|

市场调查报告书

商品编码

1630350

气雾阀:市场占有率分析、产业趋势、成长预测(2025-2030)Aerosol Valve - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

价格

※ 本网页内容可能与最新版本有所差异。详细情况请与我们联繫。

简介目录

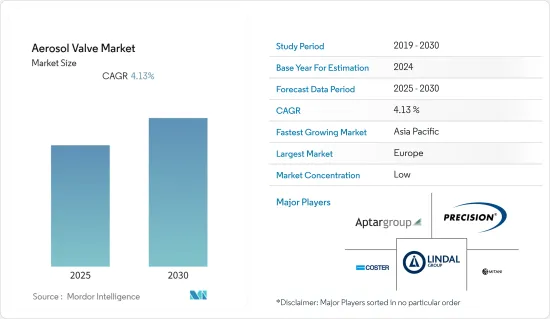

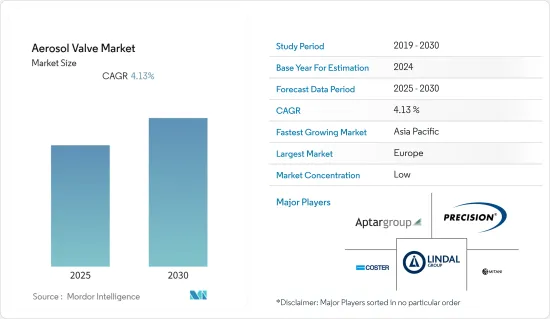

气雾剂阀门市场预计在预测期内复合年增长率为 4.13%

主要亮点

- 气喘吸入器和其他类型喷雾剂等产品在医疗行业的渗透率提高,消费者生活方式的持续改善,个人护理和化妆品行业对气雾阀的需求增加,360 度应用由于相对面积覆盖,材料消耗减少25%预计在预测期内也将增加对气雾剂阀门的需求。

- 由于製造商众多,用于製造气雾阀的零件(例如垫片、密封件、弹簧和汲取管)非常广泛。此外,产品差异化程度较低,因此很容易以低成本更换供应商。这些综合效应降低了供应商的议价能力,进而影响阀门的整体定价。

- 由于城市人口的增加和收入的增加,新兴国家的汽车製造业正在经历显着增长。新兴经济体的柴油和汽油汽车向电动和混合动力汽车汽车的更换率很高,推动了对气雾阀的需求。然而,气雾剂阀门市场的成长预计将受到气雾剂製造和与容器内内容物成分相关的产品安全法规的阻碍。

- 供应商依靠伙伴关係和产品创新来维持其市场地位。 Coster Group 是第一家符合化妆品 GMP 的气雾剂阀门和致动器製造商,符合业界最高的製造和服务标准。 Coster Group 的三个义大利工厂已获得 UNI EN ISO 22716:2008 化妆品 GMP 认证。

- 由于医疗领域的需求激增以及世界各地监管机构维持稳定供应的支持,COVID-19 疫情对气雾剂阀门产业产生了积极影响。然而,由于生产活动完全暂停,汽车等其他领域的需求有所下降。

气雾阀市场趋势

个人护理领域预计将占据主要市场占有率

- 新兴市场人口可支配收入的增加以及製造商对便利包装偏好的改变是推动气雾剂阀门市场的一些因素。气雾阀是用于包装除臭剂、乳霜和身体霜、刮鬍泡、香水等各种产品的气雾罐,广泛应用于个人护理行业。

- 根据 Aerobal 的数据,化妆品产业仍然是铝气雾罐最重要的市场,占全球总产量的近 85%。除臭剂和香水是主要产品,每生产两罐就占60%的市场占有率,其次是髮胶喷雾、造型慕丝和其他化妆品。铝气雾罐的快速成长将导致工业气雾阀的需求增加。

