|

市场调查报告书

商品编码

1630448

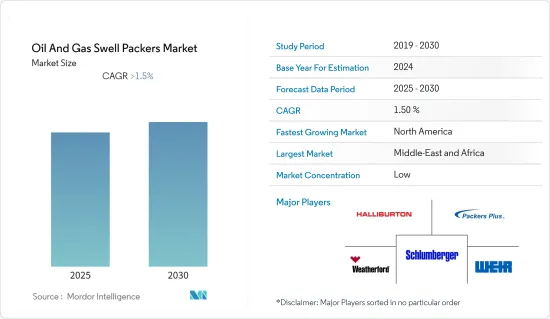

石油和天然气膨胀封隔器 -市场占有率分析、行业趋势/统计、成长预测 (2025-2030)Oil And Gas Swell Packers - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

价格

※ 本网页内容可能与最新版本有所差异。详细情况请与我们联繫。

简介目录

预计石油和天然气膨胀封隔器市场在预测期内将维持超过 1.5% 的复合年增长率。

COVID-19 的爆发对市场产生了负面影响。目前市场已恢復至疫情前水准。

主要亮点

- 石油和天然气产量的增加以及天然气田钻井和完井作业的快速增加预计将推动石油和天然气膨胀封隔器市场的发展。

- 然而,波动的石油和天然气价格预计将减缓下游活动并抑製石油和天然气膨胀封隔器市场。

- 仍处于研究阶段的气体水合物领域的发展及其生产新技术的需求可能会在未来为石油和天然气膨胀封隔器市场创造多个机会。

- 由于上游产业的快速成长,预计北美将成为预测期内成长最快的石油和天然气膨胀封隔器市场。 2021年,该地区原油产量将与前一年同期比较%,这可能会对膨胀封隔器市场产生正面影响。

油气膨胀封隔器市场趋势

土地市场预计将主导市场

- 需要膨胀封隔器在钻桿和套管之间提供密封的井数量的增加,以及新井和修井的完井,可能会推动市场的发展。此外,膨胀封隔器几乎没有移动部件,因此易于安装,并且不需要钻桿即可将其安装指定。

- 此外,陆上油田勘探的投资成本低于海上,因此增加了陆上投资,推动了预测期内石油和天然气膨胀封隔器市场的发展。

- 2021年全球天然气产量为40,369亿立方公尺(bcm),超过2020年全球产量3,861.5 bcm。此外,2021年,全球发电量的约5.88%来自天然气。全球天然气需求和产量的增加预计将对更多的钻井活动产生积极影响,并有望推动石油和天然气膨胀封隔器市场。

- 近年来,世界各地发现了几个新的石油和天然气田。埃及将于2022年发现新油田,在西部沙漠、苏伊士湾、地中海和尼罗河Delta发现42口油井和11口气井。此类新发现油田的开发预计将对油气膨胀封隔器市场产生正面影响。

- 因此,鑑于上述几点,在预测期内,陆上部分可能会主导石油和天然气膨胀封隔器市场。

北美有望成为快速成长的市场

- 由于全球原油和天然气产量快速成长,北美占据了很大的市场份额。 2021年,北美原油产量约占全球原油产量的26.6%。

- 北美国家计划透过使用天然气等碳排放较低的清洁燃料来减少碳排放。在北美等国家,天然气能源已经超过煤炭电力,并有可能接管能源部门以减少温室气体排放。

- 此外,膨胀封隔器的使用越来越多,正在取代设计复杂的机械封隔器,并且在安装和拆卸过程中可能会遇到一些问题。另一方面,膨胀封隔器很简单,不存在这个问题。

- 截至2021年,北美原油产量为10.747亿吨,高于2020年的10.587亿吨。原油产量的与前一年同期比较增长反映了需要安装封隔器以防止套管侵蚀的新井的增加。这可能会推动该地区膨胀封隔器市场的成长。

- 截至2022年,美国总合756座旋转钻机在运作,其中海上钻机14座,内陆钻机4座,陆上钻机738座。如果旋挖钻机一週的大部分时间(7 天中有 4 天)都在现场进行钻探,则视为运作中。这显示该国上游领域以钻机和生产平台等固定资产为主。在预测期内,产量增加可能会对石油和天然气膨胀封隔器市场产生正面影响。

