|

市场调查报告书

商品编码

1630406

中东和非洲电池能源储存系统市场:市场占有率分析、产业趋势、成长预测(2025-2030)Middle-East and Africa Battery Energy Storage System - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

※ 本网页内容可能与最新版本有所差异。详细情况请与我们联繫。

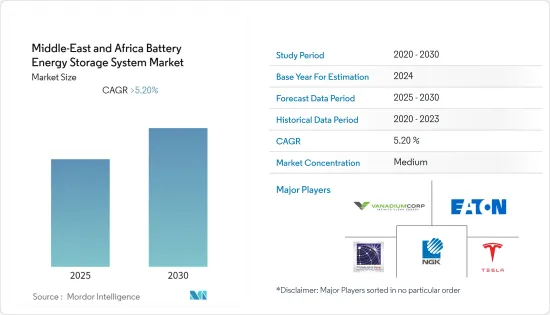

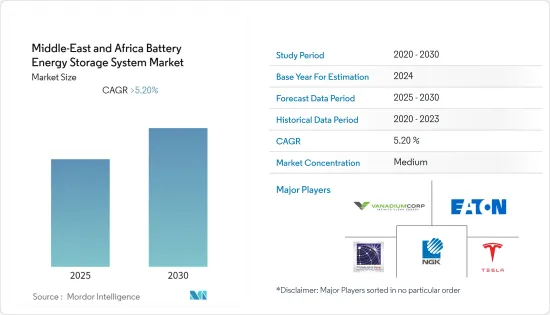

中东和非洲电池能源储存系统市场预计在预测期内复合年增长率将超过5.2%。

COVID-19 对 2020 年市场产生了中等影响。目前市场已达到疫情前的水准。

主要亮点

- 在中东和非洲,作为首选能源储存解决方案的电池的需求正在增加,这主要得益于技术创新和电池成本的降低。推动市场的关键因素是可再生能源渗透率的提高、对可靠不间断电力供应的需求以及老化的电网基础设施。

- 然而,安装电池能源储存系统所需的高额初始投资预计将阻碍所研究市场的成长。

- 物联网 (IoT) 和机器学习等数位技术正在推动创新软体平台的创建,以提高电池储存的技术能力、经济性和可融资性。

- 在预测期内,阿拉伯联合大公国在中东和非洲的电池能源储存系统市场将显着成长。

中东和非洲电池能源储存系统係统市场趋势

锂离子电池领域占市场主导地位

- 在技术方面,中东和非洲先进的能源储存市场对锂离子电池的需求量很大。这些电池也用于该地区储存来自太阳能和风能等再生能源来源的能源储存。

- 最近电池开发的大部分重点都集中在锂离子电池上,因为电力应用与电动车和家用电子电器产品之间存在强大的协同效应。

- 锂离子电池的发展受到汽车产业使用量增加和电池成本下降等因素的推动。

- 锂离子系统为电网应用提供了许多优势,包括高能量密度、快速反应、非常高的效率和灵活的操作。这些特性使得锂离子电池原则上可用于大多数应用。

- 在中东和非洲最不开发中国家,需求成长可以忽略不计。在中东地区,大多数国家都依赖原油生产。

- 在非洲,锂离子电池的采用正在增加。由于锂离子市场可以为电动车提供更长的续航里程,因此成本在过去十年中大幅下降,事实证明,其利润可能是储能市场的 10 倍。

- 锂离子电池是一种已经使用了十年的商业性技术,因此其性能具有一定的确定性。

预计阿联酋市场将显着成长

- 阿拉伯联合大公国是可再生能源领域的新兴市场。阿联酋是可再生能源领域的新兴市场,预计将举办多个可再生能源计划。

- 阿拉伯联合大公国的关键驱动力之一是对清洁和可再生能源的依赖,导致该国大力投资开发可再生储存系统。 2050年,可再生能源发电计划预计发电量将超过70GW,投资额达7,000亿美元。

