|

市场调查报告书

商品编码

1630394

CDR(内容清理/重建):全球市场占有率分析、产业趋势/统计、成长预测(2025-2030)Global Content Disarm and Reconstruction - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

※ 本网页内容可能与最新版本有所差异。详细情况请与我们联繫。

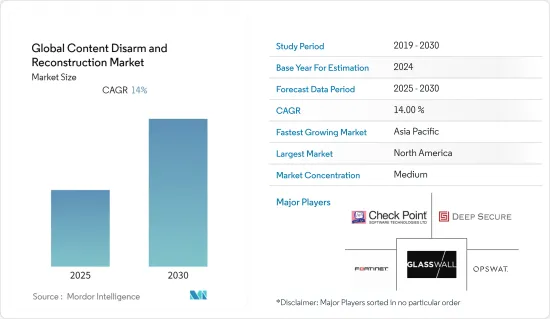

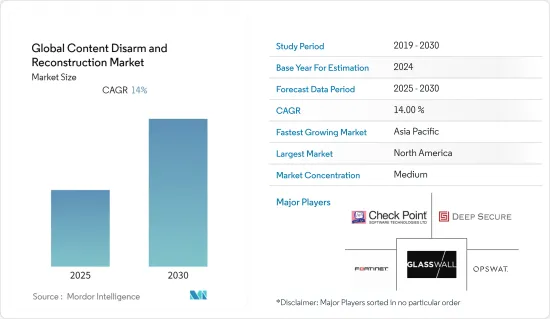

全球 CDR(内容清理和重建)市场预计在预测期内复合年增长率为 14%。

主要亮点

- 预计到 2021 年,全球整体勒索软体造成的损失将从 2015 年的约 2.6 亿美元增加到 150 亿美元至 160 亿美元。由于此类攻击突然增多,市场上出现了创纪录的投资者资金流入1,000多笔交易,其中84笔交易金额超过1亿美元。

- Momentum Cyber 也指出,这些交易包括工业网路安全新兴企业Dragos 获得的 2 亿美元 D 轮投资、Claroty 的 1.4 亿美元 IPO 前融资以及无密码身份验证公司 Transmit Security 的 1.4 亿美元 IPO 前融资他表示,其中包括5.43 亿美元的A 轮融资。此外,总资金筹措与前一年同期比较增加了138%。由于这一历史性的投资金额,2021 年被称为独角兽的安全新兴企业比以往任何时候都多。包括 Wiz、Noname Security 和 LaceWork 在内的 30 多家新兴企业估值超过 10 亿美元,而去年只有 6 家。

- 由于基于云端基础的安全解决方案的接受度、安全威胁意识的增强以及互联物联网设备网路安全解决方案的开发,该市场预计将扩大。此外,不断变化的 IT 趋势和越来越多地采用云端解决方案,为用于保护组织资料、品牌价值和身分的 CDR(内容解除和重建)解决方案带来了潜在的成长前景。

- 此外,随着《一般资料保护条例》(GDPR) 的实施,政府和监管机构越来越期望内容安全有更严格的合规性和监管规范,以应对敏感个人资讯的持续安全漏洞。随着世界各国政府在数位化和IT基础设施改造方面投入数百万美元,对内容清理和重建 (CDR) 解决方案的需求不断增加。

- 此外,Swissinfo.ch表示,NCSC(国家网路安全中心)报告了350起网路攻击(网路钓鱼、虚假网站、对组织的直接攻击等),事件数量从100起到150起不等。在家工作的增加是由于冠状病毒,因为在家工作缺乏与职场环境相同的基本保护和威慑(例如网路安全)。此类漏洞的威胁可能为全球 CDR(内容清理和重建)市场创造利润丰厚的机会,以防止恶意攻击者渗透网路边界。

CDR(内容清理/重建)市场趋势

预测期内中小企业的成长速度将会加快

- 由于资料保护条例收紧以及网路基础设施内缺乏高成本的安全解决方案,预计中小企业细分市场在预测期内将以更高的复合年增长率成长。中小企业的规模可能很小,但他们为全球范围内的大量客户提供服务。财务限制阻碍中小型企业实施强大且全面的 CDR(内容清理和重建)解决方案。由于网路安全薄弱和预算紧张,小型企业更容易遭受资料外洩和身分盗窃。