- 基于上述情况,预计北美将成为预测期内石油和天然气膨胀封隔器市场成长最快的市场。

石油和天然气膨胀封隔器产业概述

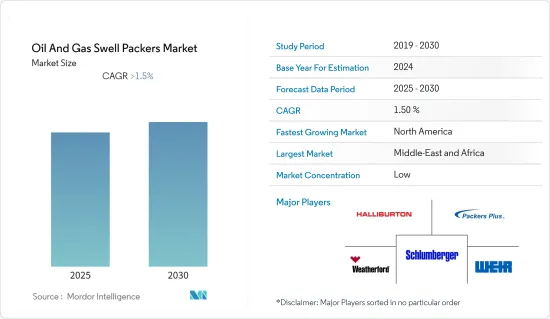

石油和天然气膨胀封隔器市场适度细分。该市场的主要企业(排名不分先后)包括斯伦贝谢有限公司、哈里伯顿公司、Weatherford International plc、Weir Group PLC 和 Packers Plus Energy Services Inc。

其他好处

- Excel 格式的市场预测 (ME) 表

- 3 个月分析师支持

目录

第一章简介

- 调查范围

- 市场定义

- 研究场所

第 2 章执行摘要

第三章调查方法

第四章市场概况

- 介绍

- 至2028年市场规模及需求预测(单位:十亿美元)

- 最新趋势和发展

- 政府法规和措施

- 市场动态

- 促进因素

- 抑制因素

- 供应链分析

- 波特五力分析

- 供应商的议价能力

- 消费者议价能力

- 新进入者的威胁

- 替代品的威胁

- 竞争公司之间敌对关係的强度

第五章市场区隔

- 部署地点

- 陆上

- 离岸

- 地区

- 北美洲

- 欧洲

- 亚太地区

- 南美洲

- 中东/非洲

第六章 竞争状况

- 合併、收购、联盟和合资企业

- 主要企业策略

- 公司简介

- Schlumberger Limited

- Halliburton Company

- Weatherford International plc

- Weir Group PLC

- Swell X

- TAM International, Inc.

- Tendeka

- Packers Plus Energy Services Inc.

第七章 市场机会及未来趋势

简介目录

Product Code: 71547

The Oil And Gas Swell Packers Market is expected to register a CAGR of greater than 1.5% during the forecast period.

The outbreak of COVID-19 had a negative effect on the market. Currently, the market has rebounded to pre-pandemic levels.

Key Highlights

- Increasing production of oil and gas, along with rapidly growing drilling and completion operations in oil and gas fields, are likely to drive the oil and gas swell packers market.

- However, the volatile oil prices are expected to slow downstream activities and restrain the oil and gas swell packers' market.

- The development in the area of gas hydrates, which is still in the research phase, and its requirement for new technologies for its production are likely to create several opportunities for the oil and gas swell packers market in the future.

- Due to its rapidly growing upstream industry, North America is expected to be the fastest-growing market for oil and gas swell packers during the forecast period. In 2021, the region produced 4.8% more crude oil than the previous year, which is likely to positively impact the swell packers market.

Oil And Gas Swell Packers Market Trends

Onshore Segment Expected to Dominate the Market

- The increasing number of wells and the completion of several new and workover wells, which require swell packers to seal the area between the drill pipe and casing, will likely drive the market. Moreover, swell packers have very few moving parts, making them simple and not requiring a drill stem to install them in position.

- Moreover, the lower investment cost of onshore field development than offshore is attracting more investment in onshore, thus driving the oil and gas swell packers market during the forecast period.

- In 2021, the global natural gas production was 4036.9 billion cubic meters (bcm), higher than the world's production in 2020, 3861.5 bcm. Moreover, in 2021, about 5.88% of the electricity generated worldwide was from natural gas. The increasing demand for and production of natural gas around the world is likely to positively impact more well-completion activities, which are expected to drive the oil and gas swell packers market.

