|

市场调查报告书

商品编码

1630373

无源光纤网路(PON) 设备 -市场占有率分析、产业趋势、成长预测(2025-2030 年)Passive Optical Network (PON) Equipment - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

价格

※ 本网页内容可能与最新版本有所差异。详细情况请与我们联繫。

简介目录

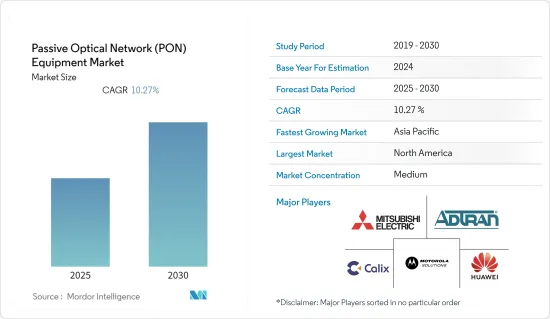

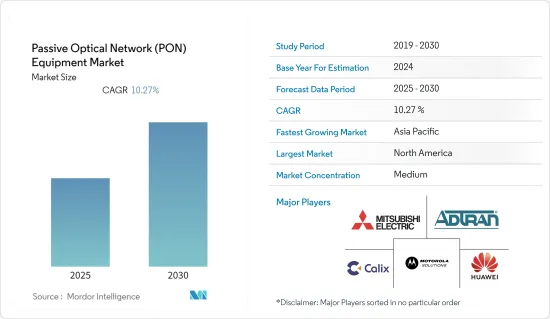

无源光纤网路(PON) 设备市场预计在预测期间内复合年增长率为 10.27%

主要亮点

- 此外,政府正在采取诸如采用光纤丰富网路的智慧城市计画等倡议,以实现物联网基础设施的顺畅流动。光纤网路支援为水、电、污水、污水管理、安全和通讯等公共产业提供动力的技术。据联合国预计,到2050年,全球超过68%的人口将居住在都市区,智慧城市计划预计在全球范围内活性化。

- 随着资料流量持续呈指数级增长,对更高容量网路的需求也不断增加。无源光纤网路(PON)是这个问题的有效解决方案,因为它们可以远距提供高频宽。对频宽的需求不断增长是推动无源光纤网路市场成长的关键因素。随着视讯串流和其他频宽密集型程式变得越来越普遍,消费者需要更快、更可靠的网路。 PON 非常适合满足这些需求,因为它可以在很长的距离内提供Gigabit速度,而无需使用主动元件或昂贵的光纤。

- 由于COVID-19的爆发,世界各国都采取了预防措施。虽然学校关闭,社区被要求留在家里,但许多组织正在寻找允许员工在家工作的方法。电讯公司已积极建置全光纤基础设施,以提供超高速、超可靠且面向未来的宽频网路。

- 例如,根据世界5G大会上公布的资料,在5G的推动下,过去三年,中国行动用户的平均每月线上流量从7.8GB增加到14.9GB。这为COVID-19大流行期间的远距工作、线上教育、数位生活、科学研究和疫情防治提供了便利。这些因素对预测期内的市场成长率做出了重大贡献。

无源光纤网路(PON)市场趋势

GPON设备预计将大幅成长

- 增强型行动宽频(eMBB) 描述了 5G NR 和 4G LTE 更高的资料频宽以及改进的延迟。 eMBB 透过直接向客户提供行动宽频服务,为许多营运商带来了 5G 的新使用案例。随着已开发国家和开发中国家智慧型手机资料使用量的增加,这提高了频谱效率和功率,补充了数位服务的充足容量。

- VIAVI Solutions Inc. 是一家测试、测量和保障解决方案以及先进精密光学解决方案提供商,最近推出了 Fusion JMEP 10,这是一款外形规格可插拔 (SFP+)Gigabit乙太网路收发器,用于网路测试、开通和效能监控宣布到 10GbE。 Fusion JMEP 10 是VIAVI NITRO 生命週期管理平台的一部分,支援5G xHaul、商业乙太网路服务、电缆DAA(分散式存取架构)以及光纤存取网路GPON/XGSPON(千兆位元被动光网路)等应用。

