|

市场调查报告书

商品编码

1630430

采矿实验室自动化:市场占有率分析、产业趋势与统计、成长预测(2025-2030)Mining Laboratory Automation - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

价格

※ 本网页内容可能与最新版本有所差异。详细情况请与我们联繫。

简介目录

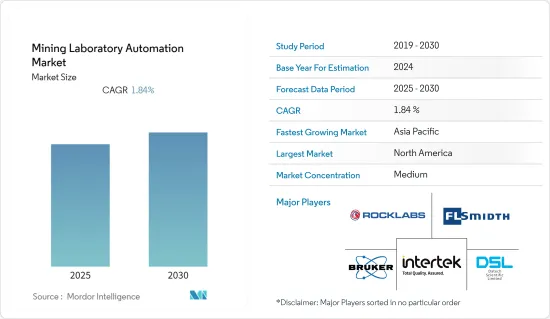

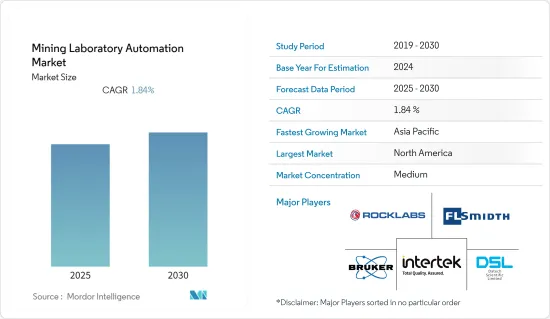

采矿实验室自动化市场预计在预测期内复合年增长率为 1.84%。

主要亮点

- 采矿业对自动化设备的需求主要是由对提高生产力和工人安全的日益增长的需求所推动的。 COVID-19 的疫情正在推动自动化需求,预计从长远来看,自动化需求将会增加,主要是为了解决劳动力短缺和成本上升的问题。

- 由于实验室生产力的提高和营运成本的降低,自动化、人工智慧和机器人技术的采用正在迅速增加,预计这将进一步推动市场成长。

- 许多采矿企业正在与科技公司合作,在其营运范围内开发和创新创造性解决方案,以提高矿山工作人员的安全。此外,先进的资料分析应用于原始资料,以创建视觉化、见解和建议,并即时交付给矿山经理和员工的行动装置。这项行业创新和技术采用的案例预计将提供一些成长机会。

- 2020 年 3 月,诺基亚与 CENGN 和 NORCAT 合作,在 NORCAT 地下中心安装和营运专用 LTE/4.9G 无线连接网路。 NORCAT 和 CENGN 将作为未来采矿技术的中心,帮助诺基亚进一步推进其推动全球采矿创新的承诺。

- 实验室自动化模组(包括软体)的设置成本偏高,令小型企业望而却步。预计这一因素将使市场成长机会向预测期记忆体在于供应链中的供应商倾斜。

采矿实验室自动化市场趋势

实验室资讯管理系统预计将占据最大份额

- 实验室资讯管理系统 (LIMS) 是一款帮助专业人员和科学家管理样本、测试结果和相关资料以提高实验室生产力的软体。它有助于标准化工作流程、检查和程序,让您能够精确控制流程。确保产品标准、品管和环境安全标准,提高生产力并满足监管需求。

- 采矿实验室需要涵盖从稀土和基底金属到宝石的广泛测试系统。因此,这些解决方案允许配置可以使用提供的功能建立和修改的工作流程、萤幕和测试。采矿和金属加工实验室还需要使用 CCLAS 6 等复杂的实验室资讯管理系统 (LIMS) 来管理其流程。

- CCLAS 6 是一种基于网路的 LIMS 解决方案,可透过灵活的样品註册、条码标籤列印、工作清单产生、从各种分析仪器中资料撷取以及自动产生分析报告和商业发票来实现实验室流程的自动化。该系统提供品管功能,可根据规格监控操作产品材料和品管参考标准。

