|

市场调查报告书

商品编码

1630420

石油和天然气核磁共振设备:市场占有率分析、产业趋势、成长预测(2025-2030)Oil and Gas Nuclear Magnetic Resonance - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

价格

※ 本网页内容可能与最新版本有所差异。详细情况请与我们联繫。

简介目录

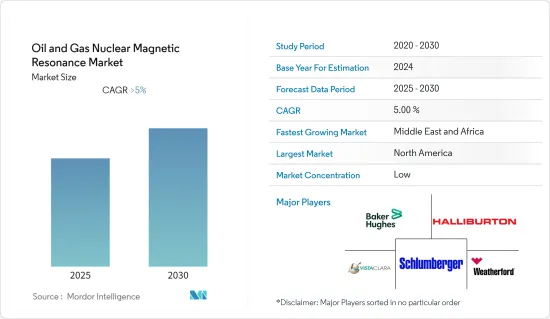

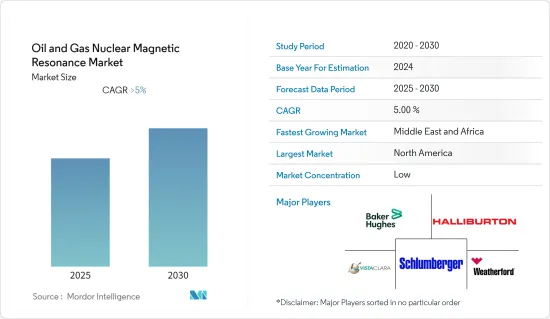

石油和天然气核磁共振市场预计在预测期内将以超过 5% 的复合年增长率成长。

2020年,COVID-19对市场产生了负面影响。目前,市场已达到疫情前水准。

主要亮点

- 从长远来看,中东和北美等地区上游活动的增加预计将推动市场。此外,天然气勘探的增加,尤其是页岩地层的探勘,正在推动对测井工具的需求。

- 同时,随着向可再生能源的持续转变以及对精炼石油产品的需求下降,上游石油和天然气产业正在放缓。因此,核磁共振测井的需求也可能受到阻碍。

- 深海探勘和超深海探勘的增加增加了与成功探勘相关的风险。为了提高确定性,核磁共振等应用测井将创造重大机会。

- 北美拥有全球巨大的可采页岩气和緻密油蕴藏量,在核磁共振市场上占据主导地位,预计在预测期内将继续占据主导地位。

石油和天然气核磁共振市场趋势

陆上部门主导需求

- NMR 是一种测井记录,可提供有关存在的流体量、这些流体的性质以及包含流体的孔隙尺寸的资讯。

- 在俄罗斯,Gazprom Neft 继续勘探 Bazhenov 油田,目标是到 2023年终页岩产量达到 4 万桶/日。为了成功回收,对包括核磁共振在内的测井的需求预计会增加。

- 2022年12月,石油和天然气有限公司提案在安得拉邦钻探53口探勘井。 KG盆地Godavari on-Land PML(石油采矿租赁)区块有50个,Cuddapah盆地CD-ONHP~2020/1(OALP-Vi)区块有3个,投资金额为2.62亿美元。根据地质和地球物理调查,ONGC决定从2021年至2028年在AP州东戈达瓦里和提案地区KG盆地的Godavariion Shore PML区块进行50口陆上勘探钻探。

- 到2022年,亚太地区的钻机数量将增加至197座,预计将有新的钻探活动。新井可能会在预测期内进行测井活动。

- 受全球疫情影响,上游计划预计短期内会出现延误。在预测期的下半年,由于新计画的启动,核磁共振市场预计将显着增长。

北美市场占据主导地位

- 美国是最大的原油和天然气生产国之一,2021年产量分别占全球产量的约20%和23%。由于以二迭纪盆地为首的页岩蕴藏量的大力钻探,2019年产量大幅增加。

- 截至2018年,美国陆上石油产量约占该国石油产量的84%,占天然气产量的3%。陆上探勘活动的增加预计将在预测期内推动核磁共振需求。

- 在美国,预计2018年至2025年间将投资约760亿美元用于该国即将推出的97个石油和天然气计划。随着新的探勘和钻探计划的开展,核磁共振测井可以显示出可观的成长。

