|

市场调查报告书

商品编码

1630377

东非可再生能源 -市场占有率分析、产业趋势与统计、成长预测(2025-2030)East Africa Renewable Energy - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

价格

※ 本网页内容可能与最新版本有所差异。详细情况请与我们联繫。

简介目录

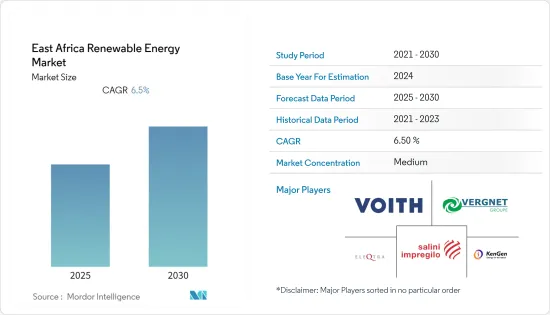

东非可再生能源市场预计在预测期内复合年增长率为 6.5%。

COVID-19 对 2020 年市场产生了负面影响。目前市场处于大流行前的水平。

主要亮点

- 从长远来看,环保意识和法规的增强以及每千瓦发电成本的降低等因素预计将推动市场的发展。

- 另一方面,与石化燃料相比,可再生能源的价格较高预计将抑制市场。

- 采用薄膜技术製造的新型太阳能电池,在太阳能电池中使用碲化镉窄薄膜,由于其高效率和低成本,可能成为该领域的机会。

- 由于政府的支持措施和可再生能源计划投资的增加,预计肯亚将在预测期内成为该地区成长最快的可再生能源市场。

东非可再生能源市场趋势

水电领域占市场主导地位

- 由于东非各地水坝的建设,预计水力发电领域仍将是市场的最大领域。大部分可再生能源水力发电能力正在衣索比亚和莫三比克建设。

- 水力发电部分包括可用于供应可再生能源的各种规模的水库大坝。水力发电是东非最常用的可再生能源。

- 到 2021 年,水力发电(包括混合发电厂)将占该地区可再生能源发电总量的近 78%,约 8,726 兆瓦。在预测期内,水力发电预计仍将是最大的可再生能源贡献领域。

- 该地区国家的地理特征有利于透过水力发电。因为尼罗河、山脉和大湖等物理结构的存在。

- 因此,提供可再生能源的大型水库预计将继续主导市场,因为它们的规模比其他可再生能源更大,而且投资也在增加。

肯亚主导市场成长

- 由于大量即将开展的计划和有利的政府措施等因素,预计肯亚将在预测期内成为该地区成长最快的可再生能源市场。截至2021年,该国可再生能源装置容量约为2,384MW。

- 2022 年 7 月,肯亚能源与石油监理局 (EPRA) 发布了法规草案,支持引入光电装置净计量製度。新规定适用于1MW以下的光电系统。至此,该国初步将安装约100MW的太阳能发电容量。

- 2022 年 2 月,由英国、荷兰、瑞士和瑞典政府资助的新兴非洲基础设施基金 (EAIF) 将投资 3,500 万美元,用于计划中 4,000 万千瓦太阳能发电工程的成本 8,700 万美元。年期贷款。

- 2022年8月,肯亚政府宣布开始在基苏木建设太阳能发电厂。 40MWp Kisumu Solar One Park 将建在政府向基博斯捐赠的 100 公顷土地上。

- 因此,由于预测期内可再生能源装置容量大幅增加,肯亚预计将主导市场成长。

东非可再生能源产业概况

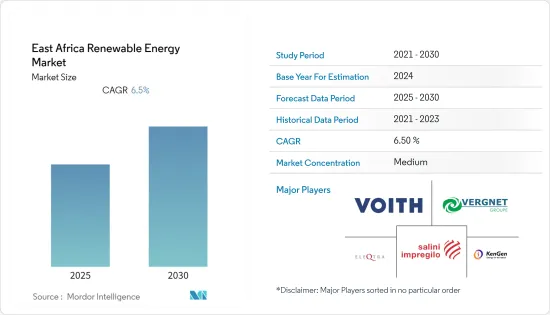

东非可再生能源市场适度一体化。市场的主要企业包括 Voith GmbH &Co.KGaA、肯亚发电公司 PLC、Salini Costruttori SpA、Vergnet SA、Eleqtra Inc.

其他好处

- Excel 格式的市场预测 (ME) 表

- 3 个月分析师支持

目录

第一章简介

- 调查范围

- 市场定义

- 研究场所

第二章调查方法

第三章执行摘要

第四章市场概况

- 介绍

- 至2027年可再生能源产能预测(单位:GW)

- 最新趋势和发展

- 政府法规和措施

- 市场动态

- 促进因素

- 抑制因素

- 供应链分析

- 波特五力分析

- 供应商的议价能力

- 消费者议价能力

- 新进入者的威胁

- 替代品的威胁

- 竞争公司之间敌对关係的强度

第五章市场区隔

- 类型

- 水力发电

- 阳光

- 风力

- 其他的

- 地区

- 坦尚尼亚

- 乌干达

- 肯亚

- 其他东非地区

第六章 竞争状况

- 併购、合资、联盟、协议

- 主要企业策略

- 公司简介

- Voith GmbH & Co. KGaA

- Kenya Electricity Generating Company PLC

- Salini Costruttori SpA

- Vergnet SA

- REDAVIA GmbH

- Eleqtra Inc.

