|

市场调查报告书

商品编码

1631573

证券评估 -市场占有率分析、产业趋势/统计、成长预测(2025-2030)Security Assessment - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

价格

※ 本网页内容可能与最新版本有所差异。详细情况请与我们联繫。

简介目录

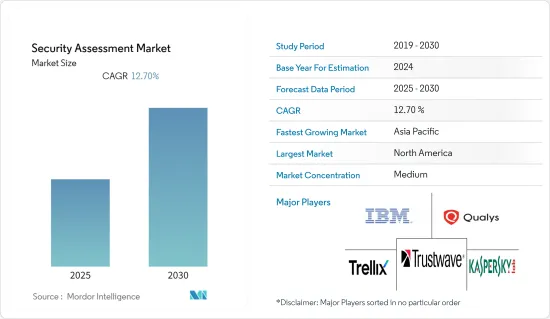

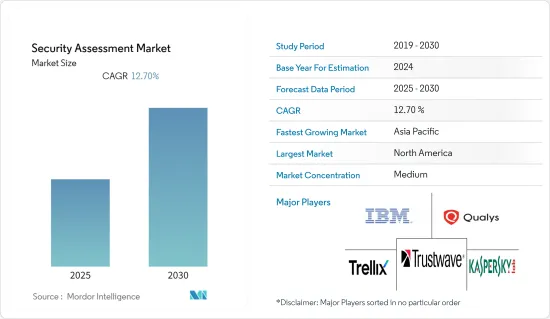

预测期内,安全评估市场的复合年增长率预计为 12.7%

主要亮点

- 据思科系统公司称,透过增加 BYOD 采用率,实施 BYOD 的公司每年为每位员工平均节省 350 美元。虽然这种趋势对企业有很多好处,例如降低硬体成本、提高远端工作人员的生产力和提高客户满意度,但它也增加了隐私、资料窃取和不安全的使用,并增加了资料外洩和网路攻击的发生。此外,由于人口增长和工业业务数位化的进步,电脑、笔记型电脑、行动电话、平板终端、POS终端等的数量正在大幅增加。

- 随着智慧型设备的激增,许多新端点被添加到世界各地的网路中。因此,端点设备的激增增加了对安全评估的需求。随着向数位时代的重大转变,最终用户产业中未解决的漏洞正在增加。勒索软体的兴起是推动安全评估解决方案需求的重要因素。此外,最近的 Fortinet 勒索软体调查发现,大约 94% 的受访者担心勒索软体攻击的威胁,其中 76% 非常担心或极度担心。 85% 的受访者更担心勒索软体攻击,而不是任何其他网路威胁。因此,对风险评估解决方案的需求不断增加,以支持市场成长。

- 预算限制和组织缺乏意识是市场成长的主要限制。开发先进的安全评估解决方案的研发成本非常高,导致此类保全服务的定价很高。因此,它可能会成为安全评估市场成长的障碍。

- 全球大流行增加了对远距工作解决方案的需求。公司正在从传统的职场做法过渡到新接受的在家工作场景。从公司安全能力的角度来看,必须谨慎管理这些短暂的影响。随着连接到网路的未受保护的个人设备数量的增加,损害网路安全的风险也随之增加。

安全评估市场趋势

机场使用量显着增加

- 预计全球航空业未来将大幅成长。根据 IATA 的数据,上年度商业航空公司的客运收入仅 2,270 亿美元。然而,今年商业航空公司的客运收入已达3,780亿美元,并有望进一步成长。

- 此外,由于旅客数量和商业空中交通量的大幅增加,机场正在迅速实施尖端的安全筛检技术。世界各国政府正投入大量资金扩建这些机场。根据 IATA 去年的研究,由于 COVID-19 大流行,世界各国政府已向航空公司拨款超过 2,430 亿美元。