- 到2021年,该国可再生能源装置容量将达到2,706兆瓦,杜拜倡议基金将斥资272亿美元支持沙姆斯杜拜倡议,该计画旨在加速屋顶太阳能板的安装,诸如此类的投资正在大力推动可再生的引进。

- 此外,阿联酋2050年能源战略的目标是到2050年将清洁能源在国家能源结构中的份额提高到50%,从而在预测期内刺激对能源储存系统的需求。

- 在中东国家中,阿联酋拥有最有利的能源储存环境,阿拉伯国家中能源储存计划正在进行中,未来采用的意愿也很高。

中东和非洲电池能源储存系统係统产业概况

中东和非洲电池能源储存系统係统市场已整合。市场主要企业包括(排名不分先后)Philadelphia Solar LTD、NGK INSULATORS, LTD.、Eaton Corporation PLC、Tesla Inc. 和 Vanadiumcorp Resource Inc.。

其他好处

- Excel 格式的市场预测 (ME) 表

- 3 个月分析师支持

目录

第一章简介

- 调查范围

- 市场定义

- 研究场所

第 2 章执行摘要

第三章调查方法

第四章市场概况

- 介绍

- 至2028年市场规模及需求预测(单位:十亿美元)

- 最新趋势和发展

- 政府法规和措施

- 市场动态

- 促进因素

- 抑制因素

- 供应链分析

- 波特五力分析

- 供应商的议价能力

- 消费者议价能力

- 新进入者的威胁

- 替代品的威胁

- 竞争公司之间敌对关係的强度

第五章市场区隔

- 技术部分

- 锂离子电池

- 铅酸电池

- 其他的

- 目的

- 住宅

- 商业/工业

- 公共产业

- 地区

- 阿拉伯聯合大公国

- 沙乌地阿拉伯

- 南非

- 埃及

- 其他中东/非洲

第六章 竞争状况

- 併购、合资、联盟、协议

- 主要企业策略

- 公司简介

- NGK INSULATORS, LTD.

- Eaton Corporation PLC

- Philadelphia Solar LTD

- Tesla Inc

- Vanadiumcorp Resource Inc

- Eskom Holdings SOC Ltd

- Sumitomo Corporation

第七章 市场机会及未来趋势

The Middle-East and Africa Battery Energy Storage System Market is expected to register a CAGR of greater than 5.2% during the forecast period.

COVID-19 moderately impacted the market in 2020. Currently. The market has reached pre-pandemic levels.

Key Highlights

- In the Middle East and African region, the demand for batteries has increased in the Middle East as a preferred energy storage solution primarily due to technological innovation and the reduction of battery costs. Major factors driving the market are the increasing levels of renewable energy penetration, demand for reliable and uninterrupted power supply, and aging grid infrastructure.

- However, the high initial investment required for the installation of the battery energy storage system is expected to hinder the growth of the market studied.

- Digital technologies, such as the Internet of Things (IoT) and machine learning, have engendered the creation of innovative software platforms that advance the technical capabilities and economic viability, and bankability of battery storage, which in turn, is likely to provide an opportunity in the market.

- The United Arab Emirates is to witness significant growth in the Middle East and Africa battery energy storage system market across the region during the forecast period.

MEA Battery Energy Storage System Market Trends

Lithium-ion Battery Segment to Dominate the Market

- In terms of technology, lithium-ion batteries are in huge demand in the Middle East and Africa Advance Energy Storage Market. These batteries are also being used for the storage of energy from renewable energy sources such as solar and wind in the region.

- Due to strong synergies between power applications and both electric vehicles and consumer electronics, much of the recent focus of battery development has been on lithium-ion batteries.

- Lithium-ion battery storage is driven by the factors such as increased usage in the automotive industry and the declining costs of batteries.

- Lithium-ion systems have a number of advantages for grid applications, including high energy density, rapid response, very high efficiencies, and flexible operation. These features enable lithium-ion batteries to be used for most applications in principle.