- 5G 和光纤相容性将带来互惠互利的伙伴关係。在光纤入户难度高、成本高、耗时长的地区,5G固定无线存取可以填补FTTH部署的空白,扩大覆盖范围。客户将从蜂巢式网路迁移到 Wi-Fi,并将 5G 流量卸载到 Wi-Fi 和 FTTH。这有助于有效管理 RAN 容量和定价,为关键任务应用释放 5G 容量,并改善客户的家庭体验。行动装置用户期望 5G 显着提高速度并实现全球覆盖,这需要高效能的行动传输网路。此外,现有的基于被动光纤网路(PON) 技术的 FTTH 网路将用于提供此传输。

- 随着GPON在全球的部署加速,通讯业者也积极迈向光纤部署的下一步。未来5年,光纤接入网路将迅速进入千兆位元组时代。 10G PON无源光纤网路技术具有广覆盖、宽频宽的特性。世界各地的营运商在安装高速光纤接入网路时更喜欢这种技术,因为单一系统可以为30至40个家庭提供千兆位元组的存取。

亚太地区成长迅速

- 近年来,高速网路和5G网路越来越受到关注。该地区以中国、日本、台湾、印度和澳洲等新兴国家为主导。中国拥有完善的5G生态系统,预计预测期内将进一步发展。然而,由于 5G 技术预计将成为目前行动宽频的热点技术,因此预期成长将较为温和。

- 我国正迈向以10G PON技术为代表的Gigabit超宽频新阶段,光纤网路基础优势领先全球。各大通讯供应商纷纷制定了简洁的Gigabit光纤网路发展规划。至2021年,全国300多个城市将建成Gigabit宽频接取网络,服务超过8,000万户家庭。全国超过270万Gigabit上网用户获得了大部分通讯营运商的Gigabit商用套餐。仅仅五个月的时间,新增用户数量就超过了去年的总量。

- 北京移动将在全市建设数百个双Gigabit精品社区,并加速F5G建设。广州电信联合华为发表首个FTTR白皮书,以全光住宅网路技术实现Gigabit宽频全户覆盖。为夯实数位经济的坚实基础,杭州移动发布了「双5G」数位城市白皮书。中国的Gigabit宽频旨在连接众多设备和终端,实现家庭、企业、商业、工业製造等多场景应用,为消费者提供可靠的高速频宽存取能力,预计将持续扩大。

- 中国电信业者在5G方面的投资超过594亿美元,预计产生1.25兆美元的经济影响。这表明新型网路基础设施正在为经济成长做出重大贡献。科技部副部长项立斌指出,5G商用已进入正回馈循环,经过三年多的发展,工业5G应用数量已从零增加到一个。我们分析这些因素对预测期内市场成长率的影响。

无源光纤网路(PON) 产业概览

无源光纤网路设备市场适度整合,因为市场上只有少数公司存在。这些公司也进行了大量投资,为客户提供广泛的技术。此外,这些公司持续投资于策略伙伴关係、收购和产品开发,以增加市场占有率。以下是这些公司目前的一些进展。

- 2022年5月-在奥地利维也纳举行的2022年FTTH大会上,全球重要的行动互联网通讯、企业与消费科技解决方案供应商中兴通讯(0763.HK/000063.SZ)宣布推出业界首款光纤网路单元(ONU) 原型,提供50 Gigabit无源光纤网路连结(50G PON) 和 Wi-Fi 7 技术。

其他好处

- Excel 格式的市场预测 (ME) 表

- 3 个月分析师支持

目录

第一章简介

- 研究假设和市场定义

- 调查范围

第二章调查方法

第三章执行摘要

第四章市场动态

- 市场概况

- 波特五力分析

- 供应商的议价能力

- 买家/消费者的议价能力

- 新进入者的威胁

- 替代品的威胁

- 竞争公司之间敌对关係的强度

- COVID-19 市场影响评估

第五章市场动态

- 市场驱动因素

- 网路运作安全可靠的需求

- 与传统网路相比的环保替代方案

- 总拥有成本低,投资收益率高

- 市场限制因素

- 操作员介面的组件成本高

第六章 市场细分

- 按结构分

- 乙太网路光纤网路(EPON)设备

- Gigabit被动光纤网路(GPON)设备

- 按成分

- 波分复用多工器/解多工器

- 滤光片

- 光功率分配器

- 光缆

- 光线路终端(OLT)

- 光纤网路终端(ONT)

- 按地区

- 北美洲

- 欧洲

- 亚太地区

- 拉丁美洲

- 中东/非洲

第七章 竞争格局

- 公司简介

- ADTRAN, Inc.

- Calix, Inc.

- Huawei Technologies Co., Ltd.

- Mitsubishi Electric Corporation

- Motorola Solutions, Inc.

