|

市场调查报告书

商品编码

1630346

自助结帐系统系统:市场占有率分析、产业趋势/统计、成长预测(2025-2030)Self-checkout System - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

※ 本网页内容可能与最新版本有所差异。详细情况请与我们联繫。

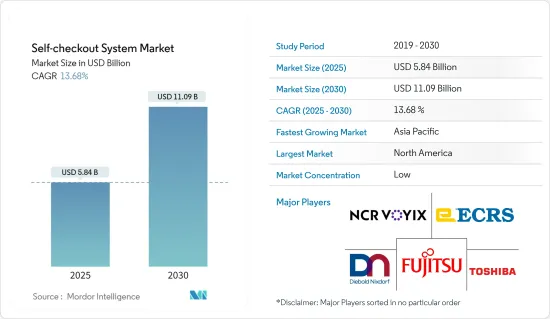

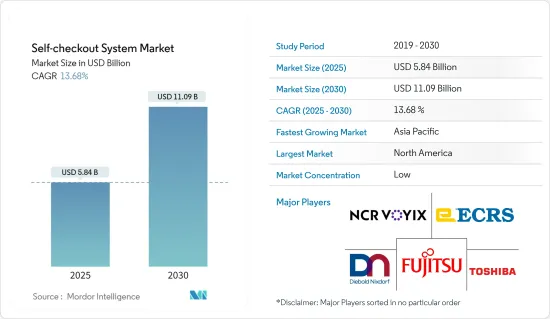

自助结帐系统系统市场规模预计到 2025 年为 58.4 亿美元,预计到 2030 年将达到 110.9 亿美元,预测期内(2025-2030 年)复合年增长率为 13.68%。

自助结帐系统设施开创了店内非接触式购物体验的新时代,符合不断变化的消费者偏好,以最大限度地减少实体互动,自助结帐系统在零售领域的发展势头越来越强劲。

主要亮点

- 在新冠肺炎 (COVID-19) 大流行期间,消费者更愿意在购物时尽量减少身体接触,而自助结帐系统站提供了方便且卫生的解决方案。这些系统允许顾客独立扫描商品并使用非接触式付款选项进行支付,从而减少与商店员工的互动。随着零售商努力满足消费者的偏好并改善整体购物体验,自助结帐系统系统的采用正在不断增长。

- 消费者越来越倾向于自助结帐系统系统,这使他们能够更好地控制店内交易。这种转变使消费者能够根据自己的喜好个性化他们的购物体验。作为回应,品牌正在将更多自助结帐系统功能整合到其行动应用程式中,以增强店内购物体验。该策略与超个性化的努力一致,并允许品牌提供客製化的促销和定价。

- 全球零售业的快速扩张极大地推动了对自助结帐系统系统的需求。为了满足消费者不断变化的需求,零售商越来越多地采用创新技术来增强购物体验。自助结帐系统系统具有多种优势,包括减少等待时间、提高客户满意度和提高业务效率。随着零售业的持续成长和竞争的加剧,对自助结帐系统系统的需求预计将保持强劲,特别是在人口不断增长和零售环境繁忙的地区。

- 然而,一些消费者(尤其是老年人)不愿采用新技术以及他们对使用自助结帐系统系统的看法对市场成长构成了挑战。此外,许多零售商还面临重大障碍,包括盗窃率上升、尖峰时段排长队阻碍消费者,以及将这些系统扩展到更多车道所需的高成本。

- 经济成长和不断变化的消费者支出模式正在推动零售业的扩张。随着经济成长,平均收入增加,导致消费者在商品和购买方面的支出增加,包括在零售商店购物。

自助结帐系统系统市场趋势

零售业是最大的最终用户

- 自助结帐系统越来越多地引入零售业,例如杂货店和便利商店,人们经常在这些行业中购买多种商品,从而刺激了市场扩张。

- 人工智慧驱动的自助结帐系统正在推动零售业的成长。 2024 年 1 月,市场参与者 Diebold Nixdorf 推出了无收银结帐系统,该系统利用人工智慧来减少损耗、验证酒类购买的年龄并加快无条码商品的交易速度。此外,迪堡利多富的技术利用电脑视觉快速辨识水果和蔬菜的种类和数量,提高会计速度。

- 2023 年 11 月,美国Met Culinary Management 宣布计划在其零售店推出非接触式结帐系统。该系统简化了结帐流程并最大限度地减少了排队时间。消费者只需将商品放入扫描器即可立即结帐。大都会队与玛丽蒙特曼哈顿学院和亚马逊合作,计划于 2024 年初首次推出「Just Walk Out」便利商店概念。此创新系统允许消费者使用信用卡或手掌识别进入商店、选择商品并无缝退出。当您离开商店时,所购买的商品将自动从您的卡中扣除。