- In recent years, several new oil and gas fields were discovered around the world. In 2022, a new oil field was found in Egypt, which includes 42 oil wells and 11 gas wells in the Western Desert, the Suez Gulf, the Mediterranean Sea, and the Nile Delta. The development of such newly discovered fields is expected to positively impact the oil and gas swell packers market.

- Hence, owing to the above points, the onshore segment is likely to dominate the oil and gas swell packers market during the forecast period.

North America Expected to be the Fastest Growing Market

- North America, due to its rapid increase in crude oil and natural gas production around the world, held a significant share of the market. In 2021, North America produced approximately 26.6% of the global crude oil production.

- Countries in North America have planned to decrease their carbon signature by using cleaner fuels, such as natural gas, from which the carbon emissions are less. In countries like North America, natural gas energy has already surpassed coal-based power and is likely to take over the energy sector, thus reducing greenhouse gas emissions.

- The increasing use of swell packers can also be seen as an alternative to mechanical packers with complex designs, which are likely to encounter some problems when installed or uninstalled. Swell packers, on the other hand, are simple and do not have such issues.

- As of 2021, North America's crude oil production was 1074.7 million metric tons (MT), which was higher than the region produced in 2020, at 1058.7 million tons (MT). The increase in crude oil production over the year reflects the increase in new wells, which require the installation of packers to prevent the casing from getting eroded. This is likely going to drive the swell packers market in the region.

- As of 2022, the United States had a total of 756 active rotary rigs, of which 14 are offshore rigs, 4 are inland water rigs, and 738 are onshore rigs. A rotary rig is considered active when it is on location and is drilling the majority of the week (4 days out of 7 days). This indicates the dominance of fixed assets such as drilling rigs and production platforms in the upstream segment of the country. Increasing production is likely to positively impact the oil and gas swell packers market during the forecast period.

- Hence, owing to the above points, North America is expected to be the fastest-growing market for oil and gas swell packers during the forecast period.

Oil And Gas Swell Packers Industry Overview

The oil and gas swell packers market is moderately fragmented. Some of the key players in this market (in no particular order) include Schlumberger Limited, Halliburton Company, Weatherford International plc, Weir Group PLC, and Packers Plus Energy Services Inc.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Scope of the Study

- 1.2 Market Definition

- 1.3 Study Assumptions

2 EXECUTIVE SUMMARY

3 RESEARCH METHODOLOGY

4 MARKET OVERVIEW

- 4.1 Introduction

- 4.2 Market Size and Demand Forecast in USD billion, till 2028

- 4.3 Recent Trends and Developments

- 4.4 Government Policies and Regulations

- 4.5 Market Dynamics

- 4.5.1 Drivers

- 4.5.2 Restraints

- 4.6 Supply Chain Analysis

- 4.7 Porter's Five Forces Analysis

- 4.7.1 Bargaining Power of Suppliers

- 4.7.2 Bargaining Power of Consumers

- 4.7.3 Threat of New Entrants

- 4.7.4 Threat of Substitute Products and Services

- 4.7.5 Intensity of Competitive Rivalry

5 MARKET SEGMENTATION

- 5.1 Location of Deployment

- 5.1.1 Onshore

- 5.1.2 Offshore

- 5.2 Geography

- 5.2.1 North America

- 5.2.2 Europe

- 5.2.3 Asia-Pacific

- 5.2.4 South America

- 5.2.5 Middle-East and Africa

6 COMPETITIVE LANDSCAPE

- 6.1 Mergers, Acquisitions, Collaboration and Joint Ventures

- 6.2 Strategies Adopted by Key Players

- 6.3 Company Profiles

- 6.3.1 Schlumberger Limited

- 6.3.2 Halliburton Company

- 6.3.3 Weatherford International plc

- 6.3.4 Weir Group PLC

- 6.3.5 Swell X

- 6.3.6 TAM International, Inc.

- 6.3.7 Tendeka

- 6.3.8 Packers Plus Energy Services Inc.

7 MARKET OPPORTUNITIES AND FUTURE TRENDS

02-2729-4219

+886-2-2729-4219