|

市场调查报告书

商品编码

1631585

运输用重型包装纸和多层纸袋:市场占有率分析、产业趋势和成长预测(2025-2030)Heavy Duty Paper And Multiwall Shipping Sack - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

※ 本网页内容可能与最新版本有所差异。详细情况请与我们联繫。

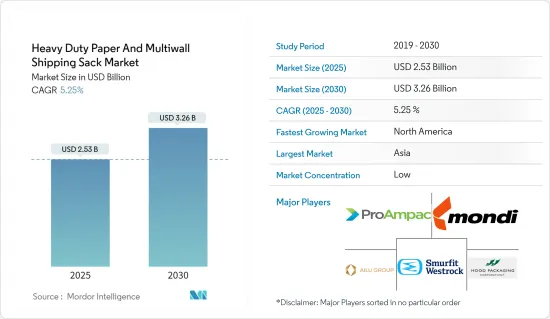

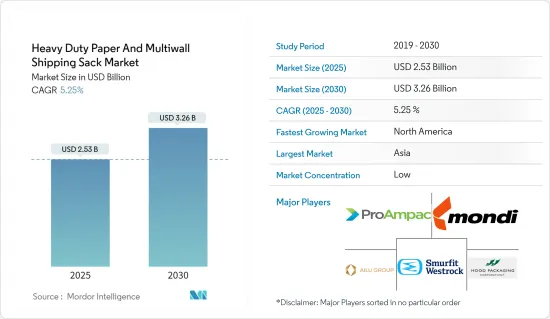

运输重型包装纸和多层纸袋市场规模预计到2025年为25.3亿美元,到2030年达到32.6亿美元,预测期内(2025-2030年)复合年增长率为5.25%。

主要亮点

- 化肥、纺织和水泥製造等各行业对重型包装纸和多层纸袋的需求不断增加。这一增长的关键驱动力是人们日益认识到纸包装作为环保解决方案。随着人们对永续性的兴趣日益浓厚,越来越多的最终用户开始采用这些环保的产品包装选项。

- 纸包装具有多种优点,使其越来越受欢迎。它们生物分解性、可回收,通常由可再生资源製成,符合全球永续实践运动。此外,重型包装纸和多层纸袋在储存和运输过程中为产品提供卓越的保护,使其适合需要坚固包装解决方案的行业。

- 多层纸袋因其产品促销的客製化潜力而越来越受欢迎。这些袋子由多层牛皮纸製成,最内层经过特殊涂层和贴合加工以防止污染。多层纸袋的多功能性允许采用多种印刷技术,使公司能够有效地展示其品牌和产品资讯。这些客製化功能使多层纸袋对于希望提高产品知名度和市场占有率的公司特别有吸引力。

- 多层纸袋的需求主要受到开发中国家和已开发国家房地产业成长的推动,因为它们广泛用于水泥包装。建设产业水泥生产和分销的增加增加了对耐用且可靠的包装解决方案的需求。多层纸袋为水泥产品在运输和储存过程中提供必要的强度和保护,使其成为业界的理想选择。

- 随着纸包装成为首选替代品,政府禁止塑胶包装的措施预计将显着促进市场成长。包括中国、印度和台湾在内的一些国家已经实施了消除一次性塑胶的环境安全政策。这些政策旨在减少塑胶污染并促进更永续的包装选择。多层纸袋的环保特性与世界对永续包装解决方案的日益重视不谋而合。

- 随着公司和消费者的环保意识日益增强,纸袋的生物分解性和可回收特性使其在建筑、农业、食品和化学等多个行业中广受欢迎。监管压力、不断变化的消费者偏好和企业永续性目标推动了向纸质包装的转变。多层纸袋是一种多功能、环保的包装解决方案,可针对各种产品类型和尺寸进行定制,使其成为希望减少环境足迹同时保持产品完整性的製造商和零售商的绝佳选择。

- 包括超级市场和大卖场在内的有组织零售的扩张预计将在预测期内推动市场成长。由于多层纸袋的耐用性和环保特性,许多零售业的公司更喜欢多层纸袋而不是标准塑胶包装。多层纸袋可提供更好的产品保护,尤其是在大量生产中,这对零售环境非常重要。此外,园艺业的成长预计将促进市场成长。园艺产业通常需要耐用、透气的种子、肥料和其他产品包装,这使得多层纸袋成为理想的选择。多层纸袋可容纳各种产品类型和尺寸的多功能性进一步增强了其在各种零售和农业空间中的吸引力。

