|

市场调查报告书

商品编码

1630387

云端供应链管理:市场占有率分析、产业趋势/统计、成长预测(2025-2030)Cloud Supply Chain Management - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

※ 本网页内容可能与最新版本有所差异。详细情况请与我们联繫。

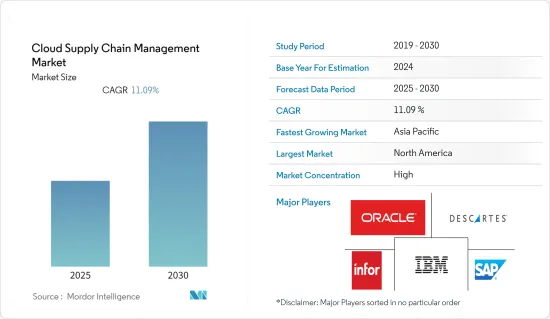

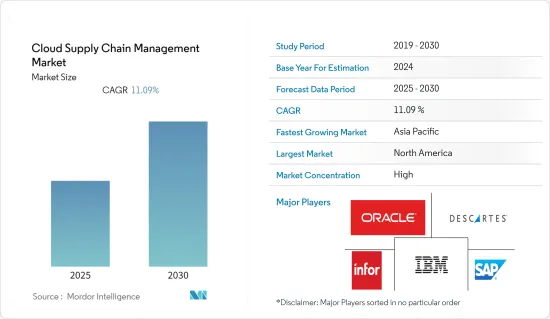

云端供应链管理市场预计在预测期内复合年增长率为11.09%。

主要亮点

- 云端运算正在迅速扩展,以支援协作运输管理解决方案(TMS)和运输管理的其他方面,例如网路容量采购、完整的可视性和事件管理,以及货运支付和审核等辅助功能。

- 云端运算现在是一种选择,它为供应链管理人员提供了一种快速、高效地存取和部署透过 SaaS 模型交付的创新解决方案的途径,从而显着节省了成本。随着工业 4.0 的出现,许多供应商正在实施数位技术来改进、自动化和现代化其整个流程。云端整合变得越来越流行,因为它提供了可扩展性、安全性、成本、控制和速度等显着优势。

- COVID-19 大流行凸显了对可靠且始终可用的供应链技术解决方案的需求不断增长。资讯延迟是透过云端实现的。为供应链提供动力的复杂系统和资料网络,从供应商及其供应商开始,透过入境物流提供者、公司工厂和仓库、出库运输商、经销商,最终整合到客户。这就是云端改变供应链的方式。云端提供了快速、廉价且安全地提高资讯共用标准所需的氛围和技术。供应链合作伙伴之间的无缝整合可轻鬆提供整个供应链的近乎即时的可见性。

- 企业在使用云端基础的解决方案时最常面临的问题是资料保护和隐私。资料存取权限应仅授予核准成员,例如值得信赖的供应链合作伙伴。虽然云端基础的解决方案拥有许多安全通讯协定来防止对个人资料的不必要访问,但资料安全最终取决于每个公司如何使用其可支配的资源。这对市场来说是一个挑战。

云端供应链管理市场趋势

零售业预计将大幅成长

- 随着大多数主要企业采用云端基础的技术,透过从资料中获得前所未有的可见性和洞察力来转变其供应链,零售业有望实现显着成长。技术整合的重点是了解客户旅程并提供实质改进。

- 因此,零售业参与者需要能够帮助他们更有效地管理纸本文件以及结构化和非结构化资料的工具,以保持竞争力。这就是为什么大多数主要企业都采用云端基础的技术来转变其供应链,并从资料中获得前所未有的可见性和洞察力。技术整合的重点是了解客户旅程并提供实质改进。

- 随着电子商务的发展增加了市场参与者的数量,客户维繫变得比以往任何时候都更加重要。云端运算透过撷取和分析来自多个来源的资料、识别模式和预测需求以及提供随选服务来帮助改善客户体验。此外,零售商可以业务线应用程式存取所有业务内容,从而能够为客户提供及时的回应和优质的服务,并使自己与竞争对手区分开来。

- 此外,自动化工具透过数位化库存资讯并使用分析和视觉化报告来改善分销和库存管理。这使得零售商能够实现供应链自动化,从透过入境承运商管理和分配库存到商店层级的匹配。这意味着更低的营运成本、更清晰、更快速的发票核对方式,以及更快的重新订购时间以提高填充率。

