|

市场调查报告书

商品编码

1630384

汽车乙太网路 -市场占有率分析、产业趋势与统计、成长预测(2025-2030)Automotive Ethernet - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

※ 本网页内容可能与最新版本有所差异。详细情况请与我们联繫。

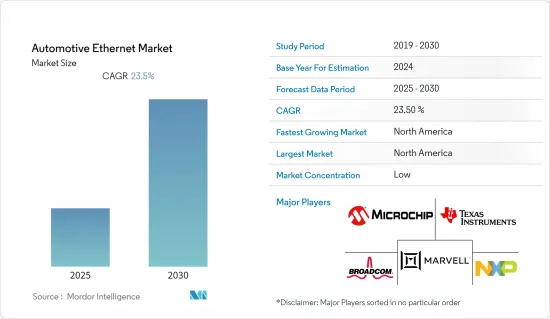

汽车乙太网路市场预计在预测期内复合年增长率为 23.5%

主要亮点

- 随着ADAS(高级驾驶辅助系统)、资讯娱乐和自动驾驶汽车开发的快速发展,以及乙太网路成本的降低,与传统线束相比,汽车乙太网路在有效连接车辆电子系统方面发挥着重要作用,因此我们取得了显着的成就。

- 汽车乙太网路描述了跨汽车应用的连接,包括动力传动系统、底盘、车身、舒适性、ADAS 和资讯娱乐系统。它透过支援高速或低速运行的高频宽应用,解决了设计人员和工程师在整合不同系统时面临的挑战。

- 乙太网路往往会绕过传统的布线进行连接,从而允许所有车辆组件透过更轻、更有效的布线进行连接。仅此一项就可以让製造商降低 80% 的连接成本和 30% 的电缆重量。这也可以作为具有成本效益的联网汽车开发的潜在应用。

- 高效能导航系统、高阶娱乐和远端资讯处理要求联网汽车中的系统「始终开启」。车载资料通讯频宽的增加正在推动乙太网路部署市场。

- 由于最近的COVID-19爆发,汽车乙太网路市场短期内成长放缓,主要汽车製造厂因世界各国实施的封锁措施而暂停生产。

汽车乙太网路市场趋势

对 ADAS(高级驾驶辅助系统)的需求不断增长正在推动市场成长

- 随着越来越多的车辆配备自动驾驶功能,汽车乙太网路的成长机会预计将扩大。自动驾驶在很大程度上依赖高清地图以及基于道路的信息,例如车道尺寸、人行横道和路标。高清地图是根据感测器收集的资料建构的。需要乙太网路来连接这些元件以保持高效的资料传输,从而促进汽车乙太网路的成长。

- 目前,在汽车领域,由于与ADAS相关的MEMS的引入、连网汽车的出现以及资讯娱乐和物联网设备的技术进步,汽车中电控系统的含量正在增加。汽车中越来越多地采用物联网解决方案,为各种现代、高度互联的 ADAS 和自动驾驶功能创造了成长机会。将汽车与周围的一切连接起来,或者说车对一切(V2X),是迈向自动驾驶汽车互联网络的重要一步。乙太网路相容性在将车辆连接到智慧基础设施方面的优势使其成为重要的车辆组件。

- 根据国际汽车工业协会 (OICA) 统计,去年全球汽车产量约 8,000 万辆。随着车辆数量的增加以及对避免碰撞和事故的安全功能的需求的增加,公司正在提供提醒驾驶员潜在问题的技术。许多汽车製造商都高度采用ADAS,包括紧急煞车辅助、主动车距控制巡航系统、盲点侦测、后方横向车流警示、交通标誌辅助、智慧灯、智慧速度辅助、车道/道路偏离警告等等。

- 与安全相关的政府法规也是推动汽车乙太网路成长的关键因素。其中许多系统都包含在当前车型中,有些系统是强制性的,因为它们有助于道路安全。例如,2019年3月,欧盟委员会宣布了新法规,要求去年生产的所有新型轻型车辆都配备智慧速度辅助系统(ISA)。欧洲 NCAP 和美国公路交通安全管理局 (NHTSA) 安全评估进一步推动了 ADAS 的采用,并在评估中纳入了安全辅助系统的可用性和性能。

