|

市场调查报告书

商品编码

1630433

非洲的託管服务:市场占有率分析、行业趋势和成长预测(2025-2030 年)Africa Managed Services - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

※ 本网页内容可能与最新版本有所差异。详细情况请与我们联繫。

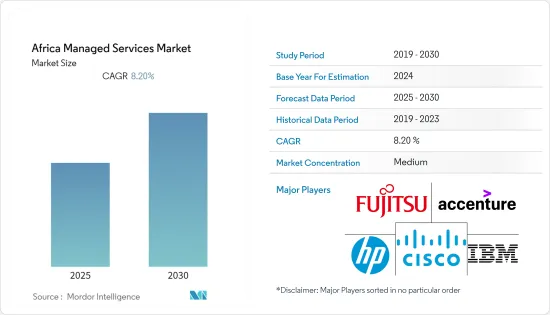

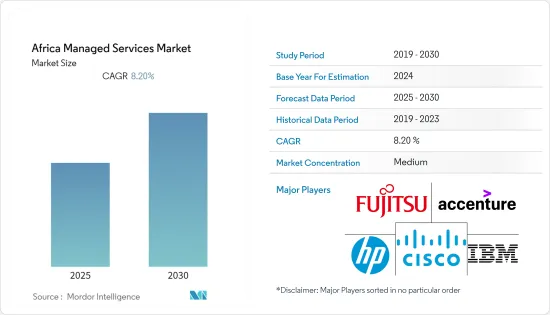

非洲管理服务市场预计在预测期内复合年增长率为 8.2%

主要亮点

- 资料储存的云端采用和实施正在迅速进展,巨量资料分析的采用正在促进市场成长。此外,物联网技术的快速成长和发展也有望促进市场的成长和开发。託管服务使企业能够存取增强的应用程式和服务,主要专注于其核心策略细分市场,同时将其他业务留给具有这些细分市场业务知识的服务供应商。此外,云端、物联网平台、容器、DevOps 和巨量资料的託管服务预计将在预测期内为託管服务供应商提供巨大的潜力。

- 在当前市场情势下,南非等非洲主要国家网路攻击激增。随着南非许多企业和政府机构转向数位平台,网路安全局的一项研究表明,公众不断努力向公众提供资讯、教育和动员公众,以应对日益严重的网路犯罪流行。越宣传活动提高意识提升。根据《2021年非洲网路威胁评估报告》,南非遭受非洲最具针对性的勒索软体攻击和商业电子邮件外洩攻击。这迫使企业采取安全第一的心态。託管服务供应商现在专注于确保客户服务基础设施的安全。

- 非洲的託管服务公司正在利用领先科技公司建立的解决方案来开发自己的託管服务组合。例如,Britehouse 是一家专门从事基于 SAP 的解决方案的实施、开发和管理的 IT 顾问公司(非洲地区的託管服务供应商),为我们在非洲各地建立的企业提供託管 SAP 解决方案作为託管服务。灵活的平台联合国经济和社会事务部最近的一项研究显示,2022年非洲的平均年龄为18.8岁,其中一半人口年龄较大,一半人口年轻。非洲是世界上最年轻的大陆,14岁以下人口比例最高,占总人口的40%。非洲不断增长的年轻人口的数位技能和行为得到改善,可以抵消一些不利趋势,并为电讯和资讯通信技术服务等行业带来良好的成长。

- COVID-19 的爆发证明了数位化经济的好处,有利于在家工作(WFH)。这可能是非洲市场加速提高社会经济背景下数位电信服务标准的机会。

- 然而,日益严重的安全和隐私问题以及非洲基础设施的缺乏是可能限制整体市场成长的主要问题。

非洲管理服务市场趋势

IT和通讯产业预计在预测期内将显着成长

- 非洲仍然是世界上成长最快的行动通讯市场之一。根据爱立信的行动报告,到 2025 年,行动宽频用户将占撒哈拉以南非洲地区行动用户的 70% 左右,其中 4G 普及率和使用量的增加将成为关键的成长引擎。这项变化背后的成长要素包括人口年轻化和低成本智慧型手机的普及。

- 该地区缺乏网路安全技能,导致骇客特别针对银行和通讯业者等组织。例如,2022年12月,拥有2022年撒哈拉以南非洲世界杯转播权的新世界电视台表示,自赛事开始以来,它遭受了一系列网路攻击。该地区此类案例不断增加,推动了整体市场的成长。

- 由于通讯基础设施落后,需要支付高昂的费用,该国的电话费很高。这就是 IT-Simplified、LeftClick、Sensys 和 Innovative Solutions 等本地公司提供 VoIP(网际网路协定语音)作为核心託管服务的原因。在最新的例子中,Bigen Group 选择 LanDynamix 在其布隆方丹办公室实施网际网路通讯协定语音 (VoIP) 解决方案。这项新实施预计可减少高达 50% 的电话费用。

