|

市场调查报告书

商品编码

1631586

全球环境生活协助(AAL) -市场占有率分析、产业趋势/统计、成长预测(2025-2030 年)Global Ambient Assisted Living (AAL) - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

※ 本网页内容可能与最新版本有所差异。详细情况请与我们联繫。

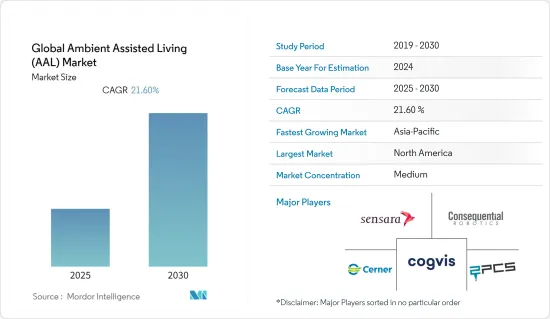

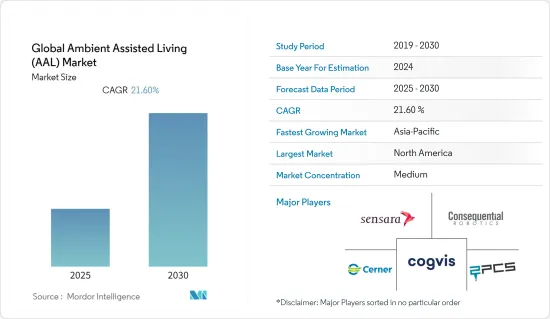

全球环境辅助生活市场预计在预测期内复合年增长率为 21.6%

主要亮点

- 据联合国称,2017 年至 2050 年间,全球 80 岁及以上人口预计将增加两倍以上,从 1.37 亿增至 4.25 亿。此外,世界人口老化速度加快,某些地区和国家的人口老化程度也更高。例如,根据联合国的数据,北美和欧洲的老年人口占世界总人口的比例最高。人口老化将推动市场。

- 美国疾病管制与预防中心的报告显示,出生时平均寿命整体稳定成长,目标是从2017年的73.3岁增加到2022年的74.4岁。这一增长大部分是由于婴儿死亡率降低。根据同一调查,美国的平均寿命为78.6岁,连续第三年下降。人们追求健康的生活方式,以保持健康并监控饮食习惯。人们行为的这些变化预计将增加对环境生活协助解决方案的需求。

- 此外,随着物联网 (IoT) 的兴起和越来越多的人使用互联网,远端医疗、远距照护、远端医疗、远距辅导和行动医疗等 AAL 解决方案和服务变得越来越受欢迎。医生也越来越多地使用数位健康工具来改进他们的实践并使其更加高效和安全。

- 许多 AAL 服务过去比现在更昂贵,因为它们需要体力劳动,并且需要患者或医生出差进行监测、资料和样本收集、诊断和筛检。由于现代技术创新,此类护理的成本正在下降。

- 儘管远端医疗是 AAL 的一部分,但老年人很难利用它,因为他们更喜欢面对面接受治疗。然而,随着最近技术的扩散和 COVID-19 的爆发,使用远端医疗解决方案已成为强烈的趋势。例如,American Well 的一项调查发现,超过 52% 的 65 岁以上美国人愿意使用远端医疗。首要原因是更快的服务、节省时间、更大的便利性、节省金钱以及更好地获得医疗专业人员的帮助。

环境生活协助市场趋势

慢性病的增加和人口老化预计将推动市场成长

- 老年人更容易患慢性病。牛津大学预计,未来几十年,法国65岁以上人口比例将稳定上升,2030年达到25%左右,2050年接近30%。由于预计在不久的将来老年人口将增加,该族群将更容易患心血管疾病、肌肉骨骼疾病等慢性疾病,这可能会对市场产生积极影响。

- 中国的慢性病患者数量正在显着增加。这是因为该国的老年人数量正在增加。根据《2019年世界人口老化》报告,预计2030年中国65岁以上人口将达到2.4698亿,而2019年为1.6448亿。

- 在全球范围内,慢性疾病显着增加,特别是高血压、糖尿病和呼吸系统疾病。据 IDF 称,有 4.63 亿成年人患有糖尿病,预计 2019 年这一数字将增至 7 亿。 65 岁以上的人中有五分之一患有糖尿病。