运输用重型包装纸和多层纸袋的市场趋势

农业和化肥领域预计将占据较大市场占有率

- 运输用多层纸袋广泛用于包装各种农业、化肥物资。对于托运人来说,这是一种经济高效的选择,同时还可以增强自订功能。製造商可以设计这些袋子以满足特定要求,确保最佳的产品品质保护。这些袋子的多层结构提供了卓越的强度和耐用性,使其适合各种产品和运输条件。

- 多层纸袋用于运输的重要优势之一是其多功能性。根据包装产品的特定需求,可以使用不同的材料製造多层运输袋,例如牛皮纸、聚乙烯或两者的组合。这种灵活性使我们能够根据需要提供客製化解决方案,包括防潮性、抗穿刺性和阻隔性。

- 用于运输的多层纸袋非常环保,通常由可回收材料製成。方面与农业产业对永续包装解决方案不断增长的需求不谋而合。我们还提供高品质的图形印刷,以实现清晰的产品标识和品牌。

- 用于运输的多层纸袋以最低的成本提供最佳的保护,并满足标准处理、运输和服务要求。它在储存和运输方面非常高效,使其成为许多寻求优化包装流程和降低整体成本的农业和化肥公司的首选。

- 在农业中,多层纸袋主要用于农药、化肥等农产品的包装。这些袋子在农业供应链中发挥重要作用。农民需要大量的种子、农药、化肥等农业物资,多层纸袋为储存和运输提供了有效的解决方案。这些袋子旨在帮助保持其所含材料的化学性质,确保产品在使用前保持新鲜和吸引力。此外,多层纸袋便于运输和运输过程中的处理,降低破损和溢出的风险。

- 日本农产品出口市场的成长证实了多层纸袋在农业中的重要性。 2023年,日本农产品出口额将达到约64.4亿美元,较2021年的57.2亿美元大幅成长。这一成长趋势凸显了日本农业产业的扩张以及日本在国际市场上的影响力不断增强。

- 农产品占日本出口初级产品的大部分,反映了农业对日本经济的重要性。农产品出口的成长趋势为多层纸袋製造商满足该行业的需求提供了巨大的机会。随着农产品需求的成长,对可靠、高效的包装解决方案的需求也在成长。这使得多层袋製造商能够在支持日本农产品出口产业的持续成长和成功方面发挥重要作用。

预计亚洲将占据很大的市场份额

- 由于都市化和农业、化肥、建筑、化学品和大规模食品生产等最终用途产业的扩张,亚洲提供了充足的成长机会。因此,对运输用重型包装纸和多层纸袋的需求量很大。许多亚洲国家的快速都市化导致建设活动和基础设施发展增加,增加了对强大包装解决方案的需求。

- 农业现代化和化肥使用量的增加增加了对耐用纸包装的需求。工业扩张带来的化学工业的成长进一步增加了对运输用重型包装纸袋的需求。此外,不断发展的食品产业需要可靠、高效的包装选择,以确保运输和储存过程中的产品安全和质量,特别是在大规模生产和分销方面。

- 亚洲的都市化趋势尤其明显,中国、印度和印尼等国家的都市区成长迅速。这种转变将为消费品创造新的市场,并增加对高效物流和包装解决方案的需求。建设产业是都市化的主要受益者,需要对水泥、骨材和化学物质进行重型包装,这推动了对多层运输袋的需求。

- 现代农业技术以及专用化肥和农药的日益采用增加了农业对安全、防潮包装的需求。重型纸袋是这些应用的理想选择,因为它们可以提供免受环境因素影响的保护,同时易于处理和运输。

- 由于国内消费和出口需求,亚洲化学工业正在迅速扩张。这种成长需要强大的包装解决方案,能够承受严酷的运输和储存,同时确保潜在危险物质的安全。具有多层保护的运输用多层纸袋是适当的。

- 食品产业面临着在整个供应链中保持产品新鲜度和完整性的挑战,特别是在大规模生产中。重型纸包装和多层纸袋提供了保护食品在运输和储存过程中免受污染、潮湿和物理损坏的解决方案。随着亚洲国家不断发展食品加工和出口能力,对这些包装解决方案的需求预计将会成长。

- 亚洲面临着采用永续包装解决方案的巨大社会和监管压力。这一趋势正在加速该地区重型运输纸和多层纸袋包装的采用。这种向环保替代品的转变是由日益增长的环境问题和减少塑胶废弃物的需要所推动的。在亚洲,企业和政府正在製定雄心勃勃的永续性目标,包括减少一次性塑胶和推广可回收包装材料。这些永续性努力增加了对创新纸基包装解决方案的研发投资,这些解决方案可以承受运输和储存的严酷,同时最大限度地减少对环境的影响。

