|

市场调查报告书

商品编码

1630417

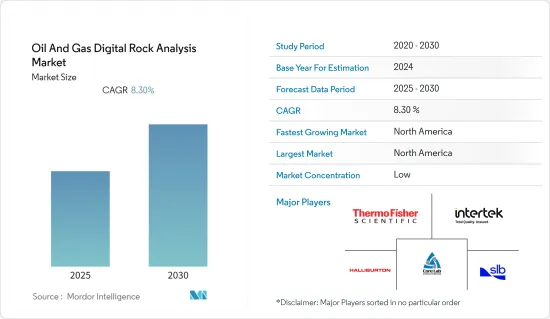

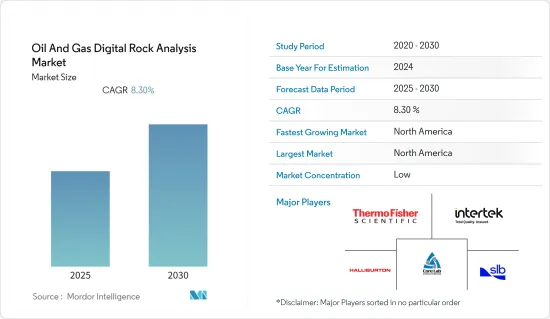

石油和天然气数位岩石分析 -市场占有率分析、行业趋势/统计、成长预测(2025-2030)Oil And Gas Digital Rock Analysis - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

价格

※ 本网页内容可能与最新版本有所差异。详细情况请与我们联繫。

简介目录

石油和天然气数位岩石分析市场预计在预测期内复合年增长率为 8.3%

主要亮点

- 从长远来看,增加生产复杂性以最大限度地提高传统型储存产量等因素预计将在预测期内推动市场发展。

- 另一方面,生产高分辨率岩石结构的高成本预计将抑制市场。

- 然而,用于测井活动的先进成像技术的发展预计将在预测期内为市场研究创造巨大的机会。

- 由于先进成像技术的可用性以及该过程中熟练工人的存在,预计北美将在预测期内主导市场。

石油和天然气数位岩石分析市场趋势

传统细分市场主导市场

- 石油和天然气数位岩石分析整合了各种科学领域,包括先进显微镜、物理学、地质学、地球化学、岩石物理学和石油工程。其主要目标是全面了解储存岩石孔隙尺度的微观结构。透过采用这种方法,勘探和生产 (E&P) 营运商可以降低风险、提高碳氢化合物产量并优化油井采收率。与传统方法相比,数位岩石分析所带来的进步预计将推动市场成长。

- 几十年来,传统型储存一直是油气探勘和生产的焦点。因此,存在大量关于传统型储存的现有资料和知识。数位岩石分析可以增进对传统型储存的了解、优化生产策略并提高采收率。

- 此外,许多传统型储存已经成熟并已投入生产很长时间。借助数位岩石分析,操作员可以深入了解储存行为、评估剩余蕴藏量并优化油田开发和管理策略,以最大限度地提高这些成熟油田的产量。

- 根据美国能源资讯署2023年6月短期能源展望(June 2023),预计到2024年全球原油产量将以近3%的年增长率成长。此外,2022年全球原油产量与前一年同期比较%,达100,024兆瓦/日。探勘和生产活动的增加将增加对数位岩石分析的需求。

- 此外,数位岩石分析可以整合到传统型储存的储存表征和建模工作流程中。透过将数位岩石分析资料纳入储存模拟模型和生产最佳化工作流程,操作员可以提高准确性、改善预测并就油田开发和生产策略做出明智的决策。

- 因此,鑑于上述几点,预计传统型产业将在预测期内占据市场主导地位。

北美市场占据主导地位

- 从历史上看,北美,尤其是美国,一直是石油和天然气行业采用先进技术的领导者。

- 北美拥有许多技术提供者、研究机构和大学,为数位岩石分析技术的进步做出了贡献。这些进步有助于促进创新、改进成像技术并加强区域资料分析方法。

- 此外,北美拥有大量石油和天然气蕴藏量以及成熟的工业。该地区传统型和传统型储存的探勘和生产活动对数位岩石分析等先进储存表征技术产生了强烈需求。

- 根据美国能源局统计,2021年至2022年美国天然气产量成长超过4%。 2022年该国天然气总产量为43,384,575百万立方英尺,而2021年为41,666,118百万立方英尺,这表明该地区有完善的石油和天然气工业。

- 此外,北美处于页岩气革命的前沿,页岩气开发和緻密油资源备受关注,尤其是在美国。数位岩石分析对于了解这些传统型储存的复杂孔隙结构和流体行为至关重要,对于这些地区的生产和采收率优化具有重要意义。

