|

市场调查报告书

商品编码

1631575

光纤陀螺仪 -市场占有率分析、产业趋势/统计、成长预测(2025-2030)Fiber Optic Gyroscope - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

※ 本网页内容可能与最新版本有所差异。详细情况请与我们联繫。

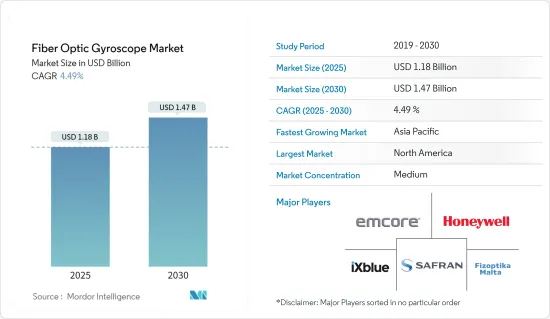

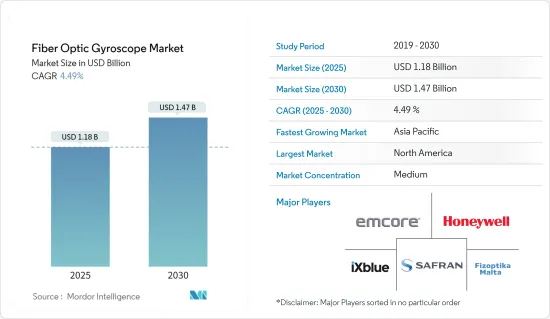

光纤陀螺仪市场规模预计到 2025 年为 11.8 亿美元,预计到 2030 年将达到 14.7 亿美元,预测期内(2025-2030 年)复合年增长率为 4.49%。

光纤陀螺仪以其高输出速率和测量各种角度角速度的准确性而闻名,并且正在迅速被采用。这种趋势在非载人军用车辆和机载监控系统中尤其明显,推动了航太和国防领域对陀螺仪的需求。

光纤陀螺仪在航太、国防和工业等各个领域越来越受到关注。背后的原因包括体积小、重量轻、寿命长、可靠性高、功耗低、适合大规模生产。因此,每个细分市场的需求都在增加,这推动了市场的成长。随着世界各国政府增加军事开支以增强防御能力,对光纤陀螺仪的需求正在迅速增加,特别是远程操作车辆导引等应用。

推动这一市场发展的是无人机和无人机在国防和商业领域的日益普及。根据美国联邦航空管理局 (FAA) 的报告,2023 年美国约有 516,800 架无人机註册用于休閒飞行。值得注意的是,这一数字不包括业余无人机,因为它们不需要註册。

加强光纤陀螺仪(FOG)市场的主要驱动因素包括新兴经济体和成熟经济体国防支出的增加,以及工业和家庭自动化的快速采用。以色列是军事应用领域的领先国家,总部位于特拉维夫的 Airobotics 正在展示其实力,在企业自主解决方案方面处于领先地位,推动光纤陀螺仪市场的发展。在石油钻井过程中使用光纤陀螺仪进行测量以及远程操作车辆的兴起和发展正在进一步推动市场成长。

此外,用于家用电子电器和工业应用的光纤陀螺仪(FOG)小型化趋势以及降低製造成本的努力也对市场成长做出了重大贡献。透过缩小光纤陀螺的尺寸和成本,製造商正在将其应用扩展到家用电子电器、汽车、航太和工业自动化等领域。光纤陀螺仪卓越的准确性和可靠性正在刺激其在新市场和现有市场中的采用。由于对小型高性能感测器的需求迅速增长,预计未来几年光纤陀螺市场将显着成长。

儘管市场对光纤陀螺仪的需求很大,但其复杂、昂贵且耗时的製造流程是主要限制。这项限制限制了光纤陀螺仪的渗透率,在一定程度上抑制了市场的成长。

宏观经济因素,包括地缘政治问题和经济状况的变化,对于塑造市场至关重要。例如,经济强劲的地区将更多预算分配给先进的军事和国防系统,从而增加了这些解决方案的采用。战争等地缘政治挑战进一步推动市场成长。

光纤陀螺仪市场趋势

航太航太领域占市场主导地位

- 航太业是光纤陀螺仪的主要最终用户,广泛采用这些设备进行飞行控制、地面探测和动态全球定位系统 (GPS) 追踪。再加上航空领域的投资趋势,尤其是亚太地区的投资趋势,这一趋势将加强对光纤陀螺仪的需求。

