|

市场调查报告书

商品编码

1630365

压力容器 -市场占有率分析、产业趋势/统计、成长预测 (2025-2030)Pressure Vessel - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

价格

※ 本网页内容可能与最新版本有所差异。详细情况请与我们联繫。

简介目录

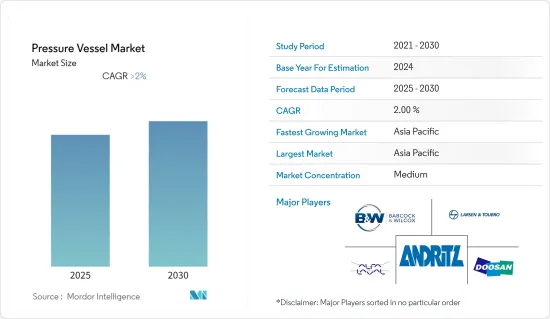

预计压力容器市场在预测期内的复合年增长率将超过2%。

COVID-19 对 2020 年市场产生了负面影响。目前,市场已达到疫情前水准。

主要亮点

- 中期来看,总发电能力和油气精製能力持续成长等因素预计将推动压力容器市场。

- 另一方面,增加对不需要压力容器的可再生能源发电的投资预计将抑制市场。

- 压力容器(如压力锅炉)的技术发展,可以燃烧不同类型的燃料,因此在电力供应和成本效益的情况下使用,预计将为未来的压力容器市场带来一些创造机会。

- 亚太地区在市场上占据主导地位,并且在预测期内可能呈现出最高的复合年增长率。这一增长归因于该地区国家(包括印度、中国和日本)对石油和天然气、化学和化肥行业的投资增加。

压力容器市场趋势

加工容器领域预计将大幅成长

- 加工容器是用于在受控环境中去除、组合、搅拌和分解产品的压力容器。加工容器的例子包括锅炉和分离器。这些加工容器由碳钢和各种不会与加工材料反应的合金等材料製成。

- 中东、非洲、亚太等地区开发中国家众多。这些地区的许多国家无法为其很大一部分人口提供能源。这些国家正在努力提高发电能力,预计将推动压力容器市场的发展。

- 根据《BP世界能源统计年鑑》显示,2021年全球发电量约28,466.3兆瓦时(TWh),较2017与前一年同期比较增6.2%及10.1%。其中,火力发电技术(石油、煤炭、天然气、核能发电厂)占2021年总发电量的近71.25%。发电量的增加代表着全球发电厂数量的增加,预计将推动压力容器市场的发展。

- 2022年12月,阿法拉伐获得了一份合同,为美国可再生燃料和精製公司CVR Energy的子公司提供由分离器、热交换器、泵浦和搅拌器等各种设备组成的预处理系统。

- 因此,鑑于上述情况,加工容器领域可能是预测期内压力容器市场成长最快的领域。

亚太地区预计将主导市场成长

- 由于该地区能源需求的不断增长,亚太地区可能成为压力容器市场成长最快和最大的市场。该地区许多政府和公司正在电力和精製行业进行大量投资,包括使用多个压力容器。

- 中国和印度等国家在使用压力容器的行业中有正在进行和即将进行的计划。这些计划背后的动机是缩小该地区能源需求和能源消耗之间的差距。利用煤炭、天然气、石油和核能等能源来源发电需要大量的动力船舶。

- 2021年,亚太地区热能发电量与前一年同期比较%,达到10,299.6兆瓦时(TWh),占总发电量的73.6%。

- 2022年5月,住友重工业株式会社订单东曹株式会社的EPC(设计、采购和施工)合约订单,在山口州周南市南阳团地建造74MW级木质生物质再生燃料锅炉州。该锅炉是以木质燃料为主要燃料,采用再热方式的高效率生物质锅炉。

- 2021年8月,Thermax Babcock和Thermax的全资子公司Wilcox Energy Solutions (TBWES)将为印度西部炼油厂和石化联合体的三台燃油和燃气锅炉提供基于EPC的锅炉包装,该订单已订单。 29.3亿印度卢比。