- 因此,鑑于上述几点,北美地区预计将在预测期内主导油气数位岩石分析市场。

石油和天然气数位岩石分析产业概述

石油和天然气数位岩石分析市场分为几个部分。市场的主要企业(排名不分先后)包括 Schlumberger Limited、Halliburton Company、Core Laboratories NV、Thermo Fisher Scientific Inc. 和 Intertek Group plc。

其他好处

- Excel 格式的市场预测 (ME) 表

- 3 个月分析师支持

目录

第一章简介

- 调查范围

- 市场定义

- 研究场所

第二章调查方法

第三章执行摘要

第四章市场概况

- 介绍

- 至2028年市场规模及需求预测(单位:十亿美元)

- 至2028年原油产量与消费量预测(单位:千桶/日)

- 至2028年天然气产量与消费量预测(单位:十亿立方英尺/天)

- 最新趋势和发展

- 政府法规和措施

- 市场动态

- 促进因素

- 关注非传统资源

- 全球能源需求和探勘活动

- 抑制因素

- 实施成本高

- 促进因素

- 供应链分析

- 波特五力分析

- 供应商的议价能力

- 消费者议价能力

- 新进入者的威胁

- 替代品的威胁

- 竞争公司之间的敌对关係

第五章市场区隔

- 类型

- 传统的

- 非传统的

- 市场分析:按地区(2028 年之前的市场规模和需求预测)

- 北美洲

- 美国

- 加拿大

- 其他北美地区

- 亚太地区

- 中国

- 印度

- 澳洲

- 印尼

- 马来西亚

- 其他亚太地区

- 欧洲

- 俄罗斯

- 挪威

- 英国

- 欧洲其他地区

- 南美洲

- 巴西

- 阿根廷

- 委内瑞拉

- 南美洲其他地区

- 中东/非洲

- 沙乌地阿拉伯

- 阿拉伯聯合大公国

- 卡达

- 奈及利亚

- 其他中东/非洲

- 北美洲

第六章 竞争状况

- 併购、合资、联盟、协议

- 主要企业策略

- 公司简介

- Schlumberger Limited

- Halliburton Company

- Thermo Fisher Scientific Inc.

- Intertek Group PLC

- Core Laboratories NV

- Zeiss International

- FREDsense Technologies Corp.

- Petricore Norway AS

第七章 市场机会及未来趋势

- 先进成像技术的发展

简介目录

Product Code: 71245

The Oil And Gas Digital Rock Analysis Market is expected to register a CAGR of 8.3% during the forecast period.

Key Highlights

- Over the long term, factors such as an increase in the complexity of production from unconventional reservoirs to maximize production are expected to drive the market during the forecast period.

- On the flip side, the high cost of producing high-resolution rock structures is expected to restrain the market.

- However, developing advanced imaging techniques for logging activities is expected to create significant opportunities for market studies during the forecasted period.

- North America is expected to dominate the market during the forecasted period due to the availability of advanced imaging technology and more skilled workers for the process.

Oil & Gas Digital Rock Analysis Market Trends

Conventional Segment to Dominate the Market

- Oil and gas digital rock analysis integrates various scientific disciplines, including advanced microscopy, physics, geology, geochemistry, petrophysics, and petroleum engineering. Its primary objective is to comprehensively understand the microscopic structure of reservoir rocks at the pore scale. Exploration and production (E&P) operators can mitigate risks, enhance hydrocarbon production, and optimize well recovery by employing this approach. The advancements offered by digital rock analysis compared to traditional methods are anticipated to drive its growth in the market.

- Conventional reservoirs have been the focus of oil and gas exploration and production for decades. As a result, there is a wealth of existing data and knowledge about conventional reservoirs. Digital rock analysis can enhance the understanding of conventional reservoirs, optimize production strategies, and improve recovery rates.

- Moreover, many conventional reservoirs are mature, meaning they have been producing for an extended period. With the help of digital rock analysis, operators can gain insights into reservoir behavior, assess remaining reserves, and optimize field development and management strategies to maximize production from these mature fields.

- According to the United States Energy Information Administration, Short-Term Energy Outlook, June 2023, global crude oil production is set to increase by close to 3% annual growth by 2024. Furthermore, global crude oil production increased by 4.48% in 2022 compared to the previous year, recording 100,024 mb/d. Increasing exploration and production activities consequently increase the demand for digital rock analysis.

- Furthermore, digital rock analysis can be integrated into reservoir characterization and modeling workflows for conventional reservoirs. By incorporating digital rock analysis data into reservoir simulation models and production optimization workflows, operators can enhance accuracy, improve predictions, and make informed decisions about field development and production strategies.

- Therefore, according to the above points, the conventional sector is expected to dominate the market during the forecasted period.