- 2022年2月,BP PLC宣布启动墨西哥湾赫歇尔扩建计划。 Herschel 是 2022 年在全球实施的四个重大计划中的第一个。计划的第一阶段包括开发新的海底生产系统。第一口井高峰期时,该平台年总产量预计将增加10,600桶油当量/日。

- 因此,核磁共振测井很可能在未来几年应用于新井。

- 由于美国和加拿大页岩蕴藏量庞大,井数量不断增加,预计在预测期内对核磁共振的需求也会增加。

石油天然气核磁共振产业概况

石油天然气核磁共振市场已巩固。主要企业(排名不分先后)包括 Vista Clara Inc、Halliburton Company、Weatherford International plc、Baker Hughes Company 和 Schlumberger Limited。

其他好处

- Excel 格式的市场预测 (ME) 表

- 3 个月分析师支持

目录

第一章简介

- 调查范围

- 市场定义

- 研究场所

第二章调查方法

第三章执行摘要

第四章市场概况

- 介绍

- 至2028年市场规模及需求预测(单位:十亿美元)

- 最新趋势和发展

- 政府法规和措施

- 市场动态

- 促进因素

- 抑制因素

- 供应链分析

- 波特五力分析

- 供应商的议价能力

- 消费者议价能力

- 新进入者的威胁

- 替代品的威胁

- 竞争公司之间敌对关係的强度

第五章市场区隔

- 部署地点

- 离岸

- 陆上

- 地区

- 北美洲

- 欧洲

- 亚太地区

- 中东/非洲

- 南美洲

第六章 竞争状况

- 併购、合资、联盟、协议

- 主要企业策略

- 公司简介

- Halliburton Company

- Weatherford International plc

- Vista Clara Inc

- Baker Hughes Company

- Qteq Pty Ltd

- Mount Sopris Instruments Inc.

- Schlumberger Limited

第七章 市场机会及未来趋势

简介目录

Product Code: 71267

The Oil and Gas Nuclear Magnetic Resonance Market is expected to register a CAGR of greater than 5% during the forecast period.

In 2020, COVID-19 had a detrimental effect on the market. Presently, the market reached pre-pandemic levels.

Key Highlights

- Over the long term, increasing upstream activities in regions like the Middle East and North America is expected to drive the market. Additionally, growing natural gas exploration, especially from shale formations, is driving the demand for logging tools.

- On the other hand, the increasing shift towards renewable energy leading to a decrease in demand for refined petroleum products is causing a slowdown in the upstream oil and gas sector. Thus, the demand for NMR logging is also likely to be hindered.

- Nevertheless, increasing deepwater and ultradeep exploration increases the risk associated with successful exploration. To increase certainty, application logging like NMR will likely create significant opportunities.

- With its vast reserves of recoverable shale gas and tight oil reserves in the world, North America is dominating the NMR market and is expected to continue in the forecast period.

Oil and Gas Nuclear Magnetic Resonance Market Trends

Onshore Sector to Dominate the Demand

- NMR is a type of log that provides information about the quantities of fluids present, the properties of these fluids, and the pores' sizes containing the fluids.

- In Russia, Gazprom Neft continues to conduct studies on its Bazhenov acreage and is targeting 40,000 b/d of production from shale by the end of 2023. The demand for logging, including NMR, will likely increase to attain successful recovery.

