高了零件的精度。汽车中的每个座椅、车门、面板和零件都必须精确对齐,以提高乘客的安全性、舒适度和满意度。为了检查和评估机械设备的对准而进行公差测量的需求也推动了对计量服务的需求。此外,据 Ola Electric 称,印度将于 2024 年开始生产续航里程为 500 公里的电动车。该计划是印度有史以来最大的汽车项目。

- 从离线品质检测到近线和线上测量技术的转变使得汽车领域的采样率更高,检测时间更短,从而推动了汽车行业工业测量设备市场的成长。

亚太地区成长最快

- 预计在预测期内,亚太地区将占据工业测量设备市场的最大份额。亚太地区的成长是由该地区不断增长的汽车和製造业推动的。当地公司不断的技术进步也推动了市场的成长。

- 此外,亚太国家政府对研发的大量资金和广泛的工业基础是该地区工业测量设备市场的关键推动因素。中国、韩国和日本是对该地区市场成长做出贡献的主要国家。

- 此外,2021年8月,海克斯康与印度中央製造技术实验室(CMTI)合作建立了工业4.0卓越和体验中心、智慧製造开发和演示单元(CMTI),这是一个工业4.0卓越和体验中心位于印度班加罗尔的CMTI 中心)成立。

- 工业和发电应用预计将推动亚太地区计量服务市场的发展。计量服务用于各种发电应用,包括水平机械轴承、主轴、铸件、涡轮机、顶部对准、涡旋箱形状和组装以及其他应用。

- 莫迪在另一场权衡会议上强调了印度在提高「印度製造」宣传活动中提供的产品品质方面所做的努力,并呼吁政府提高区域产业的品管标准。 2021年1月,国家标准化与计量体系的建立,是成为未来产业区域和全球枢纽、各产业全球市场目标的重要支撑和组成部分。

工业测量设备产业概况

工业测量设备市场竞争激烈,参与企业众多。市场集中度中等,主要企业采取产品创新、併购等策略。此外,每家公司都在采取多项成长和扩大策略,以获得市场竞争优势。

- 2022 年 8 月 - 3D 扫描和检测解决方案领先开发商 LMI Technologies (LMI) 宣布正式发布其最新 4K+ 解析度智慧 3D 雷射线轮廓感测器 Gocator 2600 系列。这些工厂校准的传感器具有自订光学器件和强大的 9 兆像素成像器,适用于电池检查、建筑材料、汽车、橡胶和轮胎製造以及一般工厂自动化,每个配置文件有 4,200 个资料点,用于高解析度3D 扫描和检查。

- 2022 年 3 月 - Hexagon AB 宣布收购 ETQ,后者是基于 SaaS 的品管系统 (QMS)、环境、健康和安全软体以及合规管理软体的供应商。该公司将作为海克斯康製造智慧部门的一部分运作。 ETQ Reliance 是 ETQ 的多租户 QMS 软体,为自动收集和分发製造品管资料、不合格报告和客户回馈提供了资料骨干。

其他好处

- Excel 格式的市场预测 (ME) 表

- 3 个月分析师支持

目录

第一章简介

- 研究假设和市场定义

- 调查范围

第二章调查方法

第三章执行摘要

第四章市场洞察

- 市场概况

- 产业吸引力-波特五力分析

- 供应商的议价能力

- 买方议价能力

- 新进入者的威胁

- 替代品的威胁

- 竞争公司之间的敌对关係

- 产业价值链分析

- 评估 COVID-19 对工业测量设备市场的影响

第五章市场动态

- 市场驱动因素

- 巨量资料分析的兴起

- 采用云端服务整合测量资料

- 新兴国家对汽车的需求不断成长

- 市场问题

- 安装称重设备高成本

- 缺乏有效处理称重系统的专业知识

第六章 市场细分

- 按类型

- 硬体

- 软体

- 按服务

- 按设备

- 三坐标测量机

- 光学数位转换器和扫描仪

- 测量仪器

- X光/电脑断层扫描器

- 自动光学检定

- QR 图装置

- 按用途

- 逆向工程

- 品管和检验

- 绘图和建模

- 其他的

- 按最终用户产业

- 航太/国防

- 车

- 製造业

- 半导体

- 其他的

- 按地区

- 北美洲

- 欧洲

- 亚太地区

- 其他的

第七章 竞争格局

- 公司简介

- Hexagon AB

- Renishaw PLC

- FARO Technologies

- Nikon Metrology

- Carl Zeiss AG

- Jenoptik AG

- Perceptron

- Automated Precision Inc.