亚太地区实现显着成长

- 乘用车产量的增加是推动亚太地区市场成长的关键因素之一。梅赛德斯-奔驰、福特和大众等汽车製造商正在印度推出扩张计划,以最大限度地提高製造能力和产量,并最大限度地减少当地市场的供需缺口。这些计划预计将扩大印度对时间敏感的汽车网路组件市场。因此,汽车乙太网路市场预计在整个研究期间将经历强劲成长。

- 随着越来越多的目标商标产品製造商 (OEM ) 在生产的每款新车型中提供新的联网汽车功能,印度的联网汽车市场正在取得重大进展。消费者对舒适性、便利性、安全性和保障性的需求日益增长,推动了具有增强型 HMI 功能、增强型互联技术和整合 ADAS(高级驾驶员辅助系统)解决方案的车辆市场不断增长。

- 印度大多数优质OEM现在都将智慧型手机连接或嵌入式连接作为标准配置,但基本型除外。相比之下,大众市场汽车製造商仅在中阶和高阶车型中配备智慧型手机和嵌入式连线功能。印度市场联网汽车的发展是由于消费者对联网汽车服务的认识不断提高以及愿意付款更高价格的选择而推动的。

- 对于包括中国、印度、马来西亚和东南亚其他新兴市场在内的大多数地区而言,GDP加速成长和雄心勃勃的亚洲消费者将成为未来几年最大的两个成长要素。在联网汽车和自动驾驶汽车消费方面,北美和欧洲仍然处于领先地位,原因是 Marvell Technology Group Ltd 和 Broadcom Incorporated 等主要参与者的存在、对先进技术的高度接受以及车载以太网的采用增加它已成为主流车型中的一个强大领域。

- 然而,考虑到印度的停产趋势,SIAM估计印度汽车製造商和零件製造商在疫情期间每天损失近2.8亿美元的收益。印度马鲁蒂铃木、现代汽车、本田、马恆达、丰田基洛斯卡汽车、塔塔汽车、起亚汽车和名爵汽车印度等主要製造商已暂时关闭其工厂。市场可能会遇到潜在的组件供应链中断,导致汽车乙太网路销售和产量减少。

汽车乙太网路产业概况

汽车乙太网路市场竞争激烈且细分。分散的市场主要受到有关设立和营运的监管要求的约束。此外,随着技术创新、收购和联盟的增加,未来市场的竞争可能会变得更加激烈。主要市场参与企业包括 Broadcom Inc.、NXP Semiconductors NV、Marvell Technology Group Ltd.、Microchip Technology Inc. 和 Texas Instruments Inc.。

- 2022 年 5 月 - Broadcom Inc. 的高频宽汽车乙太网路切换器设备 BCM8958X交付。该设备的开发是为了满足车载网路应用不断增长的频宽需求,并加速软体定义车辆 (SDV) 的采用。 BCM8958X 具有 16 个乙太网路连接埠(其中最多 6 个支援 10 Gbps)、1,000BASE-T1 和 100BASE-T1 PHY 整合以及更高的交换容量,提供汽车区域电控系统(ECU) 架构所需的灵活性。包括改进的性能和对中央处理ECU 架构的支援。该交换器还具有最先进的基于规则的资料包过滤引擎,可适应不同的车辆操作模式,以提高驾驶安全性。

其他好处

- Excel 格式的市场预测 (ME) 表

- 3 个月分析师支持

目录

第一章简介

- 研究假设和市场定义

- 调查范围

第二章调查方法

第三章执行摘要

第四章市场动态

- 市场概况

- 产业价值链分析

- 产业吸引力-波特五力分析

- 供应商的议价能力

- 消费者议价能力

- 新进入者的威胁

- 替代品的威胁

- 竞争公司之间的敌对关係

- 市场驱动因素

- 对资讯娱乐和 ADAS 的需求不断增长

- 低成本乙太网路技术的快速采用

- 市场限制因素

- 组件之间的互通性和应用程式的可计算性

- 评估 COVID-19 对产业的影响

第五章市场区隔

- 按成分

- 硬体

- 软体和服务

- 按地区

- 北美洲

- 欧洲

- 亚太地区

- 拉丁美洲

- 中东/非洲

第六章 竞争状况

- 公司简介

- Broadcom Inc.

- NXP Semiconductors NV

- Marvell Technology Group Ltd

- Molex Incorporated

- Microchip Technology Inc.

