|

市场调查报告书

商品编码

1630369

亚太地区柴油发电机:市场占有率分析、产业趋势与成长预测(2025-2030)Asia-Pacific Diesel Generator - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

价格

※ 本网页内容可能与最新版本有所差异。详细情况请与我们联繫。

简介目录

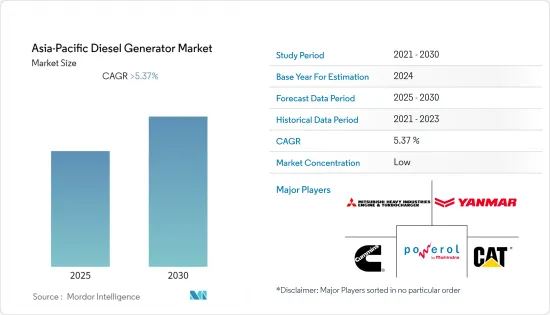

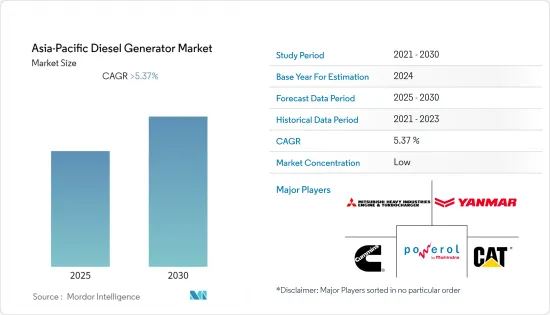

预计亚太地区柴油发电机市场在预测期内的复合年增长率将超过5.37%。

COVID-19 对 2020 年市场产生了负面影响。市场现在可能达到大流行前的水平。

主要亮点

- 从长远来看,政府大幅提高农村电气化率的目标、都市区停电的增加以及输配电基础设施安装所需的较长时间是柴油发电机市场的驱动因素。

- 另一方面,天然气供应量的增加和天然气发电机技术的快速发展、可再生能源作为替代能源的日益采用、柴油发电机的维护挑战等都是马苏市场的限制因素。

- 新兴经济体的商业和工业部门、新兴经济体的住宅部门以及国防业务不断增长的电力需求预计很快就会为市场参与企业创造重大机会。

- 2021年中国占最大市场占有率,大部分需求来自全国各地,商业办公空间和小型供应商市场呈上升趋势。

亚太地区柴油发电机市场趋势

工业领域主导市场

- 预计到 2021 年,工业领域将占据柴油发电机市场的最大份额。工业运作主要依赖停电期间(以避免生产风险)和电网接入受限地区的柴油发电机发电。

- 工业部门,包括采矿业、製造业、农业和建设业,在所有最终用途部门中能源消耗比例最大。因此,这些产业,特别是医疗设施、製药业和製造设施对持续可靠电力供应的需求不断增加,预计将增加对柴油发电机的需求。

- 此外,2021年,新加坡工业增加价值较上年成长13.4%。相较之下,缅甸2021年增加价值额与前一年同期比较下降约21%。反过来,该行业的成长预计将支持柴油发电机市场的成长。

- 此外,由于中国和印度製造业迅速扩张,预计未来几年工业成长将强劲,预计将推动工业领域对柴油发电机的需求。

- 此外,2022 年 8 月,卡特彼勒宣布为亚洲市场增加新的备用柴油发电机:三个 60Hz 功率节点,功率范围为 20 至 30kW。这些装置适用于各种应用,包括小型医疗、零售和商业企业。

- 此外,政府扩大工业部门的倡议,特别是在中国和印度,预计将在预测期内推动柴油发电机的需求。

中国主导市场

- 由于基础设施计划的增加、电力供需缺口的扩大、全国製造设施的扩大以及商业办公空间的增加,中国正在引领亚太柴油发电机市场。

- 该国受益于柴油发电机的成本和效率,生活水准的提高正在推动对备用电力设备的需求。

- 中国现有製造设施的扩张以及中国中央政府发起的「中国製造」倡议等因素预计将推动中国柴油发电机市场的发展。

- 此外,基础设施、通讯和资讯技术(IT)/IT支援服务等各种最终用途领域的快速成长预计也将进一步推动中国柴油发电机的需求。

- 中国的天然气管网不足,这是大多数需要天然气的产业的主要障碍。政府正在大力投资以提高发电能力,预计这将抑制燃气发电机市场的成长,并为柴油发电机创造机会。

- 2021年,中国实际国内生产总值毛额(GDP)成长率达到约8.1%。受疫情影响,2020年增幅降至2.24%。不过,根据国际货币论坛的预测,2027年GDP成长率预计在4.63%左右。 GDP 成长影响国内商品和服务,并支持需要柴油发电机的产业的成长。