- 总之,消费者越来越喜欢自助结帐系统系统的实体店,以避免排长队,这正在推动市场渗透。自助结帐系统系统也迎合了重视隐私的消费者,使他们能够在与店员最少互动的情况下谨慎地购买商品。此类便利商店增加了客流量,并显示未来几年零售市场的成长轨迹充满希望。

- 近年来,顾客的购物行为发生了显着变化。零售自动化的兴起和对改善客户体验的关注引导零售业拥抱各种技术进步。随着消费者寻求无缝购物体验并渴望人工智慧驱动的产品提案,自助结帐系统的采用正在迅速增加。这些对于在零售商店建立自助结帐系统动能至关重要。

- Flexera Software 表示,2023 年零售和电子商务产业的资讯科技 (IT) 支出将会增加。到 2023 年,IT 支出将占零售业企业收益的 10%,而 2022 年全球整体这一比例为 7%。

北美占最大市场占有率

- 该地区的零售商正在努力应对电子商务管道日益激烈的竞争以及不断上升的员工和房地产成本。因此,这些营运商优先考虑提高生产力和降低管理成本。

- 由于消费者对离线购买和个人产品测试的偏好不断变化,北美各地的零售连锁店越来越多地实施自助结帐系统系统。这些自助结帐系统系统不仅改善了消费者体验,还使零售商能够服务更广泛的客户群并提高竞争力。此外,美国零售业的持续进步和自动化有望推动未来几年的市场成长。

- 推动市场成长的另一个关键因素是消费者对自助服务解决方案的偏好日益增加。精通科技的消费者,尤其是美国和加拿大的购物者,要求在零售环境中获得方便、安全的自助体验。随着科技的进步,零售商迅速采用无现金自助结帐系统,无需人工干预即可实现安全的购物和结帐。

- 例如,2024 年 4 月,杂货零售商 ALDI 与 Grabango 合作,在其芝加哥郊区的商店推出了 ALDIgo,一种无需结帐的购物体验。 Grabango 的系统无缝整合到现有的 ALDI 商店,无需更改商店货架图或产品展示。该系统利用电脑视觉技术来识别和监控商店中的每件商品,使消费者无需排队等候或手动扫描所购买的商品即可退出商店。

- 此外,自助结帐系统系统的进步正在推动市场成长。製造商越来越多地将人工智慧 (AI)、机器视觉系统和吸顶摄影机等最尖端科技整合到自助结帐系统系统中,帮助零售商减少入店行窃事件。

- 与全球和地区的众多参与者合作,解决方案配备了最新技术。例如,全球智慧 POS 和自助服务解决方案领导者 Partner Tech USA Inc. 于 2024 年 7 月发布了最新的自助结帐系统软体。这个新版本配备了尖端的人工智慧功能,透过简化交易、遏制诈欺和减少客户介入的需要,改善了整体自助结帐系统体验。这种技术进步,加上该地区的广泛采用,可能会在预测期内推动所研究市场的成长。

自助结帐系统系统产业概况

自助结帐系统系统市场的竞争程度很高,预计在预测期内仍将如此。该市场由老字型大小企业在改进其产品技术方面投入了大量资金。

其中一些供应商包括 Diebold Nixdorf, Inc.、Fujitsu Limited、NCR Vendors 和 Toshiba World Commerce Solutions。新进入市场的参与者需要高水准的资本要求、创新和广告。但对于行业主要企业来说,这是理所当然的。公司可以透过强大的竞争策略(例如技术联盟、大量研发投资以及收购)来维持自身的发展。

其他好处

- Excel 格式的市场预测 (ME) 表

- 3 个月的分析师支持

目录

第一章简介

- 研究假设和市场定义

- 调查范围

第二章调查方法

第三章执行摘要

第四章市场洞察

- 市场概况

- 产业吸引力-波特五力分析

- 供应商的议价能力

- 买家/消费者的议价能力

- 新进入者的威胁

- 替代品的威胁

- 竞争公司之间的敌对关係

- 产业价值链分析

- 评估宏观经济趋势对市场的影响

第五章市场动态

- 市场驱动因素

- 加快结帐速度

- 解决新兴国家劳动力短缺问题

- 市场挑战/限制

- 不愿使用自助结帐系统系统/缺乏意识

第六章 市场细分

- 副产品

- 硬体

- 软体

- 按服务

- 按交易类型

- 现金

- 无现金

- 按型号类型

- 独立的

- 檯面

- 移动的

- 按最终用户产业

- 零售

- 娱乐

- 旅行

- 金融服务

- 卫生保健

- 其他最终用户产业

- 按地区

- 北美洲

- 欧洲

- 亚洲

- 澳洲/纽西兰

- 拉丁美洲

- 中东/非洲

第七章 竞争格局

- 公司简介

- Diebold Nixdorf, Inc.

- Fujitsu Ltd.

