|

市场调查报告书

商品编码

1630414

智慧完井:市场占有率分析、产业趋势与成长预测(2025-2030)Intelligent Well Completion - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

※ 本网页内容可能与最新版本有所差异。详细情况请与我们联繫。

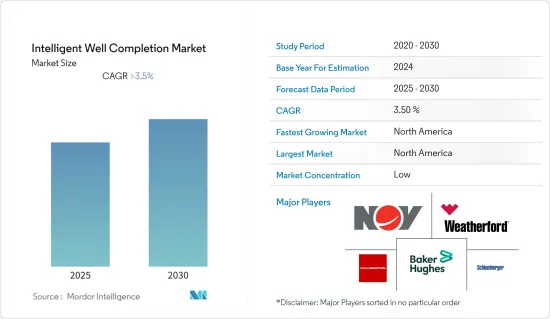

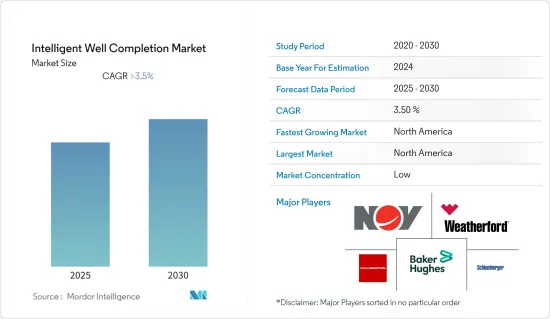

预计智慧完井市场在预测期内的复合年增长率将超过3.5%。

COVID-19 大流行对市场产生了负面影响,因为它导致正在进行和即将进行的计划延迟,并导致油价暴跌。目前,市场已达到疫情前水准。

主要亮点

- 传统型和非传统资源产量的增加以及油井维护成本的降低等因素预计将推动市场发展。

- 然而,原油和天然气价格的波动可能会限制市场成长。

- 智慧井补充技术的新发展,例如高端自适应流量控制补充技术的进步,预计将使石油和天然气生产变得更加可行,并可以为市场相关人员提供机会。

- 预计在预测期内,北美将成为智慧完井的最大市场,其中美国和加拿大占据大部分市场。

智慧完井市场趋势

离岸是成长最快的领域

- 在海上钻井中,井孔干预成本高且风险较高。智慧完井已经证明了其在多分支井、多区水平井、非均质储存井和成熟储存生产管理中的价值。进一步的技术进步预计将推动市场成长。

- 儘管石油和天然气价格波动,但自由现金流预计在2023年将继续成长,为主要离岸客户投资石油和天然气生产提供更大的灵活性。高水准的自由现金流可能有助于该领域的新投资,并支持智慧完井市场。

- 儘管非常规陆上产量正在大幅成长,但到2021年海上产量将占石油和天然气总产量的约28%。由于对碳氢化合物资源的需求增加,预计海上石油和天然气产量将会增加。离岸部门的增加预计将有助于市场成长。

- 全球石油产量从2020年的41.709亿吨下降到2021年的42.214亿吨,下降0.5%。预测期内产量可能会进一步增加,从而推动智慧完井市场的发展。

- 因此,由于自由现金流的增加、技术的进步和石油产量的增加,海工产业预计将成为预测期内成长最快的产业。

北美市场占据主导地位

- 2021年,美国是全球最大的石油生产国。该国也是智慧钻井技术的最大用户之一,特别是用于经济可行地开采该国页岩地层中的传统型碳氢化合物资源。这是因为页岩油气储存管理起来很复杂,而且往往比传统型井成熟得更快。因此,传统型储存需要增强智慧完井技术来生产石油。

