|

市场调查报告书

商品编码

1630431

北美车队管理解决方案:市场占有率分析、行业趋势和成长预测(2025-2030 年)North America Fleet Management Solutions - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

※ 本网页内容可能与最新版本有所差异。详细情况请与我们联繫。

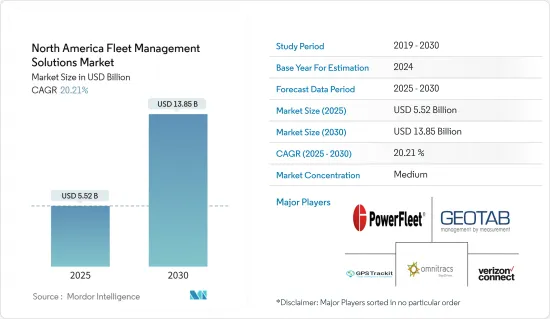

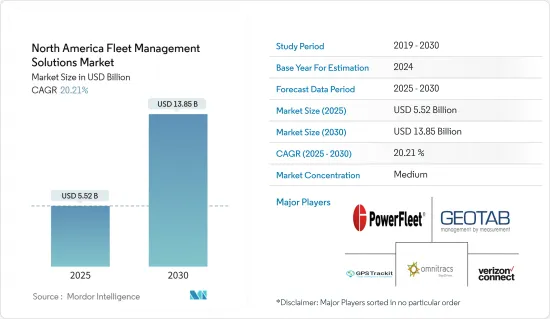

北美车队管理解决方案市场规模预计到 2025 年为 55.2 亿美元,预计到 2030 年将达到 138.5 亿美元,预测期内(2025-2030 年)复合年增长率为 20.21%。

越来越多地采用无线技术、增加对车队管理解决方案的投资以优化车辆运营费用以及增加国际贸易是推动北美车队管理解决方案市场成长的关键因素。

主要亮点

- 通讯技术的快速扩展使世界变成了数十亿辆联网汽车的集合,使驾驶员能够与道路上的其他车辆(车辆到车辆)、路边基础设施(车辆到基础设施)和云端进行互动(车辆通讯基础设施)。

- 此外,许多领先的供应商正在共同开发和推出新的先进车队管理解决方案,以满足不断增长的需求。例如,2019年,iD Systems与永恆力合作,为永恆力车开发高度整合的远端检测平台,并结合先进的车队管理软体。这项技术合作关係将使永恆力的客户能够执行更安全、更具成本效益的物流业务。

- 此外,5G 的快速普及正在推动各行业车队管理系统的发展。例如,爱立信的 2019 年行动产业报告预测,到 2024 年,5G 蜂窝用户数量将达到 19 亿,推动连网汽车的成长。北美市场预计成长最快,63%的行动用户使用5G服务,东亚47%的行动电话用户也获得5G服务。这一增长很大程度上归功于晶片组价格的下降以及 NB-IoT 和 Cat-M1 等蜂窝技术的扩展。

- 然而,云端和基于伺服器的服务缺乏资料安全性正在阻碍市场成长。云端基础的服务带来了许多独特的安全问题和挑战。资料由第三方提供者储存并在云端存取。这意味着您对资料的可见性和控制力有限。

北美车队管理解决方案市场趋势

交通运输业显着成长

- 由于智慧城市计画推动的智慧交通计划数量不断增加,预计在预测期内对车队管理解决方案的需求将会增加。智慧交通计划的目的是减少对私家车的依赖,增加公共运输的吸引力,鼓励城市居民和游客从私家车转换公共运输,并解决日益严重的交通问题。例如,智慧交通系统可以限制私家车行驶特定路线,为其他交通方式保留优先车道或整条道路。

- 在美国和加拿大,越来越多的公司采用商用车来增强运输服务,预计将提振北美市场。例如,2019年,美国以12,764,999辆商用车销量排名第一;加拿大以1,479,252辆商用车排名第三。