- 美国对个人保健产品的需求及其对全球数量的贡献明显更高。美国是继欧洲国家之后最大的化妆品和个人保健产品消费量,FDA对进口产品进行监管和检查。由于这些因素,儘管除臭剂和髮胶喷雾等产品的需求出现波动,但预计该国仍将推动市场成长。

- 此外,参与企业正在投资阀门技术以实现永续性并响应市场成长。 2021 年 7 月,Williams Advanced Engineering 与 Salford Valve Company Ltd (Salvalco) 合作,支援并开发颠覆性气雾剂阀门技术。近年来,Salvalco 从 Foresight Group LLP 与 Williams Advanced Engineering (WAE) 合作管理的投资基金中获得了超过 300 万欧元的资金。

预计欧洲将占据最大市场占有率

- 在欧洲,医疗、个人护理和汽车等各领域对气雾阀有大量需求。 Global Web Index 对 2,300 多名经常购买天然化妆品和个人保健产品的英国网路使用者进行的一项调查发现,据我了解,大约 80% 的人表示他们在购买时会考虑到环境和健康。

- 根据欧洲气雾剂联合会 (FEA) 的数据,英国、德国和法国的气雾剂市场占有率占欧洲所有领域气雾剂年产量的 60% 以上,推动了该地区气雾剂阀门的成长机会。

- 就气雾剂生产而言,个人护理领域拥有最大的市场占有率,占 57%,其次是油漆、清漆、食品、药品和化学品。由于气雾阀在这些罐中的广泛使用,气雾阀在该地区也在同步成长。

- 由于政府对废旧罐头的收集和回收有严格的规定,该行业遵循最佳的业务链来遵守法规。例如,欧洲成员国必须开发废旧包装的回收和回收系统,并实现包装废弃物中 80% 钢和 60% 铝的最低迴收目标。这将促进气雾剂阀门的回收,并透过克服上述市场限制因素来实现可持续的市场成长。

气雾剂阀门产业概况

由于存在多个供应商,气雾剂阀门市场呈现零碎化。主要参与企业包括 Aptar Group、Precision Valve Corporation 和 Coster Tecnologie Speciali。市场上也出现了多种产品发布、合作和伙伴关係。

- 2021 年 12 月 - 作为其永续性计画的一部分,拜尔斯道夫为妮维雅 Ecocodeo 产品线引入了更气候友善的气雾阀系统,并为整个妮维雅男士产品线引入了 100% 再生铝罐。此外,该公司表示将为欧洲市场提供采用环保永续包装的除臭剂和刮鬍凝胶系列。

其他好处

- Excel 格式的市场预测 (ME) 表

- 3 个月分析师支持

目录

第一章简介

- 研究假设和市场定义

- 调查范围

第二章调查方法

第三章执行摘要

第四章市场洞察

- 市场概况

- 产业价值链分析

- 产业吸引力-波特五力分析

- 供应商的议价能力

- 买方议价能力

- 新进入者的威胁

- 替代品的威胁

- 竞争公司之间敌对关係的强度

- 评估 COVID-19 对产业的影响

第五章市场动态

- 市场驱动因素

- 化妆品及护业需求旺盛

- 转向易于处理和方便的包装

- 市场限制因素

- 严格的政府法规

第六章 市场细分

- 类型

- 连续式

- 定量的

- 最终用户产业

- 个人护理

- 居家医疗

- 医疗保健

- 汽车工业

- 其他的

- 地区

- 北美洲

- 欧洲

- 亚太地区

- 拉丁美洲

- 中东/非洲

第七章 竞争格局

- 公司简介

- Aptargroup

- The Precision Valve Corporation

- Coster Tecnologie Speciali

- Lindal Group Holding GmbH

- Mitani Valve

- Summit Packaging Systems

- Clayton Corp.

- Newman Green

- Koh-I-Noor Mlada Vozice AS

- Salvalco

- Majesty Packaging Systems Limited

- Shanghai Sunhome Industrial Company

- EC Pack Industrial Limited

- C. Ehrensperger Ag.