- 该地区石油产量从2020年的10.587亿吨增加到2021年的10.747亿吨,成长1.9%。预测期内产量可能会进一步增加,从而推动智慧完井市场的发展。

- 斯伦贝谢有限公司的智慧完井系统帮助客户将平均产量提高20%,减少注水量60%。各公司正在投资智慧完井技术的研发,以增加井筒利润,预计有助于市场成长。

- 截至 2022 年,墨西哥湾地区占美国海上碳氢化合物产量的 97%,占碳氢化合物总产量的 15%。该地区是世界上海上钻机和其他石油和天然气基础设施最集中的地区之一,包括生产和钻探平臺、海上船舶和管道网路。

- 因此,由于丰富的石油产量、非常规资源开采的增加以及技术的进步,北美地区有望成为智慧完井的最大市场。

智慧完井产业概况

智慧完井市场细分为:该市场的主要企业(排名不分先后)包括斯伦贝谢有限公司、哈里伯顿公司、贝克休斯公司、威德福国际公司和国民油井华高公司。

其他好处

- Excel 格式的市场预测 (ME) 表

- 3 个月分析师支持

目录

第一章简介

- 调查范围

- 市场定义

- 研究场所

第二章调查方法

第三章执行摘要

第四章市场概况

- 介绍

- 至2028年市场规模及需求预测(单位:十亿美元)

- 石油产量及预测(单位:百万桶/日,2028年)

- 2028 年之前的天然气产量和预测(单位:十亿立方英尺)

- 最新趋势和发展

- 政府法规和措施

- 市场动态

- 促进因素

- 抑制因素

- 供应链分析

- 波特五力分析

- 供应商的议价能力

- 消费者议价能力

- 新进入者的威胁

- 替代品的威胁

- 竞争公司之间敌对关係的强度

第五章市场区隔

- 目的

- 陆上

- 离岸

- 成分

- 硬体

- 软体

- 地区

- 北美洲

- 欧洲

- 亚太地区

- 南美洲

- 中东/非洲

第六章 竞争状况

- 併购、合资、联盟、协议

- 主要企业策略

- 公司简介

- Weatherford International plc

- National-Oilwell Varco Inc.

- Baker Hughes Company

- Schoeller-Bleckmann Oilfield Equipment AG

- Packers Plus Energy Services, Inc.

- Schlumberger Ltd

- Halliburton Company

- Trican Well Service Ltd

- Superior Energy Services, Inc.

- Weir Group PLC

- Welltec A/S

第七章 市场机会及未来趋势

The Intelligent Well Completion Market is expected to register a CAGR of greater than 3.5% during the forecast period.

The COVID-19 outbreak had a negative impact on the market because it caused delays in ongoing and upcoming projects and caused the price of crude oil to crash. Currently, the market has reached pre-pandemic levels.

Key Highlights

- Factors such as increasing production from conventional and unconventional resources and reducing the maintenance costs of the well are expected to drive the market.

- However, volatility in crude oil and natural gas prices may restrain the growth of the market.

- New developments in intelligent well completion technology, like the advancements in high-end self-adaptive inflow control completion technology, are expected to make oil and gas production more viable and may provide an opportunity for market players.

- North America is expected to be the largest market for intelligent well completion in the forecast period, with the United States and Canada leading in the utilization of a large portion of the market.

Intelligent Well Completion Market Trends

Offshore to be the Fastest Growing Segment

- In offshore drilling, well intervention is expensive and high-risk. Intelligent completions have proven their value in managing production from multilateral wells, horizontal wells with multiple zones, wells in heterogeneous reservoirs, and mature reservoirs. Further technological advancements are expected to aid the market's growth.

- Despite the volatility in oil and gas prices, expectations are that free cash flow is expected to continue to grow in 2023, giving major offshore customers greater flexibility to invest in oil and gas production. A high level of free cash flow aids in new investments in the sector, which may aid the intelligent well-completion market.

- Although significant growth has taken place in unconventional onshore production, offshore production represented approximately 28% of overall oil and gas production in 2021. Offshore oil and gas production is expected to increase due to the increasing demand for hydrocarbon resources. An increase in the offshore sector is expected to contribute to the growth of the market.