- 基于上述情况,预计亚太地区将在预测期内主导压力容器市场。

压力容器行业概况

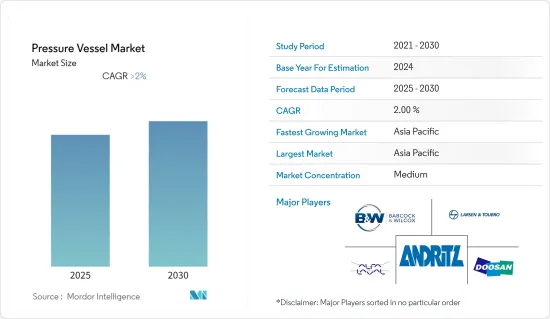

压力容器市场适度整合。市场的主要企业(排名不分先后)包括 Babcock & Wilcox Enterprises Inc、Doosan Heavy Industries & Construction、Alfa Laval AB、Andritz AG 和 Larsen & Toubro Limited。

其他好处

- Excel 格式的市场预测 (ME) 表

- 3 个月分析师支持

目录

第一章简介

- 调查范围

- 市场定义

- 研究场所

第 2 章执行摘要

第三章调查方法

第四章市场概况

- 介绍

- 2027年之前的市场规模与需求预测(单位:十亿美元)

- 最新趋势和发展

- 政府法规和措施

- 市场动态

- 促进因素

- 抑制因素

- 供应链分析

- 波特五力分析

- 供应商的议价能力

- 消费者议价能力

- 新进入者的威胁

- 替代品的威胁

- 竞争公司之间的敌对关係

第五章市场区隔

- 目的

- 储存容器

- 处理容器

- 其他的

- 最终用户产业

- 石油和天然气

- 化学品/肥料

- 电力

- 其他的

- 地区

- 北美洲

- 欧洲

- 亚太地区

- 南美洲

- 中东/非洲

第六章 竞争状况

- 合併、收购、联盟和合资企业

- 主要企业策略

- 公司简介

- Babcock & Wilcox Enterprises Inc

- Doosan Heavy Industries & Construction

- Alfa Laval AB

- Andritz AG

- Larsen & Toubro Limited

- Aager GmbH(Ergil)

- IHI Plant Services Corporation

- Frames Group BV

- GEA Group AG

第七章 市场机会及未来趋势

简介目录

Product Code: 70160

The Pressure Vessel Market is expected to register a CAGR of greater than 2% during the forecast period.

COVID-19 negatively impacted the market in 2020. Presently the market has now reached pre-pandemic levels.

Key Highlights

- Over the medium term, factors such as a constant increase in the total power generation capacity and refining capacity of oil and gas will likely drive the pressure vessel market.

- On the other hand, rising investments in renewable energy generation that rarely require pressure vessels are expected to restrain the market.

- Nevertheless, technological development in pressure vessels such as pressure boilers, which can be used to combust different types of fuels and thus are used under the availability and cost-effectiveness of the power, is expected to create several opportunities for the Pressure Vessel Market in the future.

- The Asia-Pacific region dominates the market and is likely to witness the highest CAGR during the forecast period. This growth is attributed to the increasing investments in oil and gas, chemical, and fertilizer industries in the countries of this region, including India, China, and Japan.

Pressure Vessel Market Trends

Processing Vessel Segment Expected to Grow Significantly

- Processing vessels are pressure vessels used to remove, combine, agitate, or break down products in a controlled environment. A few examples of processing vessels include boilers and separators. These processing vessels are made up of materials such as carbon steel and a wide variety of alloys, which do not react with processing substances.

- Regions such as the Middle East and Africa and the Asia Pacific have many developing countries. Many of these countries in the region are unable to provide energy to a significant percentage of their population. These countries are working to increase their power generation capacities, which are expected to drive the pressure vessel market.

- According to BP Statistical Review of World Energy, in 2021, the global electricity generation was about 28466.3 Terawatt-Hour (TWh), up by 6.2% year-on-year and 10.1% since 2017. Of this, thermal technologies (oil, coal, natural gas, and nuclear power plants) accounted for nearly 71.25% of the total electricity generation in 2021. The increase in electricity generation depicts the worldwide increase in the number of power plants expected to drive the Pressure Vessel Market.

- In December 2022, Alfa Laval announced that it had won a contract to supply pre-treatment systems consisting of various equipment such as separators, heat exchangers, pumps, and agitators for the US-based renewable fuels and petroleum refining company, a subsidiary of CVR Energy and the aim is to supply processing systems for feedstock pre-treatment, part of a strategic investment in the refinery supporting CVR's expansion into renewable biofuel production.

