|

市场调查报告书

商品编码

1631594

热熔胶贴标机:市场占有率分析、产业趋势/统计、成长预测(2025-2030)Hot Melt Glue Labeler - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

价格

※ 本网页内容可能与最新版本有所差异。详细情况请与我们联繫。

简介目录

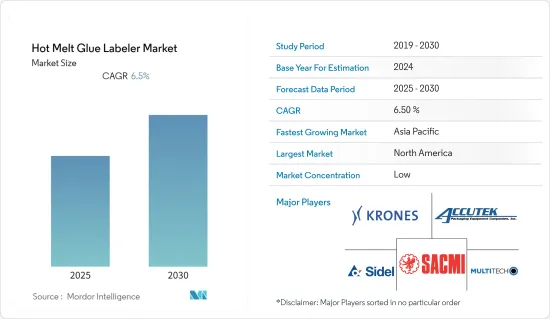

热熔胶贴标机市场预计在预测期内复合年增长率为 6.5%

主要亮点

- 全自动热熔胶贴标机适用于多种类型的容器和标籤材料,满足使用者对各种容器的要求。此外,这些型号对于大批量生产要求来说具有成本效益。

- 模组化设计概念的引入预计将有助于热熔胶贴标机的广泛采用,该概念使用户可以轻鬆更换瓶子。这使得最终用户可以根据需要将冷胶和热熔贴标站互换连接到主机。

- 此外,许多参与企业正在推出可降低使用热胶时的能源成本和烟雾的模型。 Futura 的贴标机模型最近经过彻底重新设计,以实现上述目标。公司推出的新站使维修成本降低了50%以上。

热熔胶贴标机市场趋势

食品和饮料领域的应用预计将推动市场成长

- 世界各地的食品和饮料包装必须遵守极为严格的安全标准。这些法规也适用于用于密封和折迭箱子和纸箱、形成密封托盘、标籤包装、窗帘、过滤器和许多其他应用的黏合剂。

- 食品包装中使用的不同类型的热熔胶包括乙烯醋酸乙烯酯(EVA)热熔胶、茂金属热熔胶、Fugent热熔胶和聚氨酯反应型(PUR)热熔胶。大多数热熔胶均符合 FDA 标准,可直接和间接接触食品。茂金属热熔胶专门为食品和饮料包装行业提供最高品质的黏合而设计。

- 此外,广泛使用热熔胶标籤的宝特瓶的产量也不断增加。例如,光是可口可乐每年就生产约 1,080 亿个 500 毫升的宝特瓶,仅占全球宝特瓶产量的一小部分。

- 此外,在过去的十年中,世界瓶装水的消费量显着增加。这一增长是由美国等国家引领的。根据 IBWA 的数据,2018 年该国瓶装消费量创下 42.3 加仑的历史新高。预计这将进一步扩大热熔胶标籤在该市场的使用。

亚太地区预计将成为全球成长最快的地区

- 亚太地区食品产业的销售持续成长,新的创新技术的采用正在迅速再形成包装食品格局。这些动态发展预计将促进该地区的市场成长。例如,HUL 重新推出了 Kissan Sweet &Spicy 系列番茄酱,以满足新时代消费者不断变化的口味。 HUL 也为其优质果酱变体 Kissan Tropical Blast 和 Kissan Mixed Fruit Jam 推出了新包装。由于热熔胶广泛用于瓶装食品的包装,这一市场发展预计将支持该地区的市场成长。

- 此外,饮料包装对货架高可视性、便利性和优质化的需求正在导致包装新品种和差异化的引入,进而导致市场扩张。据 Mondi 称,东南亚占各种用途特种罐的三分之一,包括软性饮料、啤酒、即饮茶、咖啡、苏打水、果汁、机能饮料。

- 亚太市场是全球最具活力的医药市场之一。例如,2018年,印度药品及药品出口额突破1兆卢比。此外,中国是全球两个最大的成药市场之一,价值250亿美元(资料来自Sun Pharma)。在咳嗽、感冒和过敏领域,瓶装糖浆占据了非处方药市场的大部分,该地区为热熔胶标籤应用提供了巨大的机会。