- 随着中小型企业迅速采用具有成本效益的云端采用模式,云端采用模式预计将以更高的复合年增长率成长。小型企业越来越多地转向 PaaS 和 IaaS 来提供消费者云端服务、文件共用、CRM、电子邮件、聊天、内部通讯等。在维护本地网路的同时,中小型企业随着采用新技术,越来越多地将云端整合到其网路基础架构中。

- 整体而言,小型企业有巨大的机会采取有效的策略来保持竞争优势,而云端在这过程中发挥关键作用。例如,微软最近的一项研究调查了16个国家的3,000多家小型企业,以了解他们采用云端处理的意愿。他们发现 43% 的工作负载将在三年内变成付费云端服务。

- 云端解决方案为小型企业主提供了多种好处。云端解决方案的可扩展性和灵活性使您能够利用竞争优势并快速前进。例如,Apogaeis Technologies LLP 为许多全球中小企业提供 SaaS 和 PaaS 解决方案,为其整个业务流程增加价值。

- 此外,据安全机构称,2021 年 3 月,针对本地 Microsoft Exchange 伺服器的攻击呈上升趋势。中小型企业经常使用电子邮件伺服器。这就是为什么这些攻击是针对他们的。为此,Microsoft 为使用本机 Microsoft Exchange 伺服器的客户推出了新的一键缓解工具。刚接触补丁和更新过程的客户可能会从中受益。

北美成为最大市场规模

- 北美预计将成为 CDR(内容清理和重建)解决方案和服务供应商最收益的地区。勒索软体、APT、零时差攻击、恶意软体和檔案式攻击等增加是推动北美市场成长的主要因素。

- 北美包括美国和加拿大等主要经济体,它们正在迅速采用CDR解决方案。该地区的 CDR 市场作为保护 IT 系统免受恶意软体侵害的主动安全措施而受到关注。该地区的中小企业和大型企业已经敏锐地意识到CDR服务,并开始利用它们来应对网路威胁。

- 为了保护政府和私人营业单位的利益,已经启动了各种倡议,预计将绘製未来几年的基础设施网路安全地图。例如,2021年3月,美国宣布计划启动三项新的研究计划,以保护国家能源系统的安全。美国能源部网路安全、能源安全和紧急应变办公室 (CESER) 宣布了一项新计划,旨在保护美国能源系统免受日益增长的网路和物理危害。希望这些努力将为该领域解决方案的采用铺平道路。

- 此外,根据美国管理和预算办公室的数据,美国政府提案了2021 财年 187.8 亿美元的网路安全预算,其中包括广泛的资金,以确保政府安全并加强关键基础设施和关键技术的安全。战略。 IC3 表示,加州因网路犯罪造成的损失总计超过 5.73 亿美元,几乎是排名第二的纽约州 2.93 亿美元损失的两倍。

- 由于 CDR(内容清理和重建)解决方案提供主动安全措施来阻止资料洩露,北美市场正在受到关注。中小型企业以及大型区域企业越来越意识到 CDR(内容解除和重建)流程及其好处,并开始实施它来打击网路诈骗和资料窃取。

CDR(内容清理与重建)产业概述

CDR(内容清理和重建)市场竞争适中,由几个主要企业组成。在全球提供服务的主要供应商包括 Check Point Software Technologies、Fortinet、Deep Secure、Sasa Software、ReSec Technologies 和 OPSWAT。这些供应商正在采用各种有机和无机成长策略,包括新产品发布、伙伴关係、联盟和收购,以扩大他们在 CDR(内容清理和重建)市场的产品。

- 2022 年 7 月:用于关键基础设施保护 (CIP) 的网路安全和 CDR 解决方案 OPSWAT 宣布其已获得资料保护类别中的 Amazon Web Services (AWS) 安全能力。此认证证明 OPSWAT 可以为客户提供资料保护的网路安全专业知识,帮助他们实现云端安全目标,成功满足 AWS 技术和品质要求。