- 市场上的主要供应商正在透过收购市场上其他正在加强其产品系列的参与者来扩大其影响力。例如,2019 年,FLSmidtha 透过收购 IMP Automation Group 完成了其采矿业自动化实验室解决方案组合。 IMP 集团在澳洲和南非拥有稳固的立足点。 IMP 集团的解决方案补充了 FLSmidth 的品管和采矿流程优化产品。

预计北美将主导市场

- 由于北美在各行业的技术实施方面占据主导地位,预计在预测期内将主导采矿实验室自动化市场。该地区采矿业的成长进一步增加了在该行业实施实验室自动化解决方案的成长机会。

- 加拿大在地质上也拥有得天独厚的天然资源。据加拿大自然资源部称,该国钾肥产量排名第一,铀和钻石产量排名第二,铝产量排名第三。此外,加拿大是国际采矿管辖区中有效税率最低的国家之一。流通份额机制、矿产探勘税额扣抵和多项国家措施被誉为刺激矿产探勘和鼓励市场投资的创新方法。

- 例如,2020 年 5 月,加拿大新兴企业ColdBlockTechnologies Inc. 推出了一种创新的样品消解技术,该技术为服务于环境、金属和合金、采矿、食品和农业以及製药行业的实验室提供了新的性能标准,并已成为该技术的资金筹措。这笔资金筹措将使我们能够加速第三代产品的开发,以满足实验室自动化需求。

- 该地区有许多新的使用案例,增加了各种产品的市场需求。例如,2020 年 12 月,MSA Labs 宣布将根据与 Barrick 签订的化验服务协议,使用光子分析为该矿场提供持续的现场实验室管理和分析服务。 PhotonAssay 技术使用高能量 X 射线,只需 2 分钟即可分析金、银和互补金属。它可以测量多达 500 克的样品,并提供与样品的化学和物理形式无关的批量测量。 X射线分析过程不会破坏样品,因此可以储存样品以进行进一步分析。

- 采矿业的上升趋势正在激励市场参与者与实验室自动化解决方案提供者建立策略联盟,并扩大其在市场上的影响力。例如,2020 年 5 月,Teledyne CETAC Technologies 与 Summit Scientific 合作,成为美国落基山脉地区的经销商。 高峰会 Scientific 提供化学分析解决方案以及自动化样品引入和样品製备的系统。 Cetac Technologies 将为 Summit Scientific 提供分析实验室解决方案,满足实验室业务中需要先进自动化和提高生产力的需求。

采矿实验室自动化产业概述

由于全球范围内存在多个实验室自动化解决方案供应商,采矿实验室的竞争格局较为分散。解决方案供应商正在市场创新并进入多个新兴市场。此外,多家解决方案供应商已建立策略联盟和伙伴关係关係,以提高其在市场上的影响力。

- 2020 年 2 月 - 力拓 (Rio Tinto) 授予 Scott Technology 一份合同,为西澳大利亚皮尔巴拉 (Pilbara) 的 Koudaideri铁矿石计划设计和建造自动化采矿实验室。根据协议,斯科特科技将建造一个机器人样品製备和分析实验室并提供设备。

其他好处

- Excel 格式的市场预测 (ME) 表

- 3 个月的分析师支持

目录

第一章简介

- 研究假设和市场定义

- 调查范围

第二章调查方法

第三章执行摘要

第四章市场动态

- 市场概况

- 产业吸引力-波特五力分析

- 供应商的议价能力

- 买家/消费者的议价能力

- 新进入者的威胁

- 替代品的威胁

- 竞争公司之间的敌对关係

- 市场驱动因素

- 从传统方法转向自动化

- 新的和创新的解决方案

- 市场限制因素

- 整个模组的初始设定成本较高

- COVID-19 市场影响评估

- 主要用途(实验室和采矿场)

- 主要使用案例

第五章市场区隔

- 产品

- 机器人

- 实验室资讯管理系统(LIMS)

- 容器实验室

- 全自动分析仪及製样设备

- 地区

- 北美洲

- 欧洲

- 亚太地区

- 拉丁美洲

- 中东/非洲

第六章 竞争状况

- 公司简介

- FLSmidth A/S

- Bruker Corporation

- Datech Scientific Ltd.