- Nokia Corporation

- Telefonaktiebolaget LM Ericsson

- Tellabs, Inc.

- Verizon Communications, Inc.

- ZTE Corporation

第八章投资分析

第九章 市场机会及未来趋势

简介目录

Product Code: 70276

The Passive Optical Network Equipment Market is expected to register a CAGR of 10.27% during the forecast period.

Key Highlights

- Additionally, governments are taking initiatives like smart city programs with fiber optic-rich networks to enable the smooth flow of IoT infrastructure. Fiber optic network allows the technology to drive utilities like water, electricity, wastewater, sewerage management, security, and communication. According to the UN, over 68% of the global population is estimated to live in urban areas by 2050, which will fuel more smart city projects globally.

- The demand for networks with greater capacity is increasing as data traffic keeps growing exponentially. Because they can deliver high bandwidths across great distances, passive optical networks (PONs) present a viable solution to this issue. The rising need for bandwidth is the primary factor driving the passive optical network market growth. Consumers demand faster and more dependable networks as video streaming and other bandwidth-intensive apps proliferate. Due to their ability to deliver gigabit speeds over considerable distances without the use of active components or pricey optical fiber, PONs are uniquely suited to meet this demand.

- Due to the COVID-19 outbreak, countries worldwide implemented preventive measures. While schools were closed and communities were asked to stay at home, many organizations were finding ways to enable employees to work from their homes. Telecom companies actively made efforts to build full-fiber infrastructure to deliver an ultrafast, ultra-reliable, and futureproof broadband network.

- For instance, the average monthly mobile user in China's online traffic increased from 7.8 GB to 14.9 GB over the past three years, driven by 5G, according to data released at the global 5g convention. It facilitated remote work, online education, digital life, scientific research, and epidemic prevention and control during the COVID-19 pandemic. These factors significantly contribute to the market growth rate during the forecast period.

Passive Optical Network (PON) Market Trends

GPON Equipments is Expected to Grow Significantly

- Enhanced mobile broadband (eMBB) provides greater data bandwidth due to latency improvements on 5G NR and 4G LTE. It led most operators towards new use cases for 5G by delivering mobile broadband services directly to customers. It, thus, complements ample capacity for digital services, owing to better spectral efficiency, power, and increasing smartphone data usage in developed & developing countries.

- Recently, VIAVI Solutions Inc., a test, measurement, assurance solutions, and advanced precision optical solutions provider, announced Fusion JMEP 10, a small form-factor pluggable (SFP+) Gigabit Ethernet transceiver for network test, turn-up, and performance monitoring up to 10 GbE. The Fusion JMEP 10, which is part of the VIAVI NITRO lifecycle management platform, addresses10 GbE emergence as the dominant Ethernet bandwidth for applications such as 5G xHaul, Business Ethernet Services, Distributed Access Architecture (DAA) for Cable and Gigabit Passive Optical Networks (GPON/XGSPON) for Fiber Access Networks.

- The compatibility of 5G and fiber results in a reciprocal partnership. In areas where connecting fiber to the home is challenging, expensive, or takes too long, 5G fixed wireless access can fill in the gaps in FTTH deployments and expand coverage. Customers leave the cellular network for Wi-Fi, offloading 5G traffic to Wi-Fi and FTTH. It facilitates managing RAN capacity and prices effectively, freeing up 5G capacity for mission-critical applications and improving the customer experience at home. Users of mobile devices anticipate substantially faster speeds and global coverage from 5G, which requires a high-performance mobile transport network. Further, to offer that transport, a passive optical network (PON) technology-based FTTH networks already in existence are used.

- With the accelerating rollout of GPON worldwide, telecom operators are also actively moving toward the next step in fiber rollouts. The Gigabyte era will rapidly enter optical access networks during the next five years. The 10G PON passive optical network technology is distinguished by its broad coverage and high bandwidth. When installing high-speed optical access networks, operators around the world favor this technology since it can give Gigabyte access to 30-40 households on a single system.

Asia-Pacific Region to Witness the Fastest Growth

- Recently, there is an increased emphasis on high-speed internet and 5G network. The major driving countries in the region for the same are emerging countries, including China, Japan, Taiwan, India, and Australia. China includes an established ecosystem for 5G and is expected to grow further in the forecast period. However, the 5G technology is expected to serve as a hotspot technology with the current mobile broadband; the growth is expected to be gradual.