- Hidroelectrica de Cahora Bassa SA

- Electricidade de Mocambique EP

第七章 市场机会及未来趋势

简介目录

Product Code: 70280

The East Africa Renewable Energy Market is expected to register a CAGR of 6.5% during the forecast period.

COVID-19 negatively impacted the market in 2020. Currently, the market has reached pre-pandemic levels.

Key Highlights

- Over the long term, factors such as increased environmental awareness and regulations and decreased cost per kilowatt of electricity generated are expected to boost the market.

- On the other hand, the high price of renewable energy relative to fossil fuels is expected to restrain the market.

- Nevertheless, new models of solar cells made of a thin film technology that uses narrow coatings of cadmium telluride in solar cells, which have higher efficiency and lower cost, may prove to be an opportunity in the sector.

- Kenya is expected to be the fastest-growing renewable energy market in the region during the forecast period due to the government's supportive policies and rising investment in renewable energy projects.

East Africa Renewable Energy Market Trends

Hydropower Segment to Dominate the Market

- The hydropower segment is expected to remain the largest segment in the market as dams have been built across East Africa. Most of the renewable hydro capacity has been constructed in Ethiopia and Mozambique.

- The hydropower Segment includes different-sized reservoir dams that can be used to provide renewable energy. Hydropower is the most used renewable energy in East Africa.

- Hydropower (including mixed plants) constitutes almost 78% of the total renewable energy generated in the region in 2021, around 8,726 MW. It is expected to remain the single largest renewable energy contributing segment in the forecast period.

- The geographical features of the countries in the region aid in the creation of energy from hydropower. Due to the presence of physical structures like the Nile River, Mountains, and the great lakes.

- Therefore, vast reservoirs of dams providing renewable energy are expected to continue to dominate the market due to their large size relative to other renewable energy and an increase in investments.

Kenya to Dominate the Market Growth

- Kanya is expected to be the fastest-growing renewable energy market in the region during the forecast period, owing to factors like a number of upcoming projects combined with favorable government policies. As of 2021, the country had renewable energy installed capacity of about 2384 MW.

- In July 2022, Kenya's Energy and Petroleum Regulatory Authority (EPRA) released a draft regulation to support introducing a net-metering regime for PV installations. The new rules will apply to PV systems up to 1 MW in size. It will help the country initially deploy around 100 MW of solar capacity.

- In February 2022, the Emerging Africa Infrastructure Fund (EAIF), financed by the governments of the United Kingdom, the Netherlands, Switzerland, and Sweden, provided a USD 35 million, 15-year loan towards the USD 87 million costs of a 40MW solar project planned in Kenya.

- In August 2022, the Kenyan government announced to start of the construction work of a solar photovoltaic power plant in Kisumu. The 40 MWp Kisumu Solar One Park will be built in Kibos on 100 hectares of land donated by the government.

- Hence, Kenya is expected to dominate the market growth due to its significant installed renewable energy capacity increase in the forecast period.

East Africa Renewable Energy Industry Overview

East Africa Renewable Energy Market is moderately consolidated. Some of the key players in this market are (not in particular order) Voith GmbH & Co. KGaA, Kenya Electricity Generating Company PLC, Salini Costruttori S.p.A., Vergnet SA, Eleqtra Inc.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Scope of the Study

- 1.2 Market Definition

- 1.3 Study Assumptions

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET OVERVIEW

- 4.1 Introduction

- 4.2 Renewable Energy Installed Capacity Forecast in GW, till 2027

- 4.3 Recent Trends and Developments

- 4.4 Government Policies and Regulations

- 4.5 Market Dynamics

- 4.5.1 Drivers

- 4.5.2 Restraints

- 4.6 Supply Chain Analysis

- 4.7 Porter's Five Forces Analysis

- 4.7.1 Bargaining Power of Suppliers

- 4.7.2 Bargaining Power of Consumers

- 4.7.3 Threat of New Entrants

- 4.7.4 Threat of Substitutes Products and Services

- 4.7.5 Intensity of Competitive Rivalry

5 MARKET SEGMENTATION

- 5.1 Type

- 5.1.1 Hydropower

- 5.1.2 Solar

- 5.1.3 Wind

- 5.1.4 Others

- 5.2 Geography

- 5.2.1 Tanzania

- 5.2.2 Uganda

- 5.2.3 Kenya

- 5.2.4 Rest of East Africa

6 COMPETITIVE LANDSCAPE

- 6.1 Mergers and Acquisitions, Joint Ventures, Collaborations, and Agreements

- 6.2 Strategies Adopted by Leading Players

- 6.3 Company Profiles

- 6.3.1 Voith GmbH & Co. KGaA

- 6.3.2 Kenya Electricity Generating Company PLC

- 6.3.3 Salini Costruttori S.p.A.

- 6.3.4 Vergnet SA

- 6.3.5 REDAVIA GmbH

- 6.3.6 Eleqtra Inc.

- 6.3.7 Hidroelectrica de Cahora Bassa S.A.

- 6.3.8 Electricidade de Mocambique E.P.

7 MARKET OPPORTUNITIES AND FUTURE TRENDS

02-2729-4219

+886-2-2729-4219