- 预计未来几年,自助筛检技术将获得机场当局的大量需求。乘客将能够透过自动扫描仪将自己的物品通过X光设备,同时通过人体扫描仪。

- 供应商正在快速开发机场自动化筛检解决方案,预计未来几年投资比例将呈指数级增长。例如,伦敦绍森德机场正在测试新的机上行李检查系统,以改善客户体验。为了进一步减少航站楼旅程中的互动点,史密斯探测的 HI-SCAN 6040 CTiX 是一款最先进的电脑断层扫描 (CT) 随身行李检查设备,以及 iLane.evo 自动托盘处理系统。

- 上年度,亚太地区在现有机场建设上的支出最多,投资额超过 2,270 亿美元。北美和欧洲这些倡议的总合金额与亚太地区的支出相当。

- 安全评估是评估组织安全状况的日常练习。扫描 IT 系统和业务流程中的漏洞并提案对策以降低未来攻击的风险。安全审核也有助于使系统和实务保持最新状态。

预计北美将占据较大市场占有率

- 北美大陆预计将占据主要市场占有率。主要原因是大型安全评估服务供应商在市场上拥有强大的影响力,为许多最终用户行业的多家公司提供各种服务。换句话说,北美是 IBM 公司、FireEye、Rapid7 Inc. 和 Qualys Inc. 等市场主要企业的所在地。

- 由于各行业资料外洩事件显着增加,企业正在转向全面的评估服务。例如,白宫经济顾问委员会估计,高风险的网路操作每年对美国经济造成 570 亿美元至 1,090 亿美元的损失。

- 此外,北美(尤其是美国)的网路攻击呈上升趋势,且达到历史最高水准。这主要是由于该地区连网设备数量迅速增加。为了方便银行、购物、通讯等活动,美国客户依赖公共云端,许多行动应用程式都预先安装了资料。

- 地方政府当局实施的法规也正在加速网路安全解决方案的采用。去年,美国发布了一项改善网路安全的行政命令。该行政命令强调的首要任务包括网路事件的预防、侦测、评估和补救。

- 美国政府签署了建立网路安全和基础设施安全局(CISA)的立法,以加强国家对网路攻击的防御。 CISA 与联邦政府合作提供网路安全工具、事件回应服务和评估能力,以保护支援我们合作伙伴机构关键业务的政府网路。

安全评估行业概况

由于有多家供应商服务国内和国际市场,安全评估市场竞争相当激烈。主要竞争对手纷纷采取产品创新、策略联盟等策略来维持市场竞争,并留下产业相当集中的印象。 IBM 公司、卡巴斯基实验室和 FireEye, Inc. 是市场参与企业。

- 2023 年 1 月 -威胁侦测与安全检查技术供应商史密斯探测公司 (SmithsDetection) 宣布推出新一代全自动托盘返回系统 iLane A20。这种新模式可提供更高的吞吐量和效率,从而实现更无缝的安检流程和更好的乘客在检查站的体验。此外,ilane 是与物料输送解决方案提供商 Interroll 合作开发的,是史密斯探测现有 iLane 托盘返回系统产品组合的扩展。

- 除了自动化之外,它还允许并行撤资,即多人可以同时准备筛检、检查空托盘并转移可疑行李。 iLane A20 是模组化的,可以进行配置以满足特定的吞吐量等级、美观要求和空间限制。它还无需更换整个通道来进行升级,从而降低了成本,并为系统性能管理提供了运行状况监控。

- 2022 年 6 月 - Trustwave 旨在提高威胁可见度、快速侦测和回应威胁,并提高组织面对不断变化的威胁情势时的整体网路安全弹性。

- 此外,Trustwave MDR 和 Trustwave MDR Elite 可以对混合多重云端环境进行即时 24x7 监控,以发现活动威胁和异常情况,并由全球威胁营运商、威胁猎手和恶意软体专家组成的精英团队提供支援。客户还将获得 Trustwave Security Colony 的免费订阅。 Trustwave Security Colony 是专为 CISO 设计的经过验证的资源,拥有数百个套件、指南、手册和评估,这些工具包、指南、手册和评估是根据全球数百个网路安全咨询经验开发的。