- 此外,2022年3月,三菱重工发动机及涡轮增压器有限公司(MHIET)在中国市场推出了新系列柴油发电机「MGS-R系列」。新系列的待机输出在 50Hz 时为 500 至 2,750kVA,在 60Hz 时为 460 至 2,000kVA。

- 鑑于上述情况,预计中国将在预测期内主导柴油发电机市场。

亚太地区柴油发电机产业概况

亚太地区柴油发电机市场区隔:该市场的主要企业(排名不分先后)包括康明斯公司、三菱重工发动机和涡轮增压器有限公司、洋马控股公司、卡特彼勒和马恆达 Powerol 有限公司。

其他好处

- Excel 格式的市场预测 (ME) 表

- 3 个月分析师支持

目录

第一章简介

- 调查范围

- 市场定义

- 研究场所

第二章调查方法

第三章执行摘要

第四章市场概况

- 介绍

- 2027年之前的市场规模与需求预测(单位:十亿美元)

- 最新趋势和发展

- 政府法规和措施

- 市场动态

- 促进因素

- 抑制因素

- 供应链分析

- 波特五力分析

- 供应商的议价能力

- 消费者议价能力

- 新进入者的威胁

- 替代品的威胁

- 竞争公司之间的敌对关係

第五章市场区隔

- 容量

- 75kVA以下

- 75-350kVA以下

- 350kVA以上

- 最终用户

- 住宅

- 商业的

- 工业的

- 目的

- 备用电源

- 主功率/连续功率

- 抑低尖峰负载功率

- 地区

- 中国

- 印度

- 日本

- 韩国

- 其他亚太地区

第六章 竞争状况

- 併购、合资、联盟、协议

- 主要企业策略

- 公司简介

- Cummins Inc

- Mitsubishi Heavy Industries Engine & Turbocharger, Ltd

- Yanmar Holdings co. Ltd

- Caterpillar Inc

- Mahindra Powerol Ltd

- Generac Power Systems

- Doosan Corporation

- Honda Siel Power Products Ltd

- Kohler Co

第七章 市场机会及未来趋势

简介目录

Product Code: 70216

The Asia-Pacific Diesel Generator Market is expected to register a CAGR of greater than 5.37% during the forecast period.

COVID-19 negatively impacted the market in 2020. Presently the market is likely to reach pre-pandemic levels.

Key Highlights

- Over the long term, the targets of the governments of various countries to achieve significant improvement in the rural electrification rate, increase in power outages in the urban areas, and the more extended timeframe required to set up the transmission and distribution infrastructure are some of the driving factors for the diesel generator market.

- On the flip side, the increasing availability of natural gas and the rapidly expanding natural gas generator technology, increasing deployment of renewables as an alternative power source, and the maintenance challenges for diesel generators are the restraining factors for the market studied.

- The commercial and industrial sectors of emerging economies, the residential sector of developed economies, and the increasing need for power in defense operations are expected to create significant opportunities for market participants shortly.

- China accounted for the largest market share in 2021, with most of the demand coming from across the nation and rising commercial office spaces and small-scale vendor markets.

Asia Pacific Diesel Generator Market Trends

Industrial Sector to Dominate the Market

- In 2021, the industrial sector is estimated to account for the largest share of the diesel generator market. Industrial operations mainly depend on electricity generated from diesel generators during power outages (to avoid production risks) and in regions with limited grid access.

- The industrial sector, which includes mining, manufacturing, agriculture, and construction, accounts for the largest share of energy consumption of any end-use sector. Therefore, the increasing demand for continuous and reliable power supply from these industries, especially from healthcare facilities, pharmaceutical industries, and manufacturing facilities, is expected to escalate the demand for diesel generators.

- Moreover, in 2021, the value added in the industry in Singapore grew by 13.4 percent from the previous year. In comparison, Myanmar recorded a decrease of approximately 21 percent from the previous year in value added in the industry in 2021. The growing industrial growth will, in turn, supports the growth of the diesel generator market.

- Also, China and India are expected to witness robust industrial growth in the coming years because of the sharp increase in manufacturing sectors, which is expected to drive the demand for diesel generators in the industrial sector.

- Moreover, in August 2022, Caterpillar announced that it had added new standby diesel gen-sets, namely three 60 Hz power nodes from 20 to 30 kW in the Asian market. These units are suited to a range of applications, including small healthcare, retail and commercial enterprises.