- 2023财年,印度有机和无机化学品出口达294.9亿美元,高于2021财年的198.2亿美元。化学品出口的大幅成长反映了印度化学工业实力的不断增强及其在全球市场上不断扩大的影响力。出口强劲成长,两年内达到近100亿美元,显示国际对印度化工产品的强劲需求。化学品出口的成长趋势为亚洲重型包装纸和多层运输袋製造商带来了广阔的机会。

- 随着化学品出口量的增加,对安全跨境运输化学品的坚固可靠的包装解决方案的需求预计也会增加。亚洲的工业包装材料製造商处于有利地位,可以利用这个不断增长的市场,这可能会导致专为化学品运输设计的特殊包装产品的生产和销售增加。

运输重型包装纸和多层纸袋产业概述

运送重型包装纸和多层纸袋市场较为分散。市场参与者的分销管道和原材料获取管道的存在会影响竞争。 Mondi PLC、ProAmpac Holdings Inc. 和 Smurfit Kappa 等公司正在采取伙伴关係、合併和收购等策略活动来扩大其影响力。

其他好处:

- Excel 格式的市场预测 (ME) 表

- 3 个月分析师支持

目录

第一章简介

- 研究假设和市场定义

- 调查范围

第二章调查方法

第三章执行摘要

第四章市场洞察

- 市场概况

- 产业吸引力-波特五力分析

- 供应商的议价能力

- 消费者议价能力

- 新进入者的威胁

- 替代品的威胁

- 竞争公司之间敌对关係的强度

- 产业供应链分析

第五章市场动态

- 市场驱动因素

- 最近的法律改革使纸袋比塑胶袋更具优势。

- 农业需求的增加将导致市场显着成长

- 市场挑战

- 政府法规和对永续性的日益关注正在改变运输袋的模式。

第六章 市场细分

- 按最终用户产业

- 农业/肥料

- 建筑/化学

- 食品(大型)

- 纤维

- 其他最终用户产业

- 按地区

- 北美洲

- 欧洲

- 亚洲

- 拉丁美洲

- 中东/非洲

第七章 竞争格局

- 公司简介

- Endpak Packaging Inc.

- Mondi Plc

- Northeast Packaging Company

- ProAmpac Holdings Inc.

- Smurfit Kappa

- Hood Packaging Corporation

- Shanghai Ailu package CO. Ltd

- Global-Pak, Inc.

- Dairyland Packaging USA, LLC

- Aumento Polymer Tekniks Pvt. Ltd

第八章投资分析

第9章市场的未来

The Heavy Duty Paper And Multiwall Shipping Sack Market size is estimated at USD 2.53 billion in 2025, and is expected to reach USD 3.26 billion by 2030, at a CAGR of 5.25% during the forecast period (2025-2030).

Key Highlights

- The demand for heavy-duty paper and multiwall bags is increasing across various industries, including fertilizer, textile, and cement manufacturing. This growth is primarily driven by the increasing awareness of paper packaging as an environmentally friendly solution. As sustainability concerns rise, more end users are adopting these eco-conscious product packaging options.

- Paper packaging has several advantages that contribute to its growing popularity. It is biodegradable, recyclable, and often made from renewable resources, aligning with the global push for sustainable practices. Additionally, heavy-duty paper and multiwall bags provide excellent protection for products during storage and transportation, making them suitable for industries that require robust packaging solutions.

- Multiwall paper bags are gaining traction due to their customization potential for product promotion. These bags consist of multiple layers of kraft paper, with the innermost layer specially coated and laminated to prevent contamination. The versatility of multiwall paper bags allows various printing techniques, enabling companies to showcase their branding and product information effectively. This customization capability makes them particularly attractive for businesses looking to enhance their product visibility and market presence.

- The demand for multiwall paper bags is primarily driven by the growth of the real estate industry in both developing and developed countries, as they are extensively used in cement packaging. The increased cement production and distribution in the construction industry boosts the need for durable and reliable packaging solutions. Multiwall paper bags offer the necessary strength and protection for cement products during transportation and storage, making them an ideal choice for the industry.

- Government initiatives to ban plastic packaging are expected to significantly boost the market's growth as paper packaging becomes a preferred alternative. Several countries, including China, India, and Taiwan, have implemented environmental safety policies to eliminate single-use plastics. These policies aim to reduce plastic pollution and promote more sustainable packaging options. The eco-friendly nature of multiwall paper bags aligns with the growing global emphasis on sustainable packaging solutions.