- China is advancing towards a new Gigabit ultra-wide stage, represented by 10G PON technology, and leading the global in terms of optical networks' fundamental advantages. Primary telecom providers effectively put up concise development plans for a gigabit optical network. Over 300 cities nationwide had a gigabit broadband access network in 2021, serving more than 80 million households. More than 2.7 million National Gigabit internet access consumers have received gigabit commercial packages from most provincial telecommunications providers. The number of new users surpassed the total number from the previous year in just five months.

- In addition to building hundreds of double Gigabyte boutique communities throughout the city, Beijing Mobile will hasten the construction of F5G. The first FTTR White Paper, published by Guangzhou Telecom and Huawei, ensures Gigabit broadband full house coverage through an all-optical residential network technology. To strengthen the firm foundation of the digital economy, Hangzhou Mobile published the "Double 5G" Digital City White Paper. China's Gigabit Broadband will continue to broaden its coverage to connect many devices and terminals, achieve multi-scenario applications such as home, enterprise, business, and industrial manufacturing, and give consumers reliable, high-speed bandwidth access capacity.

- Chinese telecom companies have invested more than USD 59.4 billion in 5G, generating more than USD 59.4 billion in 5G, generating an estimated USD 1.25 trillion in economic output. It shows the significant contribution new network infrastructure makes to economic growth. The commercial use of 5G entered a positive feedback loop, according to Xiang Libin, vice-minister of science and technology, and noted that after more than three years of development, industry-oriented 5G applications have increased from zero to one. These factors are analyzed to contribute to the market growth rate during the forecast period.

Passive Optical Network (PON) Industry Overview

The market for passive optical network equipment is moderately consolidated due to the presence of a few companies in the market. Also, these companies are investing extensively in offering customers a wide range of technologies. Moreover, these companies continuously invest in strategic partnerships, acquisitions, and product development to gain market share. Some of the current advancements by the companies are listed below.

- May 2022 - At the FTTH Conference 2022 in Vienna, Austria, ZTE Corporation (0763. HK / 000063.SZ), a significant global supplier of telecoms, enterprise, and consumer technology solutions for the mobile internet, declared that it had unveiled the prototype of the first Optical Network Unit (ONU) in the industry to offer both 50-Gigabit-Capable Passive Optical Networking (50G PON) and Wi-Fi 7 technologies.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET DYNAMICS

- 4.1 Market Overview

- 4.2 Porter's Five Forces Analysis

- 4.2.1 Bargaining Power of Suppliers

- 4.2.2 Bargaining Power of Buyers/Consumers

- 4.2.3 Threat of New Entrants

- 4.2.4 Threat of Substitute Products

- 4.2.5 Intensity of Competitive Rivalry

- 4.3 Assessment on the Impact of COVID-19 on the market

5 MARKET DYNAMICS

- 5.1 Market Drivers

- 5.1.1 Demand for secure and reliable network operation

- 5.1.2 Eco-friendly substitute as compared to traditional networks

- 5.1.3 Low total cost of ownership and high return on investment

- 5.2 Market Restraints

- 5.2.1 High component cost at operator interface

6 MARKET SEGMENTATION

- 6.1 By Structure

- 6.1.1 Ethernet Passive Optical Network (EPON) Equipment

- 6.1.2 Gigabit Passive Optical Network (GPON) Equipment

- 6.2 By component

- 6.2.1 Wavelength Division Multiplexer/De-Multiplexer

- 6.2.2 Optical filters

- 6.2.3 Optical power splitters

- 6.2.4 Optical cables

- 6.2.5 Optical Line Terminal (OLT)

- 6.2.6 Optical Network Terminal (ONT)

- 6.3 By Geography

- 6.3.1 North America

- 6.3.2 Europe

- 6.3.3 Asia-Pacific

- 6.3.4 Latin America

- 6.3.5 Middle East & Africa

7 COMPETITIVE LANDSCAPE

- 7.1 Company Profiles

- 7.1.1 ADTRAN, Inc.

- 7.1.2 Calix, Inc.

- 7.1.3 Huawei Technologies Co., Ltd.

- 7.1.4 Mitsubishi Electric Corporation

- 7.1.5 Motorola Solutions, Inc.

- 7.1.6 Nokia Corporation

- 7.1.7 Telefonaktiebolaget LM Ericsson

- 7.1.8 Tellabs, Inc.

- 7.1.9 Verizon Communications, Inc.

- 7.1.10 ZTE Corporation

8 INVESTMENT ANALYSIS

9 MARKET OPPORTUNITIES AND FUTURE TRENDS

02-2729-4219

+886-2-2729-4219