- Hence, owing to the above points, the processing vessel segment is likely to be the fastest-growing segment in the pressure vessel market during the forecast period.

Asia-Pacific Expected to Dominate the Market Growth

- Asia-Pacific region, due to the constant increase in the energy demand in the region, is likely to be the fastest-growing and the largest market for the pressure vessel market. Many governments and companies in the region are investing a significant amount in power and refining sectors, which include the usage of several pressure vessels.

- Countries such as China and India have ongoing projects and upcoming projects in the sectors that use pressure vessels. The motive behind these projects is to fill the gap between energy demand and energy consumption in the region. Power generation from thermal energy sources such as coal, natural gas, oil, and nuclear, require a considerable number of power vessels.

- In 2021, the electricity generation of Asia-Pacific from thermal energy was 10299.6 terawatt-hours (TWh), which was 8% higher year-on-year, and accounted for neraly 73.6% of the total electricity generation in 2021.

- In May 2022, Sumitomo Heavy Industries, Ltd. secured an order from Tosoh Corporation for a 74 MW-class wood biomass and recycled fuel-fired boiler for a palnned power plant in Nanyo Complex, Shunan City, Yamaguchi Prefecture based on an EPC (engineering, procurement and construction) contract. The boiler is a a high-efficiency biomass-fired boiler that uses wood-based fuel as its primary fuel and employs the reheating system.

- In August 2021, Thermax Babcock and Wilcox Energy Solutions (TBWES), a wholly-owned subsidiary of Thermax, has concluded a INR 2.93 billion order for a boiler package comprising 3 oil and gas-fired boilers on an EPC basis for a refinery and petrochemical complex in Western India.

- Hence, owing to the above points, Asia-Pacific is expected to dominate the pressure vessel market during the forecast period.

Pressure Vessel Industry Overview

The Pressure Vessel Market is moderately consolidated in nature. Some of the major players in the market (not in particular order) include Babcock & Wilcox Enterprises Inc, Doosan Heavy Industries & Construction, Alfa Laval AB, Andritz AG, and Larsen & Toubro Limited, among others.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Scope of the Study

- 1.2 Market Definition

- 1.3 Study Assumptions

2 EXECUTIVE SUMMARY

3 RESEARCH METHODOLOGY

4 MARKET OVERVIEW

- 4.1 Introduction

- 4.2 Market Size and Demand Forecast in USD billion, till 2027

- 4.3 Recent Trends and Developments

- 4.4 Government Policies and Regulations

- 4.5 Market Dynamics

- 4.5.1 Drivers

- 4.5.2 Restraints

- 4.6 Supply Chain Analysis

- 4.7 Porter's Five Force Analysis

- 4.7.1 Bargaining Power of Suppliers

- 4.7.2 Bargaining Power of Consumers

- 4.7.3 Threat of New Entrants

- 4.7.4 Threat of Substitutes Products and Services

- 4.7.5 Intensity of Competitive Rivalry

5 MARKET SEGMENTATION

- 5.1 Application

- 5.1.1 Storage Vessel

- 5.1.2 Processing Vessel

- 5.1.3 Others

- 5.2 End-User Industry

- 5.2.1 Oil and Gas

- 5.2.2 Chemicals and Fertilizers

- 5.2.3 Power

- 5.2.4 Others

- 5.3 Geography

- 5.3.1 North America

- 5.3.2 Europe

- 5.3.3 Asia-Pacific

- 5.3.4 South America

- 5.3.5 Middle-East and Africa

6 COMPETITIVE LANDSCAPE

- 6.1 Mergers, Acquisitions, Collaboration and Joint Ventures

- 6.2 Strategies Adopted by Key Players

- 6.3 Company Profiles

- 6.3.1 Babcock & Wilcox Enterprises Inc

- 6.3.2 Doosan Heavy Industries & Construction

- 6.3.3 Alfa Laval AB

- 6.3.4 Andritz AG

- 6.3.5 Larsen & Toubro Limited

- 6.3.6 Aager GmbH (Ergil)

- 6.3.7 IHI Plant Services Corporation

- 6.3.8 Frames Group BV

- 6.3.9 GEA Group AG

7 MARKET OPPORTUNITIES AND FUTURE TRENDS

02-2729-4219

+886-2-2729-4219