- NCR Corporation

- ECR Software Corporation

- Toshiba Global Commerce Solutions

- ITAB Scanflow AB

- Pan-Oston Corporation

- DXC Technology

- Slabb Kiosks

- ShelfX Inc.

- Pegasus(Pegasus Turnkey Solution(OPC)Private Limited)

- Ombori

第八章投资分析

第九章 市场机会及未来趋势

The Self-checkout System Market size is estimated at USD 5.84 billion in 2025, and is expected to reach USD 11.09 billion by 2030, at a CAGR of 13.68% during the forecast period (2025-2030).

Self-checking systems are increasingly gaining momentum in the retail sector as self-checkout facilities usher in a new era of contactless shopping experiences within the store, aligning with evolving consumer preferences for minimal physical interaction.

Key Highlights

- Consumers increasingly prefer to minimize physical contact during their shopping experience during the COVID-19 pandemic, and self-checkout stations provide a convenient and hygienic solution. These systems allow customers to independently scan items, pay using contactless payment options, and reduce interaction with store staff. As retailers strive to meet consumer preferences and enhance the overall shopping experience, the adoption of self-checkout systems is growing.

- Consumers are increasingly gravitating towards self-checkout options, allowing them to take greater control over their in-store transactions. This shift empowers consumers to personalize their shopping experiences according to their preferences. In response, brands are integrating more self-checkout features into their mobile apps, thereby enhancing the in-store journey. This strategy aligns with hyper-personalization efforts, enabling brands to offer customized promotions and pricing.

- The rapid expansion of the global retail sector is significantly driving the demand for self-checkout systems. As retailers aim to meet the evolving needs of consumers, they are increasingly adopting innovative technologies to enhance the shopping experience. Self-checkout systems offer several benefits, including reduced wait times, improved customer satisfaction, and increased operational efficiency. As the retail sector continues to grow and become more competitive, the demand for self-checkout solutions is expected to remain strong, particularly in regions with high population growth and busy retail environments.

- However, resistance from some consumers, particularly older individuals, to adopt new technology and awareness about the use of self-checkout systems challenges market growth. Additionally, many retailers face significant obstacles, including increased theft rates, long lines that deter shoppers during peak hours, and the high costs associated with expanding these systems to more lanes.

- The economic growth and shifting consumer spending patterns have driven the expansion of the retail sector. With the economic growth, the average income has increased, which has resulted in increased consumer spending on goods and purchases, including retail purchases.

Self-Checkout System Market Trends

Retail Industry to be the Largest End User

- Self-checkout systems are increasingly being deployed in bustling retail settings, such as grocery and convenience stores, where customers often buy multiple items, thereby fueling the market's expansion.

- AI-driven self-checkout systems are bolstering the growth of retail stores. In January 2024, market player Diebold Nixdorf unveiled a new technology for its cashierless registers, leveraging AI to mitigate shrinkage, verify age for liquor purchases, and expedite transactions for items without barcodes. Furthermore, Diebold Nixdorf's technology utilizes computer vision to swiftly identify produce types and quantities, enhancing the checkout speed.

- In November 2023, US-based Metz Culinary Management, Inc. announced its plans to roll out a contactless checkout system across retail locations. This system streamlines the checkout process, minimizing time spent in cashier lines. Shoppers can simply place items on a scanner for instant checkout. Metz, in collaboration with Marymount Manhattan College and Amazon, is set to debut its 'Just Walk Out' C-store concept in early 2024. This innovative system allows shoppers to enter using credit card or palm recognition, select items, and exit seamlessly. Purchases are automatically charged to their card upon leaving.

- In conclusion, consumers increasingly favor brick-and-mortar stores with self-checkout options to bypass long lines, which drives market adoption. Self-checkout systems also cater to privacy-conscious shoppers, allowing discreet purchases with minimal associate interaction. Such conveniences boost in-store foot traffic, signaling a promising growth trajectory for the retail market in the coming years.

- Customer shopping behaviors have undergone a significant transformation in recent years. The rise of retail automation and a growing emphasis on enhancing customer experiences are steering the retail sector toward embracing various technological advancements. Consumers seek seamless shopping and crave AI-driven product suggestions, fueling the surge in self-checkout systems implementations. These are pivotal in driving the momentum towards self-checkout options at retail outlets.

- According to Flexera Software, the retail & e-commerce industry witnessed increased information and technology (IT) spending in 2023. In 2023, the retail industry witnessed 10% of IT spending as a share of company revenue compared to 7% in 2022 globally.

North America Holds Largest Market Share

- Retail operators in the region grapple with challenges like escalating employee and real estate costs alongside fierce competition from e-commerce channels. Consequently, these operators are prioritizing productivity enhancements and overhead cost reductions.