北美占据主要市场占有率

- 北美市场正在显着成长,这主要归功于 GS1 标准的选择,该标准旨在提高美国25 个产业的实体和数位通路供应链的安全性、效率和可见度。

- 美国的云端采用率正在增加,这对市场做出了贡献。根据 Stormforgein 2021 年 4 月发布的报告,18% 的北美受访者表示,他们的组织每月在云端使用上的支出在 10 万至 25 万美元之间。此外,44% 的受访者预计他们的云端支出将在未来 12 个月内略有增加,另外 32% 的受访者预计他们的组织的云端支出将在未来 12 个月内大幅增加。

- 美国客户受益于日益多样化的交通选择。物流企业透过供应链管理软体、包装、物料输送、仓储、货运、退货管理、经纪等提供资讯流整合。

- 此外,封锁和旅行限制扰乱了美国经济的各个部门,在这段动盪时期对供应链业务产生了重大影响。在这个不确定的时期,企业越来越依赖云端运算和储存来提高其供应网路的灵活性和敏捷性。

- 此外,加拿大政府制定了「云端优先」策略,该策略在启动资讯技术投资、措施、策略和计划时将云端服务确定为主要交付选项并对其进行评估。云端还允许加拿大政府利用私人提供者的创新,并使资讯技术更加敏捷。这些措施预计将为云端供应链管理提供充足的机会。

云端供应链管理产业概况

云端供应链管理市场高度集中,由Oracle公司、SAP SE、笛卡尔系统集团公司、Infor公司和IBM公司等主要企业主导。这些拥有重要市场份额的主要企业正致力于扩大海外基本客群。这些公司正在利用策略联合措施来扩大市场占有率并提高盈利。然而,随着产品创新和技术进步,中小企业正在透过获得新契约和开发新市场来增加其在市场中的占有率。

- 2022 年 5 月 - SAP 与 Apple 合作,建立跨数位供应链的协作。作为与 Apple 持续合作关係的一部分,SAP 宣布推出一套新的应用程序,以简化数位供应链,并为员工提供简单的工具来改变他们在 iPhone 和 iPad 上的工作方式。

- 2021 年 9 月 - 工业云端供应商 Infor 发布了 Infor Hospitality Management Solutions (HMS) 3.8.4 版,这是 Infor 饭店解决方案套件中完全支援云端的饭店管理软体的最新版本。此更新的重点是提供用于优化和提供客製化服务的新选项。 Infor 的 HMS 是一种即时、可存取、云端基础的技术,可满足当今客户繁忙的日程安排,并允许饭店客製化流畅、无摩擦的体验。

其他好处

- Excel 格式的市场预测 (ME) 表

- 3 个月分析师支持

目录

第一章简介

- 调查先决条件

- 调查范围

第二章调查方法

第三章执行摘要

第四章市场洞察

- 市场概况

- 产业价值链分析

- 产业吸引力-波特五力分析

- 供应商的议价能力

- 消费者议价能力

- 新进入者的威胁

- 竞争公司之间的敌对关係

- 替代品的威胁

第五章市场动态

- 市场驱动因素

- 中小型企业快速采用云端基础的解决方案进行需求管理

- 电子商务领域的成长加速了客户维繫技术解决方案的采用

- 市场限制因素

- 企业对安全和隐私的担忧日益增加

第六章 市场细分

- 按解决方案

- 需求规划与预测

- 库存/仓库管理

- 产品生命週期管理

- 运输与物流管理

- 销售/营运计划

- 其他解决方案(采购、产品主资料管理、订单管理)

- 依部署类型

- 混合云

- 公有云

- 私有云端

- 按组织规模

- 大公司

- 小型企业

- 按最终用户产业

- 零售

- 饮食

- 製造业

- 车

- 石油和天然气

- 卫生保健

- 其他最终用户产业

- 按地区

- 北美洲

- 欧洲

- 亚太地区

- 拉丁美洲

- 中东/非洲

第七章 竞争状况

- 公司简介

- SAP SE

- Oracle Corporation

- Infor Inc

- Descartes Systems Group Inc

- IBM Corporation

- JDA Software Group Inc

- Manhattan Associates Inc

- Logility Inc.