- As businesses and consumers become more environmentally conscious, these bags' biodegradable and recyclable properties contribute to their increasing popularity across various industries, including construction, agriculture, food, and chemicals. The shift toward paper packaging is driven by regulatory pressures, changing consumer preferences, and corporate sustainability goals. Multiwall paper bags offer a versatile and environmentally responsible packaging solution that can be customized for different product types and sizes, making them an attractive option for manufacturers and retailers looking to reduce their environmental footprint while maintaining product integrity.

- The expansion of organized retail, including supermarkets and hypermarkets, is expected to drive the growth of the market during the forecast period. Many companies in the retail sector prefer multiwall bags over standard plastic packaging due to their durability and eco-friendly properties. Multiwall bags offer better product protection, especially in bulk quantities, which is crucial for retail environments. Additionally, the growing horticulture industry is expected to contribute to market growth. Horticultural businesses often require sturdy, breathable packaging for seeds, fertilizers, and other products, making multiwall bags an ideal choice. The versatility of multiwall bags in accommodating various product types and sizes further enhances their appeal across different retail and agricultural spaces.

Heavy Duty Paper And Multiwall Shipping Sack Market Trends

The Agriculture and Fertilizers Segment is Expected to Hold a Significant Market Share

- Multiwall shipping sacks are widely used for packaging diverse agricultural and fertilizer materials. They offer a cost-efficient option for shippers while providing enhanced custom capabilities. Manufacturers can design these sacks to meet specific requirements, ensuring optimal product quality protection-a crucial factor in the agriculture industry. The multi-layered construction of these sacks provides superior strength and durability, making them suitable for various products and shipping conditions.

- One critical advantage of multiwall shipping sacks is their versatility. Depending on the specific needs of the product being packaged, multiwall shipping sacks can be produced using different materials, such as kraft paper, polyethylene, or a combination of both. This flexibility allows tailored solutions that address moisture resistance, puncture resistance, or barrier properties as required.

- Multiwall shipping sacks are environmentally friendly and often made from recyclable materials. This aspect aligns with the growing demand for sustainable packaging solutions in the agriculture industry. The sacks can also be printed with high-quality graphics, enabling clear product identification and branding.

- Multiwall shipping sacks deliver optimal protection at the lowest cost, satisfying standard handling, shipping, and service requirements. Their efficiency in terms of storage and transportation makes them a preferred choice for many agriculture and fertilizer companies looking to optimize their packaging processes and reduce overall costs.

- In agriculture, multiwall bags are primarily used for packaging agricultural products such as pesticides and fertilizers. These bags serve a crucial role in the farm supply chain. Farmers require seeds, pesticides, fertilizers, and other agricultural supplies in bulk quantities, and multiwall sacks provide an effective solution for storage and transportation. These bags are designed to help preserve the chemical properties of the materials they contain, ensuring that products remain fresh and compelling until use. Additionally, multiwall bags facilitate easier handling during shipping and transport, reducing the risk of damage or spillage.

- Japan's growing agricultural export market underscores the importance of multiwall bags in agriculture. In 2023, Japan's agricultural commodity exports reached approximately USD 6.44 billion, a significant increase from USD 5.72 billion in 2021. This growth trend highlights Japan's expanding agriculture industry and the country's increasing presence in international markets.

- Agricultural goods constituted the majority of primary sector products exported from Japan, reflecting the industry's importance to the country's economy. This upward trajectory of farming exports presents a substantial opportunity for manufacturers of multiwall bags to cater to the demand in the segment. As the demand for agricultural products grows, so does the need for reliable and efficient packaging solutions. This will allow multiwall bag manufacturers to play a vital role in supporting the continued growth and success of Japan's agricultural export industry.

Asia is Expected to Hold a Significant Share of the Market

- Asia presents ample growth opportunities due to urbanization and the expansion of end-use industries such as agriculture, fertilizers, construction, chemicals, and large-scale food production. This equates to a high demand for heavy-duty paper and multiwall shipping sacks. The rapid urbanization in many Asian countries has led to increased construction activities and infrastructure development, boosting the need for robust packaging solutions.

- The agriculture industry's modernization and the rising use of fertilizers contribute to the demand for durable paper packaging. The chemical industry's growth, driven by industrial expansion, further amplifies the requirement for sturdy shipping sacks. Moreover, the evolving food industry necessitates reliable and efficient packaging options, particularly in terms of large-scale production and distribution, to ensure product safety and quality during transportation and storage.

- The urbanization trend in Asia is particularly significant, with countries like China, India, and Indonesia experiencing rapid growth in their urban populations. This shift creates new markets for consumer goods and increases the need for efficient logistics and packaging solutions. The construction industry, a key beneficiary of urbanization, requires heavy-duty packaging for cement, aggregates, and chemicals, driving the demand for multiwall shipping sacks.