- 南非政府宣布计划在 2023年终实现全国宽频覆盖。南非的通讯业拥有整个大陆最先进的基础设施之一。 Liquid Intelligence Technologies、Telkom、Broadband InfraCo、市政供应商和行动网路营运商也正在进行大量投资,以提高网路能力。

- 据爱立信称,到 2027 年,撒哈拉以南非洲地区的 5G 用户总数预计将达到 1.04 亿。随着撒哈拉以南非洲地区 5G 用户数量的不断增加,预计该市场将在预测期内大幅成长。

预计南非在整个预测期内将占据很大份额

- 工作模式的变化、用户设备的激增、云端原生应用程式的兴起以及行动应用程式的成长等因素正在加速云端运算服务在南非的广泛采用。预计这将成为该地区的关键驱动力,进而帮助市场呈指数级增长。

- 在当前的市场情况下,南非越来越多的企业正在转向云端,进而转向託管服务。南非云端解决方案供应商之一 Afrihost 表示:「与传统的本地伺服器解决方案相比,我们对云端提供的安全性、节省成本和灵活性充满信心,因此我们能够减少资料和通讯。越来越多的公司将他们的需求转移到云端。随着企业越来越希望专注于其核心业务活动,南非市场预计将创造商机。

- 此外,南非市场的主要参与者正在进行重大活动,作为其改善业务和影响力策略的一部分,以便接触客户并满足他们对各种应用的需求。例如,2022 年 12 月,英国网路安全、身分验证、云端转型和託管服务供应商 Kocho 宣布在南非开普敦设立办事处。在这个新办公室中,他将担任一线和 DevOps 角色,以支援 Kocho 不断增长的国际客户组合。

- 备份、资料管治和合规性等云端解决方案正在南非扩展。因此,许多公司正在外包其云端部门以增加竞争。嘉百森技术公司 (Gabsen Technologies) 选择资料保护和管理公司 Dhruva 在整个非洲扩展其云端基础的资料保护服务。

- 据 GSMA 称,撒哈拉以南非洲地区的行动使用量预计在未来几年将大幅成长,到 2025年终将达到 6.23 亿独立用户。此外,到 2025 年,该地区的行动网路用户数量预计将达到约 4.83 亿,为整个全部区域创造巨大的成长机会。

非洲管理服务业概览

非洲的管理服务市场竞争适中,由大量全球和区域公司组成。这些参与企业拥有重要的市场占有率,并致力于扩大其区域基本客群。这些参与企业将重点放在研发投资上,引入新的解决方案、策略联盟以及其他有机和无机成长策略,以在预测期内赢得竞争。

2022 年 10 月,託管服务供应商SmartCIC 将其固网连接和现场服务解决方案扩展到非洲 32 个国家。客户得到当地现场工程师的支持,在整个非洲大陆的当地市场提供一致的性能和客户体验。除了固网连接外,SmartCIC还推出了连接54个非洲国家的卫星服务。 SmartCIC 向非洲的扩张将使企业和服务供应商能够在充满挑战的新市场中高效连接、部署和管理数位基础设施。

2022 年 2 月,为中东和非洲地区的企业和政府机构提供服务的领先区域 IT服务供应商BARQ Systems 宣布转型为拥有成熟託管服务组合的 IT服务供应商。作为这项转型的关键部分,BARQ Systems 将推出新的 SOCaaS(安全营运中心即服务),目标是在 2025 年提供更全面的订阅为基础的 IT 服务。

其他好处

- Excel 格式的市场预测 (ME) 表

- 3 个月分析师支持

目录

第一章简介

- 研究假设和市场定义

- 调查范围

第二章调查方法

第三章执行摘要

第四章市场洞察

- 市场概况

- 产业吸引力-波特五力分析

- 新进入者的威胁

- 买家/消费者的议价能力

- 供应商的议价能力

- 替代品的威胁

- 竞争公司之间敌对关係的强度

- 评估 COVID-19 对非洲託管服务市场的影响

第五章市场动态

- 采用市场动态

- 市场驱动因素

- 巨量资料和分析的有利趋势以及资讯通信技术支出的增加

- 非洲中小企业更采用託管服务

- 市场问题

- 安全和隐私问题以及基础设施缺乏

第六章 市场细分

- 服务类型

- 主机服务

- 资安管理服务

- 行动化运营服务

- 其他的

- 部署

- 私人的

- 民众

- 杂交种

- 最终用户产业

- IT&电信

- BFSI

- 零售

- 医疗保健

- 其他的

- 国家名称

- 南非

- 肯亚

- 其他非洲

第七章 竞争格局

- 公司简介

- Cisco Systems

- IBM Corporation

- HP Development Company LP

- NEC Corporation

- Accenture PLC

- Fujitsu Ltd.