- The demand has been growing at a negligible rate in the less developed nations of the Middle East & Africa. In the Middle Eastern region, most of the countries are dependent on crude oil production.

- In Africa, lithium-ion battery deployment is on the rise. The cost has dropped considerably in the past decade, primarily as the Li-ion market can provide longer ranges to electric cars, which is showing to be probably ten times more lucrative than the storage market.

- It's a commercially available technology with a decade of deployment that provides some certainty of performance.

United Arab Emirates is Expected to Witness Significant Growth in the Market

- United Arab Emirates is an emerging market in the renewable energy sector. It is expected to undertake several renewable energy projects that are likely to foster the increase in demand for battery storage systems.

- One of the main drivers in the country is the steps taken in reliance on clean and renewable energy, which is leading the country to invest significantly in the development of renewable storage systems. Renewable energy projects will generate more than 70 GW of power by 2050, witnessing an investment of USD 700 billion.

- The country's renewable energy installed capacity reached 2706 MW in 2021, and the strong push for the adoption of renewable energy led by investments such as the USD 27.2 billion Dubai Green Fund to support the Shams Dubai initiative, a program aimed at promoting the installation of rooftop solar panels.

- Additionally, The 'UAE Energy Strategy 2050' aims to increase the contribution of clean energy to the country's overall national energy mix, to 50%, by 2050, thereby creating demand for energy storage systems in the forecast period.

- Among the Middle-Eastern countries, UAE has the most favorable environments for energy storage and is one of the Arab countries with ongoing energy storage projects with serious future adoption ambitions.

MEA Battery Energy Storage System Industry Overview

The Middle East and Africa Battery Energy Storage System Market is consolidated. Some of the key players in the market (not in a particular order) include Philadelphia Solar LTD, NGK INSULATORS, LTD., Eaton Corporation PLC, Tesla Inc, and Vanadiumcorp Resource Inc.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Scope of the Study

- 1.2 Market Definition

- 1.3 Study Assumptions

2 EXECUTIVE SUMMARY

3 RESEARCH METHODOLOGY

4 MARKET OVERVIEW

- 4.1 Introduction

- 4.2 Market Size and Demand Forecast in USD billion, till 2028

- 4.3 Recent Trends and Developments

- 4.4 Government Policies and Regulations

- 4.5 Market Dynamics

- 4.5.1 Drivers

- 4.5.2 Restraints

- 4.6 Supply Chain Analysis

- 4.7 Porter's Five Force Analysis

- 4.7.1 Bargaining Power of Suppliers

- 4.7.2 Bargaining Power of Consumers

- 4.7.3 Threat of New Entrants

- 4.7.4 Threat of Substitute Products and Services

- 4.7.5 Intensity of Competitive Rivalry

5 MARKET SEGMENTATION

- 5.1 Technology

- 5.1.1 Li-Ion Battery

- 5.1.2 Lead Acid Battery

- 5.1.3 Others

- 5.2 Application

- 5.2.1 Residential

- 5.2.2 Commercial and Industrial

- 5.2.3 Utility

- 5.3 Geography

- 5.3.1 United Arab Emirates

- 5.3.2 Saudi Arabia

- 5.3.3 South Africa

- 5.3.4 Egypt

- 5.3.5 Rest of Middle-East and Africa

6 COMPETITIVE LANDSCAPE

- 6.1 Mergers and Acquisitions, Joint Ventures, Collaborations, and Agreements

- 6.2 Strategies Adopted by Leading Players

- 6.3 Company Profiles

- 6.3.1 NGK INSULATORS, LTD.

- 6.3.2 Eaton Corporation PLC

- 6.3.3 Philadelphia Solar LTD

- 6.3.4 Tesla Inc

- 6.3.5 Vanadiumcorp Resource Inc

- 6.3.6 Eskom Holdings SOC Ltd

- 6.3.7 Sumitomo Corporation