- KLA Corporation

- Applied Materials Inc.

第八章投资分析

第9章市场的未来

简介目录

Product Code: 69398

The Industrial Metrology Market is expected to register a CAGR of 6% during the forecast period.

Key Highlights

- Furthermore, BMW has developed an innovative, fully automated inline measurement cell for quality control. This new inline multiple measurement cell streamlines this phase by integrating the measurement process into the production flow and can operate 24/7 if required. The inline measurement cell features four robots and a range of innovative measurement methods, including Laser Radar.

- The development of 3D measurement solutions, portable CMM, robot-mounted optical CMM scanners, cloud-based software application platforms, and dimensional metrology services led to high growth in the market. For instance, in October 2021, ZEISS confirmed the acquisition of Capture 3D, a prominent GOM 3D non-contact measuring solutions provider based in the USA. Capture 3D delivers 3D measurement solutions to help customers significantly improve product design, manufacturing, quality control, and production processes.

- The growing adoption of IoT-enabled sensors across the manufacturing value chain also brings advancements in the measuring process. In 2021, the Institute for Laser Technologies in Medicine and Metrology (ILM) at the University of Ulm developed a special sensor for short measurement times and environmental influences. It uses multi-wavelength digital holography, and allied implementation allows the collection of topographic data of an entire area for diffuse and specular reflective surfaces within one image.

- Furthermore, the COVID-19 pandemic and the measures taken by governments and businesses around the world have accelerated the digital transformation of industries. These measures include increased budgets for digital transformation projects. However, the pace of infrastructure evolution, which forms metrology as one of its core elements, has not been balanced.

- Due to the COVID-19 outbreak, the work environments were redesigned with fewer workers spending less time collaboratively due to physical-distancing requirements. This created an acute need for industries to be more agile. Hence, the demand for industrial metrology is expected to increase globally over the coming years. The worldwide impact of this virus is pushing virtual and online tools, which may further boost the growth of the industrial metrology market.

Industrial Metrology Market Trends

Automotive Industry is Expected to Hold the Largest Share

- The automotive sector is expected to witness a major evolution during the forecast period, as automobile manufacturing is quickly moving to automated facilities. The need for highly reliable and quality processes and the rising demand for electric vehicles are expected to drive major growth.

- According to India Investment Grid, the USD 74 Billion Automobile industry is expected to reach USD 300 Billion by 2026. In addition, India is also planning to host four large auto manufacturing hubs in Delhi-Gurgaon-Faridabad in the North and Mumbai-Pune-Nashik-Aurangabad in the West, Chennai- Bengaluru-Hosur in the South, and Jamshedpur-Kolkata in the East.

- Moreover, the rising need for inspection, measurement, and quality checks of various components in the automotive sector is driving growth. The automotive industry has increasingly used optical measurement systems and coordinate measuring machines (CMM) instead of conventional strain gauges, accelerometers, transducers, and extensometers to improve vehicles' safety and comfort. In addition, according to Scotiabank, 66.7 million cars were sold worldwide in 2021. and it has expected to rise by 66.9 million units in 2022, which will drive studied market growth in the future.

- Technological advancements in automobiles are resulting in an increased level of precision of components. Every seat, door, panel, and component in an automobile must be precision aligned to promote passenger safety, comfort, and satisfaction. The necessity of tolerance measurement to inspect and assess equipment alignment on machinery is also driving the demand for metrology services. Furthermore, production of electric vehicles with a 500 km range will begin in India in 2024, according to Ola Electric. The project is the largest automobile undertaking ever in India.

- The shift in preference from off-line quality inspection to near-line or in-line measurement techniques, enabling higher sampling rates and shorter inspection times in the automotive sector, is driving the growth of the industrial metrology market for the automotive industry.

Asia Pacific to Register the Fastest Growth

- The Asia Pacific is expected to account for the largest share in the industrial metrology market during the forecast period. The growth in the Asia-Pacific is attributed to the region's growing automotive and manufacturing sectors. Also, continuous technological advancements by regional companies are propelling the market's growth.

- Moreover, large funding from governments of various Asia-Pacific countries in R&D and extensive industrial bases are the major contributors to the regional industrial metrology market. China, South Korea, and Japan are the major countries contributing to the market growth in the region.

- Further, in August 2021, Hexagon partnered with India's Central Manufacturing Technology Institute (CMTI) to establish a Smart Manufacturing Development and Demonstration Cell (SMDDC), an Industry 4.0 Centre of Excellence and Experience Centre, at the CMTI premises in Bengaluru, India.