- Texas Instruments Inc.

- Cadence Design Systems Inc.

- TTTech Auto AG

- Xilinx Inc.

- TE Connectivity Ltd

- Toshiba Corporation

第七章 投资分析

第八章 市场机会及未来趋势

The Automotive Ethernet Market is expected to register a CAGR of 23.5% during the forecast period.

Key Highlights

- The increased deployment of Advanced Driver Assistant System (ADAS), infotainment, rapid progress in the development of autonomous vehicles, and the low cost of ethernet has led to the immense growth of automotive ethernet as it serves the purpose of connecting in-vehicle electronic system efficiently as compared to traditional harness.

- Automotive ethernet offers connectivity across automotive applications, such as powertrain, chassis, body and comfort, ADAS, and infotainment systems. Supporting high bandwidth applications operating at high or low speed addresses the challenges designers and engineers face in integrating different systems.

- Ethernet tends to bypass traditional cabling for connectivity, allowing all vehicle components to connect with lighter and more effective wires. This alone has enabled manufacturers to reduce connectivity costs by 80% and cabling weight by 30%. This also serves as a potential application for the cost-effective development of a connected car.

- High-performance navigation systems, high-end entertainment, and telematics require the system to remain 'always on' in a connected car. The increasing bandwidth for in-vehicle data communications has driven the ethernet deployment market.

- With the recent outbreak of COVID-19, the automotive ethernet market is witnessing a decline in growth in the short run due to major automotive manufacturing plants having stopped their production in response to the lockdown being enforced by many countries across the world.

Automotive Ethernet Market Trends

Increased Demand for Advanced Driver Assistance System (ADAS) to boost the Market Growth

- It has been estimated that as the number of vehicles equipped with autonomous driving increases, automotive ethernet is expected to witness increased opportunities for growth. Autonomous driving heavily depends on HD maps with road-based information like lane sizes, crosswalks, and road signs. HD maps are built with data collected from sensors. Ethernet is needed to connect these components to maintain efficient data transfer and, therefore, will contribute to the growth of automotive ethernet.

- Currently, in the automotive sector, the introduction of MEMS associated with ADAS, the emergence of connected vehicles, and the technological advancements of infotainment and IoT equipment is leading to an increase in electronic control unit contents in automobiles. The growing adoption of IoT solutions in automotive provides growth opportunities to a wide range of highly connected modern ADAS and autonomous driving functions. Having vehicles connected to everything in their vicinity or Vehicle-to-Everything (V2X) is an essential step toward a connected network of autonomous vehicles. Ethernet compatibility advantages when connecting vehicles to smart infrastructure make it an essential vehicle part.

- According to the International Organization of Motor Vehicle Manufacturers (OICA), approximately 80 million vehicles were produced globally last year. With growing volumes of vehicles and the rising demand for safety features designed to avoid collisions and accidents, companies are offering technologies that alert the driver about potential problems. Many vehicle manufacturers highly adopt ADAS to provide customers with Emergency Brake Assist, Adaptive Cruise Control, Blind Spot Detection, Rear Cross-Traffic Alert, Traffic Sign Assist, Intelligent Lights, Intelligent Speed Assist, and Lane/Road Departure Alert.

- Government regulations revolving around safety and security are also major drivers for the growth of automotive ethernet. While many of these systems are embedded in current models of cars, some of them will become mandatory as they contribute towards road safety. For instance, in March 2019, the European Commission announced a new rule to make Intelligent Speed Assistance (ISA) mandatory for all newly manufactured light vehicles starting in the last year. Euro NCAP and the US NHTSA safety assessment are additional driving forces behind ADAS adoption, which include the availability and the performance of safety assistant systems in their ratings.

Asia-Pacific to Witness Significant Growth

- Increased production of passenger vehicles is one of the major factors driving the market growth in the Asian-Pacific Region. Automakers like Mercedes-Benz, Ford, and Volkswagen are rolling out expansion plans in India to maximize manufacturing capacity and output and minimize the local market's supply-demand gap. With these plans, the Indian market for time-sensitive in-vehicle networking components will increase. Thus the automotive ethernet market is poised for strong growth through the studied period.