- 此外,美国正加大力度透过出口扩大其最具竞争力的产业和产品的生产,以扩大经济规模,增强经济成长,并有望刺激市场。例如,报告称,2019年,美国的货物贸易总额达4.14万亿美元,这得益于跟踪路线进展、接收自动更新、改善客户体验、提高到达率的能力次反映了对车队管理解决方案通过共用和延迟减少通话数量的需求不断增长。

美国取得了显着成长并引领市场。

- 美国的车辆事故不断增加,导致一些企业申请成本最高,迫使他们实施车队管理解决方案。例如,根据联邦汽车运输安全管理局(FMCSA) 的报告,2017 年,估计有37,133 人在34,247 起致命事故中丧生,而2017 年,涉及大型卡车或公共汽车的4,455 起事故导致约37,133 人死亡,其中5,005 人死亡,其中8 人死亡。

- 这就是为什么大多数公司使用事故管理工具来提供对车辆和交通的即时洞察,以预防事故并提高驾驶员安全。这些解决方案使用 GPS 工具、行动技术和物联网 (IoT),使企业的即时车辆追踪和车队管理变得更简单、更容易。

- 此外,由于网路购物的盛行,美国零售业正在扩张,预计企业将使用更多车辆,预计将推动市场。例如,亚马逊位于橡树溪的新履约中心计划于 2020 年开幕。市政府负责人估计他们每天将额外僱用 175 辆卡车来装卸货物。

- 然而,大多数车队管理系统(例如自动引导系统)严重依赖感测器等电子元件,而最近因COVID-19 大流行而导致的电子供应链中断导致了显着的市场週期和增长率,这可能反映在这一点上。

北美车队管理解决方案产业概览

北美车队管理解决方案市场竞争激烈,由 PowerFleet, Inc.、Geotab, Inc.、Verizon Communications Inc. (Connect)、Omnitracs, LLC 和 GPS Trackit, Inc. 等几家大型企业主导。这些拥有压倒性市场份额的大公司正致力于扩大海外基本客群。这些公司利用策略合作措施来扩大市场占有率并提高盈利。然而,随着技术和产品创新的进步,中小企业(SME)正在透过获取新契约和开发新市场来增加其在市场中的影响力。

- 2020 年 6 月 - Geotab 宣布在北美推出 Geotab公共工程解决方案。这个一体化解决方案使车队经理能够在一个平台上全面了解所有类型的政府车辆营运资料,为他们提供了一套有效保持合规性、降低成本和维护道路安全的工具。该解决方案旨在帮助政府机构管理撒盐车、扫雪车、街道清洁车和废弃物处理车辆等车队。

- 2020 年 5 月 - Omnitracs, LLC 与 McLeod Software 合作,为货运业提供运输管理和货运软体解决方案。与 McLeod LoadMaster 运输管理系统 (TMS) 的整合增强了 Omnitracs One 平台的互通性,使其能够为世界各地的车队提供更多价值。

其他好处

- Excel 格式的市场预测 (ME) 表

- 3 个月分析师支持

目录

第一章简介

- 研究假设和市场定义

- 调查范围

第二章调查方法

第三章执行摘要

第四章市场动态

- 市场概况

- 市场驱动因素

- 有利的市场法规与日益重视的营运效率相结合

- 绿色车队概念的出现推动市场成长

- 技术进步扩大了覆盖范围并降低了安装成本

- 市场问题

- 有关地理编码的隐私和操作问题

- 市场机会

- 产业吸引力-波特五力分析

- 供应商的议价能力

- 消费者议价能力

- 新进入者的威胁

- 替代品的威胁

- 竞争公司之间的敌对关係

- COVID-19 对车队管理和远端资讯处理产业的影响

- 行业标准和法规

- 产业价值链分析-IT软体、车队硬体(远端资讯处理)、连接、汽车OEM等。

第五章市场区隔

- 按发展

- 本地

- 云

- 杂交种

- 按用途

- 资产管理

- 资讯管理

- 司机管理

- 安全与合规管理

- 风险管理

- 营运管理

- 其他解决方案

- 按最终用户产业

- 运输

- 活力

- 建设业

- 製造业

- 其他的

- 按国家/地区

- 美国

- 加拿大

第六章 竞争状况

- 公司简介

- PowerFleet, Inc.