North America to Dominate the Market

- Historically, North America, particularly the United States, has been a leader in adopting advanced technologies in the oil and gas industry.

- North America has a strong presence of technology providers, research institutions, and universities that contribute to digital rock analysis technique advancements. These advancements help drive innovation, improve imaging technologies, and enhance regional data analysis methods.

- Moreover, North America has significant oil and gas reserves and a well-established industry. The region's exploration and production activities in conventional and unconventional reservoirs create a strong demand for advanced reservoir characterization techniques like digital rock analysis.

- According to the United States Department of Energy, natural gas production in the United States increased by more than 4% between 2021 and 2022. In 2022 total natural gas production in the country was 43,384,575 million cubic feet compared to 41,666,118 million cubic feet in 2021, signifying the region's well-established oil and gas industry.

- Additionally, North America has been at the forefront of the shale revolution, particularly in the United States, with shale gas development and tight oil resources. Digital rock analysis is crucial in understanding the complex pore structures and fluid behavior in these unconventional reservoirs, making it valuable for optimizing production and recovery in these regions.

- Therefore, per the above points, the North American region is expected to dominate the Oil and Gas Digital Rock Analysis Market during the forecasted period.

Oil & Gas Digital Rock Analysis Industry Overview

The oil and gas digital rock analysis market is partially fragmented. Some key players in this market (in no particular order) are Schlumberger Limited, Halliburton Company, Core Laboratories N.V., Thermo Fisher Scientific Inc., and Intertek Group plc.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Scope of the Study

- 1.2 Market Definition

- 1.3 Study Assumptions

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET OVERVIEW

- 4.1 Introduction

- 4.2 Market Size and Demand Forecast in USD billion, till 2028

- 4.3 Crude Oil Production and Consumption Forecast, in thousands barrels per day, till 2028

- 4.4 Natural Gas Production and Consumption Forecast, in billion cubic feet per day, till 2028

- 4.5 Recent Trends and Developments

- 4.6 Government Policies and Regulations

- 4.7 Market Dynamics

- 4.7.1 Drivers

- 4.7.1.1 Focus On Unconventional Resources

- 4.7.1.2 Global Energy Demand And Exploration Activities

- 4.7.2 Restraints

- 4.7.2.1 High Implementation Costs

- 4.7.1 Drivers

- 4.8 Supply Chain Analysis

- 4.9 Porter's Five Forces Analysis

- 4.9.1 Bargaining Power of Suppliers

- 4.9.2 Bargaining Power of Consumers

- 4.9.3 Threat of New Entrants

- 4.9.4 Threat of Substitutes Products and Services

- 4.9.5 Intensity of Competitive Rivalry

5 MARKET SEGMENTATION

- 5.1 Type

- 5.1.1 Conventional

- 5.1.2 Unconventional

- 5.2 Geography Regional Market Analysis {Market Size and Demand Forecast till 2028 (for regions only)}

- 5.2.1 North America

- 5.2.1.1 United States

- 5.2.1.2 Canada

- 5.2.1.3 Rest of North America

- 5.2.2 Asia-Pacific

- 5.2.2.1 China

- 5.2.2.2 India

- 5.2.2.3 Australia

- 5.2.2.4 Indonesia

- 5.2.2.5 Malaysia

- 5.2.2.6 Rest of Asia-Pacific

- 5.2.3 Europe

- 5.2.3.1 Russia

- 5.2.3.2 Norway

- 5.2.3.3 United Kingdom

- 5.2.3.4 Rest of Europe

- 5.2.4 South America

- 5.2.4.1 Brazil

- 5.2.4.2 Argentina

- 5.2.4.3 Venezuela

- 5.2.4.4 Rest of South America

- 5.2.5 Middle-East and Africa

- 5.2.5.1 Saudi Arabia

- 5.2.5.2 United Arab Emirates

- 5.2.5.3 Qatar

- 5.2.5.4 Nigeria

- 5.2.5.5 Rest of Middle-East and Africa

- 5.2.1 North America

6 COMPETITIVE LANDSCAPE

- 6.1 Mergers and Acquisitions, Joint Ventures, Collaborations, and Agreements

- 6.2 Strategies Adopted by Leading Players

- 6.3 Company Profiles

- 6.3.1 Schlumberger Limited

- 6.3.2 Halliburton Company

- 6.3.3 Thermo Fisher Scientific Inc.

- 6.3.4 Intertek Group PLC

- 6.3.5 Core Laboratories N.V.

- 6.3.6 Zeiss International

- 6.3.7 FREDsense Technologies Corp.

- 6.3.8 Petricore Norway AS

7 MARKET OPPORTUNITIES AND FUTURE TRENDS

- 7.1 Development Of Advanced Imaging Techniques

02-2729-4219

+886-2-2729-4219