- With more original equipment manufacturers (OEMs) providing new connected car capabilities with each new model produced, the connected car market in India is seeing significant advancements. The market for vehicles with enhanced HMI features, more connected technologies, and the integration of advanced driver assistance system (ADAS) solutions has grown in response to rising consumer demands for comfort, convenience, safety, and security.

- Except for the base variation, most premium OEMs in India now include smartphone connectivity or embedded connectivity as a standard feature. In contrast, volume OEMs only include smartphones or embedded connectivity on mid- and high-end variants. The development of connected automobiles in the Indian market has been facilitated by consumers' growing awareness of connected car services and willingness to pay for pricier options.

- Faster GDP growth and highly aspirational Asian consumers are the two major growth drivers for most regions, such as China, India, Malaysia, and the other developing markets in Southeast Asia in the coming years. In terms of consumption of connected and autonomous vehicles, North America and Europe remain the prominent regions owing to the presence of significant players such as Marvell Technology Group Ltd and Broadcom Incorporated, among others, the high acceptance rate of advanced technology and increasing adoption of Ethernet in-vehicle networks for mainstream models.

- However, closure trends in India led the SIAM to estimate that nearly USD 280 Million per day was revenue loss for Indian automakers and component manufacturers amidst the pandemic. Significant players like Maruti Suzuki India, Hyundai, Honda, Mahindra, Toyota Kirloskar Motor, Tata Motors, Kia Motors, and MG Motor India have temporarily shut down their plants. The market is very likely to suffer from potential component supply chain disruption, leading to reduced sales and production of an automotive ethernet.

Automotive Ethernet Industry Overview

The automotive ethernet market is fragmented in nature due to high competition. Despite the fragmentation, the market is primarily tied by the regulatory requirements for establishment and operation. Furthermore, with increasing innovation, acquisitions, and partnerships, market rivalry tends to rise in the future. Some major market players are Broadcom Inc., NXP Semiconductors NV, Marvell Technology Group Ltd, Microchip Technology Inc., and Texas Instruments Inc.

- May 2022 - The BCM8958X, a high bandwidth monolithic automotive Ethernet switch device from Broadcom Inc., was delivered. It was created to meet the expanding bandwidth need for in-vehicle networking applications and to promote the adoption of software-defined vehicles (SDV). With its 16 Ethernet ports, up to six of which are 10 Gbps capable, integrated 1000BASE-T1 and 100BASE-T1 PHYs, and higher switching capacity, the BCM8958X offers the increased flexibility and central compute ECU architecture support needed for automotive zonal electronic control unit (ECU) architectures. This switch also has a cutting-edge rule-based packet filter engine that can adjust to various vehicle operation modes to improve driving security.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET DYNAMICS

- 4.1 Market Overview

- 4.2 Industry Value Chain Analysis

- 4.3 Industry Attractiveness - Porter's Five Forces Analysis

- 4.3.1 Bargaining Power of Suppliers

- 4.3.2 Bargaining Power of Consumers

- 4.3.3 Threat of New Entrants

- 4.3.4 Threat of Substitutes

- 4.3.5 Intensity of Competitive Rivalry

- 4.4 Market Drivers

- 4.4.1 Increased Demand for Infotainment and ADAS

- 4.4.2 Rapid Adoption of Low cost Ethernet Technology

- 4.5 Market Restraints

- 4.5.1 Interoperability Among Components and Application Computability

- 4.6 Assessment of Impact of Covid-19 on the Industry

5 MARKET SEGMENTATION

- 5.1 By Component

- 5.1.1 Hardware

- 5.1.2 Software and Services

- 5.2 Geography

- 5.2.1 North America

- 5.2.2 Europe

- 5.2.3 Asia-Pacific

- 5.2.4 Latin America

- 5.2.5 Middle East and Africa

6 COMPETITIVE LANDSCAPE

- 6.1 Company Profiles

- 6.1.1 Broadcom Inc.

- 6.1.2 NXP Semiconductors NV

- 6.1.3 Marvell Technology Group Ltd

- 6.1.4 Molex Incorporated

- 6.1.5 Microchip Technology Inc.

- 6.1.6 Texas Instruments Inc.

- 6.1.7 Cadence Design Systems Inc.

- 6.1.8 TTTech Auto AG

- 6.1.9 Xilinx Inc.

- 6.1.10 TE Connectivity Ltd

- 6.1.11 Toshiba Corporation