|

市场调查报告书

商品编码

1631580

主动剂量计:市场占有率分析、产业趋势、成长预测(2025-2030)Active Dosimeter - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

※ 本网页内容可能与最新版本有所差异。详细情况请与我们联繫。

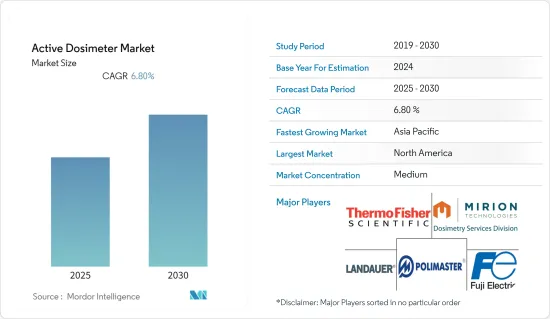

预计主动剂量计市场在预测期间内复合年增长率为 6.8%

主要亮点

- 需要剂量计的工作环境包括医院、诊断影像诊所、实验室、工业设施和一些矿场(例如砂矿)。在核能发电厂、核能研究设施和医学实验室工作的人们需要持续监测有害辐射的暴露。 OSHA 的电离辐射标准要求雇主确保工人进入限制区域并遵守适用职业限制的 25%(18 岁以下工人为 5%)。因此,他们是电子个人剂量计的主要使用者。

- 由于对此类电子剂量计的需求不断增加,市场正在显着增长。人们对有害辐射及其不利影响的认识不断提高预计将导致市场成长。

- 然而,设备成本高昂限制了市场成长。此外,电磁场导致的不同读数可能会影响设备的课责,这可能会对市场造成挫折。该设备对机械不稳定很敏感,导致读数不准确或错误。这阻碍了主动剂量计市场的成长。

- COVID-19 大流行对全球各行业的供应链造成了严重破坏,导致世界各地许多公司暂停或缩减业务,以对抗病毒的传播。疫情影响了无源电子元件市场,导致整个供应链的元件产量和原材料生产水准运作下降。这意味着许多地区和国家的销售额都出现了下降。

主动剂量计市场趋势

医疗应用预计将占据很大份额

- 医学辐射剂量测定测量、计算和评估照射和衰减人体的电离辐射的数量和类型。辐射剂量计用于测量各种固体、气态和液态的辐射,主要分为离子室型、半导体型和钻石检测器型。这些检测器追踪外部放射治疗和摄入或吸入放射性物质引起的内部辐射。

- 职业辐射暴露最高的职业之一是参与介入治疗的医护人员。 APD(主动个人剂量计)可以显着增加介入治疗时的辐射计量。然而,在介入手术期间使用 APD 可能会带来许多问题。这是由于辐射的特殊能量和角度分布及其脉衝性质所致。介入治疗的类型、工作方法和个人习惯、使用的防护设备以及X射线野的特征只是影响职业暴露和患者周围辐射传播的一些因素。

- 儘管硅二极体是大多数主动剂量计中使用的检测器,但它们的校准经常被忽视,因为正在校准的辐射束的特性与正在使用的辐射束的特性非常不同。该研究强调了使用主动剂量计的问题,包括它们在医院常见的脉衝 X 射线场中的可靠性。如果监管机构和专业机构对医院使用的这些设备进行测试和校准提供指导,这种情况可能会有所改善。

- 由于放射线检查对于诊断和确定 COVID-19 病例的预后至关重要,因此临床环境中几乎所有疑似患者都必须接受诊断评估,通常在短时间内进行多次 CT 扫描也很常见。武汉的医院安装了多台CT机和来自全国各地的放射技师。放射技术人员只有接受辐射防护训练并配戴个人剂量计监测外照射后,才能向各自的站报到。

北美预计将占据很大份额

- 由于医疗、工业和国防等多个最终用户的需求不断增长,预计北美地区将在主动剂量计市场中占据主要份额。

- 该地区剂量计的监管标准正在推动主动剂量计市场的发展。目前美国劳工部职业安全与健康管理局 (OSHA) 的监管实践规定了采用 A 计权、5 dB 交换率和慢指数时间平均的剂量计的应用。

- 此外,随着日本对核能发电厂作为能源来源的依赖程度不断增加,新核能发电厂的建设越来越频繁,在核能发电厂工作的员工数量也不断增加。核能发电厂的高辐射风险需要了解所有工人的辐射暴露情况,这正在推动所研究市场的成长。

- 作为国家计划的一部分,美国正在增加医疗保健行业的支出,预计到 2025 年将达到 GDP 的 20%。

- 此外,由于对剂量计的需求不断增长,以进入更广泛的客户群和技术生态系统,该地区见证了知名公司的多项创新、合作和收购。 2021 年 11 月,为医疗、核能、国防和研究产业提供检测、测量、分析和监测解决方案的全球供应商 Mirion Technologies Inc. 收购了美国剂量计服务经销商 CHP Dosimetry。 CHP Dosimetry 目前是 Mirion 的客户,CHP Dosimetry 为其客户提供许多 Mirion 品牌产品,包括 Mirion 的标誌性创新产品 Instadose 剂量监测平台。

