|

市场调查报告书

商品编码

1630432

事件流处理 -市场占有率分析、产业趋势/统计、成长预测 (2025-2030)Event Stream Processing - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

※ 本网页内容可能与最新版本有所差异。详细情况请与我们联繫。

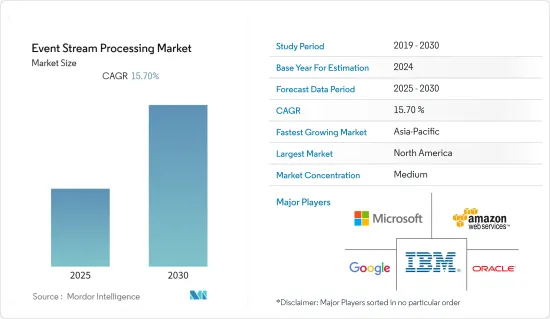

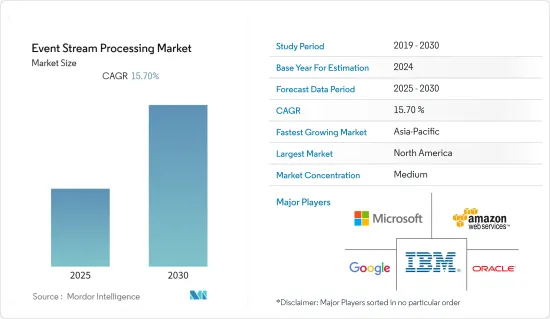

预计事件流处理市场在预测期内将以 15.7% 的复合年增长率成长

主要亮点

- 根据 MachEye 的数据,人们每天产生 2.5 亿位元组的资料,并且预计每年都会快速成长。商业智慧用户努力将数量激增的复杂资料转化为可操作的见解。因此,我们相信对更先进、更易于使用的资料转换工具的需求将会很大。

- 有针对性的优惠和预测分析使零售商能够为每位客户开发高度精细和个人化的优惠。例如,零售商可以透过提供奖励频繁购买和推动更多购买的优惠来个性化店内体验并提高所有通路的销售额。预测分析可用于向客户进行提升销售和交叉销售。此外,预测分析还可以帮助企业预测客户终身价值 (CLV)。 CLV 透过分析过去的行为并识别一段时间内最盈利的客户,帮助预测长期客户的折扣价值。

- 此外,即时处理大量 RFID资料的需求迅速增加了无线射频辨识 (RFID) 事件处理应用中事件流处理的使用。 RFID 标籤与物品或人相连,并产生可由RFID读取器读取的讯号。这使得公司能够即时了解货物和人员的位置,这在管理供应链和确保人员安全等多个领域中发挥着重要作用。

- 根据 Sisense 研究,50% 的企业至少与 COVID-19 大流行之前一样多地使用预测分析,其中包括超过 68% 的中小企业。例如,COVID-19 大流行期间的一个关键挑战是确保顾客在访问实体店时的安全。借助商业智慧工具、社交网路平台和客户关係管理(CRM)系统,企业可以从客户那里获得直接回馈,并采取适当的措施来确保每个人的健康和安全。

- 对资料分析和资料视觉化工具的需求显着增加。例如,根据 IBM Quant Crunch 的数据,多达 272 万个工作需要资料科学技能,使其成为各行业最抢手的职位之一。 MIS 或 CS 系毕业的大学生对资料库建模或实际资料库环境知之甚少。没有特定的 IT 科学专业开设资料库课程,更不用说商业智慧或分析课程了。他们缺乏接触职场使用的工具和技术的机会。

事件流处理市场趋势

物联网 (IoT) 和智慧型装置的采用率不断提高

- 根据 Oracle 最近的一项调查,企业物联网采用者愿意采取更简单的路线。在接受调查的 800 名物联网决策者中,近三分之二 (64%) 表示,他们会选择「现成的」物联网解决方案,而不是自订的物联网解决方案,这表明企业购买产品的方式是改变。此外,75% 的受访者希望他们的解决方案提供者包含或打包连接功能,70% 的受访者希望他们的提供者将资料和分析作为完整解决方案的一部分提供功能。这些结果表明,人们越来越需要透过简单的方法来添加物联网功能并加快实现价值的时间。