- Aroma Industries

- Seugn Il Corporation

- Yingbo Aerosol Valve(Zhongshan)Co., Ltd.

- Guangzhou Zhongpin Aerosol Valves Co., Ltd

- Maruichi Co. Ltd

第八章投资分析

第9章市场的未来

简介目录

Product Code: 69644

The Aerosol Valve Market is expected to register a CAGR of 4.13% during the forecast period.

Key Highlights

- Increasing product penetration in the healthcare industry for products, such as asthma inhalers and other types of sprays, continuously improving consumer lifestyle backing the demand from the personal care and cosmetic industry for aerosol valves, which enable the application in 360 degrees and consume 25% less substance for the relative area coverage is also expected to boost the demand for aerosol valves over the forecast period.

- The components used for manufacturing aerosol valves, such as gaskets, seals, springs, and dip tubes, are available in abundance owing to the presence of many manufacturers. In addition, low product differentiation enables easy supplier switching at a low cost. The combined effect of this has resulted in the low bargaining power of suppliers and thus has an impact on the overall pricing of valves.

- Due to the rise in urban population, which is increasing income, the automotive manufacturing is witnessing tremendous growth in emerging economies. In developed economies, there is a high replacement rate of diesel/petrol cars with electric or hybrid cars, propelling the demand for aerosol valves. However, aerosol valve market growth is expected to be hampered by regulations imposed on aerosol manufacturing and product safety related to the composition of the contents inside the containers.

- Vendors rely on partnerships and product innovations to remain relevant in the market. Coster Group was the first aerosol valve and actuator manufacturer to comply with cosmetic GMPs, meeting the industry's highest manufacturing and service standards. It obtained the UNI EN ISO 22716:2008 certification on cosmetic Good Manufacturing Practices (GMPs) for three Italian plants.

- The outbreak of COVID -19 has had a positive impact on the aerosol valve industry due to a sudden increase in the demand from the healthcare sector and support from regulatory bodies across the globe to maintain a steady supply. Though the demand from other sectors, such as automotive, has lowered due to a complete halt in production activities.

Aerosol Valve Market Trends

Personal Care Segment is Expected to Hold a Significant Market Share

- An increase in disposable income of the population in developing countries and changes in preferences of manufacturers for convenient packaging are some of the factors driving the aerosol valve market. Aerosol valves are widely used in the personal care industry in aerosol cans for packaging different products such as deodorants, face & body creams, shaving foams, and perfumes.

- According to AEROBAL, the cosmetics sector remains the most important market for aluminum aerosol cans by far, accounting for nearly 85% of total production worldwide. Deodorants and perfumes are the major products accounting for every second can produced and have a 60% market share, followed by hair sprays, hair mousses, and other cosmetic products. The surge in aluminum aerosol cans will lead to increased demand for aerosol valves in the industry.

- The demand for personal care products in the United States and its contribution to the global number is significantly high. After European countries, the United States marks a higher consumption of cosmetic and personal care products, with FDA regulating and inspecting imports. Owing to these factors, the country will drive the market growth despite fluctuating demand for deodorants, hair sprays, etc.

- Moreover, players are investing in valve technology for sustainability, catering to market growth. In July 2021, Williams Advanced Engineering collaborated with Salford Valve Company Ltd (Salvalco) to support and develop disruptive aerosol valve technology. Salvalco has benefitted from over Euro 3 million of funding, over recent years, from an investment fund managed by Foresight Group LLP in collaboration with Williams Advanced Engineering (WAE).

Europe is Expected to Hold the Largest Market Share

- Europe has significant demand for aerosol valves for various sectors, including healthcare, personal care, automotive, etc. A survey conducted by Global Web Index on over 2,300 web users from the United Kingdom who buy natural cosmetic and personal care products regularly indicated that about 80% did so because they care about the environment and their health.

- According to the European Aerosol Federation (FEA), the aerosol market shares of the United Kingdom, Germany, and France provide more than 60% of the annual aerosol production in Europe in all segments, boosting the growth opportunities for aerosol valves in the region.