- In December 2022, Oil and Natural Gas Corporation Ltd proposed to drill 53 exploratory wells in Andhra Pradesh, 50 in the Godavari on-Land PML (Petroleum Mining Lease) Block of KG Basin and three in CD-ONHP-2020/1 (OALP-Vi) Block Of Cuddapah basin with an investment outlay of USD 262 million. ONGC proposes to carry out the onshore exploration of 50 wells during 2021-'28 in the Godavari on-land PML block of the KG basin in the East and West Godavari Districts of AP based on geological and geophysical studies.

- New drilling can be expected with an increasing rig count in the Asia-Pacific to 197 in 2022. The new wells are likely to undergo logging activities in the forecast period.

- Due to the global pandemic, upstream project delays are expected in the short term. Later in the forecast period, with the initiation of new projects, the market of NMR is expected to grow considerably.

North America to Dominate the Market

- The United States was one of the largest producers of crude oil and natural gas, accounting for around 20% and 23% of the global production, respectively, in 2021. The production surged in 2019 due to robust drilling in its shale reserves, led by the Permian Basin.

- Onshore oil production in the United States accounts for around 84% of the country's oil production and 3% of the country's natural gas production as of 2018. Increased onshore exploration activity in the forecasted period is expected to drive the NMR demand.

- It is expected that around USD 76 billion will be spent on 97 upcoming oil and gas projects in the country between 2018 and 2025 in the United States. With new exploration and drilling projects, NMR logging can witness considerable growth.

- In February 2022, BP PLC announced the start of the Herschel Expansion project in the Gulf of Mexico. Herschel is the first of the four major projects to be delivered globally in 2022. Phase 1 of the project comprises developing a new subsea production system. At its peak, the first well is expected to increase the platform's annual gross production by an estimated 10,600 barrels of oil equivalent a day.

- Therefore the new wells in the upcoming years can witness the application of NMR logging in the future.

- Due to the availability of vast shale reserves in the United States and Canada, the number of wells is increasing, which is expected to drive the need for NMR in the forecast period.

Oil and Gas Nuclear Magnetic Resonance Industry Overview

The oil and gas nuclear magnetic resonance market is consolidated. Some major companies (in no particular order) include Vista Clara Inc, Halliburton Company, Weatherford International plc, Baker Hughes Company, and Schlumberger Limited.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Scope of Study

- 1.2 Market Definiton

- 1.3 Study Assumptions

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET OVERVIEW

- 4.1 Introduction

- 4.2 Market Size and Demand Forecast in USD billion, till 2028

- 4.3 Recent Trends and Developments

- 4.4 Government Policies and Regulations

- 4.5 Market Dynamics

- 4.5.1 Drivers

- 4.5.2 Restraints

- 4.6 Supply Chain Analysis

- 4.7 Porter's Five Forces Analysis

- 4.7.1 Bargaining Power of Suppliers

- 4.7.2 Bargaining Power of Consumers

- 4.7.3 Threat of New Entrants

- 4.7.4 Threat of Substitute Products and Services

- 4.7.5 Intensity of Competitive Rivalry

5 MARKET SEGMENTATION

- 5.1 Location of Deployment

- 5.1.1 Offshore

- 5.1.2 Onshore

- 5.2 Geogrpahy

- 5.2.1 North America

- 5.2.2 Europe

- 5.2.3 Asia-Pacific

- 5.2.4 Middle-East and Africa

- 5.2.5 South America

6 COMPETITIVE LANDSCAPE

- 6.1 Mergers and Acquisitions, Joint Ventures, Collaborations, and Agreements

- 6.2 Strategies Adopted by Leading Players

- 6.3 Company Profiles

- 6.3.1 Halliburton Company

- 6.3.2 Weatherford International plc

- 6.3.3 Vista Clara Inc

- 6.3.4 Baker Hughes Company

- 6.3.5 Qteq Pty Ltd

- 6.3.6 Mount Sopris Instruments Inc.

- 6.3.7 Schlumberger Limited

7 MARKET OPPORTUNITIES AND FUTURE TRENDS

02-2729-4219

+886-2-2729-4219