- 此外,思科的年度网路报告预测,到今年,连网装置和连线的数量将接近 300 亿,高于 2018 年的 184 亿。年终,物联网设备将占所有连网设备的 50%(147 亿),高于 2018 年的 33%(61 亿)。

- 根据微软的 IoT Signals 报告,美国以 27% 的计划投入使用率领先,其次是西班牙 (22%) 和澳洲 (18%)。在加速物联网采用方面,美国远远领先其他国家,78% 的美国公司表示,他们打算在未来两年内扩大物联网的使用。然而,今年,51%的德国企业和51%的日本企业计划扩大其使用范围。这可能是由于德国和日本市场的技术实施更为保守。

- 根据盖洛普年度健康与医疗调查,90% 的美国消费者表示他们目前使用穿戴健身追踪器,而同样比例的消费者目前使用行动医疗应用程式。结合目前的使用情况和过去使用过此类设备的美国人的比例,三分之一的美国人曾在某个时候购买过腕带或智慧型手錶等健身。 34% )或。

- 数位援助与人工智慧相结合,使用户能够免持且更有效率地部署智慧型设备,从而极大影响买家的偏好。随着 Alexa、Google Assistant、Siri 和 Bixby 等数位助理的兴起,现在可以透过语音命令来控制和管理智慧型装置。这些数位助理的开发功能,例如蓝牙扬声器控制和免持频道衝浪,正在推动智慧家居设备市场的发展。买家还选择客製化设备,以方便并改善用户体验。

预计北美将占据很大的市场份额

- 预计在预测期内,北美将保持最大的市场规模并主导 ESP 市场。该地区 ESP 供应商的大量存在是由于新技术的早期采用和高采用率,以及为改进基于事件的产品而进行的研发投资。

- 对事件流处理不断增长的需求正在推动该地区的公司提供新的解决方案来赢得市场占有率。例如,IBM Event Streams 是提供整合功能的 IBM Cloud Pak。透过事件流提供对企业资料的访问,使您能够从基于事件的资料中获取见解,并即时大规模检测并采取行动。 IBM 称其控制事件端点的能力以及 API 管理是其优势所在。

- 总部位于美国的资料分析公司 Express Analytics 去年 2 月进入印度市场,作为其全球扩大策略的一部分,公共人工智慧 (AI)和机械学,宣布将提供基于学习 (ML) 的预测分析服务。此外,该公司还与总部位于德里的 Mavcomm Advisory 签署了一项战略协议,以扩大其在快速变化的印度数位市场的产品组合。

- 美国云端领域正在进行一些伙伴关係活动。例如,科技驱动型全球公司 HCL Technologies 宣布扩大与 Google Cloud 的伙伴关係,将 HCL 的 Actian 产品组合 Actian Avalanche 引进 Google Cloud。这种混合云端资料仓储提案改善企业业务分析工作负载。 Avalanche 也在 Google Cloud 上提供商业智慧和分析平台,帮助流行的 SaaS 和企业应用程式提供易于部署和使用的全面解决方案。

- 随着越来越多的客户转向数位管道以及实体分店网路成本的增加,纯数位银行营业单位正在激增。虽然很少金融机构推出纯数位银行来吸收存款,但其他金融机构正在利用数位平台提供贷款、投资和专业服务。在每种情况下,重点都是产生新想法、改善客户体验以及为客户提供更多价值。这只能透过客户资料和事件流处理来实现。

事件流程处理产业概述

由于存在多个参与企业,全球事件流处理市场竞争适度。市场参与企业正在采取产品创新、併购和收购等策略来扩大产品系列、扩大其地理范围,并主要保持市场竞争力。

2022年10月,开发资料流处理平台的RisingWave Labs宣布获得3,600万美元A轮资金筹措,由云启合伙人、未具名企业合作伙伴及天使投资人领投。 RisingWave 的总投资超过 4,000 万美元,将用于扩大Start-Ups的营运规模,为未来几年推出新的云端服务 RisingWave Cloud 做准备。

