|

市场调查报告书

商品编码

1630415

北美成品设备与服务:市场占有率分析、产业趋势与统计、成长预测(2025-2030)North America Completion Equipment And Services - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

价格

※ 本网页内容可能与最新版本有所差异。详细情况请与我们联繫。

简介目录

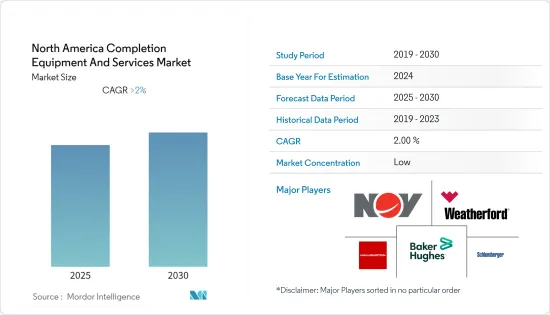

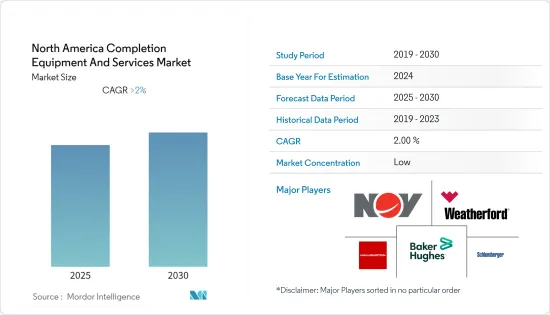

北美成品设备和服务市场预计在预测期内复合年增长率将超过 2%

主要亮点

- 传统型和非传统资源产量的增加以及油井维护成本的降低等因素预计将推动市场发展。

- 然而,原油和天然气价格的波动可能会限制市场成长。

- 智慧完井技术的新发展,例如高端自适应流量控製完井技术的进步,预计将使石油和天然气生产变得更加可行,并可以为市场相关人员提供机会。

- 由于原油和天然气产量丰富,预计美国将在预测期内成为成套设备服务市场的最大用户。

北美成套设备与服务市场趋势

田径领域主导市场

- 陆上部门是市场中最大的部分,因为大多数生产盆地都利用陆上钻机进行生产。该地区生产的大部分陆上石油是在美国开采的。陆上页岩油生产在很大程度上依赖完井和服务市场以及传统的碳氢化合物来源。石油和天然气产量的增加预计将有助于市场成长。

- 过去几年,美国页岩气领域最相关的进展都围绕着完井设计的改进,服务供应商继续尝试改变完井设施。然而,由于页岩的非线性性质,大多数市场相关人员很难将在页岩中有效或无效的最佳设计参数归零。因此,在预测期内,具体形成的进展还有很大的空间。

- 陆上钻机约占美国旋转钻机总数的95.8%。由于非常规计划的增加以及该地区石油和天然气需求的增加,二迭纪盆地和北达科他州的前景增加,预计将推动该国陆上部门的成长。

- 加拿大生产的大部分原油是从陆上油田提取的。加拿大生产的大部分原油是从 Judy Creek 油田开采的,该油田供应加拿大生产的原油约 68.36%。然而,随着该领域的成熟,重点将放在彭比纳等常规富烃盆地的探勘上,石油和天然气领域以及相关的成套设备服务市场可能会成长。

- 因此,由于该领域的投资、技术进步和石油产量的增加,预计陆上领域将在预测期内主导市场。

美国主导市场

- 美国是世界上最大的石油生产国。它也是钻井技术的最大用户之一,特别是在经济上可行的开采该国页岩传统型中的非常规陆上碳氢化合物资源方面。该地区几乎所有的页岩地层都是透过陆上设施生产的。

- 原油产量将从2017年的34.2亿桶增加到2022年的43.3亿桶。此外,页岩油气藏是完井设备和服务的大量用户,因为页岩油气储存处理起来更加复杂,而且往往比常规井成熟得更快。该地区天然气产量的增加预计将促进市场成长。