- 据世界卫生组织称,有 2.35 亿人患有气喘,其中最常见的是幼儿。据估计,每年有超过 300 万人死于慢性阻塞性肺病,占全球死亡人数的 6%。据估计,全球有 11.3 亿人患有高血压。

- 慢性呼吸系统和心血管疾病在老年人中越来越普遍。根据美国心臟协会 (AHA) 的数据,大约 4,370 万 60 岁以上的美国患有一种或多种心血管疾病,包括中风、心臟病发作和心臟衰竭。大约三分之二的心血管疾病死亡发生在 75 岁及以上的人群中。

美国预计将占很大份额

- 人口实验室认为,世界人口老化将对排放低碳解决方案的需求产生重大影响。据预测,65 岁及以上的美国人数量将从 2018 年的 5,200 万增加到 2060 年的 9,500 万,几乎翻倍,占总人口的比例将从 16% 增加到 23%。

- 此外,在环境生活协助中,娱乐系统是向使用者提供娱乐、通讯和其他服务的互连电子设备的集合。它通常配备电视、音响和其他媒体参与企业。它们还可能配备家庭自动化、游戏机和网路存取等功能。在环境生活协助(AAL),交通系统是一项让老年人和残障人士更轻鬆出行的服务。可用于社交活动、约会、办事、购物等。 AAL 描述了门到门运输服务。换句话说,司机会从家中接您并将您送到目的地。

- 多种智慧家用电子电器正在接受各种认证计画。例如,2021年4月,物联网安全全球标准ioXt联盟宣布,国际家用电子电器製造商美的已通过ioXt认证计画对七款家用电子电器产品进行了认证。目前,大多数智慧家庭设备和解决方案都是点设备,每个设备都使用自己的应用程式来运行,因此设备之间不存在整合。

- 除了医疗和医疗保险行业的公司之外,越来越多的主流穿戴解决方案提供者正在增加健康监测和跌倒检测功能。例如,苹果公司提供跌倒侦测作为其最新智慧型手錶解决方案的一部分。预计此类发展在未来几年将进一步增加。

- 随着穿戴式装置和连网技术变得越来越普遍,为人们提供帮助的 AAL 服务(例如跌倒支援、紧急服务、样本收集和监控)变得越来越受欢迎。例如,当一位老年妇女的家被大火吞没而她无法逃出时,Centra Plus 按下与警报系统相连的吊坠救了她的命。

环境生活协助产业概述

市场适度细分,小型供应商集中在需求高的国家。厂商之间的竞争策略是强化市场地位,主要厂商在技术创新和研发的投入能力较强。结果是,市场竞争日益加剧。在服务领域,借助技术增强能力预计将会增加,并成为参与企业竞争策略的一部分。

2022 年 6 月,亚马逊宣布发布一系列更新,制定了实现环境智慧的整体策略。这将改变人们与技术互动的方式以及在所有环境中利用人工智慧 (AI) 的方式。

2022 年 3 月,康卡斯特和独立健康集团 (Independence) 的数位健康合资企业 Quill 宣布推出 Quil Assure,这是一个全新的连网家庭平台,可帮助老年人更独立地生活,并增加对照顾他们的家人和朋友的支持」已宣布进行有限商业化。 Quil Assure 应用程式与智慧型手錶和扬声器配合使用,将有关护理对象健康状况的即时资讯发送到护理圈,并在需要时打开安全通讯协定。

其他好处

- Excel 格式的市场预测 (ME) 表

- 3 个月分析师支持

目录

第一章简介

- 研究假设和市场定义

- 调查范围

第二章调查方法

第三章执行摘要

第四章市场洞察

- 环境生活协助领域的市场概况与演变

- 产业吸引力-波特五力分析

- 供应商的议价能力

- 消费者议价能力

- 新进入者的威胁

- 竞争公司之间敌对关係的强度

- 替代品的威胁

- 老年人与 AAL 市场互动的关键领域(工作和培训、医疗保健和护理、资讯和通讯、休閒和文化、生活方式和建筑、流动性和交通、安全和保障、活力和能力)

- 价值炼和经营模式

- COVID-19对智慧家庭医疗产业的影响

第五章市场动态

- 市场驱动因素

- 人口变化、政府措施、消费者关注、技术进步等。

- 慢性病增加和人口老化

- 市场问题

- 复杂的法规环境和对可互通解决方案的需求

第六章 市场细分

- 解决方案类型

- 硬体(用于活动监控的传感器、用于事故检测的压力垫、壁挂式或随身佩戴的紧急按钮以及其他相关连接产品)

- 紧急服务(老人监护服务、按需联繫服务等)

- 地区

- 北美洲

- 欧洲

- 亚太地区

- 其他的

第七章 竞争格局

- 公司简介

- Sensara BV

- 2PCS Solutions GmbH

- Alcove Limited

- Cogvis Software and Consulting GmbH

- Consequential Robotics Ltd

- Cerner Corporation

- YoooM

- Televic Group NV

- Assisted Living Technologies Inc.