2022 年 3 月,thatDot 创建的 Quine 将成为一款专为大容量事件处理而设计的开放原始码流程图解决方案。据 thatDot 称,Quine 混合了图形资料和流技术,让您可以即时大规模地建立复杂的事件处理流程。开发用于串流处理的事件驱动的微服务是一项具有挑战性的工作,它结合了来自资料库和分散式系统领域的复杂挑战。共识、并发、事务逻辑、丛集行为、容错、可扩展性、平衡读写效能权衡以及其他功能都包括在内。

其他好处

- Excel 格式的市场预测 (ME) 表

- 3 个月分析师支持

目录

第一章简介

- 研究假设和市场定义

- 调查范围

第二章调查方法

第三章执行摘要

第四章市场动态

- 市场概况

- 市场驱动因素

- 物联网 (IoT) 和智慧型装置的采用率不断提高

- 越来越需要分析来自不同来源的大量资料

- 市场限制因素

- 资料安全和隐私问题

- 波特五力分析

- 供应商的议价能力

- 买方议价能力

- 新进入者的威胁

- 替代品的威胁

- 竞争公司之间敌对关係的强度

第五章市场区隔

- 安装类型

- 云

- 本地

- 成分

- 解决方案(软体和平台)

- 服务

- 应用

- 诈欺侦测

- 演算法交易

- 流程监控

- 预测性维护

- 销售与行销

- 按最终用户产业

- 资讯科技/通讯

- BFSI

- 製造业

- 零售/电子商务

- 能源与公共产业

- 其他最终用户产业

- 地区

- 北美洲

- 欧洲

- 亚太地区

- 拉丁美洲

- 中东/非洲

第六章 竞争状况

- 公司简介

- IBM Corporation

- Microsoft Corporation

- Google Inc.

- Oracle Corporation

- Amazon Web Services Inc.

- Salesforce

- Redhat

- SAP SE

- TIBCO

- Hazelcast IMDG

- SAS

- Confluent, Inc.

- Hitachi Vantara

- Informatica

第七章 投资分析

第八章 市场机会及未来趋势

The Event Stream Processing Market is expected to register a CAGR of 15.7% during the forecast period.

Key Highlights

- According to MachEye, people produce 2.5 quintillion bytes of data daily, which is expected to grow faster each year. Business intelligence users are already struggling to translate this explosion of complex data into actionable insights. As a result, there would be a significant demand for more advanced, easy-to-use data translation tools.

- Targeted offers and predictive analytics enable merchants to develop highly personalized offers for all their customers at a very granular level. For instance, retailers can personalize the in-store experience by providing offers to incentivize frequent buying and drive more purchases, thereby achieving higher sales across all their channels. Predictive analytics can be used to upsell or cross-sell a customer. Further, predictive analytics helps businesses predict a customer's lifetime value (CLV). CLV helps forecast a customer's discounted value over time by analyzing past behavior to determine the most profitable customers over time.

- Further, due to the necessity for real-time processing of vast volumes of RFID data, the use of event stream processing in radio-frequency identification (RFID) event processing applications is quickly rising. RFID tags are connected to items or people and generate a signal that an RFID reader can read. This lets businesses keep track of where goods and people are in real time, which is important for many things like managing the supply chain and keeping people safe.

- According to a survey from Sisense, 50% of companies are utilizing predictive analytics more or much more than before the COVID-19 pandemic, including over 68% of small businesses. For instance, a significant challenge of the COVID-19 pandemic was ensuring that clients felt safe when visiting brick-and-mortar stores. With the help of business intelligence tools, social networking platforms, and customer relationship management (CRM) systems, companies could get direct feedback from customers and take the right steps to ensure everyone's health and safety.