- 2022 年 3 月:内容解除与重建 (CDR) 技术供应商 Glasswall 最近推出了 Glasswall Desktop Freedom,这是其市场主导的桌上型 CDR 工具的免费增值版本。它提供免检测保护,以便用户可以信任他们的所有文件。该技术的开发是为了保护公共和私营部门组织免受恶意软体和勒索软体等檔案式的攻击的危险。自首次下载之日起,用户可以使用免费增值版本 12 个月。

其他好处:

- Excel 格式的市场预测 (ME) 表

- 3 个月的分析师支持

目录

第一章简介

- 研究假设和市场定义

- 调查范围

第二章调查方法

第三章执行摘要

第四章市场动态

- 市场概况

- 市场驱动因素

- 勒索软体、攻击和零时差攻击增加

- 严格监管,合规更强

- 恶意软体和檔案式的攻击增加

- 市场限制因素

- 实施 CDR(内容清理和重建)解决方案的预算障碍

- 产业吸引力-波特五力分析

- 供应商的议价能力

- 消费者议价能力

- 新进入者的威胁

- 替代品的威胁

- 竞争公司之间敌对关係的强度

- 评估 COVID-19 对产业的影响

第五章市场区隔

- 按成分

- 解决方案

- 服务

- 依部署方式

- 本地

- 云

- 按用途

- 电子邮件

- 网路

- 檔案传输通讯协定

- 其他应用领域

- 按组织规模

- 小型企业

- 大公司

- 按行业分类

- BFSI

- 资讯科技/通讯

- 政府机构

- 製造业

- 卫生保健

- 其他行业

- 按地区

- 北美洲

- 欧洲

- 亚太地区

- 拉丁美洲

- 中东/非洲

第六章 竞争状况

- 公司简介

- Fortinet, Inc.

- Check Point Software Technologies

- OPSWAT, Inc.

- Deep Secure Inc.

- Re-Sec Technologies Ltd.

- Votiro Inc.

- Glasswall Solutions Limited

- Sasa Software(CAS)Ltd.

- Peraton Corporation

- YazamTech Inc.

- Jiransecurity Ltd.

- Mimecast Services limited.

- SoftCamp Co., Ltd.

- Cybace Solutions

第七章 投资分析

第八章 市场机会及未来趋势

The Global Content Disarm and Reconstruction Market is expected to register a CAGR of 14% during the forecast period.

Key Highlights

- The ransomware damages are predicted to reach a global number of USD 15-16 billion in 2021, up many times from the global damages it achieved in 2015, which was around USD 260 million. Owing to such a rapid increase in attacks, the market witnessed a record influx of capital by investors into more than 1,000 deals, of which 84 were more significant than USD 100 million.

- The Momentum Cyber also suggested that these transactions included a USD 200 million Series D investment secured by industrial cybersecurity startup Dragos, Claroty's USD 140 million pre-IPO raise, and the USD 543 million Series A raised by passwordless authentication company Transmit Security. Additionally, the total financing value was 138% over the previous year. As a result of this historic investment volume, a record number of security startups were minted as unicorns in 2021. More than 30 startups achieved USD 1 billion-plus valuations, including Wiz, Noname Security, and LaceWork, compared to just six startups the previous year.

- The market is expected to rise due to the rising acceptance of cloud-based security solutions, increased awareness of security threats, and the developing of cybersecurity solutions for connected IoT devices. Furthermore, shifting IT trends and the increasing adoption of cloud solutions are opening potential growth prospects for content disarm and reconstruction solutions, which are utilized to protect an organization's data, brand value, and identity.

- Furthermore, with implementing the general data protection regulation (GDPR) to help combat persistent security leaks of sensitive personal information, governments and regulatory bodies are increasingly expecting more robust compliance and regulation norms for content security. The demand for content disarm, and reconstruction solutions are growing as governments across the globe spend extensively on digitalization and the transformation of IT infrastructure.