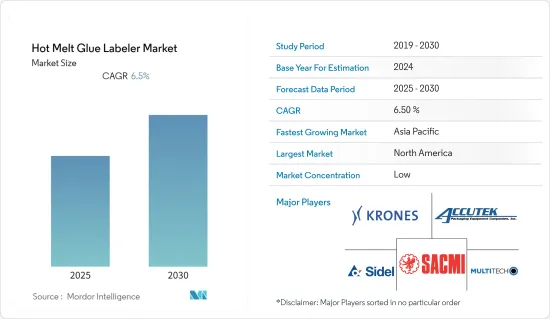

热熔胶标籤产业概况

热胶贴标机市场的竞争格局被众多中小企业分割。近期市场趋势如下。

- 2019 年 2 月 - HB Fuller 最近推出了两种专为印度印刷艺术产业设计的热熔胶。 Swifttherm 8048是由印度公司开发和製造的基于EVA的热熔胶。 Swiftherm Advantage 8,000 是一种基于茂金属的书脊黏合剂,旨在弥补传统 EVA 黏合剂和 PUR 黏合剂之间的差距。

其他好处

- Excel 格式的市场预测 (ME) 表

- 3 个月分析师支持

目录

第一章简介

- 研究成果

- 研究场所

- 调查范围

第二章调查方法

第三章执行摘要

第四章市场动态

- 市场概况

- 市场驱动因素

- 冷冻食品和饮料的标籤应用增加

- 技术进步提高了贴标机的成本效益

- 市场限制因素

- 使用仍然仅限于特定的最终用户群体

- 产业价值链分析

- 波特五力分析

- 新进入者的威胁

- 买家/消费者的议价能力

- 供应商的议价能力

- 替代品的威胁

- 竞争公司之间敌对关係的强度

第五章市场区隔

- 按类型

- 自动的

- 半自动

- 按标籤用途

- 预切标籤

- 捲筒送纸

- 按用途

- 食物

- 饮料

- 药品

- 化学

- 其他的

- 地区

- 北美洲

- 欧洲

- 亚太地区

- 其他的

第六章 竞争状况

- 公司简介

- Accutek Packaging Equipment Companies Inc.

- Aesus Packaging Systems, Inc.

- Krones AG

- Clearpack Group

- Criveller Group

- Sacmi Packaging SpA

- KHS Group

- Multi-Tech Systems International Inc.

- Sidel, Inc.(Tetra Laval Group)

- Della Toffola SpA

- Propack Automation Limited

第七章 市场机会及未来趋势

第八章投资分析

简介目录

Product Code: 72072

The Hot Melt Glue Labeler Market is expected to register a CAGR of 6.5% during the forecast period.

Key Highlights

- Automatic hot melt glue labeling machine, that are used for various kinds of material of container and label meet the requirements of users that have variety of the containers. Moreover, these models are cost-effective for mass production requirements.

- The increase in adoption of hot melt glue labelers is expected to be aided by the introduction of modularization design concepts that make it convenient for users to change the bottles. This enables end users to interchangeably connect cold-glue and hotmelt labelling stations to the main machine as required.

- Additionally, many players are introducing models that are reducing energy costs and fumes while using hot glue. Futura labeller model was completely redesigned recently to meet the above objectives. The new station introduced by the company has reduced maintenance costs by more than 50%.

Hot Melt Glue Labeler Market Trends

Application in the Food & Beverage Segments is Expected to Drive the Growth of the Market

- Food and beverage packaging across the globe must adhere to a very strict set of safety standards. These regulations are also applicable to glues that are used for case and carton sealing and folding, seal tray forming, package labeling, windowing, filters and many other applications.

- The various kinds of hot melt glues used in food packaging include ethylene-vinyl acetate (EVA) hot melt glue, metallocene hot melt glue, fugitive hot melt glue and polyurethane reactive (PUR) hot melt glue. Most of the hot melt glues are FDA compliant for both direct and indirect food contact. Metallocene hot melt glues are designed specifically to offer best quality bonds for the food and beverage packaging industry.

- Moreover, there has been continuous increase in PET bottle production where hot melt glue labels are extensively used. Coca Cola for instance alone produces about 108 billion 500ml PET plastic bottles a year, which is a fraction of the global PET bottle production levels.

- Additionally, there has been a significant rise in the consumption of bottled water in the world in the past decade. This growth has been led by countries like United States. According to the IBWA the bottled consumption in the country reached an all time high of 42.3 gallons in 2018. This is expected to further proliferate the use of hot melt glue labels in this market.