- There is a significant increase in the requirement for data analytics and data visualization tools. For example, according to the IBM Quant Crunch, up to 2.72 million jobs require data science skills, making it one of the most in-demand roles across industries. College graduates from the MIS and CS departments know little about database modeling or real-world database environments. There are specific IT sciences majors with database classes, let alone business intelligence and analytics courses. There is a lack of exposure to tools and technologies found in the workplace.

Event Stream Processing Market Trends

Increasing Adoption of the Internet of Things (IoT) and Smart Devices

- According to a recent Oracle survey, enterprise IoT adopters are prepared to take an easier route. Nearly two-thirds (64%) of the 800 IoT decision-makers surveyed said they would choose an "off-the-shelf" IoT solution over a custom-built one, showing a shift in how businesses purchase IoT products. Additionally, 75% of respondents want the connection baked into or packaged by the solution provider, and 70% want providers to provide data and analytics capabilities as part of a complete solution. The results show that there is a growing need for a simple way to add IoT capabilities that speeds up the time it takes to get value from them.

- Moreover, by this year, there will be close to 30 billion network-connected devices and connections, up from 18.4 billion in 2018, predicts Cisco's Annual Internet Report. By the end of the current year, IoT devices will make up 50% (14.7 billion) of all networked devices, up from 33% (6.1 billion) in 2018.

- According to the Microsoft IoT Signals report, the United States leads the pack with 27% of projects in the usage phase, followed by Spain (22%), and Australia (18%). In terms of accelerating IoT adoption, the US is far ahead of the rest of the world: 78% of US firms intend to increase their IoT usage over the next two years. However, only 53% of By this year, 51% of German businesses and 51% of Japanese businesses planned to increase utilization. This can be due to the more conservative technological adoption in the German and Japanese markets.

- According to Gallup's annual Health and Healthcare survey, 90% of American consumers said they are currently using a wearable fitness tracker, and the same percentage stated that they currently use a mobile health application. By combining the present use with the percentages of Americans that claim, in the past, they have used such devices, it becomes clear that, at some point, one in three Americans used a fitness tracker such as a wristband or smartwatch (34%), or tracked their health statistics on a phone or tablet application (32%).

- Digital assistance combined with AI allows users to deploy smart devices hands-free and more efficiently, dramatically influencing buyer preferences. With the rise of digital assistants such as Alexa, Google Assistant, Siri, and Bixby, smart devices can now be controlled and managed via voice commands. The developing features of these digital assistants, such as Bluetooth speaker control and hands-free channel surfing, are driving the market for smart home gadgets. Buyers also choose customized devices for their ease and improved user experience.

North America is Expected to Hold a Large Share of the Market

- North America is expected to hold the largest market size and dominate the ESP market during the forecast period. The fact that there are a lot of ESP vendors in the area is due to their early adoption of new technologies and high adoption rates, as well as their investments in research and development to improve their event-based offerings.

- The rise in demand for event stream processing is pushing firms in the region to provide new solutions to capture market share. For example, IBM Event Streams is an IBM Cloud Pak for integration capabilities. It gives enterprises access to corporate data via event streams, allowing them to gain insights from event-based data and detect and take action in real time and at scale. The IBM differentiators mentioned were the ability to control event endpoints alongside API administration.

- In February last year, Express Analytics, a US-based data analytics firm, announced that it would enter the Indian market as part of its global expansion strategy, offering artificial intelligence (AI) and machine learning (ML)-based predictive analytics services to companies in the technology, telecom, banking, advertising, and retail industries, as well as the public sector. In addition, the company has made a strategic deal with Delhi-based Mavcomm Advisory to expand its portfolio in the fast-changing digital Indian market.

- The cloud segment in the United States is witnessing several partnership activities. For instance, HCL Technologies, a global technology-oriented company, announced the extension of its partnership with Google Cloud to bring HCL's Actian portfolio offering, Actian Avalanche, to Google Cloud. This hybrid cloud data warehouse is proposed to improve an enterprise's operational analytics workload. Avalanche also offers a business intelligence and analytics platform with Google Cloud and helps popular SaaS and enterprise applications deliver a comprehensive solution that is easy to deploy and consume.

