|

市场调查报告书

商品编码

1631592

东协 UPVC 门窗:市场占有率分析、产业趋势与成长预测(2025-2030 年)ASEAN UPVC Doors And Windows - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

※ 本网页内容可能与最新版本有所差异。详细情况请与我们联繫。

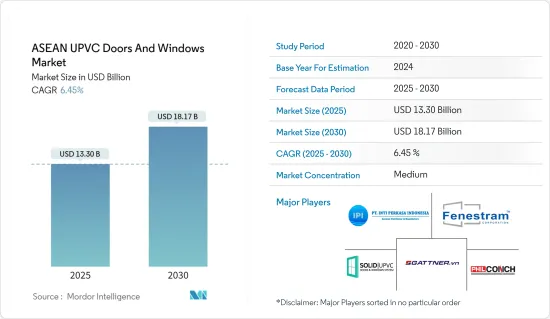

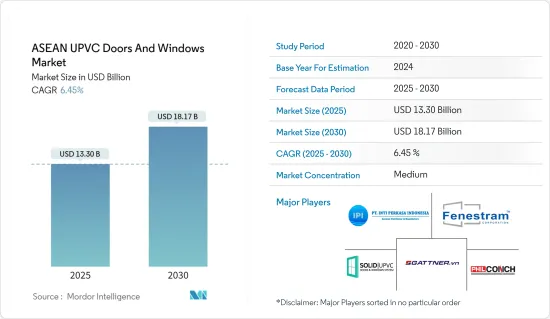

预计2025年东协UPVC门窗市场规模为133亿美元,预计2030年将达181.7亿美元,复合年增长率为6.45%。

近年来,东南亚国协的建筑业取得了显着的成长。对门窗(包括 UPVC 产品)的需求增加直接归因于此成长。 UPVC门窗因其耐用性、能源效率、低维护要求和成本效益而在东南亚国协广受欢迎。它广泛用于商业、工业和住宅用途。

东南亚国协收入阶层不断壮大,可支配收入不断增加,导致住宅和建筑计划支出增加,进一步拉动了对UPVC门窗的需求。多个东南亚国协正在投资机场、公路、铁路和智慧城市等基础设施发展计划。这些计划需要高品质的门窗,包括 UPVC 产品。东协各国政府正在实施能源效率法规并推广永续建筑方法。 UPVC 门窗以其优异的隔热性能而闻名,使其成为节能建筑的有吸引力的选择。

东协UPVC门窗市场趋势

越南高成长带动东协市场

在整个研究期间,越南由于快速的工业化和都市化已成为东南亚国协中成长最快的市场。人们对 UPVC 优点的认识不断增强,加上该国住宅和商业建设活动的蓬勃发展,可能会推动 UPVC 在门窗中的使用增加。在目前处于市场前沿的亚太地区,UPVC门窗的需求正在快速成长,这主要得益于产品创新和技术进步。该地区不断扩大的电气和电子工业、汽车工业的快速成长以及整体工业化进一步推动了这一成长。

商业领域的快速成长推动市场

印尼、泰国、越南和马来西亚等东南亚国协的工业和建筑业正在快速成长。这种快速增长增加了对 UPVC 门窗的需求。这些国家的快速都市化和正在进行的基础设施计划进一步推动了这项需求。随着城市的扩张和新计划的出现,UPVC 门窗的能源效率和美观变得至关重要。东南亚国协的消费者越来越意识到UPVC门窗的好处,包括增强安全性、降噪和耐候性。因此,木材和铝等传统材料明显转向 UPVC。

东协UPVC门窗产业概况

东协UPVC门窗市场较为分散。本报告重点介绍了东协 UPVC 门窗市场的主要国际参与者。目前,INTI PERKASA INDONESIA、SOLID UPVC Doors & Windows System、PHILCONCH、Gartner.vn 和 Fenestram Corp. 等少数菁英公司在市场上占据主导地位。然而,技术进步和产品创新使中小企业能够增加市场占有率、赢得新契约并开拓未开发的市场。

其他好处:

- Excel 格式的市场预测 (ME) 表

- 3 个月的分析师支持

目录

第一章简介

- 研究假设和市场定义

- 调查范围

第二章调查方法

第三章执行摘要

第四章市场洞察与动态

- 市场概况

- 市场驱动因素

- UPVC 产品的耐用性和低维护性推动了市场

- 市场限制因素

- UPVC门窗的安装流程

- 市场机会

- 住宅重建和改建趋势的上升创造了机会

- 价值链/供应链分析

- 波特五力分析

- 新进入者的威胁

- 买家/消费者的议价能力

- 供应商的议价能力

- 替代品的威胁

- 竞争公司之间的敌对关係

- 洞察市场创新

- COVID-19 对市场的影响

第五章市场区隔

- 依产品类型

- UPVC门

- UPVC窗

- 按最终用户类型

- 住宅

- 商业的

- 按分销管道

- 线下商店

- 网路商店

- 按地区

- 印尼

- 马来西亚

- 菲律宾

- 新加坡

- 泰国

- 越南

- 其他东南亚国协

第六章 竞争状况

- 公司简介

- Deceuninck

- INTI PERKASA INDONESIA

- LG Hausys

- VINCA

- ARC Component Manufacturing Rayong Co. Ltd

- SOLID|UPVC Doors & Windows System

- Aluplast

- Fenestram Corp.