- 完井设备的改进正在为该领域引入新的范例,例如智慧完井和智慧完井。智慧完井包括永久性井下感测器,可将资料传输到地面,以便在数位井平台上进行本地或远端监控。无论有或没有自动化,所有这些资料都会被交付,以提高油井产量。这些系统用于近海领域,作为减少油井产水量的一种方式。

- 雪佛龙和道达尔已批准在美国墨西哥湾的一个锚定计划。 Anchor计划是业界第一个获得最终投资决策 (FID) 的深水高压开发专案。能够承受 20,000 psi 压力的油井完井和生产方面的新技术进步将使人们能够获得整个墨西哥湾的其他高压资源机会,从而促进市场成长。

- 因此,由于该领域投资的增加、非常规资源产量的增加以及技术的进步,预计美国将在预测期内主导市场。

北美成品设备服务业概况

北美成品设备服务市场适度细分。该市场的主要企业(排名不分先后)包括斯伦贝谢有限公司、哈里伯顿公司、贝克休斯公司、威德福国际公司和国民油井华高公司。

其他好处

- Excel 格式的市场预测 (ME) 表

- 3 个月分析师支持

目录

第一章简介

- 调查范围

- 市场定义

- 研究场所

第二章调查方法

第三章执行摘要

第四章市场概况

- 介绍

- 至2028年市场规模及需求预测(单位:十亿美元)

- 原油产量及预测(单位:百万桶/日,2028年)

- 2028 年之前的天然气产量和预测(单位:十亿立方英尺)

- 最新趋势和发展

- 政府法规和措施

- 市场动态

- 促进因素

- 抑制因素

- 供应链分析

- 波特五力分析

- 供应商的议价能力

- 消费者议价能力

- 新进入者的威胁

- 替代品的威胁

- 竞争公司之间的敌对关係

第五章市场区隔

- 部署地点

- 陆上

- 离岸

- 地区

- 美国

- 加拿大

- 其他北美地区

第六章 竞争状况

- 併购、合资、联盟、协议

- 主要企业策略

- 公司简介

- Weatherford International plc

- National-Oilwell Varco Inc.

- Baker Hughes Company

- Schoeller-Bleckmann Oilfield Equipment AG

- Packers Plus Energy Services, Inc.

- Schlumberger Ltd

- Halliburton Company

- Trican Well Service Ltd

- Superior Energy Services, Inc.

- Weir Group PLC

- Welltec A/S

第七章市场机会与未来趋势

简介目录

Product Code: 71226

The North America Completion Equipment And Services Market is expected to register a CAGR of greater than 2% during the forecast period.

Key Highlights

- Factors such as increasing production from conventional and unconventional resources and reducing the maintenance costs of the well are expected to drive the market.

- However, volatility in crude oil and natural gas prices may restrain the growth of the market.

- New developments in intelligent well completion technology, like the advancements in high-end self-adaptive inflow control completion technology, are expected to make oil and gas production more viable and may provide an opportunity for market players.

- The United States is expected to be the largest user of the completion equipment and services market in the forecast period due to its abundant production of crude oil and natural gas.

North America Completion Equipment And Services Market Trends

Onshore to Dominate the Market

- The onshore segment is the largest segment in the market, as most of the producing basins are derived using production through onshore rigs. Most of the onshore oil produced in the region is extracted in the United States. Onshore production of shale, along with conventional sources of hydrocarbons, is heavily dependent upon the well completion and services market. An increase in the production of oil and gas is expected to aid the growth of the market.

- Among the most relevant advances made during the past few years in the United States' shales are around completion design enhancements, and service providers continue to experiment with changing completion equipment. However, the nonlinear nature of shales makes it difficult for most market players to zero in on the optimal design parameters that may or may not work in shales. This provides for a large window of formation-specific advancements in the forecast period.

- Onshore accounted for approximately 95.8% of the total number of rotary rigs in the United States. Increasing prospects in the Permian Basin and North Dakota due to the growing number of unconventional projects and growing demand for oil and natural gas in the region are expected to aid the growth of the onshore segment in the country.

- A large amount of crude oil produced in Canada is extracted from an onshore-based field. Most of the oil in Canada is derived from Judy Creek, which provides for around 68.36% of the oil produced in the country. However, as the field reaches maturity, heavy focus is being put on the exploration of basins like conventional hydrocarbon-rich ones like Pembina, which may provide growth to the oil and gas sector and its associated completion equipment services market.