- Further, Swissinfo.ch stated that the NCSC (National Cyber Security Center) reported 350 cyberattacks (phishing, fake websites, direct attacks on organizations, etc.), compared to 100-150 occurrences. The increase in working from home was attributed to the coronavirus pandemic, as persons working at home lack the same intrinsic protection and deterrent measures as those in a working environment (e.g., internet security). The threat of such breaches will create lucrative opportunities for the global content disarm and reconstruction market to prevent malicious attackers from entering the network perimeter.

Content Disarm and Reconstruction Market Trends

SMEs Segment to Grow at a Higher Pace During the Forecast Period

- The SME segment is anticipated to grow at a higher CAGR during the forecast period due to the growing data protection regulations and scarcity of high-cost security solutions within the network infrastructure. SMEs are small in terms of size but cater to a vast number of clients globally. The robust and comprehensive content disarm, and reconstruction solution is not implemented in SMEs due to financial constraints in these organizations. Weak cybersecurity and low budget make SMEs more susceptible to data breaches and identity thefts.

- The cloud deployment mode is expected to grow at a higher CAGR as Small and Medium-sized Enterprises (SMEs) quickly adopt the cost-effective cloud deployment model. There is an increasing trend of PaaS and IaaS among SMBs for consumer cloud services, file sharing, CRM, email, chat, and internal communication. While retaining the on-premise network, SMBs are more willing to integrate the cloud into their network infrastructure as they adopt new technologies.

- Overall, SMBs have great opportunities to adopt effective strategies to stand in the competition, and the cloud has a vital role in the process. For instance, a recent study done by Microsoft surveyed more than 3,000 SMEs across 16 countries to understand whether SMEs have an appetite for adopting Cloud computing. One of the findings was that within three years, the workloads of 43 % would become paid Cloud services.

- Cloud Solutions offers a gamut of advantages to small and medium business owners. With the scalability and flexibility of cloud solutions, one can quickly move forward by taking competitive advantages. For instance, Apogaeis Technologies LLP provides SaaS and PaaS solutions to many global SMEs and adds value to their entire business process.

- Moreover, in March 2021, Attacks on on-premise Microsoft Exchange servers have increased, according to security agencies. Small and medium-sized enterprises frequently use email servers. Therefore, these attacks were carried out on them. For these reasons, Microsoft has introduced a new one-click Mitigation Tool for clients with Microsoft Exchange servers on-premise. Customers who are inexperienced with the patch/update process will benefit from this.

North America to Account for the Largest Market Size

- North America is supposed to become the most significant revenue-generating area for content disarm, reconstruction solutions, and service vendors. The growing number of ransomware, APTs, zero-day attacks, and the mounting amount of malware and file-based attacks are some of the principal factors anticipated to feed the market growth in North America.

- North America includes major economies, such as the United States of America and Canada, quickly using the CDR solution. The CDR market in the region is getting traction as it gives proactive security measures for securing I.T. systems from malware. SMEs and large companies in the area have become highly aware of CDR services and have begun using them to fight cyber threats.

- To safeguard the interest of governments and private entities, various initiatives have been launched that are expected to draw the map for infrastructure cybersecurity over the coming years. For example, in March 2021, the United States announced its plans to launch three new research programs to protect the security of the country's energy system. The DOE Office of Cybersecurity, Energy Security, and Emergency Response (CESER) announced new programs to help safeguard the U.S. energy system from increasing cyber and physical hazards. Such initiatives are expected to pave the way for adopting solutions in the segment.

- Also, according to the United States Office of Management and Budget, for F.Y. 2021, the United States government proposed an 18.78 billion U.S. dollar budget for cybersecurity, supporting a broad-based cybersecurity strategy for securing the government and enhancing the security of critical infrastructure and essential technologies. California reported a loss of more than 573 million U.S. dollars through cybercrime, almost double the amount of second-placed New York, which said 293 million U.S. dollars of losses, says IC3.

