|

市场调查报告书

商品编码

1630393

全球高速应用开发-市场占有率分析、产业趋势与统计、成长预测(2025-2030)Global Rapid Application Development - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

价格

※ 本网页内容可能与最新版本有所差异。详细情况请与我们联繫。

简介目录

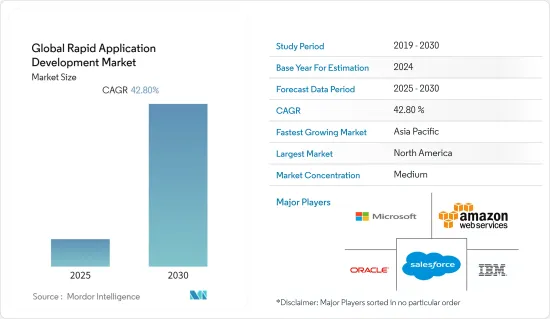

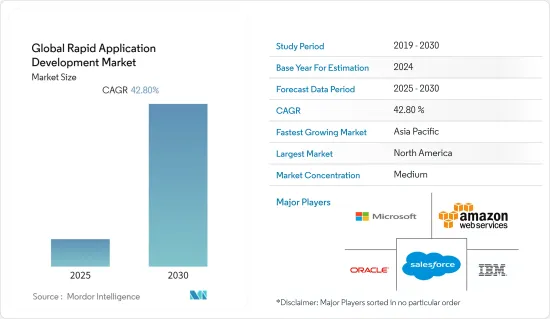

全球新兴市场发展预计在预测期内复合年增长率为42.8%

主要亮点

- 不断增长的开发、对应用程式整合的需求不断增长以及对具有强大应用程式要求的微服务的需求不断增长,是推动所研究市场在预测期内增长的一些关键因素。此外,不断增长的跨业务创新以及先进技术在业务流程中的整合正在增加跨行业应用开发的需求。

- 2021 年 5 月,软体和数位工程产品公司 Innominds 宣布推出用于软体开发的低程式码平台。随着 iSymphony 平台的上市,Innominds 加入了快速发展的低程式码、无程式码快速应用开发(RAD)机芯。

- 据 DigitalOcean 称,2020 年,65% 的创办人将维护基础设施的技术知识视为新业务进入的最大障碍。借助应用程式平台解决方案,企业可以透过处理常规基础设施任务(例如配置和管理伺服器、作业系统、资料库、应用程式运行时和其他依赖项)来获得竞争优势。

- 透过快速应用开发平台,为零售和金融公司提供最具吸引力的行动应用解决方案。最终用户正在采用各种行动应用程序,从与 iOS 和 Android 装置整合的丰富本机行动应用程式到不需要 App Store 下载的轻量级渐进式 Web 应用程式。

- RAD 依赖快速迭代和开发。这需要该领域的高级技能。所有相关人员都必须具有平等且适当的专业能力,而这样的团队可能很难组成。快速应用开发非常适合小型、密切相关的团队。因为这种模式需要有效的协作。此外,如果您的组织内没有经验丰富的专业人员,这可能会很困难。

- 由于各行业对数位应用的投资增加,COVID-19 的爆发扩大了研究市场的范围。过去需要数月甚至数年才能采用数位和云端技术的行业现在主要依靠它们来高效工作。这对简化流程并消除耗时任务的工具和平台产生了更大的需求。因此,对快速应用开发平台(一种专注于速度、使用者策略和原型製作的应用开发模型)的需求预计将会增加。

新兴市场的趋势

中小企业推动市场成长

- 中小型企业可能会推动市场成长,因为它们采用高速应用开发平台以更低的成本开发以客户为中心的应用程式并提高生产力。

- 根据 Soliant Consulting 2021 年 10 月的公告,最近的趋势表明,由于对新解决方案的需求不断增长以及快速构建和向客户交付应用程式的愿望,快速应用开发。特别受企业欢迎。这种方法允许中小型企业透过 RAD 实现更高的投资回报率,因为技术开发需求被分解为更小的部分。

- 小型企业对大多数地区的经济做出了重大贡献。根据美国小型企业管理局 (SBA) 的数据,超过 50% 的美国拥有或为小型企业工作。此外,中小企业占该国GDP的40%。在欧盟,约 99% 的公司员工人数少于 250 人。

- 即使团队规模较小,RAD 也能生存,这对需要在需要时快速交付产品和更新功能的中小型企业有利。根据 Maruti Techlabs 2021 年 2 月进行的一项研究,该产品开发涉及频繁迭代,以确保组件和原型的快速发布。因此,使用者可以衡量计划进展并检查专案是否按时完成以及整体开发成本是否在预算范围内。