主动剂量计产业概述

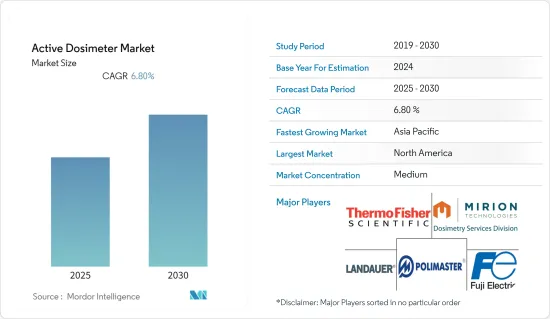

主动剂量计市场由 Landauer Inc.、Mirion Technologies Inc.、Thermo Fisher Scientific Inc.、Fuji Electric 和 Polimaster Inc. 等主要参与者组成,竞争适中。 然而,电子元件评估和测量的进步导致新公司增加了其在市场上的影响力,并导致主要企业采取收购策略进行扩张。

- 2022 年 7 月 - Mirion Technologies 宣布推出Mirion 医疗品牌,由专注于医疗的剂量测量服务、Sun Nuclear、CIRS、Biodex 和 Capintec 业务部门组成。此外,Mirion Medica 集团的成立强化了 Mirion 致力于利用其在医疗应用电离辐射方面的专业知识的承诺。

其他好处

- Excel 格式的市场预测 (ME) 表

- 3 个月分析师支持

目录

第一章简介

- 研究假设和市场定义

- 调查范围

第二章调查方法

第三章执行摘要

第四章市场洞察

- 市场概况

- 产业吸引力-波特五力分析

- 供应商的议价能力

- 消费者议价能力

- 新进入者的威胁

- 竞争公司之间的敌对关係

- 替代品的威胁

- COVID-19 市场影响评估

第五章市场动态

- 市场驱动因素

- 增加核子反应炉建设

- 扩大在医学生命科学领域的应用

- 市场限制因素

- 设备高成本

- 对机械不稳定的敏感性

第六章 市场细分

- 按用途

- 医疗用途

- 工业(石油/天然气、采矿)

- 军事/国防安全保障

- 电力能源

- 其他的

- 按地区

- 北美洲

- 欧洲

- 亚太地区

- 其他的

第七章 竞争格局

- 公司简介

- Landauer Inc.

- Polimaster Inc.

- Mirion Technologies Inc.

- Thermo Fisher Scientific Inc.

- Fuji Electric Co. Ltd.

- ATOMTEX SPE

- Tracerco Limited

- Unfors RaySafe AB

- Far West Technology Inc.

- Rotunda Scientific Technologies LLC

- Raeco Rents, LLC.

第八章投资分析

第9章市场的未来

The Active Dosimeter Market is expected to register a CAGR of 6.8% during the forecast period.

Key Highlights

- The working environments that require dosimeters may include hospitals, imaging clinics, laboratories, industrial facilities, and some mines (i.e., mineral sand mines). Individuals working in nuclear power plants, nuclear research facilities, and medical laboratories must continually monitor their exposure to harmful radiation. AcOSHA'sg to OSHA's Ionizing Radiation standard, employers must conduct dose monitoring whenever a worker enters a restricted area and receives, or is likely to receive, a dose that exceeds 25% of the applicable occupational limit (5% for workers under the age of 18) in any calendar quarter. Hence, they are the primary users of the electronic personal dosimeter.

- The market studied is growing substantially, primarily due to the rise in demand for these devices. The increasing awareness regarding harmful radiation and its ill effects is expected to market the market's growth.

- However, the market growth is restrained by the high cost of the device. Further, the different readings because of electromagnetic fields might impact the device's accountability, which may be a setback for the market. The device is sensitive to mechanical instability, leading to an inaccurate or false reading. This is hampering the growth of the active dosimeters market.

- The COVID-19 pandemic led to enormous disruptions in supply chains across industries globally, due to which many businesses worldwide halted or reduced operations to help combat the spread of the virus. The pandemic impacted the passive electronic components market, leading to decreased operation levels across the component production and raw material production levels across the supply chain. This represents a fall in sales in many regions and countries.

Active Dosimeter Market Trends

Medical Application is Expected to Hold Significant Share

- In medical radiation dosimetry, the amount and type of ionizing radiation that is exposed to and attenuated by the human body are measured, computed, and evaluated. Radiation dosimeters are used to measure radiation in a variety of solid, gas, and liquid states; these are primarily classified as ionization chamber, semiconductor, and diamond detector types. These detectors track radiation administered both externally during external beam radiation therapy and internally through ingestion or inhalation of radioactive substances.

- One of the professions with the greatest occupational doses is the medical staff involved in interventional treatments. APDs, or active personal dosemeters, may greatly enhance exposure during interventional treatments. However, employing APDs during interventional operations can provide a number of issues. This is caused by the radiation's particular energy and angular distribution as well as its pulsed character. The type of interventional treatment, working methods and personal habits, protective equipment employed, and features of the X-ray field are just a few of the factors that affect occupational exposure and the radiation spread around the patient.