- Kinaxis Inc

- HighJump Software Inc

- CloudLogix Inc.

- TECSYS, Inc.

第八章投资分析

第九章市场展望

The Cloud Supply Chain Management Market is expected to register a CAGR of 11.09% during the forecast period.

Key Highlights

- Cloud computing is quickly growing to support collaborative transportation management solutions (TMS) and other aspects of transportation management, such as sourcing of network capacity, complete visibility and event management, and ancillary functions, including freight pay and audit.

- Cloud computing is now perceived as a significant cost-saving alternative, giving a route through which supply chain executives can quickly and efficiently access innovative solutions delivered through a SaaS model and deploy them at scale. With the emergence of industry 4.0, numerous vendors are implementing digital technologies to improve, automate, and modernize the entire process. Integrating the cloud is becoming increasingly popular because it offers substantial advantages such as scalability, security, cost, control, and speed.

- The COVID-19 pandemic has highlighted the growing demand for dependable, anytime-accessible supply chain technology solutions. Through the cloud, information latency is achieved. It integrates the intricate web of systems and data that serves up the supply chain, starting with suppliers and their suppliers and moving on to inbound logistics providers, a company's factories and warehouses, outbound carriers, distributors, and eventually customers. Thereby making the cloud transformative for supply chains. It provides the atmosphere and technology required to quickly, inexpensively, and securely raise the bar for information sharing. Near-real-time visibility across the whole supply chain is easily provided by seamless integration among supply chain partners.

- The most frequent problem businesses have with cloud-based solutions is data protection and privacy. Data access should only be permitted for approved members, such as reputable supply chain partners. Data security ultimately depends on how each firm uses the resources at their disposal, even while cloud-based solutions have numerous security protocols in place to prevent unwanted access to personal data. This acts as a challenge to the market.

Cloud Supply Chain Management Market Trends

Retail Industry is Expected to Register a Significant Growth

- The retail industry is expected to register significant growth as most key players are adopting cloud-based technologies to transform their supply chains with unprecedented visibility and insights from data. Technology integrations focus on understanding the customer journey and providing substantive improvement.

- With the growing retail sector, the adoption of advanced technologies is significantly growing; therefore, the retail industry players require tools that enable organizations to manage paper documents and structured and unstructured data more effectively to remain competitive. Hence, most key players are adopting cloud-based technologies to transform their supply chains with unprecedented visibility and insights from data. Technology integrations focus on understanding the customer journey and providing substantive improvement.

- Customer retention has become more important than before due to increased players in the market with the growth of e-commerce. Cloud computing helps enhance customer experiences as it captures and analyzes data from many sources, identifies patterns and predicts needs, and offers on-demand services. It also provides retailers access to all business content from the core line-of-business applications to provide timely responses and exceptional service to the customers, separating them from their competition.

- Additionally, automation tools improve distribution and inventory management by digitizing inventory information and using analytics and visual reporting. Therefore, it enables retailers to automate the supply chain from the inbound carrier to manage and distribute inventory to store-level reconciliation. It leads to lower operational costs, a more straightforward, faster way to reconcile invoices, and improved fill rates by shrinking reorder time.

North America Hold Significant Market Share

- North America may experience notable market growth, principally driven by the selection of GS1 standards designed to promote the safety, efficiency, and visibility of supply chains across physical and digital channels in 25 sectors in the United States.

- The growing adoption of cloud in the US is contributing to the market. According to a report published by Stormforgein in April 2021, 18% of respondents from North America state that their organization has a monthly cloud spend of between USD 100,000 and USD 250,000. Further, 44% of respondents expect cloud spending to increase somewhat over the next 12 months, while another 32% indicate that they expect their organization's cloud spending to increase significantly over the next 12 months.

- Customers in the United States are profiting from the diversity of transport modes in their increasingly connected environment. Logistics businesses offer the integration of information flow through supply chain management software, packaging, material handling, warehousing, forwarding, returned goods management, and brokerage.

- Further, Lockdowns and travel restrictions have disrupted different sectors of the US economy and considerably influenced supply chain operations during these periods of fast upheaval. Businesses increasingly rely on cloud computing and storage in these uncertain times to increase the flexibility and agility of their supply networks.