- 小型企业需要随时随地存取资料,而无需承担储存和硬体维护的间接成本。此外,中小型企业正在寻求云端基础的RAD 平台来节省成本、时间和资源。这进一步推动了市场的成长。

亚太地区将经历最高的成长

- 技术的复杂性、企业影响力的增加、服务的扩展以及云端基础的服务供应商的扩展正在促进亚太市场地区的显着成长。中国、日本、印度和新加坡等国家不断拥抱最新技术并影响快速应用开发厂商。

- 根据 ThirdRock Techkno 2022 年 5 月进行的一项调查,快速应用开发已成为全球使用最广泛的开发流程之一。这种应用开发流程通常是产品开发人员的首选,因为它可以确保应用开发快速、顺利,并允许开发人员更有效率地实现其开发目标。研究还表明,78% 的公司与计划需求不同步,快速应用开发有助于最大限度地减少此类挑战。

- NASSCOM 预计,2021 年至 2025 年低代码/无代码产业的复合年增长率将达到 28.1%。疫情改变了商业运作方式,这点在印度也很明显。这就是为什么我们在低程式码应用程式平台、低程式资料科学平台、低程式码认知平台等方面进行大量投资。这些平台将上市时间缩短了 70%,对于吸收不断变化的市场需求非常有用,引领了印度的竞争曲线。

- 此外,2021 年 10 月,OutSystems 宣布在印度班加罗尔开设新的研发中心。该中心补充了该公司位于葡萄牙、美国、英国、荷兰和西班牙的全球研发中心的能力。该中心是 Outsystems 在印度的第一个卓越中心,是其在快速发展的数位时代促进高效、快速的应用开发以促进全球和本地市场业务成长的努力的一部分。

- 同样,2021年1月,西门子旗下企业低程式码应用开发供应商Mendix宣布将其世界级平台引进中国市场。 Mendix 低程式码平台为寻求加速数位转型和因全球疫情而加速的新经营方式的中国企业提供了广泛的优势。

高速应用开发产业概述

全球高速应用开发市场适度集中。为了保持竞争力,新兴市场参与企业不断推出新产品、开发新技术并进行併购。重要的市场开发措施包括:

- 2021 年 6 月 - TrailheaDX,Salesforce 推出了以下功能,包括一套强大的低程式码开发工具,使您组织中的用户能够在单一平台上创建和发布应用程序,无论技术技能或角色如何。

- 2021 年 3 月 - Zoho 发布新的 Creator 平台。这个一体化解决方案透过提供低程式码、实用的解决方案建置体验,弥合了业务使用者和 IT 团队之间的差距。透过此版本,我们的目标是帮助 IT 团队和业务使用者建立更复杂、更现代、更合规的解决方案。 Zoho Creator 致力于成为使用者友好、安全且自订的低程式码平台,以解决各种工业挑战。

- 2021 年 1 月 - Oracle 宣布其广受欢迎的 APEX 低程式码开发平台作为託管云端服务,设计人员可以使用它快速轻鬆地建立资料驱动的业务应用程式。 Oracle APEX 应用程式开发扩展了 20 年来已被 50 万开发人员使用的 APEX 功能,作为一种易于使用、基于浏览器的服务,用于开发现代 Web 和行动应用程式。

其他好处

- Excel 格式的市场预测 (ME) 表

- 3 个月分析师支持

目录

第一章简介

- 研究假设和市场定义

- 调查范围

第二章调查方法

第三章执行摘要

第四章市场洞察

- 市场概况

- 产业吸引力-波特五力分析

- 供应商的议价能力

- 消费者议价能力

- 新进入者的威胁

- 竞争公司之间的敌对关係

- 替代品的威胁

- COVID-19 市场影响评估

第五章市场动态

- 市场驱动因素

- 融合业务创新与前沿技术

- 根据您组织的动态需求灵活客製化解决方案

- 市场限制因素

- 缺乏熟练的专业人员

第 6 章 技术概览

第七章 市场区隔

- 按类型

- 低程式码开发平台

- 无程式码开发平台

- 依实施类型

- 本地

- 云

- 按组织规模

- 小型企业

- 大公司

- 按最终用户产业

- BFSI

- 零售/电子商务

- 政府/国防

- 医疗保健

- 资讯科技

- 其他最终用户产业(能源/公共产业、製造业等)

- 按地区

- 北美洲

- 欧洲

- 亚太地区

- 其他的

第八章 竞争格局

- 公司简介

- Oracle Corporation

- Microsoft Corporation

- Salesforce.com Inc.