- The North American market is attaining traction, as the content disarm and reconstruction solution gives proactive security means for stopping data breaches. SMEs and large regional organizations have become more conscious of the content disarm and reconstruction process and its advantages and started embracing them to fight cyber fraud and data thefts.

Content Disarm and Reconstruction Industry Overview

The Content Disarm and Reconstruction Market is moderately competitive and consists of several key players. Significant vendors who offer services across the globe are Check Point Software Technologies, Fortinet, Deep Secure, Sasa Software, ReSec Technologies, and OPSWAT, among others. These vendors have adopted various organic and inorganic growth strategies, such as new product launches, partnerships, collaborations, and acquisitions, to expand their offerings in the content disarm and reconstruction market.

- July 2022: OPSWAT, cybersecurity and CDR solutions for critical infrastructure protection (CIP), announced that it had attained the Amazon Web Services (AWS) Security Competency in the data protection category. This accreditation acknowledges that OPSWAT has proven that it can provide clients with cybersecurity expertise in Data Protection to assist them in achieving their cloud security objectives and has successfully met AWS's technical and quality requirements.

- March 2022: Glasswall, a provider of Content Disarm and Reconstruction (CDR) technology, recently made its market-dominating desktop CDR tool available in a freemium version called Glasswall Desktop Freedom. It provides protection that doesn't wait for detection so that users can trust every file. This technology was developed to assist safeguard organizations in the public and private sectors from the hazards of file-based attacks like malware and ransomware. Users have access to the freemium edition for 12 months after the date of their original download.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET DYNAMICS

- 4.1 Market Overview

- 4.2 Market Drivers

- 4.2.1 Growing Number of Ransomware, Apts, and Zero-Day Attacks

- 4.2.2 Augmented Stringent Regulations and Compliances

- 4.2.3 Rising Number of Malware and File-Based Attacks

- 4.3 Market Restraints

- 4.3.1 Budgetary Obstacles in Deploying Content Disarm and Reconstruction Solutions

- 4.4 Industry Attractiveness - Porter's Five Forces Analysis

- 4.4.1 Bargaining Power of Suppliers

- 4.4.2 Bargaining Power of Consumers

- 4.4.3 Threat of New Entrants

- 4.4.4 Threat of Substitutes

- 4.4.5 Intensity of Competitive Rivalry

- 4.5 Assessment of Impact of COVID-19 on the Industry

5 MARKET SEGMENTATION

- 5.1 By Component

- 5.1.1 Solutions

- 5.1.2 Services

- 5.2 By Deployment Mode

- 5.2.1 On-Premises

- 5.2.2 Cloud

- 5.3 By Application Area

- 5.3.1 Email

- 5.3.2 Web

- 5.3.3 File Transfer Protocol

- 5.3.4 Other Application Areas

- 5.4 By Organization Size

- 5.4.1 Small and Medium-Sized Enterprises

- 5.4.2 Large Enterprises

- 5.5 By End-user Vertical

- 5.5.1 BFSI

- 5.5.2 IT and Telecom

- 5.5.3 Government

- 5.5.4 Manufacturing

- 5.5.5 Healthcare

- 5.5.6 Other End-user Verticals

- 5.6 By Geography

- 5.6.1 North America

- 5.6.2 Europe

- 5.6.3 Asia Pacific

- 5.6.4 Latin America

- 5.6.5 Middle East and Africa

6 COMPETITIVE LANDSCAPE

- 6.1 Company Profiles

- 6.1.1 Fortinet, Inc.

- 6.1.2 Check Point Software Technologies

- 6.1.3 OPSWAT, Inc.

- 6.1.4 Deep Secure Inc.

- 6.1.5 Re-Sec Technologies Ltd.

- 6.1.6 Votiro Inc.

- 6.1.7 Glasswall Solutions Limited

- 6.1.8 Sasa Software (CAS) Ltd.

- 6.1.9 Peraton Corporation

- 6.1.10 YazamTech Inc.

- 6.1.11 Jiransecurity Ltd.

- 6.1.12 Mimecast Services limited.

- 6.1.13 SoftCamp Co., Ltd.

- 6.1.14 Cybace Solutions