- 例如,印度正迅速成为世界上最大的航空市场之一。过去一年,印度航空、靛蓝航空、阿卡萨航空等印度主要航空公司共订购了1,100多架飞机,成为全球史上最大的民航机订单。

- 同样,全球市场也反映了这一趋势。领先的民航机製造商波音公司预计,2023 年至 2042 年间,全球将交付约 42,595 架新民航机。光纤陀螺仪 (FOG) 在飞机导航系统、飞机运动监测以及角速度和速度等指标中发挥关键作用,预计此类案例将推动市场成长。

- 特别是光纤陀螺在太空火箭及相关系统中扮演重要角色。此外,SpaceX 和 Blue Origin 等私人公司的出现,其愿景是让太空旅行成为现实,进一步扩大了已探索的市场机会。

- 根据《乔纳森太空报告》报道,到 2023 年,将有大约 9,115 颗活跃卫星绕地球运行,与前一年同期比较增加 35%。陀螺仪在太空船和运载火箭中发挥着至关重要的作用,使它们能够侦测方向和角度运动。此功能允许精确控制和追踪太空船从其初始位置的运动。因此,卫星发射增加,创造了有利于该市场成长的环境。

亚太地区成长率显着

- 未来几年,由于几个新兴经济体国防预算的增加,亚太地区的市场将显着成长。特别是,中国和日本正在推动该地区光纤陀螺仪的需求。推动这一增长的因素包括航太和国防领域研发活动的活性化、工业化的快速发展以及对增强感测器、无人机和无人海上船舶的大量投资。

- 中国正在成为汽车工业的製造地,再加上无人驾驶汽车的新发展计划,正在刺激光纤陀螺仪的采用。中国、日本和韩国等国家更严格的监管进一步刺激了企业投资。因此,最终用户公司正在优先考虑各种监控系统中的方向测量,突显了不断增长的市场。

- 近年来,印度已成为军事和国防产品的主要消费国,这使其成为 FOG 利润丰厚的市场。例如,2024 年 2 月,美国国务院核准了一项可能价值 39 亿美元的交易,向印度购买通用原子公司的 MQ-9B 无人机。该协议强调华盛顿和新德里之间加强国防和安全合作。为印度陆军提案的一揽子计画包括31架「天空卫士」无人机、310枚小口径炸弹和170枚「地狱火」飞弹。该套件还包括专门用于海上运输的「海洋卫士号」的雷达和反潜设备。

- 印度在航太和国防生产方面取得了重大进展,为已开发市场提供了机会。例如,最近,印度第一家民用无人机製造厂阿达尼-埃尔比特先进系统印度有限公司成功向以色列交付了20多架Hermes 900中中高度(MALE)无人机。印度阿达尼防务与航空航太公司和以色列埃尔比特系统公司位于海得拉巴的合资企业是第一家在以色列境外生产这些无人机的公司。

- 其他国家也出现了类似的趋势。例如,中国正在积极增强其无人机能力。据中国民航局称,2023年终,中国註册无人机将达到127万架,与前一年同期比较增长32.2%。因此,这些趋势和进步将在预测期内推动该地区受访市场的成长。

光纤陀螺仪产业概况

光纤陀螺仪市场竞争温和,几个主要企业处于前列。这些参与企业中的少数几个目前在市场占有率上占据主导地位。无人驾驶汽车的快速崛起和持续的技术进步为市场供应商提供了诱人的机会。现有公司之间的竞争仍然温和,但公司正在利用创新策略来刺激市场需求。然而,复杂且耗时的製造流程、高投资和低成本效益等挑战正在阻碍光纤陀螺仪製造的新参与企业。主要市场参与企业包括 Emcore、霍尼韦尔和赛峰。

2024年6月,Exail与莱茵金属公司签署了一份重要合同,同意为德国陆军的Caracal 4X4车辆交付1004套Advans Ursa惯性导航系统(INS)。 Advans Ursa 利用 Exile 先进的光纤陀螺仪 (FOG) 技术,成为专为战术导航而设计的紧凑型、经济型 INS。即使在恶劣的条件下,该系统也能保证准确可靠的导航资料。因此,即使在没有 GNSS 讯号的情况下,Caracal 车辆也可以不受任何限制地自信地导航,无论时间或距离如何。