- IBM Corporation

- Amazon Web Services Inc.

- Appian Corporation

- ServiceNow

- Zoho Corporation Private Limited

- OutSystems

- LANSA

第九章投资分析

第10章市场的未来

简介目录

Product Code: 70774

The Global Rapid Application Development Market is expected to register a CAGR of 42.8% during the forecast period.

Key Highlights

- The increasing developments, growing demand for applications integration, and rising need for microservices with robust application requirements are some of the major factors driving the studied market growth over the forecast period. Further, growing innovations across businesses and integrating advanced technologies in their business processes augment the demand for application development across industries.

- In May 2021, The software and digital engineering products company, Innominds launched its low-code platform for software development. With the market release of the platform, called iSymphony, Innominds joins the fast-growing low-code no-code movement for rapid application development (RAD). iSymphony provides a development environment to create application software through a graphical user interface and configuration instead of traditional hand-coded computer programming.

- According to DigitalOcean, 65% of founders in 2020 cite technical know-how around maintaining infrastructure as a top barrier to entry for new businesses. Handling everyday infrastructure tasks like provisioning and managing servers, operating systems, databases, application runtimes, and other dependencies, with the help of application platform solutions, enables enterprises to gain competitive advantages.

- Retail and Financial enterprises deliver the most engaging mobile application solutions with the help of rapid application development platforms. End users are adopting a range of mobile applications, from rich native mobile applications with iOS and Android device integrations to lightweight progressive web applications that don't require App Store downloads.

- RAD relies on rapid iteration and development. This requires advanced skills in the field. All parties involved must have equivalent and appropriate professional competence, and forming such a team could be difficult. Rapid application development works well with small, closely related teams. This is because this model requires effective collaboration. Further, this could be a challenge without experienced professionals in an organization.

- The COVID-19 outbreak has expanded the studied market scope, owing to the growing investment in digital applications across all industries. Industries that could have taken months and years to adopt digital and cloud technologies are now mainly relying on these for working efficiently. This is a further growing need for tools and platforms that streamline processes and eliminate time-consuming tasks. Hence, the demand for rapid application development platforms is expected to increase, as it is an application development model that places a heavy focus on speed, user strategy, and prototyping.

Rapid Application Development Market Trends

Small and Medium-sized Enterprises To Drive the Market Growth

- Small and Medium-sized Enterprises are likely to drive the market's growth due to their adoption of rapid application development platforms to develop customer-centric applications at lower costs and for better productivity.

- According to Soliant Consulting in October 2021, Rapid application development has recently become particularly popular among small businesses as the need for new solutions grows, as does the desire to build apps and deliver them to customers quickly. SMEs achieve great ROI with their RAD as the methodology divides technology development requirements into smaller chunks.

- SMEs are significantly contributing to the economy of most regions. According to the US Small Business Administration (SBA), more than 50% of Americans either own or work for a small business. SMBs also account for 40% of the country's GDP. Approximately 99% of all enterprises in the EU employ fewer than 250 persons.

- RAD is beneficial when SMEs need to deliver a product and update the features quickly and when necessary, as it can survive on smaller teams. According to a survey conducted by Maruti Techlabs in February 2021, frequent iterations are involved in this product development, ensuring quicker releases of the components and prototypes. As a result, users can measure project progress and see if it will be completed on time and if the overall development cost will be within budget.

- Small businesses need access to their data on the go, with no overhead costs for storage and hardware maintenance. Moreover, SMEs are looking for cloud-based RAD platforms to save money, time, and resources. This further boost the growth of the market.

Asia Pacific to Witness Highest Growth

- The increasing sophistication of technology, the growing presence of enterprises, the expansion of services, and the expansion of cloud-based service providers have all contributed to the tremendous growth of the APAC market region. Countries such as China, Japan, India, and Singapore have adopted the latest technology and continue to influence and expand rapid application development vendors.

- According to a survey conducted by ThirdRock Techkno in May 2022, rapid application development has become one of the world's most widely used development processes. This application development process is often the first choice for product developers as it ensures fast and smooth application development and helps developers achieve their development goals more efficiently. Also, according to the survey, 78% of companies are out of sync with their project requirements, and rapid application development helps minimize such challenges.