- Intertek Group PLC

- Rocklabs(SCOTT Group)

- Thermo Fisher Scientific Inc.

- Malvern Panalytical Ltd.

- Nucomat

- HERZOG Automation Corp.

- Online LIMS Canada Limited

第七章 投资分析

第八章市场的未来

简介目录

Product Code: 71411

The Mining Laboratory Automation Market is expected to register a CAGR of 1.84% during the forecast period.

Key Highlights

- The demand for automation equipment in the mining industry is primarily driven by the rising need to enhance productivity and improve workers' safety. The outbreak of COVID-19 has driven the demand for automation and is expected to increase over the long run, primarily to cope with the shortage of labor and increasing costs.

- The deployment of automation, AI, and robotics is rapidly increasing due to the enhanced productivity and mitigating operational costs for laboratories, which is further expected to boost market growth.

- Numerous mining operations are partnering with technology companies to deploy and innovate creative solutions in their operations, to enhance the safety of the people working in the mines. Also, advanced data analytics is being applied to the raw data to create visualizations, insights, and recommendations, which is delivered to mine managers and employees in real-time on their mobile devices. Such instances of innovations and technology adoption in the industry are expected to provide several opportunities for growth.

- In March 2020, Nokia collaborated with CENGN and NORCAT to install and operate a private LTE/4.9G wireless connectivity network in NORCAT's Underground Centre. NORCAT and CENGN will serve as a hub for the future of mining technology, while Nokia will help in furthering its commitment towards advancing worldwide mining innovation.

- The cost to set the laboratory automation module, including software, is on the higher side and discourages small enterprises. This factor is expected to tilt the market growth opportunities towards vendors who have extended presence in the supply chain, over the forecast period.

Mining Laboratory Automation Market Trends

Laboratory Information Management System Expected to Exhibit Maximum Share

- A Laboratory Information Management System (LIMS) is software that allows professionals or scientist to manage samples, test results and associated data to improve lab productivity. It aids standardize workflows, tests and procedures, while providing accurate controls of the process. They ensure product standards, quality control and environmental safety standards as well as to improve productivity and meet regulatory needs.

- Mining laboratories need to cover a broad range of testing regimes ranging from rare earths and base metals to gemstones. Therefore, these solutions allows configuration of the workflows and screens and tests which can be created and modified using the supplied functionality. Also, mining and metal processing laboratories need to control their processes with a sophisticated laboratory information management system (LIMS) such as CCLAS 6.

- CCLAS 6 is a web-based LIMS solution that automates laboratory processes through flexible sample registration, barcode label printing, work list generation, online data capture from a wide range of analytical instruments, and automatic generation of analytical reports and commercial invoices. The system offers quality control functions that monitor operation product materials and quality control reference standards against specifications.

- Major vendors in the market are expanding their reach by acquiring other players in the market which are enhancing their product portfolio. For instance, in 2019, FLSmidthhas completed its portfolio of automated laboratory solutions for the mining industry through the acquisition of IMP Automation Group. IMP Group has a strong foothold in Australia and South Africa. Its solutions complement the products FLSmidthoffers for quality control and optimisation for the mining process.

North America Expected to Dominate the Market

- North America is expected to dominate the Mining Lab Automation market in the forecast period owing to the dominance of the region in technology adoption across various industries. The growing mining industry in the region has further augmented the growth opportunities for the adoption of lab automation solutions in the industry.

- Canada is also geologically endowed with natural resources. According to NRCan, the country holds the first position in potash production, second position in uranium and diamond production, and the third position in aluminum production. Moreover, Canada has one of the lowest effective tax rates among the international mining jurisdictions. Its flow-through shares mechanism, along with the mineral exploration tax credit and some provincial measures, is recognized for its innovative approach for stimulating mineral exploration, thus driving the players to invest in the market.