2024 年 6 月,惯性实验室发布了其最新产品 INS-FI。这款 GPS 辅助惯性导航系统 (INS) 采用战术级光纤陀螺仪 (FOG) 技术,将其定位为市场上最先进、最可靠的 INS 解决方案之一。拥有与所有卫星群相容的多频段 GNSS 接收器,包括 GPS、GALILEO、GLONASS、QZSS、NAVIC 和 BEIDOU。

其他好处

- Excel 格式的市场预测 (ME) 表

- 3 个月分析师支持

目录

第一章简介

- 研究假设和市场定义

- 调查范围

第二章调查方法

第三章执行摘要

第四章市场洞察

- 市场概况

- 产业吸引力-波特五力分析

- 供应商的议价能力

- 买方议价能力

- 新进入者的威胁

- 替代品的威胁

- 竞争公司之间敌对关係的强度

- 产业价值链分析

- 宏观经济趋势对光纤陀螺仪市场的影响

第五章市场动态

- 标记驱动程式

- 无人机在国防和民用领域的快速成长

- 扩大全球国防费用

- 市场限制因素

- 复杂性的显着增加正在挑战市场需求

- 先进电子机械系统对陀螺仪的需求不断成长

第六章 市场细分

- 按线圈类型

- 法兰式

- 轮毂型

- 自主型

- 按检测轴

- 1轴

- 2轴

- 3轴

- 按设备

- 指南针罗盘

- 惯性测量单元

- 惯性导航系统

- 按最终用户产业

- 航太

- 机器人技术

- 汽车(自动驾驶汽车)

- 防御

- 产业

- 其他的

- 按地区

- 北美洲

- 欧洲

- 亚太地区

- 澳洲/纽西兰

- 拉丁美洲

- 中东/非洲

第七章 竞争格局

- 公司简介

- EMCORE Corporation

- Honeywell International Inc.

- KVH Industries Inc.

- Safran Colibrys SA

- iXBlue SAS

- Northrop Grumman LITEF GmbH

- Cielo inertial Solutions Ltd

- Fizoptika Malta

- NEDAERO

- Optolink LLC

- Advanced Navigation

第八章投资分析

第9章市场的未来

The Fiber Optic Gyroscope Market size is estimated at USD 1.18 billion in 2025, and is expected to reach USD 1.47 billion by 2030, at a CAGR of 4.49% during the forecast period (2025-2030).

Fiber optic gyroscopes, known for their high output rates and precision in measuring angular velocity across diverse angles, are witnessing a surge in adoption. This trend is particularly evident in uncrewed military vehicles and airborne surveillance systems, driving up the demand for these gyroscopes in the aerospace and defense sectors.

Various sectors, including aerospace, defense, and industrial domains, are increasingly turning to fiber optic gyroscopes. This is attributed to their compact size, lightweight nature, longevity, reliability, low power consumption, and suitability for mass production. As a result, this heightened demand across sectors propels the market's growth. With governments worldwide ramping up military expenditures to bolster their defense capabilities, there is a corresponding surge in demand for fiber optic gyroscopes, especially in applications like remotely operated vehicle guidance.

The market is driven by the growing adoption of drones and UAVs across defense and commercial sectors. The Federal Aviation Administration (FAA) reported that in 2023, approximately 516.8 thousand drones were registered for recreational flying in the United States. Notably, this count excludes hobbyist drones, which are not required to be registered.

Key drivers bolstering the fiber optics gyroscope (FOG) market include heightened defense spending in both emerging and established economies, alongside a surge in automation adoption across industries and households. Israel, a frontrunner in military application advancements, showcases its prowess with Tel Aviv's Airobotics spearheading autonomous solutions for enterprises, propelling the fiber optic gyroscope market. Using fiber optic gyroscopes for measurement during oil drilling processes and the rising prominence and evolution of remotely operated vehicles further fuel the market's growth.

The market's growth is also being significantly driven by the trend of miniaturizing fiber optic gyroscopes (FOGs) for consumer electronics and industrial applications, alongside efforts to cut manufacturing costs. By reducing the size and cost of FOGs, manufacturers are broadening their applications to sectors like consumer electronics, automotive, aerospace, and industrial automation. This broadened application is spurring greater adoption of FOGs in new and established markets due to their superior precision and reliability. With the surging demand for compact, high-performance sensors, the FOG market is set for substantial growth in the years ahead.