- With increasing numbers of customers switching to digital channels and the high cost of a physical branch network, digital-only banking entities are proliferating. While few financial institutions are launching digital-only banks to collect deposits, others use digital platforms to provide lending, investing, and specialty services. In both cases, the focus is on coming up with new ideas, making the customer experience better, and giving the customer more value. This is only possible with customer data and event stream processing.

Event Stream Processing Industry Overview

The global event stream processing market is moderately competitive owing to the presence of multiple players. The players in the market are adopting strategies like product innovation, mergers, and acquisitions in order to expand their product portfolios, expand their geographic reach, and primarily to stay competitive in the market.

In October 2022, RisingWave Labs, a business developing a platform for data stream processing, announced a Series A fundraising round of USD 36 million headed by Yunqi Partners, unidentified corporate partners, and angel investors. The money, which brings RisingWave's total investment to more than USD 40 million, will be used to expand the startup's business operations in preparation for the launch of RisingWave Cloud, a new cloud service, in the next few years.

In March 2022, Quine, created by thatDot, will be an open-source streaming graph solution designed for high-volume event processing. Quine, according to thatDot, mixes graph data and streaming technologies to enable the building of real-time, complicated event processing processes at scale. Developing an event-driven microservice for stream processing is a difficult endeavor that combines complex difficulties from the database and distributed systems domains. Consensus, concurrency, transactional logic, clustering behavior, fault tolerance, scalability, balancing read and write performance trade-offs, and other features are all included.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET DYNAMICS

- 4.1 Market Overview

- 4.2 Market Drivers

- 4.2.1 Increasing Adoption of the Internet of Things (IoT) and Smart Devices

- 4.2.2 Increasing Need to Analyze Large Volumes of Data From Diverse Sources

- 4.3 Market Restraints

- 4.3.1 Concerns Associated with Data Security and Privacy

- 4.4 Porter's Five Forces Analysis

- 4.4.1 Bargaining Power of Suppliers

- 4.4.2 Bargaining Power of Buyers

- 4.4.3 Threat of New Entrants

- 4.4.4 Threat of Substitute Products

- 4.4.5 Intensity of Competitive Rivalry

5 MARKET SEGMENTATION

- 5.1 Deployment Type

- 5.1.1 Cloud

- 5.1.2 On-premise

- 5.2 Component

- 5.2.1 Solutions (Software & Platforms)

- 5.2.2 Services

- 5.3 Application

- 5.3.1 Fraud Detection

- 5.3.2 Algorithmic Trading

- 5.3.3 Process Monitoring

- 5.3.4 Predictive Maintenance

- 5.3.5 Sales and Marketing

- 5.4 End-user Vertical

- 5.4.1 IT & Telecommunications

- 5.4.2 BFSI

- 5.4.3 Manufacturing

- 5.4.4 Retail & E-commerce

- 5.4.5 Energy & Utilities

- 5.4.6 Other End-user Verticals

- 5.5 Geography

- 5.5.1 North America

- 5.5.2 Europe

- 5.5.3 Asia-Pacific

- 5.5.4 Latin America

- 5.5.5 Middle-East and Africa

6 COMPETITIVE LANDSCAPE

- 6.1 Company Profiles

- 6.1.1 IBM Corporation

- 6.1.2 Microsoft Corporation

- 6.1.3 Google Inc.

- 6.1.4 Oracle Corporation

- 6.1.5 Amazon Web Services Inc.

- 6.1.6 Salesforce

- 6.1.7 Redhat

- 6.1.8 SAP SE

- 6.1.9 TIBCO

- 6.1.10 Hazelcast IMDG

- 6.1.11 SAS

- 6.1.12 Confluent, Inc.

- 6.1.13 Hitachi Vantara

- 6.1.14 Informatica