- For instance, in May 2020, Canadian startup, ColdBlockTechnologies Inc., an inventor of the innovative sample digestion technology that delivers a new performance standard for laboratories serving the environmental, metals and alloys, mining, food and agriculture, and pharmaceuticals industries, completed a USD 1.5 million Series A round of financing. Its fundraising can accelerate the development of their Generation-3 products to satisfy the automation needs of laboratories.

- There are many emerging use cases in the region are augmenting the market demand for various products. For instance, in December 2020, under a laboratory services contract with Barrick, MSA Labs announced that it will use PhotonAssay to deliver ongoing on-site laboratory management and analysis services to the mine. The PhotonAssaytechnology uses high energy X-rays to analyzegold, silver, and complementary metals in as little as two minutes. It allows samples of up to 500g to be measured and provides a bulk reading independent of the chemical or physical form of the sample. The X-ray assay process does not destroy the sample, meaning it can be kept for further analysis.

- The growing trends in the mining industry are stimulating the market players to form a strategic collaboration with lab automation solution providers and expand their market presence. For instance, in May 2020, Teledyne CETAC Technologies collaborated with Summit Scientific as their sales representative for the Rocky Mountain region of the United States. Summit Scientific provides chemical analysis solutions, as well as systems for automating sample introduction and sample prep. Cetac Technologies will provide Summit Scientific with an analytical lab solution that needs advanced automation and improved productivity for their lab operation.

Mining Laboratory Automation Industry Overview

The competitive landscape of the Mining Laboratory is moderately fragmented owing to the presence of several lab automation solution providers globally. The solution providers are innovating and making several developments in the market. Also, several solution providers are forming strategic collaborations and partnerships to boost their market presence.

- February 2020 - Rio Tinto awarded Scott Technology a contract to design and build an automated mine laboratory for the Koodaideri iron ore project in the Pilbara, Western Australia. Under the contract, Scott Technology will construct and supply equipment for the robotic sample preparation and analysis laboratory.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions & Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET DYNAMICS

- 4.1 Market Overview

- 4.2 Industry Attractiveness - Porter's Five Forces Analysis

- 4.2.1 Bargaining Power of Suppliers

- 4.2.2 Bargaining Power of Buyers/Consumers

- 4.2.3 Threat of New Entrants

- 4.2.4 Threat of Substitute Products

- 4.2.5 Intensity of Competitive Rivalry

- 4.3 Market Drivers

- 4.3.1 Shift From Traditional Practices to Automation

- 4.3.2 New and Innovative Solutions

- 4.4 Market Restraints

- 4.4.1 Higher Initial Setup Costs for Overall Module

- 4.5 Assessment of Impact of Covid-19 on the Market

- 4.6 Key Applications (Laboratories and Mine-site)

- 4.7 Major Use Cases

5 MARKET SEGMENTATION

- 5.1 Product

- 5.1.1 Robotics

- 5.1.2 Laboratory Information Management Systems (LIMS)

- 5.1.3 Container Laboratory

- 5.1.4 Automated Analyzers and Sample Preparation Equipment

- 5.2 Geography

- 5.2.1 North America

- 5.2.2 Europe

- 5.2.3 Asia Pacific

- 5.2.4 Latin America

- 5.2.5 Middle East and Africa

6 COMPETITIVE LANDSCAPE

- 6.1 Company Profiles

- 6.1.1 FLSmidth A/S

- 6.1.2 Bruker Corporation

- 6.1.3 Datech Scientific Ltd.

- 6.1.4 Intertek Group PLC

- 6.1.5 Rocklabs (SCOTT Group)

- 6.1.6 Thermo Fisher Scientific Inc.

- 6.1.7 Malvern Panalytical Ltd.

- 6.1.8 Nucomat

- 6.1.9 HERZOG Automation Corp.

- 6.1.10 Online LIMS Canada Limited

7 INVESTMENT ANALYSIS

8 FUTURE OF THE MARKET

02-2729-4219

+886-2-2729-4219