- 2022 年 2 月 - Qualys, Inc. 是一家颠覆性的云端基础的IT、安全和合规解决方案提供商,宣布发布业界首款上下文感知 XDR Qualys Context XDR。该解决方案由高度可扩展的 Qualys 云端平台提供支持,该平台结合了来自 Qualys 感测器的丰富资产库存、漏洞上下文、网路和端点遥测、高品质威胁情报和第三方日誌资料,以识别威胁并快速减少警报疲劳。

- 此外,Qualys Context XDR 还提供了营运团队消除误报和噪音、三角测量风险态势、资产关键性和威胁情报所需的安全环境。这包括资产可见性、情境优先顺序和有意义的见解,使团队能够快速做出最具影响力的决策以改善保护。

其他好处

- Excel 格式的市场预测 (ME) 表

- 3 个月分析师支持

目录

第一章简介

- 研究假设和市场定义

- 调查范围

第二章调查方法

第三章执行摘要

第四章市场洞察

- 市场概况

- 产业吸引力-波特五力分析

- 新进入者的威胁

- 买方议价能力

- 供应商的议价能力

- 替代品的威胁

- 竞争公司之间敌对关係的强度

第五章市场动态

- 市场驱动因素

- 恶意软体和网路钓鱼威胁不断增加

- 组织中越来越多地采用物联网设备和 BYOD 趋势

- 市场问题

- 组织中的预算限制

第六章 COVID-19对安全评估市场的影响

第七章 市场区隔

- 安装类型

- 本地

- 云

- 按最终用户产业

- 资讯科技/通讯

- BFSI

- 零售

- 医疗保健

- 能源/公共产业

- 其他最终用户产业

- 地区

- 北美洲

- 欧洲

- 亚太地区

- 拉丁美洲

- 中东/非洲

第八章 竞争格局

- 公司简介

- IBM Corporation

- Trustwave Holdings, Inc(Singapore Telecommunications Limited)

- Rapid7 Inc

- Qualys Inc

- Absolute Software Corp

- Check Point Software Technologies Ltd.

- Optiv Security Inc

- FireEye, Inc

- Kaspersky Lab

- Holm Security

第九章投资分析

第10章市场的未来

简介目录

Product Code: 71651

The Security Assessment Market is expected to register a CAGR of 12.7% during the forecast period.

Key Highlights

- According to Cisco Systems, businesses that embrace BYOD policies save an average of USD 350 per employee per year due to the growing acceptance of BYOD policies. While this trend has several advantages for businesses, such as lower hardware costs, increased productivity for remote workers, and satisfied customers, it has also increased privacy and data thefts, as well as unsafe usage, resulting in data breaches and cyberattacks. Furthermore, because of the growing population and the increasing digitalization of industrial operations, there has been a significant increase in PCs, laptops, cell phones, tablets, and point-of-sale terminals.

- As the number of smart devices increases, many new endpoints are being added to networks worldwide. As a result, the growing number of endpoint devices drives the demand for security assessments. Unaddressed vulnerabilities in end-user industries are increasing with the significant shift toward the digital era. The rise of ransomware is an essential factor driving the demand for security assessment solutions. Furthermore, according to a recent Fortinet ransomware survey, approximately 94% of those polled are concerned about the threat of a ransomware attack, with 76% being very or extremely concerned. 85% of surveyed worry more about a ransomware attack than any other cyber threat. As a result, there is a growing demand for risk assessment solutions to help the market grow.

- Budgetary constraints and a lack of awareness across organizations are significant impediments to market growth. The costs of research and development to develop advanced security assessment solutions are very high, resulting in the high pricing of such security services. As a result, it may be a barrier to growth in the security assessment market.

- The global pandemic has increased the demand for remote working solutions; businesses are shifting from traditional workplace practices to the newly accepted work-from-home scenarios. In the context of the enterprise's security capabilities, these transitional effects must be carefully managed. As the number of unprotected personal devices contacting the network grows, so does the risk of compromised network security.