- Furthermore, government initiatives to expand the industrial sector, especially in China and India, are expected to propel the demand for diesel generators over the forecast period.

China to Dominate the Market

- China is the leading diesel generator market in the Asia-Pacific region owing to increasing infrastructure projects, widening power demand-supply gap, expansion of manufacturing facilities across the nation, and rising commercial office spaces.

- The country benefits from the cost and effectiveness of diesel generators, with improved living standards increasing the demand for power back-up devices.

- Factors such as the expansion of existing manufacturing units across the country and the dedicated 'Made in China' initiative launched by the Chinese central government are expected to drive the diesel generator market in the country.

- In addition, the rapid growth in various end-use sectors, such as infrastructure, telecommunication, and information technology (IT) & IT-enabled services is expected to further spur the demand for diesel generators in China.

- China has inadequate gas pipeline network, which creates a major hurdle for most industries with gas requirement. Although the government is investing heavily to ramp up this capacity, this is expected to restrain the growth of the gas generator market, creating an opportunity for diesel generators.

- In 2021, the growth of real gross domestic product (GDP) in China amounted to approximately 8.1 percent. Due to pandemic the country witnessed declination of growth rate in the year 2020 to 2.24%. However, according to the International Monetary Forum the country is estimated tol witness around 4.63% of GDP by 2027. The growth in GDP will affects the goods and services within the country and supports the growth of industries, that requires diesel generators.

- Moreover, in March 2022, Mitsubishi Heavy Industries Engine & Turbocharger, Ltd. (MHIET), a part of the Mitsubishi Heavy Industries (MHI) Group, launched a new MGS-R Series of diesel generator sets in Chinese market. The new series provides outputs ranging from 500 to 2,750 kVA for 50Hz, and 460 to 2,000 kVA for 60Hz for standby offerings.

- Owing to above points, China is expected to dominate the diesel generator market during the forecast period.

Asia Pacific Diesel Generator Industry Overview

The Asia-Pacific Diesel Generator Market is fragmented. Some of the key players in this market (in particular order) include Cummins Inc, Mitsubishi Heavy Industries Engine & Turbocharger, Ltd, and Yanmar Holdings co. Ltd, Caterpillar Inc., and Mahindra Powerol Ltd.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Scope of the Study

- 1.2 Market Definition

- 1.3 Study Assumptions

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET OVERVIEW

- 4.1 Introduction

- 4.2 Market Size and Demand Forecast in USD billion, till 2027

- 4.3 Recent Trends and Developments

- 4.4 Government Policies and Regulations

- 4.5 Market Dynamics

- 4.5.1 Drivers

- 4.5.2 Restraints

- 4.6 Supply Chain Analysis

- 4.7 Porter's Five Forces Analysis

- 4.7.1 Bargaining Power of Suppliers

- 4.7.2 Bargaining Power of Consumers

- 4.7.3 Threat of New Entrants

- 4.7.4 Threat of Substitutes Products and Services

- 4.7.5 Intensity of Competitive Rivalry

5 MARKET SEGMENTATION

- 5.1 Capacity

- 5.1.1 Below 75 kVA

- 5.1.2 75-350 kVA

- 5.1.3 Above 350 kVA

- 5.2 End-User

- 5.2.1 Residential

- 5.2.2 Commercial

- 5.2.3 Industrial

- 5.3 Application

- 5.3.1 Standby Backup Power

- 5.3.2 Prime/Continuous Power

- 5.3.3 Peak Shaving Power

- 5.4 Geography

- 5.4.1 China

- 5.4.2 India

- 5.4.3 Japan

- 5.4.4 South Korea

- 5.4.5 Rest of Asia-Pacific

6 COMPETITIVE LANDSCAPE

- 6.1 Mergers and Acquisitions, Joint Ventures, Collaborations, and Agreements

- 6.2 Strategies Adopted by Leading Players

- 6.3 Company Profiles

- 6.3.1 Cummins Inc

- 6.3.2 Mitsubishi Heavy Industries Engine & Turbocharger, Ltd

- 6.3.3 Yanmar Holdings co. Ltd

- 6.3.4 Caterpillar Inc

- 6.3.5 Mahindra Powerol Ltd

- 6.3.6 Generac Power Systems

- 6.3.7 Doosan Corporation

- 6.3.8 Honda Siel Power Products Ltd

- 6.3.9 Kohler Co

7 MARKET OPPORTUNITIES AND FUTURE TRENDS

02-2729-4219

+886-2-2729-4219