- The industrial and power generation applications are expected to drive the metrology services market in Asia-Pacific. Metrology services are used in different power generations, including horizontal machine bearing, main shaft, casting, turbines, tops-off alignment, scroll case geometry and assembly, and other applications.

- In additional Metrology Conclave, Narendra Modi emphasized the country's operation toward improving the quality of products supplied under the Make In India campaign, government participation has been extended concerning improving quality control standards within regional industries. In January 2021, at the Nationgn. Establishing a national standardization and metrology system is a key supporter and essential part of the goal to become a regional and global hub for future industries and a global market for various industries.

Industrial Metrology Industry Overview

The industrial metrology market is competitive, owing to the presence of many players. The market is moderately concentrated, with the major players applying strategies like product innovations and mergers and acquisitions. Also, companies are involved in several growth and expansion strategies to gain a competitive advantage in the market.

- August 2022 - LMI Technologies (LMI), a major developer of 3D scanning and inspection solutions, has announced the official release of its latest Gocator 2600 Series of 4K+ resolution smart 3D laser line profile sensors. These factory pre-calibrated sensors come modified with custom optics and a powerful 9-megapixel imager to deliver 4200 data points per profile for high-resolution 3D scanning and inspection across broad fields of view in applications such as battery inspection, building materials, automotive, rubber and tire production, and general factory automation.

- March 2022 - Hexagon AB has announced the acquisition of ETQ, a SaaS-based quality management system (QMS), environment, health and safety software, and compliance management software. The company will operate as part of Hexagon's Manufacturing Intelligence division. ETQ's multitenant QMS software, ETQ Reliance, provides the data backbone for automating the collection and delivery of manufacturing quality control data, nonconformance reports, and customer feedback.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET INSIGHTS

- 4.1 Market Overview

- 4.2 Industry Attractiveness - Porters Five Forces Analysis

- 4.2.1 Bargaining Power of Suppliers

- 4.2.2 Bargaining Power of Buyers

- 4.2.3 Threat of New Entrants

- 4.2.4 Threat of Substitutes

- 4.2.5 Intensity of Competitive Rivalry

- 4.3 Industry Value Chain Analysis

- 4.4 Assessment of Impact of COVID-19 on the Industrial Metrology Market

5 MARKET DYNAMICS

- 5.1 Market Drivers

- 5.1.1 Rise in Big Data Analytics

- 5.1.2 Adoption of Cloud Services to Integrate the Metrological Data

- 5.1.3 Rising Demand for Automobiles in Developing Countries

- 5.2 Market Challenges

- 5.2.1 High Cost of Setting Up Metrology Facility

- 5.2.2 Lack of Expertise for Efficient Handling of Metrological Systems

6 MARKET SEGMENTATION

- 6.1 By Type

- 6.1.1 Hardware

- 6.1.2 Software

- 6.1.3 Services

- 6.2 By Equipment

- 6.2.1 Coordinate Measuring Machine

- 6.2.2 Optical Digitizer and Scanner

- 6.2.3 Measuring Instrument

- 6.2.4 X-Ray and Computed Tomography

- 6.2.5 Automated Optical Inspection

- 6.2.6 2D Equipment

- 6.3 By Application

- 6.3.1 Reverse Engineering

- 6.3.2 Quality Control & Inspection

- 6.3.3 Mapping and Modelling

- 6.3.4 Other Applications

- 6.4 By End User Industry

- 6.4.1 Aerospace and Defense

- 6.4.2 Automotive

- 6.4.3 Manufacturing

- 6.4.4 Semiconductor

- 6.4.5 Other End User Industries

- 6.5 By Geography

- 6.5.1 North America

- 6.5.2 Europe

- 6.5.3 Asia Pacific

- 6.5.4 Rest of the World

7 COMPETITIVE LANDSCAPE

- 7.1 Company Profiles

- 7.1.1 Hexagon AB

- 7.1.2 Renishaw PLC

- 7.1.3 FARO Technologies

- 7.1.4 Nikon Metrology

- 7.1.5 Carl Zeiss AG

- 7.1.6 Jenoptik AG

- 7.1.7 Perceptron

- 7.1.8 Automated Precision Inc.

- 7.1.9 KLA Corporation

- 7.1.10 Applied Materials Inc.

8 INVESTMENT ANALYSIS

9 FUTURE OF THE MARKET

02-2729-4219

+886-2-2729-4219