Security Assessment Market Trends

Applications at Airports will Increase to a large extent

- The global aviation industry is expected to increase significantly in the coming future. According to IATA, commercial airlines generated only 227 billion U.S. dollars in passenger revenue in the previous year. Still, in the present year, commercial airlines have already generated 378 billion U.S. dollars in passenger revenue and are further expected to increase.

- Additionally, airports are rapidly implementing cutting-edge security screening techniques because of the enormous increase in passengers and commercial air traffic. Governments worldwide are investing a heft sum of money in the enlargement of these airports. According to the previous year's research by IATA, governments all across the globe have already allocated over 243 billion U.S. dollars to airlines due to the COVID-19 pandemic.

- Self-screening technologies are anticipated to gain significant demand from airport authorities in the upcoming years. Passengers can run their personal belongings through an X-ray machine due to the automated scanners as they simultaneously pass through a different body scanner.

- Vendors are rapidly creating solutions for automating airport screening, which is anticipated to expand the percentage of investments in the upcoming years dramatically. For instance, to improve the customer experience, London Southend Airport is testing a new cabin baggage screening system. To further minimize interaction points throughout the terminal journey, Smiths Detection's HI-SCAN 6040 CTiX, a cutting-edge computed tomography (CT) cabin baggage screening device, is being tested with the iLane.evo automated tray handling system.

- The Asia Pacific spent the most on current airport building in the previous year, with over 227 billion dollars invested. When combined, the value of these initiatives in North America and Europe was comparable to the amount spent in the Asia Pacific.

- Security assessments are routine exercises that assess your organization's security readiness. They include scanning for vulnerabilities in your IT systems and business processes and recommending steps to reduce the risk of future attacks. Security audits are also helpful in keeping your systems and policies up to date.

North America is Expected to Hold a Significant Market Share

- The North American continent is anticipated to account for a significant market share. The main reason for this is the market's strong presence of large security assessment service providers, who supply a variety of services to several firms across numerous end-user industries. In other words, North America is home to some of the major players in the market, such as IBM Corporation, FireEye, Rapid7 Inc., and Qualys Inc., among others.

- The significant rise in data breaches across various industries encourages businesses to use thorough evaluation services. For instance, the White House Council of Economic Advisers estimates that risky cyber operations cause the United States economy to suffer losses of between USD 57 billion to USD 109 billion annually.

- Additionally, cyberattacks in North America, particularly in the United States, are on the rise and have hit an all-time high, primarily due to the region's fast-rising number of connected devices. For the convenience of banking, shopping, communication, and other activities, American customers use public clouds, and many mobile applications come preloaded with their data.

- The regulations imposed by the regional government authorities are also accelerating the adoption of cyber security solutions. The United States released an executive order to improve cybersecurity the previous year. Some top priorities highlighted in the order include the prevention, detection, assessment, and remediation of cyber incidents.

- The US government signed the law to establish the Cybersecurity and Infrastructure Security Agency (CISA), to enhance national defense against cyberattacks. It works with the Federal Government to provide cybersecurity tools, incident response services, and assessment capabilities to safeguard the government networks that support essential operations of the partner departments and agencies.

Security Assessment Industry Overview

Due to the existence of several vendors offering services to both domestic and foreign markets, the Security Assessment Market is quite competitive. The leading competitors have adopted strategies including product innovation and strategic collaborations, among others, to remain competitive in the market, giving the impression that the industry is fairly concentrated. IBM Corporation, Kaspersky Lab, and FireEye, Inc. are a few of the market's main participants.

- January 2023 - Smiths Detection, a provider of threat detection and security inspection technologies, has announced the release of the iLane A20, its next-generation fully automated tray return system. The new model provides high throughput and efficiency, allowing for a more seamless security process and a better passenger experience at the checkpoint. Furthermore, the ilane was created in collaboration with Interroll, the provider of material handling solutions, and evolved from Smiths Detection's existing portfolio of iLane tray return systems.