- Geotab, Inc.

- Verizon Communications Inc.(Connect)

- Omnitracs, LLC

- GPS Trackit, Inc.

- Astrata Group

- Trimble Navigation Inc.

- Mix Telematics

- Inseego Group

第七章 市场未来展望

The North America Fleet Management Solutions Market size is estimated at USD 5.52 billion in 2025, and is expected to reach USD 13.85 billion by 2030, at a CAGR of 20.21% during the forecast period (2025-2030).

The growing adoption of wireless technology, increasing investment in fleet management solutions to optimize the fleet operating expenses, rising international trades are some of the major factors driving the growth of the fleet management solution market in North America.

Key Highlights

- The rapid expansion of communication technologies has turned the world into a cluster of billions of connected vehicles where the driver can communicate with other cars on the road (vehicle-to-vehicle), roadside infrastructure (vehicle-to-infrastructure), and the cloud (vehicle-to-cloud) to yields higher productivity, agility, and efficiency and is expected to drive the market.

- Moreover, most of the key vendors are collaborating to develop and launch new and advanced fleet management solutions to seize the growing demand. For instance, in 2019, I.D. Systems, Inc partnered with Jungheinrich to develop a highly integrated telemetry platform for Jungheinrich vehicles combined with sophisticated fleet management software. This technology partnership will power-up Jungheinrich customers' ability to run safer, more cost-effective intralogistics operations.

- Additionally, the rapid expansion of 5G availability is driving the growth of fleet management systems in various industries. For instance, as per Ericsson's 2019 report on the mobile industry has predicted that by 2024 there will be 1.9 billion 5G cellular subscriptions that will drive the growth of connecting vehicles. North American market is expected to grow most with 63% of mobile subscriptions with 5G service, and 47% of cellular subscribers in East Asia will have 5G access as well. Much of the growth will be credited to reductions in chipset prices and the expansion of cellular technologies such as NB-IoT and Cat-M1.

- However, lack of data security in cloud and server-based services is hampering the growth of the market. Cloud-based services bring many unique security issues and challenges. Data is stored with a third-party provider and accessed in the cloud. This means visibility and control over that data is limited.

North America Fleet Management Solutions Market Trends

Transportation Sector Will Experience Significant Growth

- The growing number of smart transportation projects under the smart city concept is expected to boost the demand for fleet management solutions over the forecast period. The goal of smart transportation projects is to reduce the reliance on private cars, make public transport more attractive, and incentivize city residents and visitors to switch from private to public transport to address the escalating traffic problems. For instance, smart transport systems can limit private cars to certain routes and reserve priority lanes or even entire roads for other modes of transport.

- Increasing the adoption of commercial vehicles by various businesses in the United States and Canada to enhance their transportation offerings is expected to boost the market in North America. For instance, in 2019, the United States secured the first rank and registered a sale of 12,764,999 commercial vehicles; moreover, Canada was third on the list with 1,479,252 commercial vehicles.

- Moreover, the United States increasing efforts to expand the production of most competitive industries and products through exports in order to achieve the scale of economies and strengthen its economic growth is expected to fuel the market. For instance, according to the report, in 2019, the total value of United States trade goods amounted to USD 4.14 trillion which reflects the growing demand for fleet management solutions to track route progress, receive automatic updates, improve client experience and reduce call volume by sharing arrival times and delays.

United States Will Experience Significant Growth and Drive the Market

- An increasing number of fleet accidents in the United States are forcing companies to adopt fleet management solutions as these are the most expensive injury claims for any businesses. For instance, according to the Federal Motor Carrier Safety Administration (FMCSA) report, an estimated 37,133 people died in 34,247 fatal accidents in 2017 and 5,005 people died in 4,455 crashes involving large trucks or buses, fatalities increased 8% from 2016, and fatal crashes also increased by 8%.

- Therefore, most of the companies are using accident management tools that provide real-time insights of the vehicles and traffic to prevent accidents and improve driver safety. These solutions use GPS tools, mobile technology, and the Internet of Things (IoT) and make real-time fleet tracking and enterprise fleet management simpler and easier.