Despite significant demand for fiber optic gyroscopes in the market, their complicated, costly, and time-consuming manufacturing process poses a considerable constraint. This limitation restricts the widespread adoption of fiber optic gyroscopes and curtails the market's growth to some degree.

Macroeconomic factors, including shifting geopolitical issues and economic conditions, are pivotal in shaping the market. For example, regions enjoying robust economic health typically allocate greater budgets to advanced military and defense systems, thereby broadening the adoption of these solutions. Geopolitical challenges, such as wars, further drive the growth of the market studied.

Fiber Optic Gyroscope Market Trends

Aerospace and Aviation Segment to Dominate the Market

- The aerospace and aviation industry, a major end-user of fiber optic gyroscopes, extensively employs these devices in flight control, ground detection, and dynamic global positioning system (GPS) tracking. Coupled with rising investments in the aviation sector, particularly in the Asia-Pacific region, this trend is set to bolster the demand for fiber optic gyroscopes.

- For instance, India is rapidly establishing itself as one of the world's largest aviation markets. Over the past year, leading Indian airlines, including Air India, Indigo, and Akasa Air, collectively placed orders for more than 1,100 aircraft, marking one of the largest commercial aircraft orders in global history.

- Similarly, the global market mirrors this trend. Boeing, a leading name in commercial aircraft manufacturing, projects that from 2023 to 2042, the global commercial fleet will welcome approximately 42,595 new aircraft deliveries. Given the prominent role of fiber optic gyroscopes (FOGs) in aircraft navigation systems, monitoring motion in aviation, and capturing metrics like angular velocity and speed, such instances are poised to propel the growth of the market.

- As countries like India ramp up their space missions, the growing activities in the space exploration sector are set to boost the market studied, especially since FOGs play a crucial role in space rockets and related systems. Moreover, the emergence of private companies like SpaceX and Blue Origin, with their vision of making space travel a reality, further amplifies the opportunities in the market studied.

- As reported by Jonathan Space Report, 2023 witnessed approximately 9,115 active satellites orbiting Earth, marking a 35% surge from the prior year's count. Gyroscopes play a pivotal role in space vehicles and launch rockets, enabling them to detect orientation and angular motion. This capability allows precise control and tracking of the craft's movement from its initial position. Consequently, the uptick in satellite launches fosters a conducive environment for the growth of the market studied.

Asia-Pacific to Witness a Significant Growth Rate

- In the coming years, the Asia-Pacific is set to witness significant market growth, driven by rising defense budgets in several emerging economies. Notably, China and Japan are leading the demand for fiber optic gyroscopes in the region. Contributing to this growth are factors such as heightened R&D activities in the aerospace and defense segment, swift industrialization, and substantial investments to enhance sensors, drones, and unmanned maritime vessels.

- China's emergence as a manufacturing hub for the automobile industry, coupled with its new development plans for driverless vehicles, is spurring the adoption of fiber optic gyroscopes. The tightening of regulations in countries like China, Japan, and South Korea has further incentivized corporate investments. As a result, end-user companies increasingly prioritize orientation measurement in various monitoring systems, underscoring the market's expansion.

- In recent years, India has emerged as a leading spender on military and defense products, making it a lucrative market for FOGs. For example, in February 2024, the US State Department approved a potential USD 3.9 billion deal for General Atomics MQ-9B drones to India. This deal underscores the strengthening of defense and security cooperation between Washington and New Delhi. The proposed package for the Indian military encompasses 31 SkyGuardian unmanned aerial vehicles, 310 Small Diameter Bombs, and 170 Hellfire missiles. The package includes radars and anti-submarine equipment for the maritime-focused SeaGuardian variant.

- India is making notable strides in aerospace and defense production, driving opportunities in the studied market. For instance, recently, Adani-Elbit Advanced Systems India Ltd, India's inaugural private UAV manufacturing facility, successfully delivered over 20 Hermes 900 medium-altitude, long-endurance (MALE) UAVs to Israel. This joint venture, based in Hyderabad and formed between India's Adani Defence and Aerospace and Israel's Elbit Systems, proudly stands as the first entity to produce these UAVs outside of Israel.

- Other countries are witnessing similar trends. For example, China is actively bolstering its UAV capabilities. According to the Civil Aviation Administration of China (CAAC), by the end of 2023, China boasted 1.27 million registered drones, marking a 32.2% increase from the prior year. Consequently, these trends and advancements are poised to fuel the growth of the market studied in the region during the forecast period.