- Moreover, the Government of Canada has a "cloud-first" strategy whereby cloud services are identified and evaluated as the principal delivery option when initiating information technology investments, initiatives, strategies, and projects. The cloud will also allow the Government of Canada to harness the innovation of private-sector providers to make its information technology more agile. Such initiatives are expected to provide ample opportunities to the cloud supply chain management.

Cloud Supply Chain Management Industry Overview

The cloud supply chain management market is highly concentrated and controlled by dominant players, like Oracle Corporation, SAP SE, Descartes Systems Group Inc., Infor Inc., and IBM Corporation. With a notable share in the market, these principal players are concentrating on expanding their customer bases across foreign countries. These businesses are leveraging strategic collaborative initiatives to strengthen their market shares and enhance their profitability. However, with product innovations and technological advancements, midsize to smaller firms are growing their market presence by securing new contracts and tapping new markets. Some of the recent developments in the market are:

- May 2022- SAP has partnered with Apple to build collaborations throughout the digital supply chain. SAP has unveiled a new suite of apps that streamline the digital supply chain and equip workers with simple tools as part of its ongoing relationship with Apple to transform how people operate on iPhones and iPads.

- September 2021- Infor, the industrial cloud provider, has released the latest edition of the fully cloud-enabled hotel management software in the Infor Hospitality suite of solutions, Infor Hospitality Management Solution (HMS) version 3.8.4. This update focuses on giving new choices for optimizing and delivering customised services. Infor HMS is cloud-based technology accessible in real time, keeping up with modern customers' hectic schedules and allowing hotels to customize a smooth and frictionless experience.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET INSIGHTS

- 4.1 Market Overview

- 4.2 Industry Value Chain Analysis

- 4.3 Industry Attractiveness - Porter's Five Forces Analysis

- 4.3.1 Bargaining Power of Suppliers

- 4.3.2 Bargaining Power of Consumers

- 4.3.3 Threat of New Entrants

- 4.3.4 Intensity of Competitive Rivalry

- 4.3.5 Threat of Substitutes

5 MARKET DYNAMICS

- 5.1 Market Drivers

- 5.1.1 Rapid Adoption of Cloud -based Solution for Demand Management by SMEs

- 5.1.2 Increasing Growth of E - commerce Sector Has Fueled the Adoption of Technological Solutions to Retain Customers

- 5.2 Market Restraints

- 5.2.1 Increasing Security and Privacy Concerns Among Enterprises

6 MARKET SEGMENTATION

- 6.1 By Solution

- 6.1.1 Demand Planning and Forecasting

- 6.1.2 Inventory and Warehouse Management

- 6.1.3 Product Life-Cycle Management

- 6.1.4 Transportation & Logistics Management

- 6.1.5 Sales and Operations Planning

- 6.1.6 Other Solutions (Procurement and Sourcing, Product Master Data Management, and Order Management)

- 6.2 By Deployment Type

- 6.2.1 Hybrid Cloud

- 6.2.2 Public Cloud

- 6.2.3 Private Cloud

- 6.3 By Organization Size

- 6.3.1 Large Enterprises

- 6.3.2 Small and Medium Enterprises

- 6.4 By End-user Industries

- 6.4.1 Retail

- 6.4.2 Food & Beverage

- 6.4.3 Manufacturing

- 6.4.4 Automotive

- 6.4.5 Oil & Gas

- 6.4.6 Healthcare

- 6.4.7 Other End-user Industries

- 6.5 By Geography

- 6.5.1 North America

- 6.5.2 Europe

- 6.5.3 Asia-Pacific

- 6.5.4 Latin America

- 6.5.5 Middle East and Africa

7 COMPETITIVE LANDSCAPE

- 7.1 Company Profiles

- 7.1.1 SAP SE

- 7.1.2 Oracle Corporation

- 7.1.3 Infor Inc

- 7.1.4 Descartes Systems Group Inc

- 7.1.5 IBM Corporation

- 7.1.6 JDA Software Group Inc

- 7.1.7 Manhattan Associates Inc

- 7.1.8 Logility Inc.

- 7.1.9 Kinaxis Inc

- 7.1.10 HighJump Software Inc

- 7.1.11 CloudLogix Inc.

- 7.1.12 TECSYS, Inc.