- Oil production in the world decreased by 0.5%, to 4221.4 million metric tons in 2021 from 4170.9 million metric tons in 2020. The output may increase further in the forecast period and provide a boost to the intelligent well-completion market.

- Hence, the offshore segment is expected to be the fastest-growing segment in the forecast period due to an increase in free cash flow, advancements in technology, and an increase in oil production.

North America to Dominate the Market

- In 2021, the United States was the largest producer of oil in the world. It is also among the largest users of intelligent well-completion techniques, which, among others, are used in the economically viable recovery of unconventional sources of hydrocarbons in the country's shale plays. This is because shale oil and gas reservoirs are more complex to handle and tend to mature faster than conventional wells. Therefore, unconventional reservoirs require higher usage of intelligent well completion to produce oil.

- Oil production in the region increased by 1.9%, to 1074.7 million metric tons in 2021 from 1058.7 million metric tons in 2020. The output may increase further in the forecast period and boost the intelligent, well-completed market.

- For their clients, Schlumberger Ltd.'s intelligent well completion system has on average increased production by 20% and decreased water injection by 60%. Many different companies are using and investing in the research and development of the techniques of intelligent well completion to increase the profit from the wells, which is expected to aid the growth of the market.

- As of 2022, the Gulf of Mexico region was responsible for 97% and 15% of the United States' offshore and total hydrocarbon production, respectively. The region has one of the highest global densities of offshore rig deployment and consists of other oil and gas infrastructure such as production and drilling platforms, marine vessels, and pipeline networks.

- Hence, the North American region is expected to be the largest market for intelligent well completion due to its abundant oil production, increasing extraction of unconventional sources, and advancements in technologies.

Intelligent Well Completion Industry Overview

The intelligent well completion market is partially fragmented. Some of the key players in this market (in no particular order) are Schlumberger Ltd, Halliburton Company, Baker Hughes Company, Weatherford International plc, and National-Oilwell Varco, Inc.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Scope of the Study

- 1.2 Market Definition

- 1.3 Study Assumptions

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET OVERVIEW

- 4.1 Introduction

- 4.2 Market Size and Demand Forecast, in USD billion, till 2028

- 4.3 Oil Production and Forecast, in million barrels per day, till 2028

- 4.4 Natural Gas Production and Forecast, in billion cubic feet, till 2028

- 4.5 Recent Trends and Developments

- 4.6 Government Policies and Regulations

- 4.7 Market Dynamics

- 4.7.1 Drivers

- 4.7.2 Restraints

- 4.8 Supply Chain Analysis

- 4.9 Porter's Five Forces Analysis

- 4.9.1 Bargaining Power of Suppliers

- 4.9.2 Bargaining Power of Consumers

- 4.9.3 Threat of New Entrants

- 4.9.4 Threat of Substitute Products and Services

- 4.9.5 Intensity of Competitive Rivalry

5 MARKET SEGMENTATION

- 5.1 Application

- 5.1.1 Onshore

- 5.1.2 Offshore

- 5.2 Component

- 5.2.1 Hardware

- 5.2.2 Software

- 5.3 Geography

- 5.3.1 North America

- 5.3.2 Europe

- 5.3.3 Asia-Pacific

- 5.3.4 South America

- 5.3.5 Middle-East and Africa

6 COMPETITIVE LANDSCAPE

- 6.1 Mergers and Acquisitions, Joint Ventures, Collaborations, and Agreements

- 6.2 Strategies Adopted by Leading Players

- 6.3 Company Profiles

- 6.3.1 Weatherford International plc

- 6.3.2 National-Oilwell Varco Inc.

- 6.3.3 Baker Hughes Company

- 6.3.4 Schoeller-Bleckmann Oilfield Equipment AG

- 6.3.5 Packers Plus Energy Services, Inc.

- 6.3.6 Schlumberger Ltd

- 6.3.7 Halliburton Company

- 6.3.8 Trican Well Service Ltd

- 6.3.9 Superior Energy Services, Inc.

- 6.3.10 Weir Group PLC

- 6.3.11 Welltec A/S