- Doro AB

第八章投资分析

第9章市场的未来

The Global Ambient Assisted Living Market is expected to register a CAGR of 21.6% during the forecast period.

Key Highlights

- According to the United Nations, globally, the number of people over 80 is projected to increase more than threefold between 2017 and 2050, rising from 137 million to 425 million. Additionally, the global population is aging faster, and the numbers are higher in certain regions and countries. For instance, North America and Europe are the two regions of the world with the highest proportion of elderly people in relation to their total populations, according to the UN. Such a rise in population aging will drive the market.

- According to the report of the US Center for Disease Control and Prevention, the overall life expectancy at birth is steadily increasing, with a target of 74.4 years by 2022, up from 73.3 years in 2017. Most of the increase is due to lower infant mortality. According to the same survey, life expectancy in the United States has dropped for the third year in a row to 78.6 years. People are striving toward a healthy lifestyle to keep them fit and monitor their eating habits; such changes in people's behavior will increase the demand for ambient assisted living solutions.

- Also, with the rise of the Internet of Things (IoT) and more people using the internet, AAL solutions and services like telehealth, telecare, telemedicine, telecoaching, and mHealth are becoming more popular. Also, more and more doctors are using digital health tools in their practices because they are more efficient and safer.

- AAL services used to be more expensive than they are now because many of them required manual labor and required either the patient or the doctor to travel, such as monitoring, collecting data and samples, diagnosing, and checking ups.The costs associated with such care have decreased with the latest technological innovations.

- Telemedicine is a part of AAL, but older people were less likely to use it because they liked getting care in person more. But the recent spread of technology and the COVID-19 outbreak made people more likely to use telemedicine solutions. For example, a study by American Well found that over 52% of Americans over the age of 65 were willing to use telehealth. The top reasons given were faster service, saving time, being more convenient, saving money, and having better access to healthcare professionals.

Ambient Assisted Living Market Trends

Increasing Chronic Diseases and Growing Aging Population are Expected to Drive the Market Growth

- The geriatric population is more inclined to chronic diseases. According to Oxford, over the next few decades, the share of the French population aged 65 and older will increase steadily, reaching about 25% in 2030 and nearly 30% in 2050. As the number of the elderly population is anticipated to increase in the near future, this population is more susceptible to chronic conditions such as cardiovascular, musculoskeletal, and other diseases, which might positively impact the market.

- China has seen a big rise in the number of people with chronic diseases. This is because there are more older people living there. According to the World Population Ageing 2019 report, in China, the population aged 65 years or older is projected to reach 246.98 million by 2030, up from 164.48 million in 2019.

- Globally, there is a big rise in chronic diseases, especially high blood pressure, diabetes, and breathing problems. According to the IDF, 463 million adults were living with diabetes, and in 2019, this is expected to rise to 700 million. 1 in 5 people over 65 has diabetes.

- In addition, 235 million people have asthma, which is common among children, according to the WHO. More than 3 million people die of COPD yearly, accounting for an estimated 6% of all deaths worldwide. In addition to this, an estimated 1.13 billion people worldwide have hypertension.

- Chronic respiratory and cardiovascular diseases among the elderly are becoming increasingly prevalent. According to the American Heart Association (AHA), about 43.7 million Americans aged 60 and above have one or more cardiovascular disease types, such as stroke, heart attack, or heart failure. About two-thirds of cardiovascular disease deaths occur in people aged 75 and older.

United States is Expected to Hold Major Share

- According to the Population Reference Bureau, the world's aging population will have a big effect on the demand for solutions that save energy and have low carbon emissions. This is likely to keep the market growing over the next few years.According to projections, the number of Americans 65 and older will nearly double from 52 million in 2018 to 95 million by 2060, increasing their percentage of the overall population from 16% to 23%.