- Telefonaktiebolaget LM Ericsson

- Castlerock Managed IT Services Company

- LanDynamix Managed IT Services

- Dimension Data Holdings PLC

第八章 非洲管理服务市场投资分析及未来潜力

The Africa Managed Services Market is expected to register a CAGR of 8.2% during the forecast period.

Key Highlights

- The rapidly increasing adoption and implementation of the cloud for data storage and the introduction of big data analytics contribute to the market's growth. Moreover, the rapid growth and evolution of IoT technology are also expected to support the growth and development of the market. As managed services enable companies to access enhanced applications and services, it primarily helps them target their core strategic areas while outsourcing the rest of the operations to the service providers with the operational expertise in that domain. Also, the managed services for cloud, IoT platforms, containers, DevOps, and Big Data are expected to hold tremendous potential for the managed service providers in the forecast period.

- In the current market scenario, cyberattacks have rapidly increased in major African countries like South Africa. With more South African businesses and government institutions migrating to digital platforms, research by cyber security organizations has noted a growing need for a sustained national public awareness campaign to inform, educate and mobilize the public against an increasing pandemic of cyber-crime. The African Cyber threat Assessment Report 2021 found that South Africa had the highest number of targeted ransomware and business email compromise attacks in Africa. This has forced companies to adopt security-first thinking. Managed services providers are now putting more effort into securing the service infrastructure of their clients.

- Managed services companies in the African region are taking advantage of the solutions built by major tech giants to develop their own managed services portfolio. For example, the IT consultancy firm that focuses on implementing, developing, and managing SAP-based solutions, Britehouse (a managed service provider present in the African region), has created a flexible platform for delivering hosted SAP solutions as a managed service to businesses throughout Africa. As per a recent survey by UN DESA, in 2022, the median age in Africa was 18.8 years, indicating that half of the population was older and half was younger than that age. Africa is the youngest continent in the world and presents the highest share of inhabitants aged 14 years and younger, 40% of the total population. A young and growing African population with improved digital skills and behavior could offset some adverse trends and indicate favorable growth for sectors like telecom and ICT services.

- The COVID-19 pandemic has demonstrated the benefits of a digitized economy, facilitating working from home (WFH). This could prove to be an opportunity for the African market to accelerate its journey towards raising the bar of digital and telecom services, which play in a socio-economical context.

- However, the surge in security and privacy concerns and the lack of infrastructure in Africa could be a significant concern, restricting the market's overall growth.

Africa Managed Services Market Trends

IT & Telecom Industry is Expected to Grow at a Significant Rate Over the Forecast Period

- Africa remains one of the fastest-growing mobile communication markets in the world. According to the Ericsson Mobility Report, by 2025, in Sub-Saharan Africa, mobile broadband subscriptions will reach around 70% of the mobile subscriptions, with increased 4G coverage and uptake being the main growth engine. Growth factors behind this shift include a young population and the availability of lower-priced smartphones.

- The region is plagued by a cybersecurity skills shortage, which causes hackers to target organizations, especially banks and telecoms. For instance, in December 2022, New World TV, the company that holds Africa's 2022 World Cup broadcasting rights for sub-Saharan Africa, stated that it had suffered a series of cyberattacks since the tournament began. The region's rise in such cases fuels the market's overall growth.

- Telephone cost in the country is high due to the high price involved in acquiring poor telecommunication infrastructure. Thus, local companies, such as IT-Simplified, LeftClick, Sensys, and Innovative Solutions, offer Voice over Internet Protocol (VoIP) as a core managed service. In the latest instance, Bigen Group selected LanDynamix to implement a voice-over-Internet protocol (VoIP) solution for the company's Bloemfontein office. This new installation is anticipated to reduce telephone costs by up to 50%.

- The government of South Africa announced its plan to provide national broadband coverage by end-2023. South Africa's telecom sector boasts one of the most advanced infrastructures on the entire continent. Also, there has been considerable investment from Liquid Intelligence Technologies, Telkom, Broadband InfraCo, municipal providers, and mobile network operators, all aimed at improvising network capabilities.

- As per Ericsson, the total number of 5G subscriptions in Sub-Saharan Africa is estimated to reach 104 million by 2027. With the rise in 5G subscriptions in the Sub-Saharan African region, the market is expected to witness drastic growth throughout the forecasted period.

South Africa is Expected to Hold a Significant Share Throughout the Forecast Period

- The wide adoption of cloud computing services in South Africa has gained pace, owing to factors such as changes in work styles, user device proliferation, emerging cloud-native applications, and mobile application growth. This will act as a significant driver within the region, which in turn will assist in augmenting the market's growth exponentially.