- Hence, the onshore segment is expected to dominate the market in the forecast period due to investments in the sector, advances in technology, and increasing production of oil.

United States to Dominate the Market

- The United States was the largest producer of crude oil in the world. It is also among the largest users of well-completion techniques, which, among others, are used in the economically viable recovery of unconventional onshore sources of hydrocarbons in the country's shale plays. Almost all the shale plays in the region are produced via onshore installments.

- Crude oil production increased to 4.33 billion barrels in 2022 from 3.42 billion barrels in 2017. Moreover, shale plays are a large user of completion equipment and services because shale oil and gas reservoirs are more complex to handle and tend to mature faster than conventional wells. An increase in the production of natural gas in the region is expected to aid the growth of the market.

- The completion equipment improvements have incorporated new paradigms in the sector, like intelligent or smart well completion. Intelligent completions include permanent downhole sensors that transmit data to the surface for local or remote monitoring on a digital well platform. All this data may or may not be automated, but it is delivered to increase the production of the well. These systems are being used in the offshore segment as a method to decrease the production of water from the wells.

- Chevron and Total have sanctioned the Anchor project in the United States Gulf of Mexico. The Anchor project is the industry's first deepwater high-pressure development to achieve a final investment decision (FID). The advancement of the new technology in well completion and production, which is capable of handling pressures of 20,000 psi, enables access to other high-pressure resource opportunities across the Gulf of Mexico, thereby contributing to the growth of the market.

- Hence, the United States is expected to dominate the market in the forecast period due to an increase in investments in the sector, growing production of unconventional resources, and advancements in technology.

North America Completion Equipment And Services Industry Overview

The North American completion equipment and services market is moderately fragmented. Some of the key players in this market (in no particular order) are Schlumberger Ltd., Halliburton Company, Baker Hughes Company, Weatherford International plc, and National-Oilwell Varco Inc.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Scope of the Study

- 1.2 Market Definition

- 1.3 Study Assumptions

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET OVERVIEW

- 4.1 Introduction

- 4.2 Market Size and Demand Forecast, in USD billion, till 2028

- 4.3 Crude Oil Production and Forecast, in million barrels per day, till 2028

- 4.4 Natural Gas Production and Forecast, in billion cubic feet, till 2028

- 4.5 Recent Trends and Developments

- 4.6 Government Policies and Regulations

- 4.7 Market Dynamics

- 4.7.1 Drivers

- 4.7.2 Restraints

- 4.8 Supply Chain Analysis

- 4.9 Porter's Five Forces Analysis

- 4.9.1 Bargaining Power of Suppliers

- 4.9.2 Bargaining Power of Consumers

- 4.9.3 Threat of New Entrants

- 4.9.4 Threat of Substitutes Products and Services

- 4.9.5 Intensity of Competitive Rivalry

5 MARKET SEGMENTATION

- 5.1 Location of Deployment

- 5.1.1 Onshore

- 5.1.2 Offshore

- 5.2 Geography

- 5.2.1 United States

- 5.2.2 Canada

- 5.2.3 Rest of North America

6 COMPETITIVE LANDSCAPE

- 6.1 Mergers and Acquisitions, Joint Ventures, Collaborations, and Agreements

- 6.2 Strategies Adopted by Leading Players

- 6.3 Company Profiles

- 6.3.1 Weatherford International plc

- 6.3.2 National-Oilwell Varco Inc.

- 6.3.3 Baker Hughes Company

- 6.3.4 Schoeller-Bleckmann Oilfield Equipment AG

- 6.3.5 Packers Plus Energy Services, Inc.

- 6.3.6 Schlumberger Ltd

- 6.3.7 Halliburton Company

- 6.3.8 Trican Well Service Ltd

- 6.3.9 Superior Energy Services, Inc.

- 6.3.10 Weir Group PLC

- 6.3.11 Welltec A/S

7 MARKET OPPORTUNITIES AND FUTURE TRENDS

02-2729-4219

+886-2-2729-4219