- Retail store chains in the North American region are increasingly installing self-checkout systems, driven by changing consumer preferences for offline purchases and personal product testing. These self-checkout systems not only enhance the consumer experience but also allow retailers to cater to a broader customer base and gain a competitive edge. Furthermore, ongoing advancements and automation in the US retail sector are poised to bolster market growth in the coming years.

- Another pivotal factor fueling market growth is the rising consumer inclination toward self-service solutions. Particularly, tech-savvy shoppers in the US and Canada are seeking convenient, secure, and self-assisted experiences in retail environments. As technology evolves, retailers are swiftly adopting cashless self-checkout systems, enabling secure shopping and checkout without manual intervention.

- For instance, in April 2024, grocery retailer ALDI teamed up with Grabango to introduce ALDIgo, a checkout-free shopping experience, at a store in suburban Chicago. The Grabango system was seamlessly integrated into an existing ALDI store, requiring no alterations to the store's planogram or product displays. Utilizing computer vision technology, the system identifies and monitors every item in the store, enabling shoppers to leave without waiting in line or manually scanning their purchases.

- Additionally, Self-checkout systems are advancing, driving market growth. Manufacturers are increasingly integrating cutting-edge technologies like Artificial Intelligence (AI), machine vision systems, and ceiling-mounted cameras into self-checkout systems, aiding retailers in reducing shoplifting incidents.

- Along with various global and regional players, solutions are equipped with the latest technologies. For instance, in July 2024, Partner Tech USA Inc., a global leader in intelligent POS and self-service solutions, unveiled its latest self-checkout software. This new version, equipped with cutting-edge AI capabilities, streamlines transactions, curbs fraud, and reduces the need for customer intervention, thereby enhancing the overall self-checkout experience. These technological advancements, combined with their widespread adoption in the region, are set to drive the growth of the Market Studied during the forecast period.

Self-Checkout System Industry Overview

The degree of competition in the Self-Checkout System Market is high and expected to remain the same over the forecast period. The market consists of long-standing established players who have made significant investments to improve product technology.

Some of the vendors include Diebold Nixdorf, Inc., Fujitsu Ltd, NCR Voyix Corporation, and Toshiba Global Commerce Solutions, among others. The new players entering the market require a high level of capital requirement, technology innovation, and advertising. However, this is quite simple for the key players in the industry. The companies can sustain themselves through powerful competitive strategies like technological collaborations, extensive investments in R&D, and acquisitions.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET INSIGHTS

- 4.1 Market Overview

- 4.2 Industry Attractiveness - Porter's Five Forces Analysis

- 4.2.1 Bargaining Power of Suppliers

- 4.2.2 Bargaining Power of Buyers/Consumers

- 4.2.3 Threat of New Entrants

- 4.2.4 Threat of Substitute Products

- 4.2.5 Intensity of Competitive Rivalry

- 4.3 Industry Value Chain Analysis

- 4.4 Assessment of the Impact of Macroeconomic Trends on the Market

5 MARKET DYNAMICS

- 5.1 Market Drivers

- 5.1.1 Increased Speed of Checkout

- 5.1.2 Addressal of the Labor Shortage Issues Across the Emerging Countries

- 5.2 Market Challenges/Restraints

- 5.2.1 Reluctance/Lack of Awareness to Use Self-Checkout Systems

6 MARKET SEGMENTATION

- 6.1 By Offering

- 6.1.1 Hardware

- 6.1.2 Software

- 6.1.3 Services

- 6.2 By Transaction Type

- 6.2.1 Cash

- 6.2.2 Cashless

- 6.3 By Model Type

- 6.3.1 Standalone

- 6.3.2 Countertop

- 6.3.3 Mobile

- 6.4 By End-user Industry

- 6.4.1 Retail

- 6.4.2 Entertainment

- 6.4.3 Travel

- 6.4.4 Financial Services

- 6.4.5 Healthcare

- 6.4.6 Other End-user Industries

- 6.5 By Geography

- 6.5.1 North America

- 6.5.2 Europe

- 6.5.3 Asia

- 6.5.4 Australia and New Zealand

- 6.5.5 Latin America

- 6.5.6 Middle East and Africa

7 COMPETITIVE LANDSCAPE

- 7.1 Company Profiles

- 7.1.1 Diebold Nixdorf, Inc.

- 7.1.2 Fujitsu Ltd.

- 7.1.3 NCR Corporation

- 7.1.4 ECR Software Corporation

- 7.1.5 Toshiba Global Commerce Solutions

- 7.1.6 ITAB Scanflow AB

- 7.1.7 Pan-Oston Corporation

- 7.1.8 DXC Technology

- 7.1.9 Slabb Kiosks

- 7.1.10 ShelfX Inc.

- 7.1.11 Pegasus (Pegasus Turnkey Solution (OPC) Private Limited)

- 7.1.12 Ombori