Fiber Optic Gyroscope Industry Overview

The fiber optic gyroscope market features a moderate level of competition, with several key players at the forefront. A select few of these players currently hold a dominant position in terms of market share. The swift ascent of unmanned vehicles, coupled with ongoing technological advancements, presents enticing opportunities for market vendors. While the competitive rivalry among established players remains moderate, companies are leveraging innovation strategies to drive market demand. However, challenges such as intricate and time-intensive manufacturing processes, substantial investments, and a low cost-benefit ratio have deterred new entrants from producing fiber optic gyroscopes. Some key market players include Emcore, Honeywell, and Safran.

June 2024: Exail clinched a significant deal with Rheinmetall, agreeing to deliver 1004 units of its Advans Ursa inertial navigation systems (INS) for the German Army's Caracal 4X4 vehicles. Leveraging Exail's advanced Fiber-Optic Gyroscope (FOG) technology, the Advans Ursa stands out as a compact and budget-friendly INS specifically designed for tactical navigation. This system ensures accurate and dependable navigation data, even in challenging conditions. As a result, Caracal vehicles can confidently navigate without any constraints, regardless of time or distance, even in scenarios where GNSS signals are entirely absent.

June 2024: Inertial Labs has unveiled its newest offering, the INS-FI. This GPS-assisted Inertial Navigation System (INS) leverages Tactical-grade Fiber Optic Gyroscope (FOG) technology, positioning it as one of the market's most sophisticated and dependable INS solutions. It boasts a multi-band GNSS receiver compatible with all constellations, including GPS, GALILEO, GLONASS, QZSS, NAVIC, and BEIDOU.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET INSIGHTS

- 4.1 Market Overview

- 4.2 Industry Attractiveness - Porter's Five Forces Analysis

- 4.2.1 Bargaining Power of Suppliers

- 4.2.2 Bargaining Power of Buyers

- 4.2.3 Threat of New Entrants

- 4.2.4 Threat of Substitute Products

- 4.2.5 Intensity of Competitive Rivalry

- 4.3 Industry Value Chain Analysis

- 4.4 Impact of Macroeconomic Trends on the Fiber Optic Gyroscope Market

5 MARKET DYNAMICS

- 5.1 Marker Drivers

- 5.1.1 Rapid Growth of Unmanned Vehicle in Defense and Civilian Applications

- 5.1.2 Expanding Defense Expenditure Globally

- 5.2 Market Restraints

- 5.2.1 Substantial Rise in Complexity Challenging the Market Demand

- 5.2.2 Increasing Demand for Advanced Microelectromechanical Systems Gyroscopes

6 MARKET SEGMENTATION

- 6.1 By Coil Type

- 6.1.1 Flanged

- 6.1.2 Hubbed

- 6.1.3 Freestanding

- 6.2 By Sensing Axis

- 6.2.1 1-axis

- 6.2.2 2-axis

- 6.2.3 3-axis

- 6.3 By Device

- 6.3.1 Gyrocompass

- 6.3.2 Inertial Measurement Unit

- 6.3.3 Inertial Navigation System

- 6.4 By End-user Industry

- 6.4.1 Aerospace and Aviation

- 6.4.2 Robotics

- 6.4.3 Automotive (Autonomous Vehicles)

- 6.4.4 Defense

- 6.4.5 Industrial

- 6.4.6 Other End-user Industries

- 6.5 By Geography

- 6.5.1 North America

- 6.5.2 Europe

- 6.5.3 Asia-Pacific

- 6.5.4 Australia and New Zealand

- 6.5.5 Latin America

- 6.5.6 Middle East and Africa

7 COMPETITIVE LANDSCAPE

- 7.1 Company Profiles

- 7.1.1 EMCORE Corporation

- 7.1.2 Honeywell International Inc.

- 7.1.3 KVH Industries Inc.

- 7.1.4 Safran Colibrys SA

- 7.1.5 iXBlue SAS

- 7.1.6 Northrop Grumman LITEF GmbH

- 7.1.7 Cielo inertial Solutions Ltd

- 7.1.8 Fizoptika Malta

- 7.1.9 NEDAERO

- 7.1.10 Optolink LLC

- 7.1.11 Advanced Navigation