- Further, the expansion of the retail sector in the United States due to the growing popularity of online shopping is expected to drive the market as more vehicles will be employed by companies. For instance, Amazon's new fulfillment center in Oak Creek is expected to open in 2020. It is estimated by the city official to employ in an additional 175 trucks on a daily basis for loading and unloading of goods.

- However, most of the fleet management systems, like automated guidance systems, heavily rely on electronic components like transducers, and the recent disruption of electronic supply chains due to the COVID-19 pandemic could reflect on the growth rates being hindered for a substantial market period.

North America Fleet Management Solutions Industry Overview

The North America fleet management solutions market is competitive and is dominated by a few major players like PowerFleet, Inc., Geotab, Inc., Verizon Communications Inc. (Connect), Omnitracs, LLC and GPS Trackit, Inc. These major players with a prominent share in the market are focusing on expanding their customer base across foreign countries. These companies are leveraging strategic collaborative initiatives to increase their market share and increase their profitability. However, with technological advancements and product innovations, mid-size to smaller companies are increasing their market presence by securing new contracts and by tapping new markets.

- June 2020 - Geotab announced the North American launch of its Geotab Public Works solution. The all-in-one solution offers fleet managers full visibility into the operational data of all government vehicle types on one single platform and provides the toolsets to effectively remain compliant, reduce costs, and maintain road safety. It is designed to assist government agencies better manage vehicles such as salt spreaders, snowplows, street sweepers and waste management vehicles.

- May 2020 - Omnitracs, LLC partnered with McLeod Software, a provider of transportation management and trucking software solutions to the trucking industry. The integration with the McLeod LoadMaster transportation management system (TMS) will enhance the interoperability of the Omnitracs One platform, delivering more value to fleets globally.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET DYNAMICS

- 4.1 Market Overview

- 4.2 Market Drivers

- 4.2.1 Favorable market regulations coupled with growing emphasis on operational efficiency

- 4.2.2 Advent of the concept of Green Fleets to further aid market growth

- 4.2.3 Technological advancements enabling greater reach and declining costs of installation

- 4.3 Market Challenges

- 4.3.1 Privacy and operational concerns related to geocoding

- 4.4 Market Opportunities

- 4.5 Industry Attractiveness - Porter's Five Forces Analysis

- 4.5.1 Bargaining Power of Suppliers

- 4.5.2 Bargaining Power of Consumers

- 4.5.3 Threat of New Entrants

- 4.5.4 Threat of Substitute Products

- 4.5.5 Intensity of Competitive Rivalry

- 4.6 Impact of COVID-19 on the Fleet Management and Telematics industry

- 4.7 Industry Standards & Regulations

- 4.8 Industry Value Chain Analysis - IT Software, Fleet Hardware (Telematics), Connectivity, Automotive OEM's, etc.

5 MARKET SEGMENTATION

- 5.1 By Deployment

- 5.1.1 On-Premise

- 5.1.2 Cloud

- 5.1.3 Hybrid

- 5.2 By Application

- 5.2.1 Asset Management

- 5.2.2 Information Management

- 5.2.3 Driver Management

- 5.2.4 Safety and Compliance Management

- 5.2.5 Risk Management

- 5.2.6 Operations Management

- 5.2.7 Other Solutions

- 5.3 By End-User Industry

- 5.3.1 Transportation

- 5.3.2 Energy

- 5.3.3 Construction

- 5.3.4 Manufacturing

- 5.3.5 Other End User Industries

- 5.4 By Country

- 5.4.1 United States

- 5.4.2 Canada

6 COMPETITIVE LANDSCAPE

- 6.1 Company Profiles

- 6.1.1 PowerFleet, Inc.

- 6.1.2 Geotab, Inc.

- 6.1.3 Verizon Communications Inc. (Connect)

- 6.1.4 Omnitracs, LLC

- 6.1.5 GPS Trackit, Inc.

- 6.1.6 Astrata Group

- 6.1.7 Trimble Navigation Inc.

- 6.1.8 Mix Telematics

- 6.1.9 Inseego Group