- The increasing adoption of modern farming techniques and specialized fertilizers and pesticides has led to a greater need for secure and moisture-resistant packaging in the agriculture industry. Heavy-duty paper sacks are ideal for these applications, as they offer protection against environmental factors while allowing easy handling and transportation.

- The chemical industry in Asia has been expanding rapidly, driven by domestic consumption and export demands. This growth necessitates robust packaging solutions that can withstand transportation and storage rigors while ensuring the safety of potentially hazardous materials. Multiwall shipping sacks, with their multiple layers of protection, are well-suited.

- The food industry, particularly in terms of large-scale production, faces challenges in maintaining product freshness and integrity throughout the supply chain. Heavy-duty paper packaging and multiwall sacks offer solutions that protect food products from contamination, moisture, and physical damage during transit and storage. As Asian countries continue to develop their food processing and export capabilities, the demand for these packaging solutions is expected to grow.

- Asia faces significant societal and regulatory pressures to adopt sustainable packaging solutions. This trend has accelerated the adoption of heavy-duty paper and multiwall shipping sack packaging in the region. The shift toward these eco-friendly alternatives is driven by growing environmental concerns and the need to reduce plastic waste. In Asia, companies and governments have established ambitious sustainability targets, which include reducing single-use plastics and promoting recyclable packaging materials. This commitment to sustainability has led to increased investment in research and development of innovative paper-based packaging solutions that can withstand the rigors of shipping and storage while minimizing environmental impact.

- In the fiscal year 2023, India's exports of organic and inorganic chemicals reached a value of USD 29.49 billion, up from USD 19.82 billion in fiscal year 2021. This significant increase in chemical exports demonstrates the growing strength of India's chemical industry and its expanding presence in global markets. The substantial growth in export value, amounting to nearly USD 10 billion over two years, indicates a robust demand for Indian chemical products internationally. This upward trend in chemical exports presents promising opportunities for manufacturers of heavy-duty paper and multiwall shipping sacks in Asia.

- As the volume of chemical exports increases, there is likely to be a corresponding demand for sturdy, reliable packaging solutions to safely transport chemicals across borders. Manufacturers of industrial packaging materials in Asia are well-positioned to capitalize on this growing market, potentially leading to increased production and sales of specialized packaging products designed for chemical transportation.

Heavy Duty Paper And Multiwall Shipping Sack Industry Overview

The heavy-duty paper and multiwall shipping sack market is fragmented. The presence of the market players' distribution channels and access to raw materials impacts the competition. Players like Mondi PLC, ProAmpac Holdings Inc., and Smurfit Kappa adopt strategic activities like partnerships, mergers, and acquisitions to expand their presence.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET INSIGHT

- 4.1 Market Overview

- 4.2 Industry Attractiveness - Porter's Five Forces Analysis

- 4.2.1 Bargaining Power of Suppliers

- 4.2.2 Bargaining Power of Consumers

- 4.2.3 Threat of New Entrants

- 4.2.4 Threat of Substitute Products

- 4.2.5 Intensity of Competitive Rivalry

- 4.3 Industry Supply Chain Analysis

5 MARKET DYNAMICS

- 5.1 Market Drivers

- 5.1.1 Recent Legislative Changes Favor the Adoption of Paper-based Bags Over Plastic

- 5.1.2 Rising Demand from the Agriculture Industry presents a Significant Market Growth

- 5.2 Market Challenge

- 5.2.1 Government regulations and a growing emphasis on sustainability are reshaping the landscape for shipping bags

6 MARKET SEGMENTATION

- 6.1 By End-user Industry

- 6.1.1 Agriculture & Fertilizers

- 6.1.2 Construction & Chemicals

- 6.1.3 Food (Large-scale)

- 6.1.4 Textiles

- 6.1.5 Other End-user Industry

- 6.2 By Geography

- 6.2.1 North America

- 6.2.2 Europe

- 6.2.3 Asia

- 6.2.4 Latin America

- 6.2.5 Middle East and Africa

7 COMPETITIVE LANDSCAPE

- 7.1 Company Profiles

- 7.1.1 Endpak Packaging Inc.

- 7.1.2 Mondi Plc

- 7.1.3 Northeast Packaging Company

- 7.1.4 ProAmpac Holdings Inc.

- 7.1.5 Smurfit Kappa

- 7.1.6 Hood Packaging Corporation

- 7.1.7 Shanghai Ailu package CO. Ltd

- 7.1.8 Global-Pak, Inc.

- 7.1.9 Dairyland Packaging USA, LLC

- 7.1.10 Aumento Polymer Tekniks Pvt. Ltd