- PHILCONCH

- VEKA

- Gattner*

第七章 市场趋势

第八章 免责声明

The ASEAN UPVC Doors And Windows Market size is estimated at USD 13.30 billion in 2025, and is expected to reach USD 18.17 billion by 2030, at a CAGR of 6.45% during the forecast period (2025-2030).

ASEAN countries have witnessed significant growth in the construction industry in recent years. The rising demand for doors and windows, including UPVC products, can be directly attributed to this growth. UPVC doors and windows are popular in ASEAN countries due to their durability, energy efficiency, low maintenance requirements, and cost-effectiveness. They are extensively utilized in commercial, industrial, and residential structures.

The rising middle-income group population in ASEAN countries has increased disposable incomes, which has resulted in higher spending on housing and construction projects, further driving the demand for UPVC doors and windows. Several ASEAN countries are investing in infrastructure development projects, such as airports, roads, railways, and smart cities. These projects require high-quality doors and windows, including UPVC products. Governments across ASEAN countries have been implementing energy efficiency regulations and promoting sustainable construction practices. UPVC doors and windows are known for their excellent thermal insulation properties, making them an attractive choice for energy-efficient buildings.

ASEAN UPVC Doors & Windows Market Trends

Vietnam's High Growth Rate Driving the ASEAN Market

Throughout the study period, Vietnam's swift industrialization and urbanization have positioned it as the fastest-growing market across ASEAN countries. Growing awareness of the benefits of UPVC, coupled with the country's booming residential and commercial construction activities, is set to drive the increased use of UPVC in doors and windows. The Asia-Pacific, currently at the forefront of the market, is witnessing a surge in demand for UPVC doors and windows, primarily driven by product innovations and technological advancements. This growth is further bolstered by the region's expanding electric and electronic industries, a burgeoning automotive industry, and overall industrialization.

Rapid Growth in the Commercial Segment Fueling the Market

ASEAN countries, including Indonesia, Thailand, Vietnam, and Malaysia, have seen robust growth in their industrial and construction sectors. This surge has spurred a heightened demand for UPVC doors and windows, driven by the rising need for commercial and industrial buildings. Rapid urbanization and ongoing infrastructure projects across these nations further bolster this demand. As cities expand and new projects emerge, the energy efficiency and aesthetic appeal of UPVC doors and windows become paramount. Consumers in ASEAN nations are increasingly recognizing the benefits of UPVC doors and windows, including enhanced security, noise reduction, and weather resistance. Consequently, there has been a marked shift toward UPVC, shifting focus from conventional materials such as wood and aluminum.

ASEAN UPVC Doors & Windows Industry Overview

The ASEAN UPVC doors and windows market exhibits fragmentation. This report highlights key international players in the ASEAN UPVC doors and windows market. Currently, a select few, including INTI PERKASA INDONESIA, SOLID UPVC Doors & Windows System, PHILCONCH, Gartner.vn, and Fenestram Corp., dominate the market in terms of share. However, driven by technological advancements and product innovations, mid-sized and smaller firms are bolstering their market presence, clinching new contracts, and exploring untapped markets.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET INSIGHTS AND DYNAMICS

- 4.1 Market Overview

- 4.2 Market Drivers

- 4.2.1 Durability and Low Maintenance of UPVC Products Driving the Market

- 4.3 Market Restraints

- 4.3.1 Installation Process for UPVC Doors and Windows

- 4.4 Market Opportunities

- 4.4.1 Rising Trends of Home Renovations and Remodeling Creating Opportunities

- 4.5 Value Chain/Supply Chain Analysis

- 4.6 Porter's Five Forces Analysis

- 4.6.1 Threat of New Entrants

- 4.6.2 Bargaining Power of Buyers/Consumers

- 4.6.3 Bargaining Power of Suppliers

- 4.6.4 Threat of Substitute Products

- 4.6.5 Intensity of Competitive Rivalry

- 4.7 Insights into Technological Innovations in the Market

- 4.8 Impact of COVID-19 on the Market

5 MARKET SEGMENTATION

- 5.1 Product Type

- 5.1.1 UPVC Doors

- 5.1.2 UPVC Windows

- 5.2 End-user Type

- 5.2.1 Residential

- 5.2.2 Commercial

- 5.3 Distribution Channel

- 5.3.1 Offline Stores

- 5.3.2 Online Stores

- 5.4 Geography

- 5.4.1 Indonesia

- 5.4.2 Malaysia

- 5.4.3 Philippines

- 5.4.4 Singapore

- 5.4.5 Thailand

- 5.4.6 Vietnam

- 5.4.7 Rest of ASEAN

6 COMPETITIVE LANDSCAPE

- 6.1 Company Profiles

- 6.1.1 Deceuninck

- 6.1.2 INTI PERKASA INDONESIA

- 6.1.3 LG Hausys

- 6.1.4 VINCA

- 6.1.5 ARC Component Manufacturing Rayong Co. Ltd

- 6.1.6 SOLID | UPVC Doors & Windows System

- 6.1.7 Aluplast

- 6.1.8 Fenestram Corp.

- 6.1.9 PHILCONCH

- 6.1.10 VEKA

- 6.1.11 Gattner*

![PVC 窗户市场:趋势、机会与竞争分析 [2024-2030]](/sample/img/cover/42/default_cover_5.png)