Asia-Pacific is Expected to be the Fastest Growing Region in the World

- The Foods business is continuously growing in terms of volume in the region and is also witnessing the introduction of new innovations that are fast re-shaping landscape of packaged foods. Such dynamic are expected to aid the growth of the market in the region. HUL for instance re-launched its Kissan Sweet & Spicy range of ketchups to meet the evolving palate of new-age consumers. HUL has also gone ahead and launched a new variant of its premium jam, Kissan Tropical blast and new packages of Kissan Mixed Fruit jams. Such developments are expected to aid the growth of the market in the region as bottled food packages make extensive use of hot melt adhesives.

- Moreover, the need for heightened shelf appeal, convenience and premiumization in beverage packaging is leading to the introduction of new variety and distinction in packages and eventual expansion of the market. According to Mondi Southeast Asia accounts for one third of its Speciality Cans that it is selling for variety of applications like soft drinks, beer, ready-to-drink teas, coffee, sparkling waters, juices, energy drinks and functional beverages.

- The Asia-pacific market is one of the most dynamic pharmaceutical markets of the world. In 2018 for instance, the export value of drugs and pharmaceuticals of India amounted to more than one trillion rupees. Additionally, China is one of the two largest markets for OTC drugs in the world valued at USD 25 billion (data sourced from Sun Pharma). With cough, cold & allergy segments that have bottled syrup as drugs accounting for a majority of the OTC market this region offers huge opportunities for hot melt glue label applications.

Hot Melt Glue Labeler Industry Overview

The competitive Landscape for the hot glue labelers market is extremely fragmented with the landscape being fragemented by multiple smaller players. The recent developments of the market are as follows:-

- Feb 2019 - HB Fuller recently introduced two hotmelt adhesives that have been designed for use in graphic arts industry in India. Swifttherm 8048 is an EVA-based hotmelt that has been developed and manufactured by the company in India. Swiftherm Advantage 8000 is a metallocene-based spine glue that has been introduced to close the gap between conventional EVA and PUR adhesives.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Deliverables

- 1.2 Study Assumptions

- 1.3 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET DYNAMICS

- 4.1 Market Overview

- 4.2 Market Drivers

- 4.2.1 Increasing Application in Labelling of Cold Food and Beverage Segment

- 4.2.2 Technological Advancement Making these Labelers More Cost Effective

- 4.3 Market Restraints

- 4.3.1 Application Remains Limited to Certain End-User Segments

- 4.4 Industry Value Chain Analysis

- 4.5 Porters 5 Force Analysis

- 4.5.1 Threat of New Entrants

- 4.5.2 Bargaining Power of Buyers/Consumers

- 4.5.3 Bargaining Power of Suppliers

- 4.5.4 Threat of Substitute Products

- 4.5.5 Intensity of Competitive Rivalry

5 MARKET SEGMENTATION

- 5.1 By Type

- 5.1.1 Automatic

- 5.1.2 Semi-Automatic

- 5.2 By Type of Label Application

- 5.2.1 Pre-Cut Label

- 5.2.2 Roll Fed

- 5.3 By Application

- 5.3.1 Food

- 5.3.2 Beverage

- 5.3.3 Pharmaceutical

- 5.3.4 Chemical

- 5.3.5 Others

- 5.4 Geography

- 5.4.1 North America

- 5.4.2 Europe

- 5.4.3 Asia Pacific

- 5.4.4 Rest of the World

6 COMPETITIVE LANDSCAPE

- 6.1 Company Profiles

- 6.1.1 Accutek Packaging Equipment Companies Inc.

- 6.1.2 Aesus Packaging Systems, Inc.

- 6.1.3 Krones AG

- 6.1.4 Clearpack Group

- 6.1.5 Criveller Group

- 6.1.6 Sacmi Packaging SpA

- 6.1.7 KHS Group

- 6.1.8 Multi-Tech Systems International Inc.

- 6.1.9 Sidel, Inc.(Tetra Laval Group)

- 6.1.10 Della Toffola SpA

- 6.1.11 Propack Automation Limited

7 MARKET OPPORTUNITIES AND FUTURE TRENDS

8 INVESTMENT ANALYSIS

02-2729-4219

+886-2-2729-4219