- In the current market scenario, more and more businesses across South Africa are making a move toward the cloud and, subsequently, managed services. According to Afrihost, one of the cloud solution providers in South Africa, 'more and more organizations are moving their data and communication needs to the cloud as they feel more confident about the security, savings, and flexibility provided by the cloud, as opposed to traditional local server solutions.' The growing demand from organizations to focus on core business activities is expected to create opportunities for the market in South Africa.

- Moreover, the market in South Africa is home to significant activities by key major players as a part of its strategy to improve its business and its presence to reach customers and meet their requirements for various applications. For instance, in December 2022, Kocho, the UK-headquartered provider of cyber security, identity, cloud transformation, and managed services, announced it had established operations in Cape Town, South Africa. The new office would create frontline and DevOps roles to support Kocho's expanding portfolio of international customers.

- Cloud solutions across backup, data governance, and compliance are growing in South Africa. Thus, many companies are outsourcing their cloud division to gain a competitive edge. Gabsen Technologies selected Dhruva, a data protection and management company, to expand its cloud-based data protection services across Africa.

- As per GSMA, the overall mobile usage in Sub-Saharan Africa is expected to increase drastically in the next coming years, reaching 623 million unique subscribers by the end of the year 2025. Also, it is anticipated that there will be around 483 million mobile internet users within the region by 2025, creating massive growth opportunities throughout the region.

Africa Managed Services Industry Overview

The Africa Managed Services Market is moderately competitive and consists of a significant number of global and regional players. These players account for a considerable market share and focus on expanding their regional customer base. These players focus on the research and development investment in introducing new solutions, strategic alliances, and other organic and inorganic growth strategies to earn a competitive edge over the forecast period.

In October 2022, SmartCIC, a managed service provider, expanded its fixed-line connectivity and field service solutions across 32 African countries. Customers gain the support of on-the-ground engineers in each country, delivering consistent performance and customer experience in local markets throughout the continent. In addition to fixed-line connectivity, SmartCIC has launched satellite services connecting Africa's 54 countries. SmartCIC's Africa expansion enables enterprises and services providers to efficiently connect, deploy, and manage digital infrastructure in new and challenging markets.

In February 2022, BARQ Systems, a leading regional IT services provider serving business and government clients across the Middle East and Africa (MEA), announced its transition to an IT service provider, providing a full-fledged portfolio of managed services. As a crucial part of this transition, BARQ Systems is introducing a new Security Operations Centre as a Service (SOCaaS), marking the beginning of its journey to offer a more comprehensive set of subscription-based IT Services by 2025.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET INSIGHT

- 4.1 Market Overview

- 4.2 Industry Attractiveness - Porter's Five Forces Analysis

- 4.2.1 Threat of New Entrants

- 4.2.2 Bargaining Power of Buyers/Consumers

- 4.2.3 Bargaining Power of Suppliers

- 4.2.4 Threat of Substitute Products

- 4.2.5 Intensity of Competitive Rivalry

- 4.3 Assessment of Impact of COVID-19 on the Africa Managed Services Market

5 MARKET DYNAMICS

- 5.1 Introduction to Market Dynamics

- 5.2 Market Drivers

- 5.2.1 Favorable Trends Pertaining to Big Data and Analytics, along with Growing ICT Spending

- 5.2.2 Increasing Adoption of Managed Service Among Small and Medium Enterprises across Africa

- 5.3 Market Challenges

- 5.3.1 Security & Privacy Concerns and Lack of Infrastructure

6 MARKET SEGMENTATION

- 6.1 Type of Service

- 6.1.1 Managed Network Services

- 6.1.2 Managed Security Services

- 6.1.3 Managed Mobility Services

- 6.1.4 Other Types of Service

- 6.2 Deployment

- 6.2.1 Private

- 6.2.2 Public

- 6.2.3 Hybrid

- 6.3 End-user Industry

- 6.3.1 IT & Telecom

- 6.3.2 BFSI

- 6.3.3 Retail

- 6.3.4 Healthcare

- 6.3.5 Other End-user Industries

- 6.4 Country

- 6.4.1 South Africa

- 6.4.2 Kenya

- 6.4.3 Rest of Africa

7 COMPETITIVE LANDSCAPE

- 7.1 Company Profiles

- 7.1.1 Cisco Systems

- 7.1.2 IBM Corporation

- 7.1.3 HP Development Company LP

- 7.1.4 NEC Corporation

- 7.1.5 Accenture PLC

- 7.1.6 Fujitsu Ltd.

- 7.1.7 Telefonaktiebolaget LM Ericsson

- 7.1.8 Castlerock Managed IT Services Company

- 7.1.9 LanDynamix Managed IT Services

- 7.1.10 Dimension Data Holdings PLC