- The personal care segment has the largest market share of 57% in terms of aerosol production, followed by paints, varnishes, food, pharmaceuticals, and chemicals. The wide application of aerosol valves in these cans results in a simultaneous growth of aerosol valves in the region.

- Stringent government regulations surrounding the collection and recycling of used cans have made the industry follow an optimum chain of operations to comply with the regulations. For instance, It is mandatory for the Member States of Europe to develop systems for the return and collection of used packaging to attain, amongst other aspects, the following minimum targets for recycling: 80% of ferrous metals and 60% of aluminum contained in packaging waste. This boosts the recycling of aerosol valves and thus provides sustainable market growth by combatting restraints such as the above.

Aerosol Valve Industry Overview

The aerosol valve market is fragmented owing to the presence of multiple vendors in the market. Some of the major players in the market are Aptar Group, Precision Valve Corporation, Coster Tecnologie Speciali, among others. The market is also witnessing multiple product launches, collaborations, and partnerships.

- December 2021 - As a part of the sustainability program, Beiersdorf introduced a more climate-friendly aerosol valve system for the Nivea Ecodeo product line while introducing 100% recycled aluminum cans across its Nivea Men line. Further, the company stated that this range of deodorants and shaving gels would be made available in environmentally sustainable packaging for the European market.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET INSIGHTS

- 4.1 Market Overview

- 4.2 Industry Value Chain Analysis

- 4.3 Industry Attractiveness - Porter's Five Forces Analysis

- 4.3.1 Bargaining Power of Suppliers

- 4.3.2 Bargaining Power of Buyers

- 4.3.3 Threat of New Entrants

- 4.3.4 Threat of Substitutes

- 4.3.5 Intensity of Competitive Rivalry

- 4.4 Assessment of Impact of Covid-19 on the Industry

5 MARKET DYNAMICS

- 5.1 Market Drivers

- 5.1.1 Strong Demand From the Cosmetic & Personal Care Industry

- 5.1.2 Shift Towards Easy-To-Handle and Convenient Packaging

- 5.2 Market Restraints

- 5.2.1 Stringent Government Regulations

6 MARKET SEGMENTATION

- 6.1 Type

- 6.1.1 Continuous

- 6.1.2 Metered

- 6.2 End-user Industry

- 6.2.1 Personal Care

- 6.2.2 Home Care

- 6.2.3 Healthcare

- 6.2.4 Automotive

- 6.2.5 Other End-user Industries

- 6.3 Geography

- 6.3.1 North America

- 6.3.2 Europe

- 6.3.3 Asia-Pacific

- 6.3.4 Latin America

- 6.3.5 Middle-East and Africa

7 COMPETITIVE LANDSCAPE

- 7.1 Company Profiles

- 7.1.1 Aptargroup

- 7.1.2 The Precision Valve Corporation

- 7.1.3 Coster Tecnologie Speciali

- 7.1.4 Lindal Group Holding GmbH

- 7.1.5 Mitani Valve

- 7.1.6 Summit Packaging Systems

- 7.1.7 Clayton Corp.

- 7.1.8 Newman Green

- 7.1.9 Koh-I-Noor Mlada Vozice A.S.

- 7.1.10 Salvalco

- 7.1.11 Majesty Packaging Systems Limited

- 7.1.12 Shanghai Sunhome Industrial Company

- 7.1.13 EC Pack Industrial Limited

- 7.1.14 C. Ehrensperger Ag.

- 7.1.15 Aroma Industries

- 7.1.16 Seugn Il Corporation

- 7.1.17 Yingbo Aerosol Valve (Zhongshan) Co., Ltd.

- 7.1.18 Guangzhou Zhongpin Aerosol Valves Co., Ltd

- 7.1.19 Maruichi Co. Ltd

8 INVESTMENT ANALYSIS

9 FUTURE OF THE MARKET

02-2729-4219

+886-2-2729-4219