- According to NASSCOM, the Low-code/No-Code industry is expected to grow at a CAGR of 28.1% from 2021 to 2025. The pandemic has changed how businesses operate, which is evident in India. This leads to significant investment, which could be a low-code application platform, a low-code data science platform, or a low-code cognitive platform. These platforms reduce time to market by 70%, are highly convenient for absorbing the ever-changing market needs, and lead the competition curve in India.

- Further, in October 2021, OutSystems announced the opening a new R&D center in Bangalore, India. The center will complement the capabilities of the company's global R&D centers in Portugal, the United States, the United Kingdom, the Netherlands, and Spain. This center is the first research base for OutSystems in India as part of its efforts to facilitate efficient and rapid application development for business growth based on global and local markets in the swiftly growing digital era.

- Similarly, in January 2021, Mendix, a Siemens enterprise and provider of low-code application development for the enterprise, announced the intro of its world-class platform to the Chinese market. The Mendix low-code platform brings extensive advantages to Chinese enterprises seeking to accelerate their digital transformation and new methods of doing business that are accelerated by the global pandemic.

Rapid Application Development Industry Overview

The Global Rapid Application Development Market is moderately concentrated. Players in the market are launching new products, developing new technologies, and mergers & acquisitions to remain competitive. Some of the critical development in the market are:

- June 2021 - TrailheaDX, Salesforce introduced the next generation of Salesforce Platform that includes a robust set of low-code development tools that can empower users within an organization, regardless of technical skill or role, to create and ship apps on a single platform.

- March 2021 - Zoho released its new Creator platform. This all-in-one solution bridges the gap between business users and IT teams by delivering a low code and practical solution-building experience. With the recent release, the company aspires to empower IT teams and business users to build a more sophisticated, modern, and compliant solution. Zoho Creator is concentrating on becoming a low-code platform that is user-friendly, secure, and custom fit for solving various industry challenges.

- January 2021 - Oracle announced its popular APEX low-code development platform as a managed cloud service that designers can use to quickly and easily build data-driven business applications. Oracle APEX Application Development extends on two decades of APEX functionality already used by 500,000 developers as an easy-to-use, browser-based service for developing modern Web and mobile apps.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET INSIGHTS

- 4.1 Market Overview

- 4.2 Industry Attractiveness - Porter's Five Forces Analysis

- 4.2.1 Bargaining Power of Suppliers

- 4.2.2 Bargaining Power of Consumers

- 4.2.3 Threat of New Entrants

- 4.2.4 Intensity of Competitive Rivalry

- 4.2.5 Threat of Substitute Products

- 4.3 Assessment of COVID-19 Impact on the Market

5 MARKET DYNAMICS

- 5.1 Market Drivers

- 5.1.1 Innovation in the Businesses and Integration of Advanced Technologies

- 5.1.2 Flexibility to Customize Solutions as per an Organizations Dynamic Requirements

- 5.2 Market Restraints

- 5.2.1 Lack of Skilled Professionals

6 TECHNOLOGY SNAPSHOT

7 MARKET SEGMENTATION

- 7.1 By Type

- 7.1.1 Low-Code Development Platforms

- 7.1.2 No-Code Development Platforms

- 7.2 By Deployment Mode

- 7.2.1 On-Premise

- 7.2.2 Cloud

- 7.3 By Organization Size

- 7.3.1 Small and Medium Enterprises

- 7.3.2 Large Enterprises

- 7.4 By End-user Industry

- 7.4.1 BFSI

- 7.4.2 Retail and E-commerce

- 7.4.3 Government and Defense

- 7.4.4 Healthcare

- 7.4.5 Information Technology

- 7.4.6 Other End-user Industries (Energy and Utilities, Manufacturing, etc.)

- 7.5 By Geography

- 7.5.1 North America

- 7.5.2 Europe

- 7.5.3 Asia-Pacific

- 7.5.4 Rest of the World

8 COMPETITIVE LANDSCAPE

- 8.1 Company Profiles

- 8.1.1 Oracle Corporation

- 8.1.2 Microsoft Corporation

- 8.1.3 Salesforce.com Inc.

- 8.1.4 IBM Corporation

- 8.1.5 Amazon Web Services Inc.

- 8.1.6 Appian Corporation

- 8.1.7 ServiceNow

- 8.1.8 Zoho Corporation Private Limited

- 8.1.9 OutSystems

- 8.1.10 LANSA

9 INVESTMENT ANALYSIS

10 FUTURE OF THE MARKET

02-2729-4219

+886-2-2729-4219