- Further, In ambient assisted living, an entertainment system is a collection of interconnected electronic gadgets that offer users entertainment, communication, and other services. Usually, the plans come with a TV, stereo, and other media players. They might also have features for home automation, game consoles, and internet access. In ambient assisted living (AAL), a transportation system is a service that makes it easier for the elderly and disabled to travel around. It can be utilized for social activities, appointments, errands, and shopping. AAL provides door-to-door transportation services, which means the driver will pick it up from home and deliver it to the destination.

- Multiple smart appliances are undergoing various certification programs. For instance, in April 2021, the ioXt Alliance, the global standard for IoT security, announced that international household appliance manufacturer Midea had certified seven appliances through the ioXt Certification Program. Currently, most smart home devices and solutions are point devices, which implies no integration among devices as each device uses its own application to function.

- Aside from companies in the healthcare and Medicare industries, more and more mainstream wearable solution providers are adding health monitoring and fall detection features.For example, Apple offers fall detection as part of its latest smartwatch solutions. Such developments are expected to increase over the coming years.

- As wearables and connected technology become more common, AAL services that help people, like fall support, emergency services, sample collection, and monitoring, are slowly becoming more popular. For example, a user's life was saved by Centra Plus when the user pressed her pendant, which links to an alarm unit, when the older woman's home was engulfed in fire and she was unable to move and get out of the house.

Ambient Assisted Living Industry Overview

The market is moderately fragmented, with smaller vendors concentrated in countries with higher demand. The competitive strategy among vendors is to gain a foothold in the market, with innovation and the capability of investing in R&D by significant vendors being on the higher side. Thus, competition in the market is intensifying. In the services segment, enhancing capabilities with the help of technologies is expected to increase and become part of players' competitive strategies.

In June 2022, Amazon announced the release of a series of updates and laid out its general strategy for enabling ambient intelligence. This will change how people in all kinds of settings interact with technology and use artificial intelligence (AI).

In March 2022, Quil, a digital health joint venture between Comcast and Independence Health Group (Independence), announced the limited commercial availability of Quil Assure, a new connected home platform that helps the elderly live more independently and strengthens the support of family and friends who care for them. The Quil Assure app works with smart watches and speakers to send real-time information about a care recipient's health to their Care Circle and turn on safety protocols when they are needed.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET INSIGHTS

- 4.1 Market Overview and Evolution of the Ambient Assisted Living Sector

- 4.2 Industry Attractiveness - Porter's Five Forces Analysis

- 4.2.1 Bargaining Power of Suppliers

- 4.2.2 Bargaining Power of Consumers

- 4.2.3 Threat of New Entrants

- 4.2.4 Intensity of Competitive Rivalry

- 4.2.5 Threat of Substitute Products

- 4.3 Major Areas Where the Older Adults Engage with the AAL Market (Work and Training, Health and Care, Information and Communication, Leisure and Culture, Living and Building, Mobility and Transport, Safety and Security, and Vitality and Abilities)

- 4.4 Value Chain and Business Models

- 4.5 Impact of COVID-19 on the Smart Home Healthcare Industry

5 MARKET DYNAMICS

- 5.1 Market Drivers

- 5.1.1 Changing Demographics, Government Initiatives, Consumer Interest, Technology Evolution, etc.

- 5.1.2 Increasing Chronic Diseases and Growing Aging Population

- 5.2 Market Challenges

- 5.2.1 Complexity of the Regulatory Environment, in Combination with the Need for Interoperable Solutions

6 MARKET SEGMENTATION

- 6.1 Type Solution

- 6.1.1 Hardware (Sensors for Activity Monitoring, Pressure Mats for Accident Detection, Emergency Buttons Attached to Walls or Worn on Body and Other Relevant Connected Products)

- 6.1.2 Emergency Services (Underlying Services for Elderly Monitoring and On-demand Contacts)

- 6.2 Geography

- 6.2.1 North America

- 6.2.2 Europe

- 6.2.3 Asia-Pacific

- 6.2.4 Rest of the World

7 COMPETITIVE LANDSCAPE

- 7.1 Company Profiles

- 7.1.1 Sensara BV

- 7.1.2 2PCS Solutions GmbH

- 7.1.3 Alcove Limited

- 7.1.4 Cogvis Software and Consulting GmbH

- 7.1.5 Consequential Robotics Ltd

- 7.1.6 Cerner Corporation

- 7.1.7 YoooM

- 7.1.8 Televic Group NV

- 7.1.9 Assisted Living Technologies Inc.

- 7.1.10 Doro AB