- Silicon diodes are the detector of choice for most active dosimeters, but frequently their calibration is neglected since the radiation beam characteristics in which they are calibrated and those in which they are employed are very different. The survey uncovered issues with active dosimeter use, such as its dependability in hospitals' common pulsed x-ray fields. The situation would probably improve with guidance from regulatory bodies and professional groups on the testing and calibration of these devices used in hospitals.

- Since radiography is essential for diagnosing COVID-19 cases and determining prognosis, nearly all suspected patients in clinical practice must have diagnostic evaluation, with many commonly undergoing repeated CT exams in a short period of time. Hospitals in Wuhan have several pieces of CT equipment installed, and radiographers from all across China have flocked there to provide a hand. Only after receiving radiation protection training and donning personal dosimeters for monitoring external radiation exposure can radiation personnel report to their posts.

North America is Expected to Hold Significant Share

- The North American region is expected to account for a significant share of the active dosimeter market due to its rising demand across multiple end users, such as healthcare, industrial, and defense.

- The regulatory standards in the region regarding dosimeters are aiding the market for active dosimeters. Currently, the US Department of Labor Occupational Safety and Health Administration (OSHA) regulatory practices specify the application of dosimeters with A-weighting, 5 dB exchange rate, and SLOW exponential time averaging.

- Furthermore, the increasing dependency on nuclear plants for energy resulted in the active construction of new plants, increasing the number of employees working at nuclear plants. With the high risk of radiation at the nuclear plants, the need for understanding the radiation exposure by all the workers has become necessary, thereby driving the growth of the market studied.

- As a part of the country's policy, the United States is increasing its expenditure on the healthcare industry, which is anticipated to reach as high as 20% of the GDP by 2025, further increasing the demand for active dosimeter equipment across radiology and cardiology departments, thereby driving the market growth during the forecast period.

- Further more, Owing to the increasing demand for dosimeters to tap into a broader customer base and technological ecosystem, the region is witnessing several innovations, collaborations, and acquisitions by prominent companies. In November 2021, Mirion Technologies Inc., a global provider of detection, measurement, analysis, and monitoring solutions to the medical, nuclear, defense, and research industries, acquired CHP Dosimetry, a dosimetry services distributor based in the United States. CHP Dosimetry is a current Mirion customer, with CHP Dosimetry providing customers with access to many Mirion-branded products, including the Instadose dosimetry monitoring platform, which is Mirion's hallmark innovation.

Active Dosimeter Industry Overview

The Active Dosimeter Market is moderately competitive and consists of major players such as Landauer Inc., Mirion Technologies Inc., Thermo Fisher Scientific Inc., Fuji Electric Co. Ltd., Polimaster Inc., etc. However, with advancements in the assessment and measurement of the electronic component, new players are increasing their market presence, and prominent players are adopting acquisition strategies to expand their companies.

- July 2022 - Mirion Technologies has announced the launch of the Mirion medical brand comprised of the organization's healthcare-focused Dosimetry Services, Sun Nuclear, CIRS, Biodex, and Capintec business units. Furthermore, the establishment of the Mirion Medical group reinforces the Mirion commitment to leveraging its expertise in ionizing radiation for healthcare applications.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET INSIGHTS

- 4.1 Market Overview

- 4.2 Industry Attractiveness - Porter's Five Forces Analysis

- 4.2.1 Bargaining Power of Suppliers

- 4.2.2 Bargaining Power of Consumers

- 4.2.3 Threat of New Entrants

- 4.2.4 Intensity of Competitive Rivalry

- 4.2.5 Threat of Substitute Products

- 4.3 Assessment of Impact of COVID-19 on the market

5 MARKET DYNAMICS

- 5.1 Market Drivers

- 5.1.1 Increasing Construction of Nuclear Reactors

- 5.1.2 Growing Application Across Medical & Lifescience Sector

- 5.2 Market Restraints

- 5.2.1 High cost of device

- 5.2.2 Sensitivity toward Mechanical Instability

6 MARKET SEGMENTATION

- 6.1 By Application

- 6.1.1 Medical

- 6.1.2 Industrial (Oil & Gas, Mining)

- 6.1.3 Military and Homeland Security

- 6.1.4 Power & Energy

- 6.1.5 Other Applications

- 6.2 By Geography

- 6.2.1 North America

- 6.2.2 Europe

- 6.2.3 Asia Pacific

- 6.2.4 Rest of the World

7 COMPETITIVE LANDSCAPE

- 7.1 Company Profiles

- 7.1.1 Landauer Inc.

- 7.1.2 Polimaster Inc.

- 7.1.3 Mirion Technologies Inc.

- 7.1.4 Thermo Fisher Scientific Inc.

- 7.1.5 Fuji Electric Co. Ltd.

- 7.1.6 ATOMTEX SPE

- 7.1.7 Tracerco Limited

- 7.1.8 Unfors RaySafe AB

- 7.1.9 Far West Technology Inc.

- 7.1.10 Rotunda Scientific Technologies LLC

- 7.1.11 Raeco Rents, LLC.