- In addition to being automated, it offers parallel divest, which allows multiple people to prepare for security screening simultaneously, empty tray verification, and the diversion of suspicious baggage. The iLane A20 is modular, with configurable configurations to meet specific throughput levels, aesthetic requirements, and space constraints. It also saves costs by eliminating the need to replace the entire lane for upgrades and providing health monitoring for system performance management.

- June 2022 - Trustwave announced new managed detection and response (MDR) offerings designed to improve threat visibility, detect and respond to threats quickly, and boost organizations' overall cybersecurity resilience in the face of an evolving threat landscape.

- Furthermore, Trustwave MDR and Trustwave MDR Elite provide real-time 24x7 monitoring of hybrid multi-cloud environments for active threats and anomalies backed by an elite team of global threat operators, threat hunters, and malware experts. Clients also receive a complimentary subscription to Trustwave Security Colony, a battle-tested resource explicitly designed for CISOs with hundreds of toolkits, guidelines, playbooks, and assessment capabilities developed from hundreds of cybersecurity consulting engagements around the world.

- February 2022- Qualys, Inc., a provider of disruptive cloud-based IT, security, and compliance solutions has announced the release of Qualys Context XDR, the industry's first context-aware XDR. The highly scalable Qualys Cloud Platform powers the solution and combines rich asset inventory, vulnerability context, network and endpoint telemetry from Qualys sensors, high-quality threat intelligence, and third-party log data to identify threats and quickly reduce alert fatigue.

- Moreover, Qualys Context XDR provides the security context that operations teams require to eliminate false positives and noise by triangulating risk posture, asset criticality, and threat intelligence. This includes visibility, contextual priority, and meaningful insights about the assets, allowing teams to quickly make the most impactful decisions for enhanced protection.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET INSIGHTS

- 4.1 Market Overview

- 4.2 Industry Attractiveness - Porter's Five Forces Analysis

- 4.2.1 Threat of New Entrants

- 4.2.2 Bargaining Power of Buyers

- 4.2.3 Bargaining Power of Suppliers

- 4.2.4 Threat of Substitute Products

- 4.2.5 Intensity of Competitive Rivalry

5 MARKET DYNAMICS

- 5.1 Market Drivers

- 5.1.1 Increase in Malware and Phishing Threats

- 5.1.2 Increased Adoption of IoT Devices and BYOD Trend in Organizations

- 5.2 Market Challenges

- 5.2.1 Budget Constraints Among the Organizations

6 IMPACT OF COVID-19 ON THE SECURITY ASSESSMENT MARKET

7 MARKET SEGMENTATION

- 7.1 Deployment Type

- 7.1.1 On-Premise

- 7.1.2 Cloud

- 7.2 End-User Vertical

- 7.2.1 IT and Telecommunication

- 7.2.2 BFSI

- 7.2.3 Retail

- 7.2.4 Healthcare

- 7.2.5 Energy & Utiliies

- 7.2.6 Other End-user Verticals

- 7.3 Geography

- 7.3.1 North America

- 7.3.2 Europe

- 7.3.3 Asia Pacific

- 7.3.4 Latin America

- 7.3.5 Middle East and Africa

8 COMPETITIVE LANDSCAPE

- 8.1 Company Profiles

- 8.1.1 IBM Corporation

- 8.1.2 Trustwave Holdings, Inc (Singapore Telecommunications Limited)

- 8.1.3 Rapid7 Inc

- 8.1.4 Qualys Inc

- 8.1.5 Absolute Software Corp

- 8.1.6 Check Point Software Technologies Ltd.

- 8.1.7 Optiv Security Inc

- 8.1.8 FireEye, Inc

- 8.1.9 Kaspersky Lab

- 8.1.10 Holm Security

9 INVESTMENT ANALYSIS

10 FUTURE OF THE MARKET

02-2729-4219

+886-2-2729-4219